Ethereum enters June 2025 within the midst of a renewed rally after months of underperformance. Following a tough begin to the 12 months, ETH spiked ~45% in late Could, outpacing each Bitcoin and the broader DeFi market.

This text will analyze all of the components to forecast Ethereum’s value trajectory via June 2025.

Basic: Upgrades, Staking and Tokenomics

A very powerful upcoming milestone is the “Pectra” arduous fork – combining Prague and Electra. Scheduled for mid-March 2025, Pectra will double Layer-2 blob house, introduce account abstraction (letting customers pay fuel charges in stablecoins like USDC), and lift the validator staking restrict from 32 ETH to 2,048 ETH.

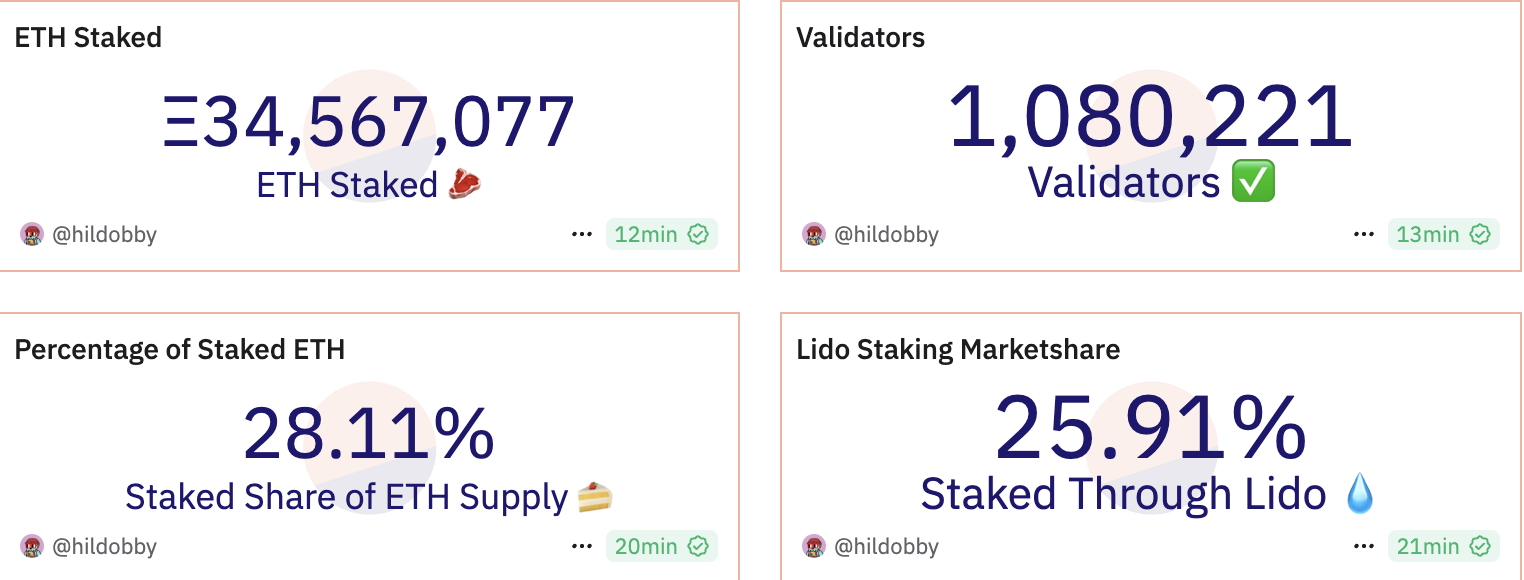

Ethereum’s staking ecosystem is powerful. Over 27% of all eligible ETH is staked on PoS (versus ~2% for BTC), and staking yields round 3–4% per 12 months. Main liquid-staking protocols like Lido now have ~$22.6 billion TVL (albeit down ~20% in latest weeks).

Supply: Dune

Extra staking means fewer ETH provide on exchanges, giving Ether a shortage enhance.

In sensible phrases, these modifications imply Ethereum can course of many extra L2 transactions per block, serving to to sharply cut back fuel charges, and make staking extra environment friendly for big holders. Part 2 of Pectra will add much more enhancements like Verkle bushes for knowledge effectivity, additional boosting throughput.

Maybe most vital is the post-Merge tokenomics: with PoS issuance enormously diminished and transaction charges burned underneath EIP-1559, Ethereum’s web issuance is now typically adverse. In reality, because the 2022 Merge, about 170,000 ETH have been faraway from circulation, giving ETH an annualized deflation of roughly –0.22%.

Supply: Ultrasound cash

At the moment about 120 million ETH exist, with roughly 18.9 million (≈15.7%) locked within the ETH2 deposit contract.

With extra ETH staked than ever earlier than, and new provide frequently offset by burns, Ethereum has successfully turned deflationary when community utilization is excessive. This provide squeeze – mixed with rising demand from DeFi customers – underpins a optimistic outlook: decrease web issuance amid rising utilization may push costs upward over time.

Learn extra: Buying and selling with Free Crypto Alerts in Night Dealer Channel

Ethereum Ecosystem: DeFi, NFTs, and dApps

As of June 2025, it hosts over 1,300 DeFi protocols, with an mixture TVL of about $46.3 billion. This dwarfs its nearest rivals (Solana $7.2B, BNB Chain $5.5B). At the same time as exercise shifts to L2s, DeFi stack is powerful: L2s like Arbitrum additionally host many Ethereum-native DeFi apps, and cross-chain bridges imply worth locked on L2s nonetheless displays Ethereum’s ecosystem.

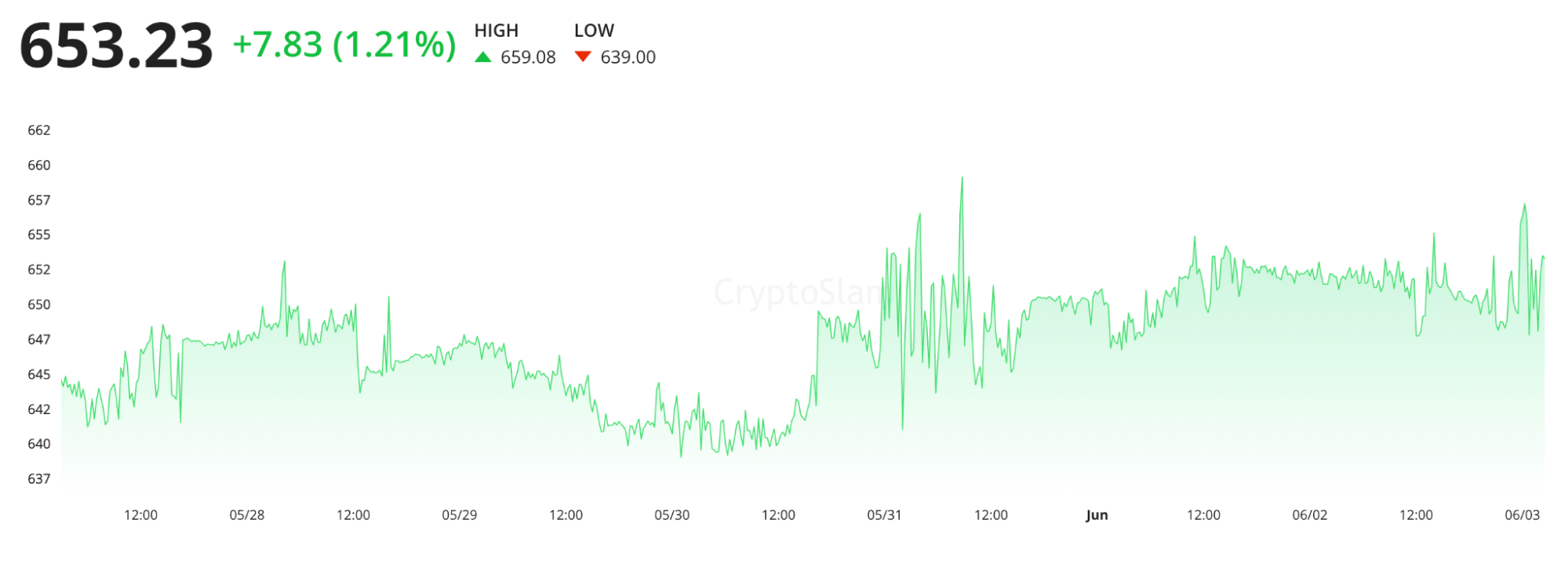

NFTs proceed to be a key a part of Ethereum’s ecosystem. After the 2021-22 hype and subsequent cooldown, the NFT market is stabilizing with renewed utility focus. Ethereum retains the lion’s share of NFT quantity: knowledge from CryptoSlam reveals that in late Could 2025 Ethereum NFTs accounted for ~$36.5M in weekly gross sales, up ~28% week-over-week and much above different chains.

Supply: CryptoSlam

Nevertheless, NFT buying and selling stays comparatively muted, that means this section remains to be re-emerging somewhat than booming. However, any broader revival in NFTs or Web3 gaming would doubtless profit Ethereum considerably, since most tasks in these areas decide on ETH.

In abstract, Ethereum’s fundamentals and ecosystem stay sturdy. It hosts the overwhelming majority of DeFi worth and NFTs, is advancing its core protocol with upgrades like Pectra and EIP-4844, and is backed by a big base of staked ETH that reduces inflation.

These optimistic drivers should be weighed in opposition to competitors (different blockchains) and technical dangers, however on stability Ethereum’s progress story seems intact as we enter mid-2025.

Market Developments and Macro Components

Spot ETH ETFs are on the forefront. After US regulators authorized a number of ETH ETFs in mid-2024. Could 2025 noticed a report $564 million of cumulative ETF inflows, and so they continued into June. As of June 3, general ETH ETF belongings stand round $9.37 billion (roughly 3.06% of ETH’s market cap).

Market sentiment stays risk-on. June 2025 has seen tech shares and crypto transfer broadly in tandem: for instance, Nasdaq’s slight beneficial properties and Bitcoin’s rise to ~$69k have positively correlated with ETH’s rebound.

With inflation cooling, the Fed has held charges regular (4.25–4.50%) in latest conferences, signaling a potential pivot to fee cuts later in 2025. Decrease rates of interest would doubtless enhance crypto once more, since “usually, decrease charges imply greater costs for cryptocurrencies”.

Supply: CME Group

Traditionally Ethereum typically sees renewed exercise within the latter half of the 12 months. On-chain metrics are already bullish: community energetic addresses and transaction counts have ticked up with the market rebound. Total, the market is leaning bullish into June however merchants will stay cautious round macro occasions that might set off volatility.

Institutional Views & Regulation

In Could 2025, newly-installed SEC Chair Paul Atkins introduced plans to situation clearer steerage on which crypto tokens are thought of securities, and even instructed permitting registered brokers to commerce “non-securities, comparable to bitcoin or ether” on various buying and selling methods.

This marks a major departure from the prior SEC stance.

SEC Chair Paul Atkins

Such developments cut back coverage uncertainty: if Ethereum (ether) is explicitly deemed a commodity somewhat than a safety, it may additional legitimize ETH markets. Furthermore, world rules (Europe’s MiCA, Asia’s evolving guidelines) stay a blended bag, however institutional curiosity in ETH seems largely undeterred.

For instance, Circle is getting ready for a US IPO at a excessive valuation, reflecting confidence in crypto infrastructure.

Some nations (China, India) preserve strict crypto bans, which restrict demand, however others are exploring blockchain know-how (CBDCs, tokenized belongings). Ethereum’s sturdy help for personal and permissioned variants (e.g. Quorum, Polygon Edge) means it typically performs a job in enterprise and central financial institution experiments, even outdoors pure crypto hypothesis.

In brief, whereas regulation may introduce short-term volatility, the present information stream round ETH in mid-2025 is generally optimistic to impartial, particularly in comparison with 2022-23.

On the institutional facet, analysis from banks and asset managers highlights ETH’s sturdy fundamentals and the inflationary arithmetic favoring the next value if demand holds. For instance, Bloomberg analysts have famous the potential for ETH staking and income fashions to help costs quickly.

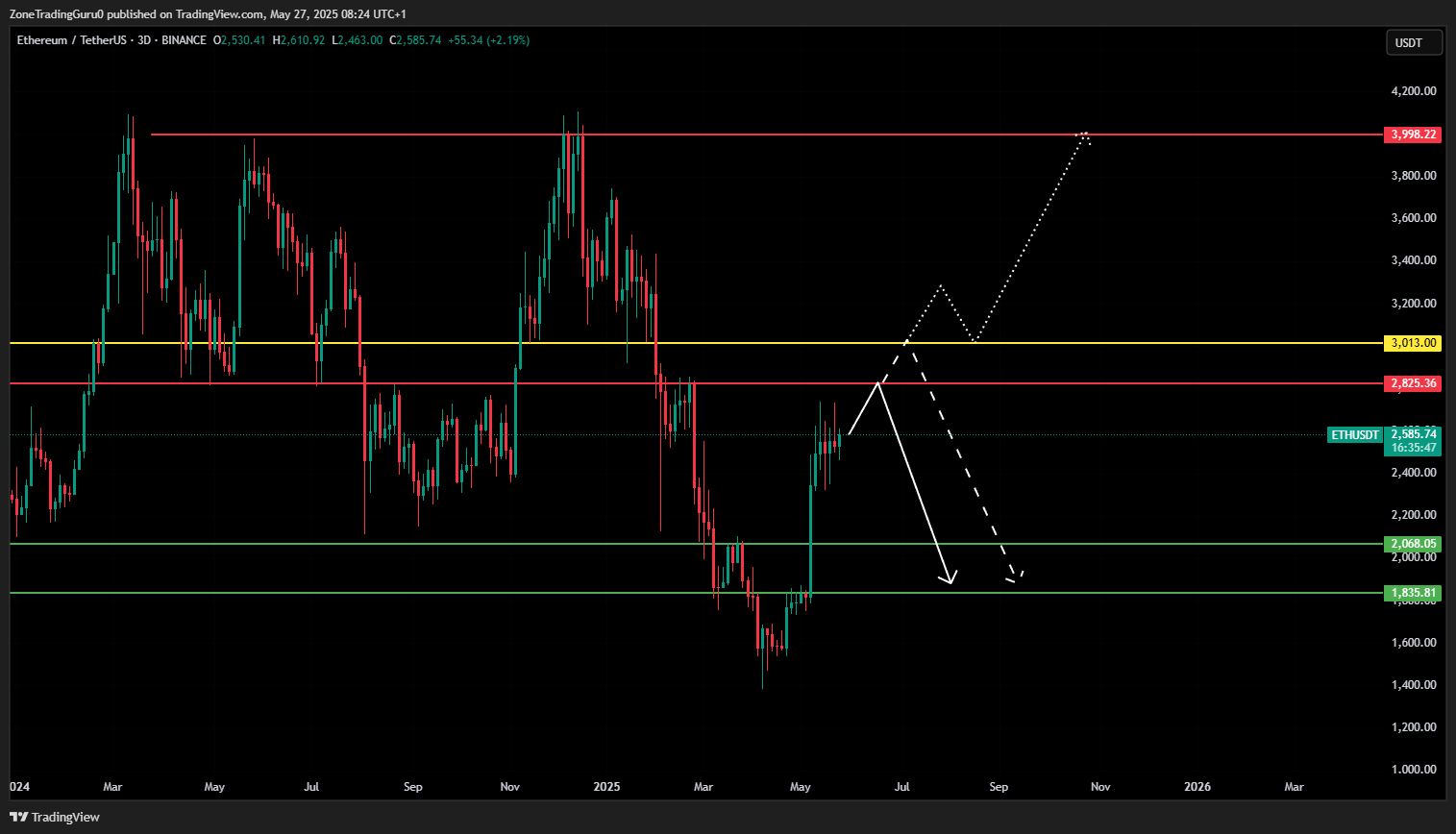

Technical Evaluation – Ethereum Value Construction

Ethereum has now recorded six consecutive weekly inexperienced candles with none notable pullback, a sample that always precedes sharp corrections within the crypto market. Such uninterrupted upward momentum could be structurally unsustainable, notably when not supported by vital consolidation or quantity enlargement. This means buyers needs to be ready for potential draw back volatility within the close to time period.

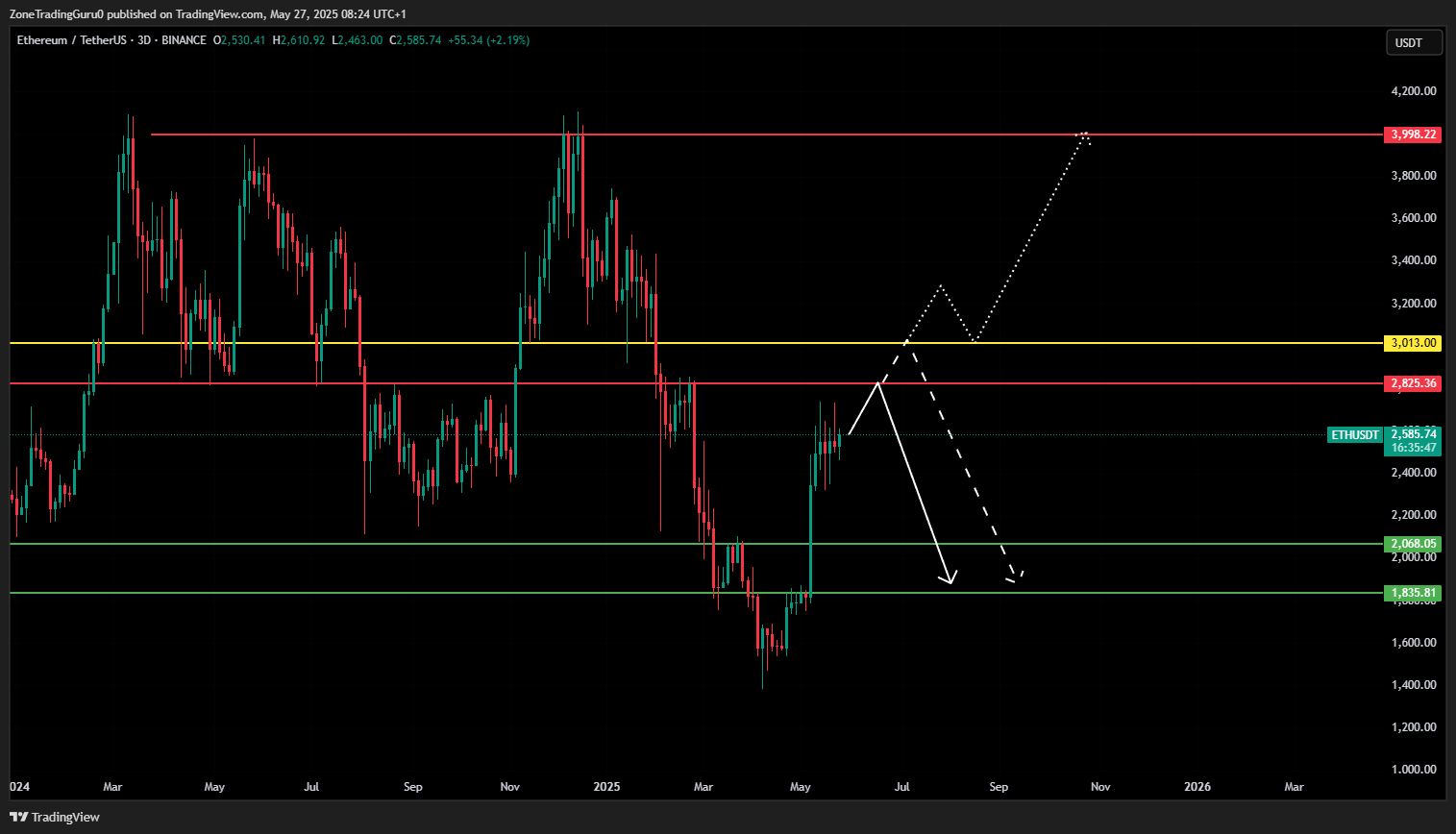

At the moment, ETH is dealing with two main resistance ranges: the primary round $2,825.36, and the second – a extra crucial threshold – at $3,013. This $3,013 zone is recognized as the important thing breakout degree that might outline whether or not Ethereum’s bullish momentum continues or fades.

Analysts are at the moment watching two foremost eventualities:

State of affairs 1: Bull Lure Close to $3,013

Ethereum might initially push towards the $2,825.36 resistance zone, probably sweeping liquidity with a pointy wick as much as the $3,013 area. Nevertheless, if no day by day candle efficiently closes above $3,013, this is able to sign a failed breakout try. In such a case, the worth may reverse path sharply, probably triggering a broader correction that sees ETH retracing towards the $2,000 space.

State of affairs 2: Bullish Continuation Above $3,013

Ought to Ethereum handle to shut a day by day candle convincingly above the $3,013 resistance, it will sign a confirmed bullish breakout. On this case, merchants may search for a retest of the $3,013 degree as help, providing a possible lengthy entry zone. If validated, the following technical goal could be the earlier cycle excessive close to $4,000, marking a continuation of the uptrend.

These ranges and eventualities provide key steerage for short-term merchants and buyers evaluating ETH’s value motion amid rising ETF-driven optimism. As all the time, threat administration stays essential, particularly in a market identified for sudden reversals and liquidity hunts.

Quick-Time period for Ethereum Value Prediction: June 2025

Within the quick time period, Ethereum’s value trajectory for June 2025 seems cautiously optimistic, supported primarily by sustained ETF inflows and a comparatively steady macroeconomic backdrop. If these favorable situations persist, ETH may retest the mid-to-high $2,800 vary, with a possible breakout pushing it briefly above the psychological $3,000 mark.

Probably the most influential driver stays the stream of capital into Ethereum spot ETFs. Since their approval earlier this 12 months, these monetary devices have attracted constant institutional curiosity, offering a powerful underlying bid for ETH. So long as these inflows stay web optimistic and regular, they provide a dependable supply of demand that may counterbalance promoting strain from profit-taking or broader market risk-off sentiment.

Past ETF flows, the general market maintains a optimistic sentiment towards Ethereum, largely as a result of buyers anticipate upcoming community upgrades that goal to enhance scalability and validator effectivity. This forward-looking optimism helps maintain value momentum, even within the absence of explosive information.

In abstract, Ethereum will doubtless commerce with a gentle upward bias all through June, so long as ETF demand stays sturdy and macro situations—comparable to rates of interest or rules—don’t immediately deteriorate.

Whereas a sustained transfer above $3,000 would doubtless require a catalyst – comparable to a big influx week or a shock improve rollout – the baseline projection stays modestly bullish.