On the lookout for the perfect purchase the dip crypto bots to capitalize on flash crashes and sudden worth dips?

The crypto market is infamous for its wild volatility. Flash crashes can wipe out portfolios in minutes, however in addition they create unbelievable shopping for alternatives for many who are ready.

The issue?

By the point you discover a flash crash manually, the chance is commonly gone. That is the place automated crypto buying and selling bots come to the rescue.

On this information, I’ll stroll you thru the 5 greatest flash crash crypto buying and selling bots particularly designed that can assist you purchase the dip and revenue from flash crashes mechanically.

However earlier than we dive into the instruments, let me share one thing vital:

These bots received’t make you wealthy in a single day. Nonetheless, when you have the persistence to find out how they work and the self-discipline to check your methods, they may assist you to flip market volatility into constant earnings.

What are Flash Crash and Purchase the Dip Bots?

Flash crash and buy-the-dip bots are specialised automated buying and selling instruments that monitor the cryptocurrency market 24/7 and execute purchase orders when particular situations are met—normally when the worth drops immediately or reaches oversold ranges.

Consider them as your private buying and selling assistant that by no means sleeps, by no means panics, and by no means misses a possibility.

These bots use varied methods to determine dip-buying alternatives:

Greenback Price Averaging (DCA): Routinely shopping for extra as the worth drops to common down your entry worth.

Technical Indicators: Utilizing RSI, Bollinger Bands, and different indicators to determine oversold situations.

Multi-timeframe Evaluation: Detecting flash crashes on shorter timeframes throughout broader uptrends.

Grid Buying and selling: Inserting a number of purchase orders at predefined worth ranges beneath the present market worth.

The great thing about these bots is that they take away emotional decision-making from the equation. No extra panic promoting or FOMO shopping for—simply chilly, calculated entries primarily based in your predefined technique.

Why You Want a Flash Crash Bot

Let me be trustworthy with you:

The crypto market doesn’t care about your sleep schedule. Flash crashes can occur in the course of the evening while you’re drowsing, and by the point you get up, the market has already recovered.

Right here’s why automated dip-buying bots are game-changers:

24/7 Market Monitoring: The bot watches the market around the clock so that you don’t should.

Lightning-Quick Execution: Bots can execute trades in milliseconds, catching the precise backside of a dip.

Emotion-Free Buying and selling: No panic, no greed—simply systematic execution of your technique.

Backtesting Capabilities: Check your dip-buying technique on historic knowledge earlier than risking actual cash.

Threat Administration: Set stop-losses and take-profit ranges to mechanically defend your capital.

Now, let’s have a look at the 5 greatest bots that may assist you to grasp the artwork of shopping for the dip.

5 Finest Crypto Flash Crash and Purchase the Dip Bots

1. Coinrule – Finest for Pre-Constructed Flash Crash Methods

Web site: Coinrule

Coinrule is my prime choose for merchants who need ready-made flash crash methods with out spending hours constructing them from scratch.

What Makes Coinrule Stand Out

Coinrule presents a devoted “Flash Crash Bot” that makes use of a multi-timeframe, buy-the-dip strategy. The bot is designed to catch sudden worth drops on a 1-hour timeframe, notably throughout uptrends when profit-taking can result in momentary worth crashes.

The actual magic of Coinrule is its library of over 300 pre-made buying and selling methods. You’ll be able to flick thru methods particularly designed for dip shopping for, customise them to your threat tolerance, and deploy them in minutes.

Key Options:

Devoted Flash Crash Bot with multi-timeframe evaluation

300+ pre-built buying and selling methods (together with a number of dip-buying methods)

“Purchase Dips in Bull Market” bot utilizing RSI indicators

Backtesting on historic knowledge

Navy-grade safety and encryption

Helps 10+ prime exchanges (Binance, Coinbase Professional, OKX, Kraken, Bitpanda)

If-This-Then-That (IFTTT) rule builder for customized methods

Cellular app for iOS and Android

When to Use Coinrule:

You’re a newbie who needs confirmed methods with out constructing from scratch

You favor a visible rule builder over coding

You need to take a look at a number of dip-buying methods rapidly

You commerce on a number of exchanges and need a unified platform

Pricing:

Coinrule presents a 30-day free trial, permitting you to check all options risk-free. Paid plans begin after the trial interval, with totally different tiers primarily based on the variety of lively bots and buying and selling quantity.

Backside line: If you wish to get began with flash crash buying and selling rapidly utilizing confirmed methods, Coinrule is your greatest guess.

2. Bitsgap – Finest for Customizable Dip Shopping for with Pump Safety

Web site: Bitsgap

Bitsgap is a strong cloud-based crypto buying and selling platform that provides one of the subtle “Purchase The Dip” (BTD) bots out there.

What Makes Bitsgap Stand Out

Bitsgap’s BTD Bot is particularly engineered to observe the marketplace for sudden worth drops and execute purchase orders mechanically. However right here’s what units it other than the competitors:

Pump Safety Function: It is a game-changer. The bot features a “Pump Safety” mechanism that stops it from reacting to synthetic worth inflation or faux pumps. This implies you received’t waste cash shopping for throughout manipulated worth actions—solely real dips.

The bot is extremely customizable, permitting you to set particular situations for triggering purchase orders, together with:

Low/Excessive Worth settings

Trailing Down options to catch absolutely the backside

Cease Loss and Take Revenue ranges

Customized proportion drops to set off buys

Key Options of Bitsgap:

Devoted Purchase The Dip (BTD) Bot

Pump Safety to keep away from false indicators

Demo Mode to check methods with out threat

Backtest capabilities with historic knowledge

GRID Bot for range-bound markets

DCA Bot for dollar-cost averaging

COMBO Bot combining a number of methods

Sensible Buying and selling Terminal

API keys safely encrypted with 2FA authentication

When to Use Bitsgap:

You need most management over your dip-buying parameters

You want safety towards pump-and-dump schemes

You need to mix a number of bot methods (DCA + Grid + BTD)

You’re critical about backtesting earlier than going dwell

Pricing:

Bitsgap presents a 7-day PRO plan trial with no bank card required. After the trial, plans begin at $23/month for the Primary plan, with Superior and Professional plans out there for greater buying and selling volumes.

Evaluations: 3.9/5 on Trustpilot (626 opinions), 4.6/5 on Capterra

Additionally, take a look at my detailed overview of Bitsgap.

Backside line: If you’d like a extremely customizable BTD bot with superior safety options, Bitsgap is value each penny.

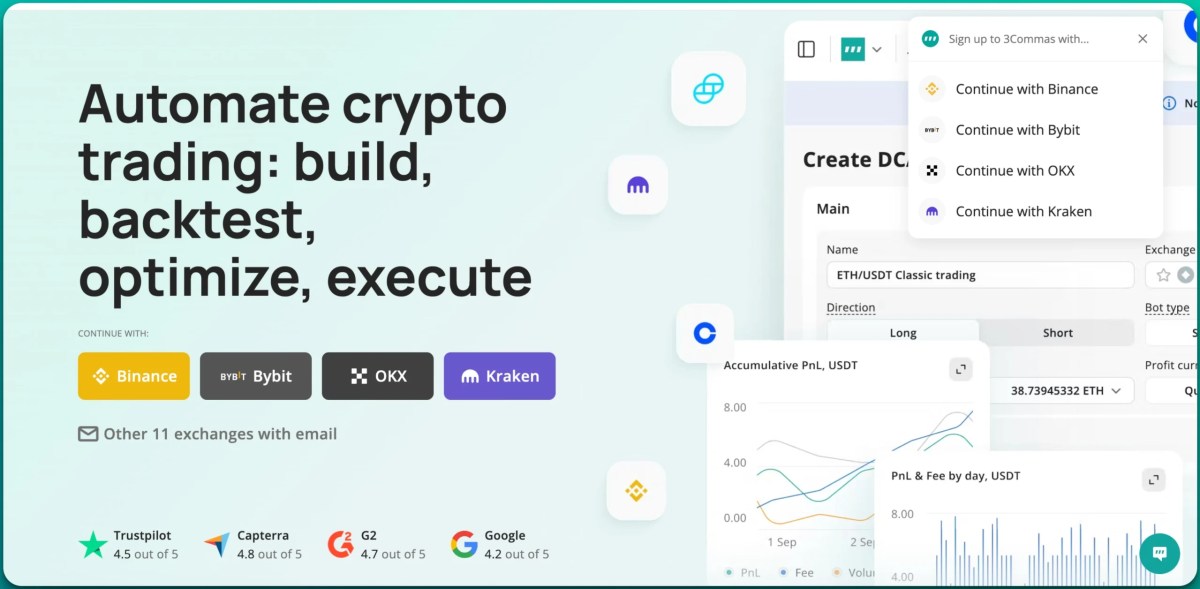

3. 3Commas – Finest for Established Platform with DCA Mastery

Web site: 3Commas

3Commas is among the most established names in crypto buying and selling automation, with over 2 million registered merchants and a confirmed monitor document since 2017.

Notice: DCA and ‘purchase the dip’ are two totally different methods, however they’re generally used collectively. In distinction, DCA is a technique to build up.a challenge at a predefined tempo. Purchase the dip, benefit from a sudden worth dip to purchase and promote it, and accumulate for revenue.

What Makes 3Commas Stand Out

3Commas has perfected the artwork of Greenback Price Averaging (DCA), which is crucial for getting the dip successfully. Their DCA bot is extremely versatile, permitting you to regulate your buying technique primarily based on worth adjustments—shopping for extra as the worth drops to decrease your common entry.

The platform additionally presents devoted Purchase The Dip (BTD) methods and GRID bots that may re-enter the market after a giant dip with buy-only grids.

Key Options:

Superior DCA Bot (most versatile out there)

Purchase The Dip (BTD) technique templates

GRID Bot with buy-only mode for dip shopping for

Sign Bot for automated sign buying and selling

SmartTrade for handbook entries with automated exits

Backtest on 1-minute historic knowledge (as much as one 12 months)

Multi-pair bots can monitor 100+ pairs concurrently

TradingView integration through webhooks

Bulk modifying for managing a number of bots

Paper buying and selling to check methods risk-free

Cellular app for iOS and Android

When to Use 3Commas:

You need a confirmed platform with a big neighborhood

You favor DCA methods for getting dips

You need to monitor a number of pairs for dip alternatives

You utilize TradingView for evaluation and need webhook integration

You’re managing a number of accounts or shoppers

Take a look at my detailed overview of 3Commas.

Pricing:

3Commas presents a free trial to check the platform. Paid plans are tiered primarily based on options and the variety of lively bots.

Evaluations: 4.5/5 on Trustpilot, 4.8/5 on Capterra, 4.7/5 on G2

Backside line: If you’d like a battle-tested platform with probably the most superior DCA options, 3Commas is the trade normal.

4. Cryptohopper – Finest for Customization and Technique Market

Web site: Cryptohopper

Cryptohopper payments itself as “the world’s most customizable crypto buying and selling bot,” and for good cause. With over 1 million customers, it’s one of the fashionable platforms for automated buying and selling.

What Makes Cryptohopper Stand Out

Cryptohopper’s power lies in its Technique Market, the place you should purchase confirmed dip-buying methods from skilled merchants. Some fashionable methods embrace:

“Purchase The Dip Technique Premium” – Makes use of a number of indicators for robust entry factors

“The Methods of Kuresofa – Shopping for the Dip” – Generates purchase indicators when worth drops excessively

The platform presents highly effective Greenback Price Averaging (DCA) options that allow you to “double or triple up on investments that went bitter”—primarily shopping for extra as the worth drops to common down your entry.

Key Options:

Market with a whole bunch of dip-buying methods

Superior DCA with customizable security orders

Quick promoting to trace currencies to the underside

Triggers to answer worth rises and falls

Trailing stop-loss for threat administration

A number of indicators: EMA, Williams %R, RSI, Bollinger Bands

Technique Designer with drag-and-drop interface

Backtesting with historic knowledge

TradingView integration

Social buying and selling to comply with professional merchants

Paper buying and selling mode

Cellular app

When to Use Cryptohopper:

You need entry to a market of confirmed methods

You favor shopping for methods somewhat than constructing them

You need most customization choices

You’re excited about social buying and selling and following professional indicators

You commerce on a number of timeframes and pairs

Pricing:

Cryptohopper presents a 3-day free trial. Paid plans begin at aggressive charges with totally different tiers primarily based on options and the variety of lively positions.

Take a look at: Cryptohopper overview

Backside line: If you’d like probably the most customizable platform with entry to skilled methods, Cryptohopper is your playground.

5. Pionex – Finest for Free Constructed-In Bots and Low Charges

Web site: Pionex

Pionex is exclusive as a result of it’s each a cryptocurrency alternate AND a bot supplier. This implies you don’t want to attach exterior exchanges—all the things occurs in a single place.

What Makes Pionex Stand Out

Right here’s the kicker: Pionex presents 16 built-in buying and selling bots utterly FREE. You solely pay the buying and selling payment of 0.05%, which is among the lowest within the trade.

The platform’s “Purchase-the-Dip” instrument is a dual-investment product that permits you to earn curiosity whereas ready on your goal purchase worth to be reached. This implies your capital isn’t sitting idle—it’s incomes yield till the dip occurs.

Pionex additionally presents highly effective Grid Bots and Futures Grid Bots that may mechanically purchase dips and promote rallies inside a predefined worth vary.

Key Options:

16 FREE built-in buying and selling bots

Purchase-the-Dip instrument with curiosity earnings

Grid Bot (Spot and Futures)

Martingale Bot for aggressive DCA

Sensible Commerce Bot for twenty-four/7 clever buying and selling

Arbitrage Bot

Rebalancing Bot

Solely 0.05% buying and selling payment (no month-to-month subscription)

Each alternate and bot supplier in a single

Cellular app

Low minimal funding

When to Use Pionex:

You need free bots with out month-to-month subscriptions

You favor an all-in-one alternate with built-in automation

You’re a high-volume dealer who needs the bottom charges

You need to earn curiosity whereas ready for dips

You’re a newbie who needs to check a number of bot varieties without spending a dime

Pricing:

Fully FREE bots with solely a 0.05% buying and selling payment per transaction. No month-to-month subscriptions, no hidden prices.

Take a look at Pionex overview to study it varied buying and selling bots options.

Backside line: If you’d like probably the most cost-effective answer with free bots and the bottom charges, Pionex is unbeatable.

Fast Comparability Desk – Finest Purchase the dip bot

Platform

Finest For

Flash Crash Function

Free Trial

Pricing

Coinrule

Pre-built methods

Devoted Flash Crash Bot

30 days

Varies by plan

Bitsgap

Customization + Safety

BTD Bot with Pump Safety

7 days PRO

From $23/mo

3Commas

Superior DCA

DCA + BTD methods

Sure

Varies by plan

Cryptohopper

Technique Market

DCA + Market methods

3 days

Varies by plan

Pionex

Free bots + Low charges

Purchase-the-Dip + Grid Bots

N/A (Free ceaselessly)

FREE (0.05% payment)

When to Use Which Bot?

Nonetheless confused about which bot to decide on? Right here’s my suggestion primarily based in your state of affairs:

Select Coinrule if:

You’re a newbie who needs confirmed methods able to deploy

You need a devoted Flash Crash Bot with multi-timeframe evaluation

You favor visible rule builders over coding

You need the longest free trial (30 days)

Select Bitsgap if:

You need most customization of your dip-buying parameters

You want safety towards pump-and-dump schemes

You’re critical about backtesting methods earlier than going dwell

You need to mix a number of bot varieties (DCA + Grid + BTD)

Select 3Commas if:

You need probably the most established platform with confirmed reliability

You favor superior DCA methods for getting dips

You need to monitor 100+ pairs concurrently

You utilize TradingView and need webhook integration

You’re managing a number of accounts

Select Cryptohopper if:

You need entry to a market {of professional} methods

You favor shopping for confirmed methods somewhat than constructing from scratch

You need most customization choices

You’re excited about social buying and selling and professional indicators

Select Pionex if:

You need free bots with out month-to-month subscriptions

You favor an all-in-one alternate with built-in automation

You’re a high-volume dealer targeted on minimizing charges

You need to take a look at a number of bot varieties with out a monetary dedication

My Private Advice

In the event you’re beginning out, I like to recommend starting with Pionex, because it’s utterly free and presents 16 totally different bots to experiment with. It will assist you to perceive how automated dip shopping for works with none monetary dedication.

When you’re snug with the fundamentals, improve to Coinrule or Bitsgap for extra subtle flash crash methods with higher customization choices.

For skilled merchants, 3Commas or Cryptohopper provide probably the most superior options and the biggest communities for studying and sharing methods.

Necessary Ideas Earlier than You Begin

Earlier than you deploy any of those bots with actual cash, preserve the following pointers in thoughts:

Begin with Paper Buying and selling: Most of those platforms provide demo modes. Use them to check your methods with out risking actual capital.

Backtest Your Methods: At all times backtest your dip-buying technique on historic knowledge earlier than going dwell. This will provide you with confidence in your strategy.

Begin Small: Even after testing, begin with a small quantity of capital. When you see constant outcomes, you may scale up.

Use Cease Losses: At all times set stop-loss ranges to guard your capital. Even the perfect dip-buying technique can fail in excessive market situations.

Be part of the Group: All these platforms have lively Telegram or Discord communities. Be part of them to be taught from skilled merchants and get assist when wanted.

Don’t Count on Miracles: These bots are instruments, not magic money-making machines. Your success is determined by your technique, threat administration, and persistence.

Monitor Market Circumstances: Whereas bots can run 24/7, you need to nonetheless monitor total market situations and regulate your methods accordingly.

Conclusion: Which is the Finest Flash Crash Bot?

There’s no single “greatest” bot for everybody—it is determined by your expertise stage, price range, and buying and selling model.

Nonetheless, if I needed to choose one for every class:

Finest for Freshmen: Pionex (free, simple to make use of, all-in-one answer)

Finest for Technique Selection: Coinrule (300+ pre-built methods)

Finest for Customization: Bitsgap (extremely customizable with pump safety)

Finest for Superior Merchants: 3Commas (most established, superior DCA)

Finest for Social Buying and selling: Cryptohopper (technique market, professional indicators)

The crypto market will proceed to expertise flash crashes and sudden dips—that’s simply the character of this risky asset class. The query is: Will you be able to capitalize on these alternatives, or will you watch them cross by?

With the precise bot and the precise technique, you may flip market volatility out of your enemy into your best ally.

My recommendation? Reap the benefits of the free trials, take a look at a number of platforms, and discover the one that matches your buying and selling model greatest. The very best bot is the one you’ll really use constantly.

Now it’s your flip. Which bot are you going to strive first?

Disclaimer: Crypto buying and selling includes vital threat. Solely make investments what you may afford to lose. At all times use correct threat administration, together with stop-losses and place sizing. The bots talked about on this article are instruments to assist automate your technique—they don’t assure earnings.

Assist us enhance. Was this beneficial

5 Finest Crypto Flash Crash and Purchase the Dip Crypto Bots (2025) was revealed on CoinSutra – Bitcoin Group