On-chain information reveals Chainlink (LINK) has seen a month of constant outflows, one thing that might show to be bullish for the altcoin’s worth.

Chainlink Trade Netflow Has Been Detrimental Lately

In a brand new put up on X, the market intelligence platform IntoTheBlock has mentioned in regards to the development within the Trade Netflow for Chainlink. The “Trade Netflow” refers to an on-chain metric that retains observe of the online quantity of LINK transferring into or out of the wallets related to centralized exchanges.

When the indicator has a optimistic worth, it means the traders are depositing a internet variety of tokens of the asset into these platforms. As one of many fundamental the explanation why holders would switch their cash to exchanges is for selling-related functions, this type of development can have a bearish implication for the asset’s worth.

Then again, the metric being underneath the zero mark suggests the change outflows are outweighing the inflows. Usually, traders take their cash away from the custody of those central entities once they wish to maintain into the long run, so such a development can have a bullish affect on the cryptocurrency.

Now, right here is the chart shared by the analytics agency that reveals the development within the Chainlink Trade Netflow over the previous month:

The worth of the metric appears to have been unfavorable lately | Supply: IntoTheBlock on X

As displayed within the above graph, the Chainlink Trade Netflow has been contained in the unfavorable area for nearly all the previous month, implying the traders have consistently been making internet withdrawals.

In complete, the exchanges have registered internet outflows amounting to $120 million on this interval. Given this development, it’s potential that the traders have been in a part of accumulation.

Throughout the previous few days, LINK has loved some restoration in its worth, which may probably be an impact of this shopping for exercise. The Trade Netflow may now be to watch within the coming days, as the place it heads subsequent may even have an affect on the coin.

Naturally, the outflow streak maintaining can be a bullish signal for Chainlink, whereas the indicator witnessing a reversal into the optimistic area may imply a bearish finish for the restoration run.

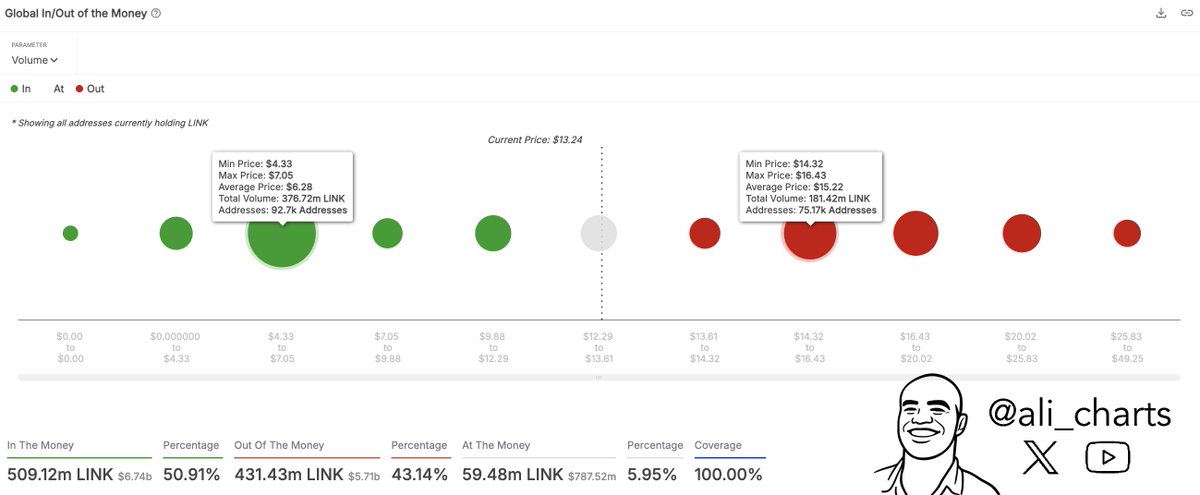

Talking of the worth restoration, on-chain information may trace at the place the subsequent main resistance wall may lie for LINK, as analyst Ali Martinez has defined in an X put up.

The price foundation distribution of the LINK provide throughout the completely different worth ranges | Supply: @ali_charts on X

From the above chart, it’s seen that the Chainlink traders final bought a complete of 181.42 million LINK contained in the $14.32 to $16.43 vary. These traders, who’re at present underwater, could present impedance to the worth if a retest happens, as they could possibly be determined to exit at their break-even.

LINK Worth

On the time of writing, Chainlink is buying and selling round $13.74, up over 10% within the final seven days.

The development within the LINK worth over the past 5 days | Supply: LINKUSDT on TradingView

Featured picture from Dall-E, IntoTheBlock.com, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent overview by our group of high know-how consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.