Victoria d’Este

Revealed: Could 30, 2025 at 1:46 pm Up to date: Could 30, 2025 at 1:47 pm

Edited and fact-checked:

Could 30, 2025 at 1:46 pm

In Temporary

Could noticed protocol groups transport options, however nothing actually arrived. Chains are in construct mode, activating upgrades and hitting testnets. This means extra efficiency, modularity, and work underneath the floor.

This Could felt like all the pieces’s shifting – however nothing’s actually arrived but. Just about all we’ve had was a gradual hum of protocol groups transport options most individuals received’t even discover till a lot afterward – however that’s not a nasty factor per se.

You’d in all probability wish to name it quiet, however that’s not fairly that both. It’s extra like chains are in construct mode once more. Upgrades are getting activated, testnets are getting hit. Lengthy-term plans slowly clicking into place. None of that screams for consideration, nevertheless it all factors in a path of extra efficiency, extra modularity, extra stuff working underneath the floor.

So yeah, it’s not the type of month that reveals up in worth charts or neighborhood drama. However, six months from now, when one thing feels smoother or quicker or simply higher, this’ll in all probability be why. Let’s get into it.

Ethereum – Pectra’s Stay

Alright, Pectra. We flagged it final month – considered one of Ethereum’s greatest updates because the Merge – and now it’s really right here, landed on Could 7. To our shock, we’ve seen fairly clean transport with no forks, no drama, no post-mortems on Twitter.

Supply: Forbes

If you happen to didn’t discover, you’re not alone. Most customers received’t really feel something immediately – and actually, that’s type of the purpose. Pectra isn’t the type of improve that lights up dashboards in a single day. As an alternative, it’ll get buried deep within the protocol so different issues can get higher later.

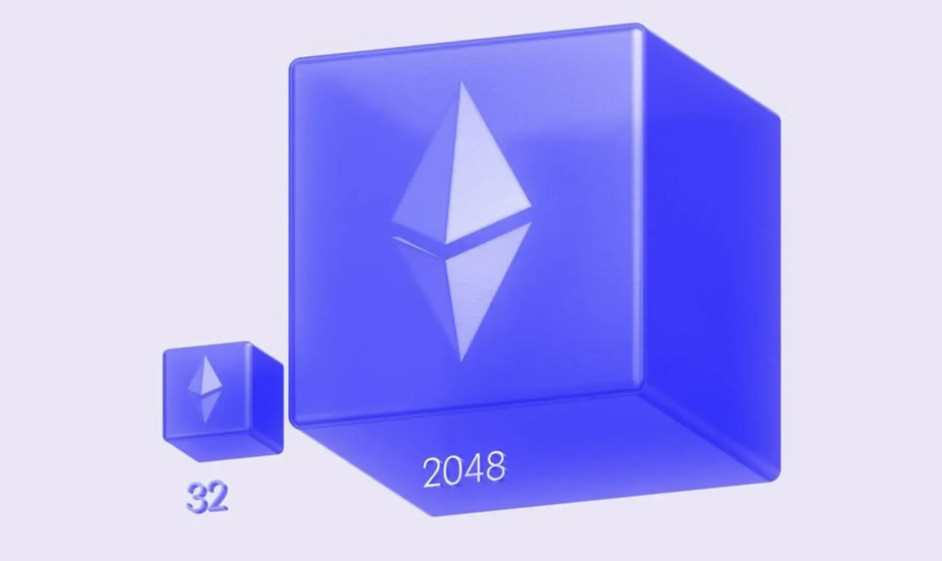

Supply: Stakin

Take sensible accounts – in all probability probably the most talked-about piece (that’s EIP-3074 in the event you’re maintaining observe). Principally, it units the stage for wallets to cease performing like dumb vaults and begin behaving extra like apps. Sponsored transactions, batch flows, possibly even no want to carry ETH in any respect to make use of Ethereum. Sounds nice, however none of that occurs by default. Wallets should help it, and frontends must adapt to it. So yeah, for no, it’s extra of a inexperienced mild than of a characteristic drop.

Supply: Stakin

Identical story with the staking adjustments. Validators can now stake as much as 2,048 ETH per node – up fairly a bit from the outdated 32 cap. If you happen to’re working an enormous operation, that’s, nicely, big. It means much less overhead, fewer shifting components. And in the event you’re not – this in all probability didn’t even blip in your radar.

And blobs* – yeah, nonetheless a factor. Pectra will increase how a lot blob knowledge suits right into a block, which makes life simpler for rollups. Extra room for batching, much less stress on charges.

*(Blobs are like non permanent, low-cost scratch area Ethereum offers to Layer 2s to allow them to put up knowledge with out clogging the chain. Pectra simply gave them larger scratchpads)

So the place does that go away us? Technically, this was an enormous month for Ethereum. However virtually, we’re nonetheless within the “wait and see what devs construct on prime of it” section. To date it’s a basis pour, not a rooftop social gathering. However in the event you’re making an attempt to guess the place the subsequent wave of pockets UX or rollup scaling comes from – this replace is the milestone you’ll wish to keep in mind.

Solana – Firedancer’s Warming Up, However Don’t Seize the Marshmallows But

Solana didn’t have an enormous headline second this month – nevertheless it did have a handful of smaller strikes that, in the event you zoom out a bit, are all pushing in the identical path: quicker, sturdier, extra grown-up.

Supply: Oak Analysis

The most important one making the rounds is Firedancer – Solana’s new validator consumer, constructed by Bounce Crypto. Nonetheless deep in testnet land, however individuals are poking at it now, and yeah it’s quick. Like actually quick. The concept is: identical community, completely completely different engine. If it really works the best way they need it to, this might take Solana from “fairly fast” to “really ridiculous” – a whole lot of hundreds of transactions per second, multi-core parallel magic, all that. It additionally means higher fault tolerance. Much less likelihood of all the pieces falling over when issues get wild. To date, it’s all inside checks and dev demos – however the numbers they’re throwing round are wild sufficient to maintain individuals watching.

Supply: Phantom

They’re not stopping there both. There’s speak of larger blocks, ongoing tweaks to consensus, they usually’ve began quietly transport confidential transfers – which, in plain phrases, means individuals can ship tokens round with out exposing all the main points on-chain. It’s not full-blown privateness mode, nevertheless it’s a extremely attention-grabbing shift.

And, as soon as once more, none of that is “mainnet reside at present” type of stuff. For all it’s value, Firedancer’s not even prepared. The brand new consensus bits aren’t rolled out. Confidential transfers are nonetheless opt-in and possibly not even on most customers’ radar. However the form of it – the entire trajectory – appears like Solana making an attempt to evolve previous its early chaos. It’s much less sprinting for headlines, extra sluggish burn towards a community that may really deal with what it’s making an attempt to be.

Will all of it pan out? Truthfully, it’s too early to say. However Firedancer certain appears like one to look at. If it hits, it received’t simply be a efficiency enhance – it might utterly shift how individuals see Solana.

Polygon – New Structure, New Token, Identical Questions (For Now)

Polygon’s nonetheless in transformation mode – and Could saved the story going. They’ve been rolling out bits of their entire Polygon 2.0 imaginative and prescient, and yeah, it’s bold: swap all the pieces to a ZK rollup basis, purpose for as much as 100,000 TPS, carry charges right down to sub-cent ranges, and sew all of it collectively into one huge multi-chain mesh with shared liquidity.

It’s the type of pitch that appears like an Ethereum L2 fever dream. And actually, in the event that they pull it off, it might be huge.

Supply: Polygon

One of many key shifts occurring now could be the migration from the outdated MATIC token to POL, which is meant to gasoline this new multi-chain setup. Migration instruments have began showing, and governance is trickling alongside, however a lot of the change remains to be underneath the hood – infra-level stuff, new stacks, ZK proving methods. Not precisely user-facing but.

Supply: Polygon

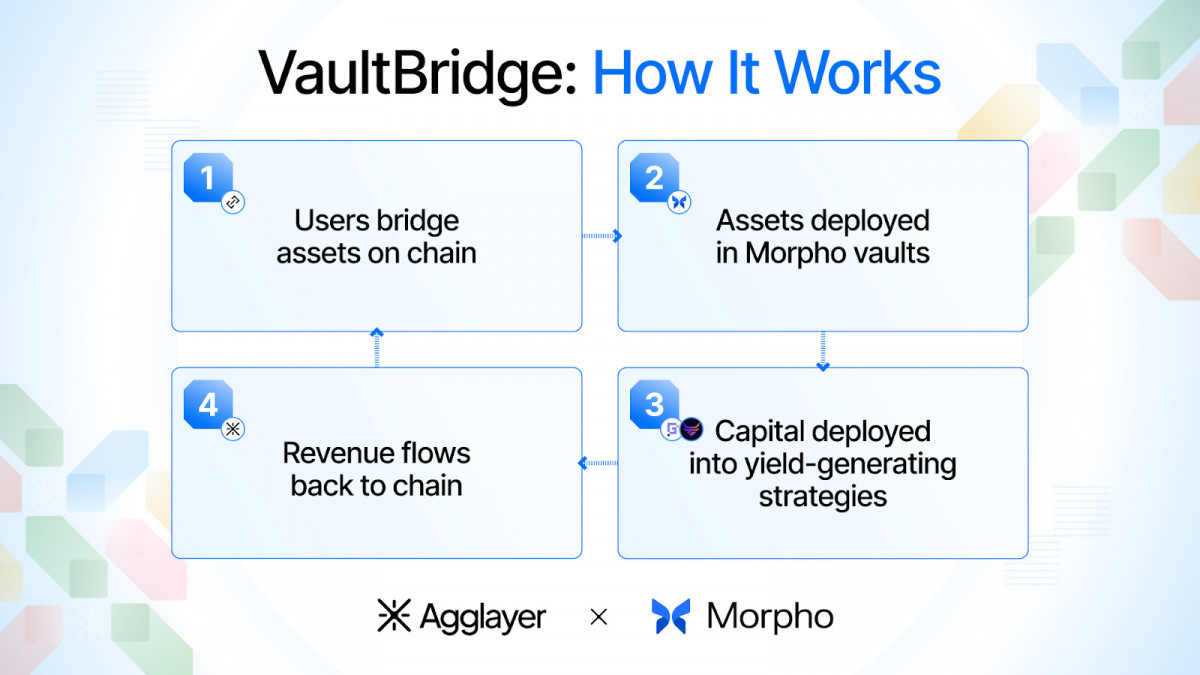

There’s additionally the continued build-out of AggLayer, their interoperability layer that’s meant to attach all these separate chains into one thing extra seamless. And it’s getting actual companions: Reddit, Stripe, and Visa have all been concerned with Polygon in a single kind or one other, which doesn’t damage the story.

However yeah – a variety of it nonetheless lives in decks and docs. The ZK stack is early, the TPS claims haven’t been examined at scale, and the multi-chain imaginative and prescient hasn’t actually been stress-tested but. It’s feels much less like “we’ve arrived” and extra like “the practice is being assembled whereas shifting.”

Nonetheless, the path is daring, and the execution appears to be shifting. If even a part of this imaginative and prescient lands – a low-fee, high-speed mesh of ZK rollups all powered by a shared token economic system – that’s a complete new kind of Ethereum scaling. We’re keeping track of it, however we wouldn’t maintain our breath for immediate outcomes.

Avalanche – FIFA’s Onboard. Most likely a Large Deal

So right here’s one which made waves exterior of crypto Twitter: FIFA – yeah, precise FIFA – introduced they’re ditching Algorand and constructing out on Avalanche, utilizing a devoted subnet for all their digital stuff going ahead. NFTs, tickets, future fan apps – the entire digital engagement suite is supposedly coming.

Supply: The Defiant

It’s a robust search for Avalanche. Not simply because FIFA is a large international model, however as a result of it pushes blockchain into real-world territory once more – stuff like occasion entry, collectibles, loyalty layers and all that. Principally all of the issues that folks stated NFTs could be good for again in 2021, besides now it’d really occur with infrastructure that may scale.

Supply: Binance Sq.

That stated, it’s nonetheless early. The announcement dropped, however there’s no public roadmap but, no token speak, no precise options to poke at. It’s extra of a handshake than a product at this stage. Whereas the subnet angle is sensible — Avalanche’s entire factor is customized chains for customized use circumstances — the true problem can be adoption, UX, and getting FIFA’s viewers to care. That’s no small ask.

Nonetheless, this one’s acquired individuals speaking, and it hints at Avalanche quietly selecting up floor within the “actual utility” column. Value monitoring – particularly if extra main orgs comply with go well with. However till one thing goes reside, it’s only a headline.

Aztec – Privateness on Ethereum? For Actual This Time?

This one acquired a variety of consideration quick – Aztec opened up their public testnet in the beginning of Could, and over 20,000 customers jumped in throughout the first day. That’s a reasonably robust sign for a zero-knowledge rollup centered on privateness, of all issues – not precisely the same old crowd magnet.

Supply: Aztec

So what’s new right here? Just about all the pieces. This isn’t Aztec Join (their outdated shielded transactions system) rebranded – it’s a full-on reboot. A correct zk-rollup the place all the pieces’s encrypted by default: quantities, addresses, what you’re doing – all of it hidden from public view, however nonetheless verifiable by way of zero-knowledge proofs. You’re nonetheless on Ethereum, simply behind a curtain.

Supply: Aztec.community

It’s been within the works for years – like, eight years – with heavy backing from a16z, Paradigm, and others who’ve been betting that privateness will ultimately matter to extra than simply area of interest DeFi weirdos. And now it’s lastly right here to play with, even when it’s nonetheless early days.

The tech’s bold, no query. You’ve acquired a brand new programming language (Noir), a recent structure, and a complete new strategy to constructing apps that don’t leak all the pieces on-chain by default. Whether or not devs really construct with it’s one other query – non-public infra tends to be more durable to work with, and consumer demand isn’t all the time as loud accurately.

Nonetheless, it appears like a second. Between regulation noise and other people simply being uninterested in each pockets tackle being a everlasting resume, privateness on Ethereum would possibly lastly have a shot. If Aztec can ship – and get others to construct with them – this might find yourself being some of the attention-grabbing launches of the 12 months.

Arbitrum – Quietly Getting Extra Resilient

This one’s not flashy, however Arbitrum made a low-key however significant shift in Could: it’s now not working on only one execution consumer.

Supply: Arbitrum

Till now, the entire community relied on their customized Geth fork (Nitro). Strong, but in addition fairly dangerous – any bug, and the entire rollup is made susceptible. That’s all the time been the weak spot with monoculture infra. Now, they’ve introduced in two heavyweights – Nethermind and Erigon – to construct and keep various purchasers which are totally appropriate with Arbitrum’s tech stack.

That may sound dry, however for a community as huge as Arbitrum, consumer range is an enormous deal. It means extra eyes on the code, much less likelihood that one bug takes all the pieces down, and higher long-term efficiency choices (Erigon particularly is understood for its effectivity). Ethereum figured this out ages in the past. L2s are lastly catching up.

Supply: Arbitrum

It additionally says one thing about the place Arbitrum sees itself: not only a quick chain for DeFi and memecoins, however precise base-layer infrastructure for apps that must maintain working. This isn’t the type of replace that pulls in new customers – nevertheless it’s precisely the sort that retains the community wholesome as soon as they’re right here.

So yeah, not thrilling in the intervening time. However completely obligatory if Arbitrum’s going to carry onto its lead whereas the remainder of the rollup crowd ranges up.

Optimism – You Most likely Missed It, However They Upgraded Every part

Whereas everybody was watching Ethereum’s Pectra rollout, Optimism and buddies within the Superchain simply quietly copied it. Kind of in a great way.

Supply: Optimism

Inside 48 hours of Pectra going reside on Ethereum, Optimism Mainnet, Base (Coinbase’s chain), Zora, Worldcoin’s chain, and some others all ran their very own coordinated improve – codenamed Isthmus. What did it do? Principally imported all of the Pectra magic: sensible account help, extra blob area, the works.

That’s the facility of the OP Stack mannequin: all these chains share the identical codebase and might transfer collectively. So as soon as Ethereum does one thing, the Superchain can roll it out quick – like, actually quick. For builders, which means entry to the newest L1 options with out having to attend months. For customers, it means L2s that really feel trendy, constant, and (hopefully) cheaper.

It’s not flashy, nevertheless it’s type of spectacular – a bunch of separate chains all pulling off a significant improve inside a pair days of one another, with no mess. If you happen to’re into interop, coordination, or simply issues not breaking throughout upgrades, this one’s completely value a nod.

There’s extra coming too – subsequent up is their Fusaka improve later this 12 months, which is supposed to plug in additional superior scaling tech like knowledge availability sampling (mainly the subsequent step in Ethereum’s lengthy sport). However even now, Optimism’s exhibiting they will transfer quick with out breaking issues.

Wrap-Up – Could’s All Setup, No Payoff (But)

So yeah, that’s type of the vibe proper now – a variety of setting the desk, not a ton of meals being served but. However that’s positive – infra takes time. There’s nonetheless a niche between the guarantees and the proof. However Could gave us an honest sense of the place the smarter groups are trying – and the place the subsequent few upgrades, launches, or ecosystem shifts would possibly come from.

Disclaimer

Consistent with the Belief Venture tips, please word that the data offered on this web page will not be supposed to be and shouldn’t be interpreted as authorized, tax, funding, monetary, or some other type of recommendation. You will need to solely make investments what you possibly can afford to lose and to hunt unbiased monetary recommendation in case you have any doubts. For additional info, we recommend referring to the phrases and circumstances in addition to the assistance and help pages offered by the issuer or advertiser. MetaversePost is dedicated to correct, unbiased reporting, however market circumstances are topic to alter with out discover.

About The Creator

Victoria is a author on quite a lot of expertise subjects together with Web3.0, AI and cryptocurrencies. Her in depth expertise permits her to jot down insightful articles for the broader viewers.

Extra articles

Victoria d’Este

Victoria is a author on quite a lot of expertise subjects together with Web3.0, AI and cryptocurrencies. Her in depth expertise permits her to jot down insightful articles for the broader viewers.