From smartphones to AI knowledge facilities, almost each digital breakthrough right this moment depends on ever-smaller, extra highly effective chips. On the coronary heart of this transformation is $ASML—Europe’s semiconductor GOAT and the one firm on the earth able to producing EUV lithography machines. However what occurs when even a monopoly faces challenges, together with, rising tariffs, and cautious buyer spending?

Enterprise Mannequin Overview: The Equipment Behind Trendy Chips

ASML designs and manufactures photolithography methods, enabling chipmakers to etch complicated circuits onto silicon wafers. It’s the sole supplier of utmost ultraviolet (EUV) lithography machines, a crucial know-how for superior semiconductor manufacturing at nodes beneath 7nm.

Rivals like Nikon and Canon nonetheless produce older DUV instruments, however ASML’s technological moat, particularly in EUV, positions it as a monopoly provider in essentially the most superior section of the market.

ASML’s Moat: Strengths, Threats, and the Highway Forward

The corporate’s core strengths lie in its monopoly over EUV methods, sturdy gross margins, and deeply entrenched relationships with main chipmakers like TSMC, Intel, and Samsung. These type a large financial moat, bolstered by its mental property and sophisticated manufacturing experience.

Regardless of this, ASML ($ASML.NV) faces some inside and exterior weaknesses. It depends closely on just a few main clients, operates in a extremely cyclical business, and faces lengthy lead occasions in system manufacturing. On the chance entrance, demand for AI chips and world fab enlargement affords important tailwinds, particularly with the rollout of Excessive-NA EUV methods. Nonetheless, threats equivalent to escalating U.S.-China tensions, export restrictions, and technological disruption stay related dangers to watch.

Q1 Snapshot: Slower Orders, However Robust Margins

ASML simply launched its monetary outcomes for Q1 2025, highlighting a difficult quarter impacted by macroeconomic elements:

Web Gross sales: €7.74 billion, a 16.4% lower (€9.26B in Q42024)

Web Earnings: €2.4 billion, down from €2.7 billion in This fall 2024.

Earnings per Share (EPS): €6.00, in comparison with €6.85 within the earlier quarter.

Gross Margin: Robust at 54.0%, benefiting from a good EUV product combine.

Trying forward, ASML guided cautiously for Q2, projecting web gross sales between €7.2 billion and €7.7 billion, with anticipated gross margins within the 50%–53% vary. Regardless of the near-term uncertainty, ASML reaffirmed its full-year 2025 forecast, anticipating web gross sales between €30 billion and €35 billion.

CEO Peter Wennink emphasised each optimism and warning:

“Our conversations to this point with clients help our expectation that 2025 and 2026 will probably be development years. Nonetheless, the latest tariff bulletins have elevated uncertainty within the macro atmosphere, and the scenario will stay dynamic for some time.”

Moreover, ASML introduced constructive developments for shareholders, elevating its annual dividend by 4.9% to €6.40 per share. Throughout Q1, the corporate additionally executed roughly €2.7 billion in share buybacks as a part of its ongoing capital return technique.Valuation: Shopping for a Monopoly at a Low cost?

ASML ($ASML.NV) is indispensable to modern chip manufacturing, supplying crucial equipment to TSMC, Intel, and Samsung. Its dominant EUV market share provides it a large moat. In Q1, though gross sales fell, margins remained sturdy, and capital return to shareholders continued by €2.7B in buybacks and a 4.9% dividend improve. Administration expects 2025 and 2026 to be development years, bolstered by AI infrastructure demand. Nonetheless, near-term warning stems from export restrictions, cyclical capex slowdowns, and common macro instability.

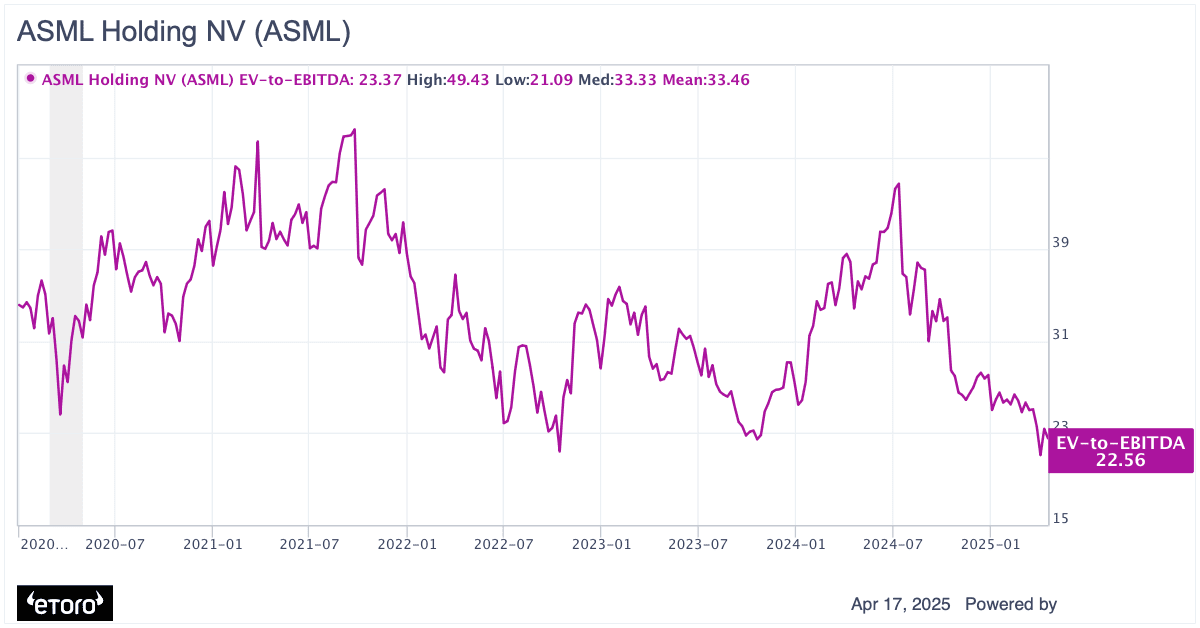

With ASML’s present price-to-earnings (PE) ratio round 27 and a ahead PE nearer to 23, the corporate is buying and selling close to its lowest valuation ranges of the previous decade. Its EV/EBITDA a number of at the moment stands at roughly 22x, which is decrease than the 5 12 months imply of 33. . Traditionally, these valuation metrics have mirrored broad market sentiment tied to development expectations. Given ASML’s unmatched place within the semiconductor provide chain and its long-term innovation roadmap, present valuation ranges could supply a compelling entry level for affected person, long-term traders.

Potential eventualities:

Within the constructive situation, sturdy AI infrastructure demand and easing geopolitical tensions speed up orders. Investor sentiment would possible rebound, and ASML may outperform as a core AI beneficiary. Valuation enlargement to 25x EV/EBITDA and bettering earnings may result in over 30% upside from present ranges over the subsequent 12 months

Within the base case, ASML grows with secure demand for EUV methods. Assuming normalized margins and a a number of of 22x EV/EBITDA, the inventory could supply a 5–10% upside as investor confidence regularly returns.

Within the unfavorable situation, extended export restrictions and weak macro demand result in margin stress and decreased web bookings. A drop to 18x EV/EBITDA and deteriorating earnings may end in a 25% draw back threat over the subsequent 12 months.

Conclusion

Whereas ASML faces brief time period dangers, the broader evaluation paints an image of a enterprise with distinctive strategic positioning and monetary resilience. The corporate’s dominant position in EUV lithography, high-margin construction, and constant capital returns help a long-term development thesis.On this context, the present valuation may signify a uncommon entry level into probably the most crucial and irreplaceable gamers within the world tech provide chain.

This communication is for data and schooling functions solely and shouldn’t be taken as funding recommendation, a private suggestion, or a proposal of, or solicitation to purchase or promote, any monetary devices. This materials has been ready with out bearing in mind any explicit recipient’s funding aims or monetary scenario and has not been ready in accordance with the authorized and regulatory necessities to advertise unbiased analysis. Any references to previous or future efficiency of a monetary instrument, index or a packaged funding product are usually not, and shouldn’t be taken as, a dependable indicator of future outcomes. eToro makes no illustration and assumes no legal responsibility as to the accuracy or completeness of the content material of this publication.