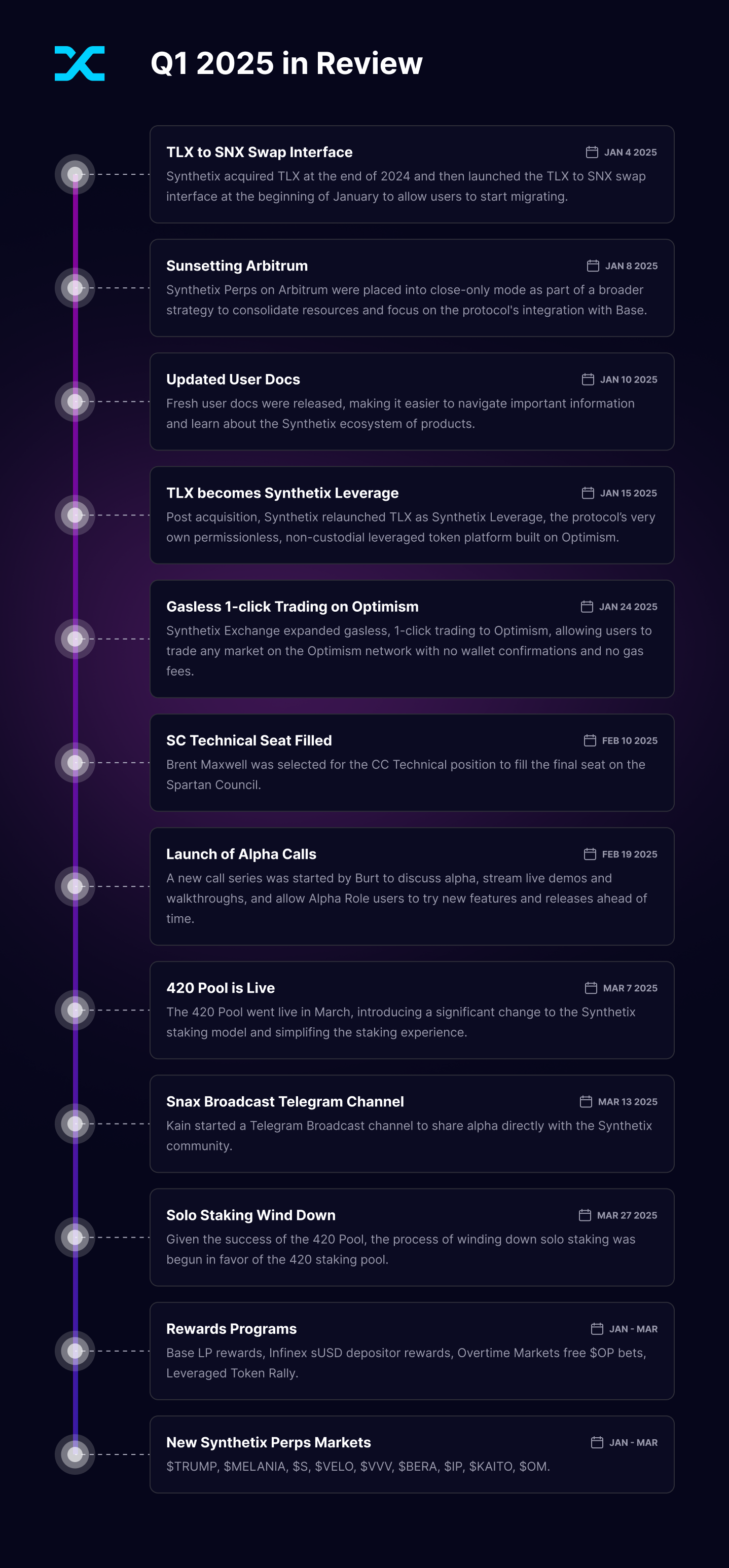

Quarterly Report for Synthetix, Quarter 1 of 2025: January — March.

Q1 Highlights

⭐ Spartan Council/CCs: 420 Pool, Alpha Calls

We’ve seen some main momentum shifts and significant progress at Synthetix in simply the primary quarter of 2025! From record-breaking migrations and the launch of the 420 Pool, to expanded Perps choices, platform upgrades, and protocol acquisitions, indicators of development are seen on practically each entrance. The strategic imaginative and prescient is on full show — largely fueled by final 12 months’s governance shake-up referendum — and there’s a renewed dedication to bettering accessibility, scalability, and person expertise. Collectively, these developments mark a transformative begin to the 12 months and lay a robust basis for what’s forward.

Among the many most impactful milestones was the fast adoption of the 420 Pool, which noticed over 137 million SNX (greater than 40% of the entire provide) migrated inside simply two weeks of launching. This exceptional uptake displays sturdy group alignment with the protocol’s transition to a delegated staking mannequin. The 420 Pool eliminates liquidation danger and provides debt forgiveness over a 12-month interval, making staking easier and extra interesting to a wider vary of customers. For the protocol, this shift brings enhanced capital effectivity, extra predictable system debt administration, and tighter alignment between incentives, governance, and person participation.

This transition has additionally paved the best way for the deprecation of solo staking — a key step in reinforcing the protocol’s transfer towards a extra unified and scalable structure. With nearly all of SNX now concentrated within the 420 Pool, the necessity to incentivize customers to handle protocol debt responsibly is not mandatory. This enables Synthetix to streamline its operations and give attention to refining a single, sturdy capital allocation mannequin. The sunsetting of solo staking displays the success of this transition and clears the trail for a extra constant person expertise and a stronger basis for future product growth.

This quarter, Synthetix additionally launched a brand new initiative known as Alpha Calls — weekly group periods designed to showcase upcoming options, collect real-time suggestions, and foster higher transparency between core contributors and customers. Held on Discord, these calls created an area for early previews of UX updates, product experiments, and strategic discussions, giving the group a extra lively function in shaping the protocol’s growth. By establishing a daily suggestions loop with engaged customers, Alpha Calls have helped the crew rapidly determine ache factors, prioritize enhancements, and take a look at concepts in a collaborative setting. This initiative not solely strengthens the protocol’s relationship with its group, but additionally reinforces a extra agile, user-driven method to constructing DeFi infrastructure.

Challenges

As Synthetix continues to push ahead with bold upgrades and new product launches, a number of underlying challenges have surfaced — significantly round capital retention, incentive design, and person expectations. Whereas the protocol has seen sturdy engagement from its core group, points with non-stablecoin LP liquidation rewards, declining TVL, and fluctuating buying and selling exercise have come into sharper focus. Because the protocol matures, addressing these challenges head-on might be important to solidifying its function in a aggressive and fast-evolving DeFi panorama.

One rising problem this quarter has been the inconsistency in LP returns as a consequence of liquidation rewards being distributed in risky property. Whereas incentive packages have efficiently attracted liquidity suppliers, precise returns have diversified extensively relying on the efficiency of the reward tokens — significantly ETH. Throughout bullish market circumstances, it was a straightforward promote to obtain LP rewards in an appreciating asset. However because the development shifted, some LPs discovered that their rewards misplaced worth, which negatively impacted their realized APR. This led to confusion, because the APR that many LPs skilled differed considerably from the printed determine, which had been calculated on the time of distribution. In response, the protocol is planning to launch an auto-compounding vault within the coming weeks that can convert all rewards to USDC, serving to to alleviate the burden of managing risky liquidation rewards.

Whereas adoption of the 420 Pool was sturdy and buying and selling volumes mirrored elevated product demand, it hasn’t fairly begun to herald vital quantities of exterior capital. This implies that whereas current SNX holders are actively partaking with new options, exterior liquidity could also be extra reactive to broader market sentiment. A giant a part of the 420 push was designed to consolidate new capital round extra compelling yield methods and enhance onboarding for non-SNX-native customers. As Synthetix continues to evolve, attracting and retaining outdoors capital might be crucial for deepening liquidity and scaling the protocol’s influence throughout DeFi.

Lastly, each day buying and selling quantity averaged round $10 million in Q1, with main spikes in February and March as merchants flocked to futures markets in periods of volatility. By the top of the quarter, nevertheless, buying and selling exercise had cooled. Whereas a few of that is attributable to broader market circumstances, it’s additionally clear that merchants are naturally following incentives. These packages have confirmed efficient in producing brief bursts of quantity, however the fluctuations spotlight the problem of sustaining constant buying and selling exercise with out steady exterior motivation. Convincing merchants to go away the consolation and familiarity of centralized exchanges stays a key hurdle, particularly when confronted with the sometimes advanced UX of on-chain buying and selling. Luckily, Ethereum’s upcoming Pectra improve, scheduled for Might 7, guarantees to unlock plenty of enhancements on the UX entrance, doubtlessly making on-chain buying and selling extra seamless and accessible.

Protocol Stats

Overview of Synthetix Q1 Stats: January 2025 — March 2025.

Spartan Council

Q1 2025 Spartan Councilors: Benjamin Celermajer (Fenway), Brent Maxwell, Cavalier, coKaiynne, Jordan Momtazi, Kain Warwick, SpartanGlory

Whereas the primary quarter of the 12 months introduced just a few transitions, the Synthetix ecosystem stayed centered on tightening its core choices and setting the stage for a extra environment friendly, accessible, and unified future. From main system upgrades to protocol acquisitions and the launch of game-changing options, let’s get into precisely what went down this previous quarter.

🤝Kwenta & TLX Be part of the Synthetix Household

One of many largest strikes from final quarter carried into Q1 with the official rollout of Synthetix’s acquisition of Kwenta. The merger wasn’t nearly branding — it marked the start of a extra cohesive DeFi ecosystem. However Synthetix didn’t cease at simply buying Kwenta and creating Synthetix Change, as a result of the protocol wrapped up its acquisition of TLX in January and relaunched it as Synthetix Leverage — a permissionless leveraged token platform constructed on Optimism. With over 70 property and as much as 10x leverage, this new product line has been simplifying publicity to Perps whereas leveraging all of the composability Synthetix has to supply.

🔥420 Pool Lights Up a New Period of Staking

By far probably the most transformative protocol replace in Q1 was the launch of the 420 Pool, a redesigned SNX staking mannequin that eliminates frequent dangers and complexities (SIP-420).

On day one, the pool noticed 100 million SNX in deposits and kicked off a 12-month computerized debt forgiveness schedule:

50% forgiven at 6 months100% forgiven at 12 months

As soon as migrated, stakers:

Not face liquidation riskDon’t must handle c-ratios or debtReceive yields from exterior methods like Ethena, Aave, and Morpho

And the protocol advantages too! Decrease c-ratios (200%) imply deeper sUSD liquidity and extra environment friendly capital deployment for brand spanking new merchandise.

🌅Synthetix Focuses on Base: Sunsetting Arbitrum

This quarter, Synthetix additionally started the method of winding down its Arbitrum deployment, inserting all Perps markets into close-only mode on January 8. Whereas the choice wasn’t taken evenly, it mirrored a broader strategic shift towards vertical integration and community consolidation following the Synthetix Reboot.

Sustaining a number of deployments calls for vital liquidity and help overhead. By specializing in Base, the biggest and fastest-growing Ethereum L2, Synthetix can focus growth and assets into delivering a unified, streamlined buying and selling expertise. With the rollout of V3 options like gasless 1-click buying and selling, multicollateral margin, and the launch of Synthetix Leverage, Base has change into the perfect dwelling for the following period of Synthetix.

All current positions on Arbitrum stay open and could be closed at any time, however no new positions could be opened. All markets are actually accessible on Base, and customers can bridge straight from practically any EVM chain utilizing the Socket-powered swap interface, making migration quick and easy.

⚡️Gasless 1-Click on Buying and selling Involves Optimism

Talking of UX wins, gasless 1-click buying and selling was made accessible on Optimism this quarter along with Base. No pockets pop-ups, no fuel charges, no delays. Simply click on and commerce. Alongside this launch got here efficiency enhancements and response-time fixes on Base.

👋V3 Migration: Solo Staking Winds Down

On the finish of Q1, solo staking deprecation formally kicked off because the migration to V3 continued. Should you’re nonetheless staked on V2X, don’t panic — your SNX is protected and nonetheless viewable at liquidity.synthetix.io.

Nonetheless, c-ratios have begun growing to power liquidations under 160%, and for those who’re liquidated above that threshold, you’ll have a 6-month window to get well your place (SNX + debt).

New Faces, Docs, and Alpha Calls

👨💻Brent Maxwell Joins the Spartan CouncilThe long-vacant Technical Core Contributor seat was lastly stuffed on the Spartan Council with the onboarding of Brent Maxwell. A seasoned builder throughout each Web2 and Web3, Brent brings severe engineering firepower to the Spartan Council. With expertise throughout DeFi, NFTs, token launches, and DevOps, he’s stepping in at a pivotal second for the protocol’s subsequent part of growth.

📚New Consumer DocsThe up to date Synthetix Docs launched this quarter, making it simpler than ever to navigate the protocol, study the ropes, and discover what’s attainable with SNX.

📞Alpha Calls DebutAs beforehand talked about, the brand new Synthetix Alpha Calls kicked off in Discord, providing early entry to new options, stay demos, and candid chats with core contributors. Customers who wish to get in on the early enjoyable can accomplish that by asking Burt for the “Alpha” Discord function — don’t miss the following one!

📣Snax Broadcast LaunchesNeed the TLDR straight from the supply? Synthetix launched the Snax Broadcast Telegram Channel, a no-fluff feed of key updates and alpha from Kain himself.

🔮What’s Subsequent?

With the 420 Pool stay, Kwenta and TLX now a part of the household, and V3 rolling out quick, Synthetix is getting into Q2 with sturdy momentum — and no indicators of slowing down.

Anticipate:

Extra staking incentivesEnhanced vault productsLeveraged token expansionLiquidity boosts for sUSDContinued give attention to Base and Optimism integrations

Whether or not you’re a veteran staker, a leveraged degen, or simply dipping your toes in for the primary time, there’s much more coming. Keep tuned!

Finest Memes from Q1

Lastly, as a result of we will’t shut out the quarter with no little humor, right here had been a number of the finest memes from the Synthetix group.