Simply 19 days in the past, Bitcoin was buying and selling round $98,000. At the moment, it shattered expectations by hitting a brand new all time excessive of $118,820, underscoring the accelerating shift towards viewing Bitcoin as each a retailer of worth and a strategic asset.

BlackRock’s iShares Bitcoin Belief (IBIT) broke its ETF data final night time by surpassing $80 billion in belongings beneath administration, doing so in simply 374 days. That’s practically 5 instances quicker than the earlier file held by the Vanguard S&P 500 ETF (VOO), which took 1,814 days to achieve the identical mark.

As of at this time, IBIT sits at $83 billion and holds over 706,000 BTC, making it the twenty first largest ETF within the US market. Two days in the past, IBIT additionally closed at a brand new all time excessive of $63.58, reflecting an enormous demand for Bitcoin.

The variety of hours the typical American must work to afford one Bitcoin. In keeping with the most recent chart by Anil Patel, it now takes 3,766 hours, practically two full years of labor on the common US wage, to purchase simply 1 Bitcoin.

In keeping with a brand new report from Financial institution of America International Analysis, Bitcoin is the highest performing forex of 2025, beating out 19 fiat currencies with an 18.2% achieve versus the US greenback year-to-date. This places Bitcoin forward of conventional sturdy performers just like the Swedish krona, Swiss franc, and Euro. The info underscores Bitcoin’s rising energy not simply as a digital asset, however as a world financial unit.

Bitcoin has additionally reclaimed its spot among the many world’s most beneficial belongings, surpassing Amazon to turn into the fifth largest by market capitalization. With a complete market cap of $2.36 trillion and a worth of $118,820, bitcoin now ranks simply behind tech giants like Apple, Microsoft, and NVIDIA.

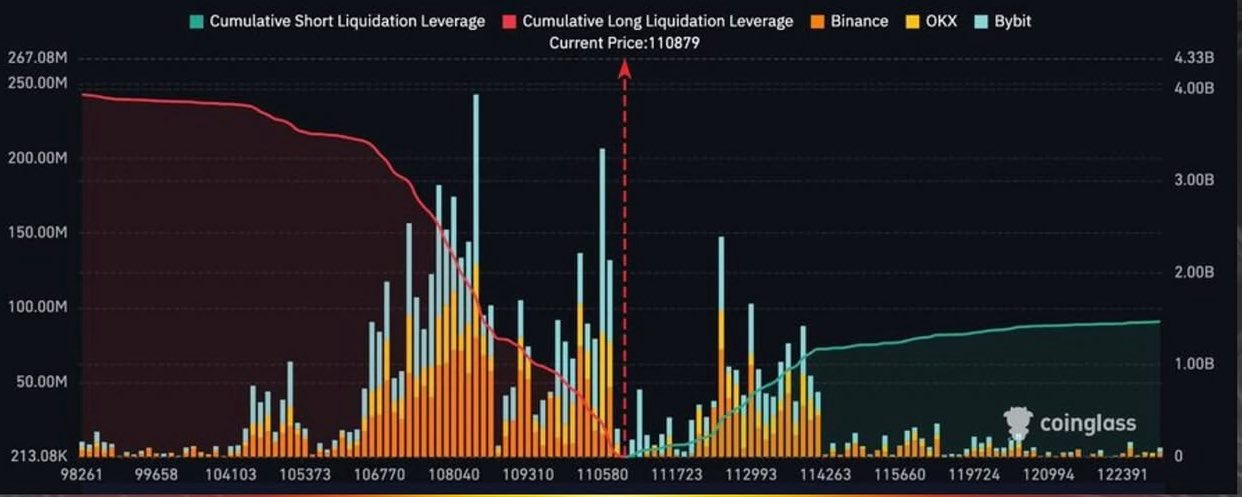

Over the previous few days, greater than $463 million in Bitcoin brief positions have been liquidated, as worth features get even increased. In keeping with information from Coinglass, a further $1.5 billion in brief positions are on the verge of liquidation if Bitcoin hits $120,000.