Q2 2025 delivered a decisive message: after a turbulent section, crypto is again on high! The cryptocurrency sector posted a sturdy 21.72% return, outdoing each main US fairness index by a large margin.

The crypto market left US equities within the mud. In keeping with 99Bitcoins’ Q2 2025 Crypto Market Report revealed on 10 July 2025, “most US fairness indices stayed beneath 15% in quarter-to-date (QTD) positive aspects, solely the S&P 500 Info Know-how sector stood out with an 18.4% rise; the broader S&P 500 gained simply 7.37%. In distinction, the crypto market outperformed all of them with a robust 21.72% return.”

Apparently, the crypto trade noticed a 18% drop in Q1 2025. Therefore, the Q2 rebound is a notable restoration. The crypto positive aspects of the second quarter of 2025 surpasses its efficiency in earlier years, reversing a 14.44% fall in Q2 2024.

DISCOVER: 9+ Finest Excessive-Threat, Excessive-Reward Crypto to Purchase in July 2025

So, What Drove Crypto’s Outperformance?

What helped propel Bitcoin’s dominance to a four-year excessive of 63%? Institutional investor curiosity stood out. Whereas retail merchants shifted focus in the direction of altcoins, establishments favored Bitcoin.

In keeping with the 99Bitcoins’ report buyers’ curiosity in crypto picked up in Q2.” In April, blockchain-related mentions in SEC filings hit a document excessive of 5,830, doubtless as a result of Trump administration’s pro-crypto method,” the report said.

Moreover, the US authorities offered much-needed regulatory readability, passing key legal guidelines and government orders that broadly help the crypto market. Notably, the elimination of IRS reporting guidelines for DeFi platforms and relaxed necessities for banks participating in crypto actions boosted confidence throughout the sector.

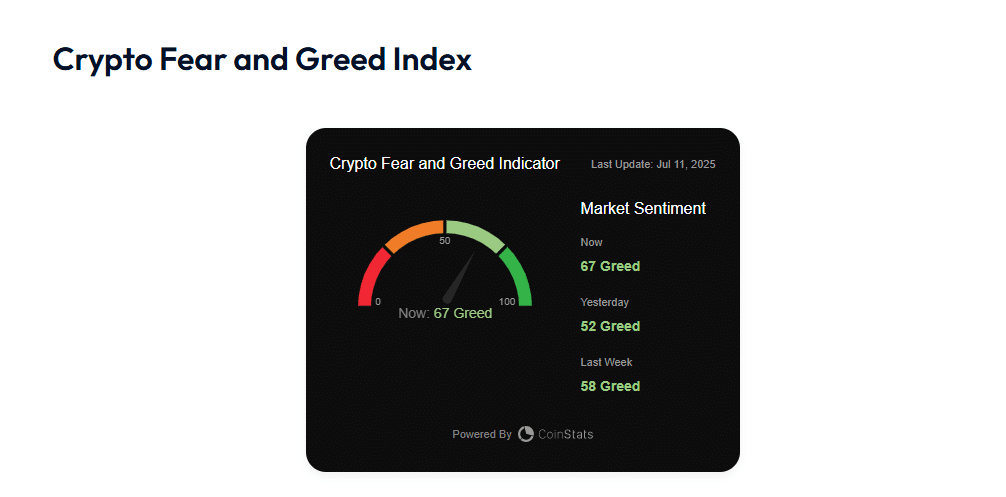

After hitting a low in March 2025, the crypto Concern and Greed index rebounded into “greed” territory for over 60 days, buoyed by constructive coverage indicators.

Simply yesterday, Bitcoin -the world’s Most worthy crypto -soared pushing above $117,000, just for patrons to aggressively step in right now, lifting BTC ▲6.76% to an all-time excessive of $118,409. The Concern and Greed Index from 99Bitcoins reveals a studying of “67.”

Learn Extra: Bitcoin Hits ATH With out FOMO, Bitcoin Hyper Raises $2.3M

Chris Wright, International Head of Advertising at 21Shares weighed in. “We consider that Bitcoin ETFs will entice 50% extra inflows this yr in comparison with final yr,” he mentioned. “This might lead to internet inflows of roughly $55 billion in 2025, representing a rise of round $20 billion year-over-year. If this pattern continues, the overall property below administration may practically double from simply over $110 billion presently, to over $200 billion by the top of the yr.”

Stablecoins Steal the Highlight

The Web3 sector noticed a surge in job openings for June 2025. Whereas Ripple, Arbitrum Basis, Stellar, and Ava Labs are among the many companies actively recruiting for numerous roles, OKX, and Kraken have introduced an growth of their Web3 groups. “Hiring surges like this are typical throughout bull markets and replicate sturdy perception within the trade’s progress potential,” the report mentioned.

However, stablecoins led sector-wide demand. In keeping with the report, 81% of small and medium companies (SMBs) conversant in crypto are serious about utilizing stablecoins for day by day operations.

Furthermore, the variety of fortune 500 corporations planning to make use of stablecoins has triples since 2024.

Circle’s profitable IPA- the place the corporate’s inventory worth soared 168% on debut – is proof od stablecoin associated urge for food and publicity.

DISCOVER: 16 Subsequent Crypto to Explode in 2025: Professional Cryptocurrency Predictions & Evaluation

The publish Crypto’s 21.72% Surge in Q2 2025 Leaves Wall Avenue Behind appeared first on 99Bitcoins.