Ether mining was a approach of producing revenue for many individuals, however that modified fully in September 2022 when Ethereum undertook a mammoth improve referred to as The Merge. The transition from the energy-intensive Proof-of-Work consensus mechanism to the extra sustainable Proof-of-Stake mannequin technically eradicated Ethereum mining, leaving miners and their tools idle and in search of their subsequent plan of action.

Most customers now ask the query, “Can you continue to mine Ethereum?” and for those who can’t, does that imply Ethereum mining is at an finish? Are there alternate options to ETH mining that former miners can make use of their {hardware} too? This text dives into Ethereum mining, why the community stopped utilizing it, and what alternate options there are.

Can You Nonetheless Mine Ethereum?

Cryptocurrency mining gained recognition in late 2021 when Bitcoin turned a well known cryptocurrency. Nonetheless, as new cryptocurrencies entered the market, a number of others quickly joined the fray. Ethereum operates on an analogous consensus mechanism to Bitcoin, and sooner or later, ETH mining turned extra worthwhile than Bitcoin mining, drawing numerous miners serious about making fast cash. Nonetheless, for those who’re serious about figuring out find out how to mine Ethereum, we sadly inform you that you simply’re too late.

It’s now not potential to mine Ethereum resulting from an operational modification that the blockchain made in September 2022. On account of an improve referred to as The Merge, the community transitioned to what’s now known as Ethereum 2.0, altering how ETH is generated and verified. Nonetheless, for those who’re serious about supporting the community and producing income from it, there’s a new approach to take action. After the merge, miners had been changed by validators, who at the moment are chargeable for securing the community by way of a course of referred to as staking.

Why Did Ethereum Change from Proof of Work (PoW) to Proof of Stake (PoS)?

Ethereum transitioned from Proof of Work (PoW) to Proof of Stake (PoS) to deal with a major concern associated to the extreme power consumption required to unravel advanced mathematical puzzles crucial for transaction validation, leading to excessive power utilization and transaction prices. The power requirement was unsustainable because of the excessive price of the method. As a substitute of counting on energy-consuming mining {hardware}, the community transitioned to a extra user-friendly methodology that makes use of validators as a substitute of miners. Right here’s a extra detailed clarification:

Vitality Effectivity: PoW’s energy-intensive nature was unsustainable, so the blockchain adopted a much less energy-intensive PoS, eliminating the necessity for computational power.Scalability: PoW was gradual and costly, normally resulting in community congestion and excessive transaction charges, in comparison with PoS, which had the potential to cut back prices and enhance speeds.Environmental Sustainability: Environmentalists had been involved in regards to the excessive power consumption of PoW, and PoS addressed that drawback immediately.Financial Incentives: PoS encourages customers to carry ETH in the long run, and stakers profit from receiving rewards for validating transactions.

“The Merge” Defined: Why Mining Is No Longer Supported?

The Ethereum community executed an improve referred to as The Merge on September 15, 2022. Earlier than The Merge, issuing ETH cash occurred in two distinct layers: the execution layer and the consensus layer. The execution layer solely relied on Ethereum miners and was backed by the Proof-of-work consensus mechanism.

The consensus layer, often known as the Beacon Chain, went dwell in 2020, requiring validators to make use of the proof-of-stake mechanism as a substitute of miners. Ethereum customers bootstrapped the chain through the use of one-way ETH deposits into a sensible contract on the Mainnet, which the Beacon Chain accepted and credited an analogous quantity on the brand new chain.

The merge mixed the execution layer that handles transactions with the brand new Beacon chain (the consensus layer) that makes use of proof-of-stake, and all actions related to the issuance layer had been transferred to the Beacon chain, which was henceforth validated by way of proof-of-work validation. Because of this, Ethereum miners who used the PoW mechanism had been rendered redundant and will now not create or add new blocks to the community after the 2 layers had been merged.

Will PoS Kill Crypto Mining Utterly?

For these asking, “Will PoS kill mining?” as we all know it, the reply is a powerful no. Nonetheless, the implementation of The Merge fully remodeled the mining panorama by introducing a brand new sort of participation. Whereas PoS could have eradicated miners who relied on energy-intensive {hardware} to unravel advanced mathematical puzzles, it launched staking, which makes use of the proof-of-stake mechanism to safe the blockchain and validate transactions.

So, is crypto mining lifeless in consequence? No, as a substitute, different blockchains nonetheless desire utilizing the Proof-of-Work mechanism, which means the demand for crypto miners stays excessive. Whereas Ethereum’s transfer from mining to staking could have impacted the mining business, PoS is not going to kill the crypto-mining business. Crypto mining stays a viable income-generating train, as some cryptocurrencies, corresponding to Ethereum Basic, Bitcoin, Litecoin, and Ravencoin, nonetheless put it to use, at the same time as extra folks be a part of the world of cryptocurrency.

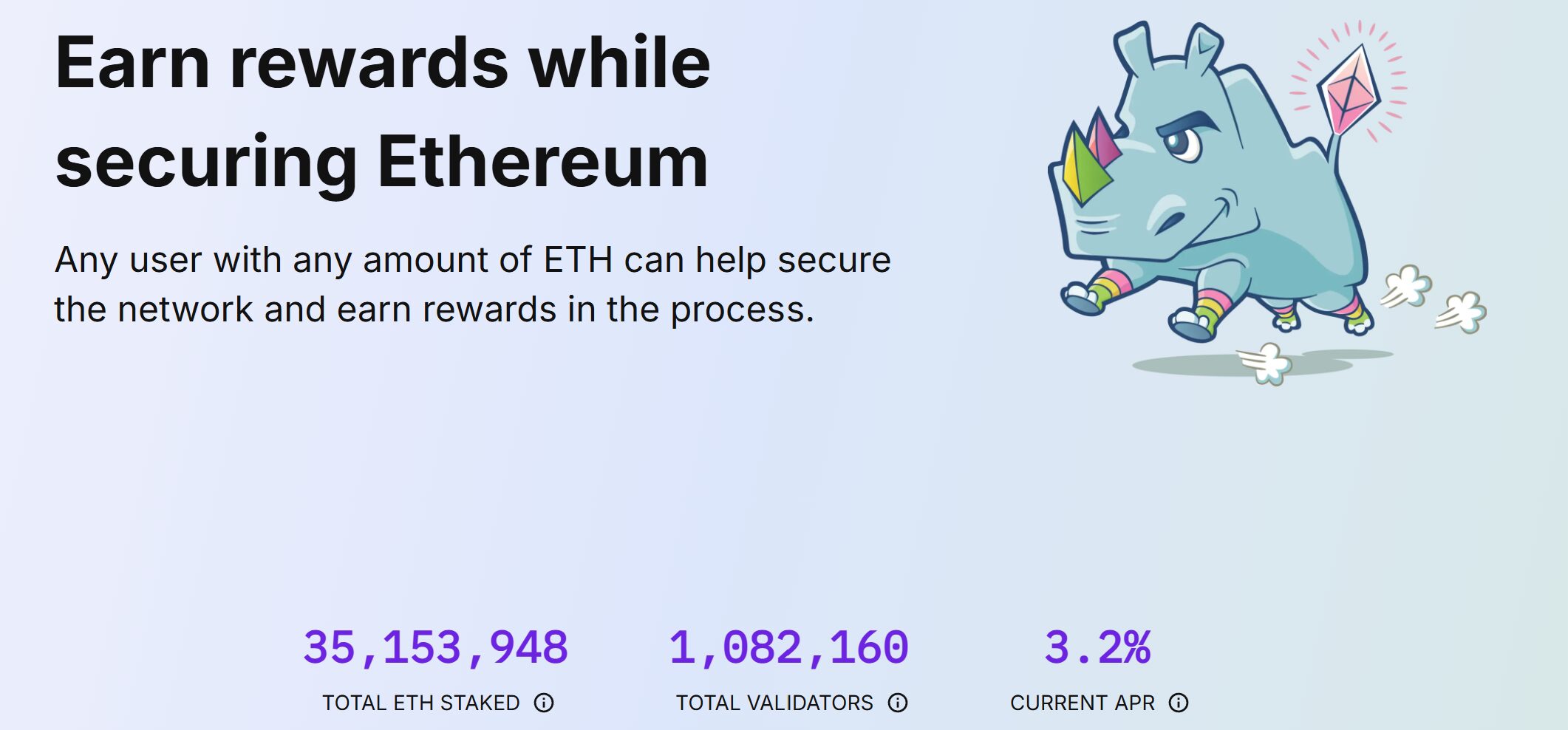

Ethereum Staking: Earn ETH with out Mining

Ethereum staking refers to a way of verifying and validating transactions on the community with out utilizing computational energy, corresponding to mining. As a substitute of fixing difficult mathematical puzzles, stakers maintain a specific amount of cryptocurrency in a devoted pockets, generally known as a staking pockets, to assist help the community’s operations. Crypto staking is a important part of the proof-of-stake consensus mannequin blockchains, which additionally promotes the adoption of blockchain expertise.

By asking stakers to carry a portion of their tokens, they’re incentivized to carry out their activity in the perfect curiosity of the blockchain, thereby maintaining it safe and avoiding the danger of shedding their staked cryptocurrency. The community makes use of a random course of to decide on stakers to behave as validators based on the variety of ETH tokens staked and the lockup interval they’ve chosen. The higher the quantity of crypto a staker holds within the staking pockets and the longer they’ve been staking, the upper the chance of their being chosen as validators. Keep in mind that through the staking interval, the staked cryptocurrency isn’t out there for buying and selling or different transactions. Nonetheless, stakers are rewarded within the type of extra ETH tokens, identical to it was with ETH mining.

PoW vs. PoS Comparability

Since we’re now clear in regards to the distinction between Ether mining by way of the PoW mannequin and staking through the PoS mannequin, it’s time to evaluate the 2 fashions:

Safety: PoW has been round for some time, and the expense and work concerned in validating transactions makes it tougher for malicious actors to assault. In distinction, PoS is newer and has much less confirmed safety.Vitality Consumption: The first downside of the PoW mannequin is the substantial quantity of electrical energy required to unravel the mathematical puzzles, which has raised environmental considerations. PoS processes, corresponding to staking, are extra power environment friendly than PoW, contemplating that validators are chosen based mostly on the variety of tokens they stake. Transaction Speeds: PoW networks are usually slower resulting from puzzle fixing and lengthy block occasions. Proof-of-stake (PoS) blockchains are extra scalable, which means they will deal with extra transactions per second as a result of the method concerned in validating transactions is quicker and extra environment friendly. PoS networks typically facilitate sooner transaction occasions as a result of, as soon as chosen, validators don’t need to wrestle to unravel advanced mathematical puzzles, thus dashing up the validation course of.Potential for Miner Centralization: PoW is mostly designed to advertise decentralization; nonetheless, the excessive prices related to electrical energy payments and mining tools may simply result in centralization, as giant mining farms with extra sources could dominate the community. PoS can face comparable dangers if giant stakeholders management important token quantities.Entry Barrier: Changing into a validator in a PoS community is cheaper than becoming a member of a PoW community since you solely want a specific amount of tokens for staking, which means it may be extra accessible to a broader vary of customers. Changing into a miner in a PoW community can grow to be a deterrent as a result of you have to purchase costly mining rigs and have a continuing provide of electrical energy.

Learn how to Stake Ethereum: Step-by-Step

Earlier than we will let you know precisely how Ethereum staking works, you have to know that there are no less than 3 ways you possibly can supply a staking service to the Ethereum community.

1. Solo Staking

This implies operating a validator node by yourself by depositing 32 ETH, which is the minimal quantity of tokens you have to grow to be a staking node. As a solo staker, you’ll have full management and possession of the staking rewards earned. Nonetheless, you need to have dependable {hardware}, technical experience, and a secure web connection to extend your possibilities of being chosen as a validator.

2. Staking Swimming pools

An alternate choice is to affix a staking pool, the place like-minded buyers pool their ETH sources collectively, making it simpler to satisfy the 32 ETH necessities. As soon as the ETH rewards have been earned, they are going to be distributed amongst individuals based mostly on the quantity of ETH they contributed to the pool.

3. Stake as a Service

These days, there are third-party suppliers of staking providers that deal with the method of operating validator nodes for a price. This may be particularly very best for newcomers who’re new to the sector.

And now to the step-by-step strategy of staking Ethereum, which entails a number of easy steps, as proven under:

Step 1: Enter Right into a Sensible Contract: Step one entails depositing the quantity of ETH you need to stake into a sensible contract. The contract ensures that your funds are locked up securely and commits you to your function as a validator.Step 2: Random Number of Validators with 32 ETH: Subsequent, the community will randomly choose validators from those that have staked a minimal of 32 ETH, guaranteeing decentralization and equity within the blockchain’s consensus mechanism. It’s the duty of ETH validators to validate transactions and suggest new blocks.Step 3: Add New Blocks to the Ethereum Blockchain: The chosen validators validate transactions or suggest new blocks and are rewarded with the newly created tokens as a reward for his or her participation. The rewards are normally paid in ETH tokens. Within the case of a mining pool, they’re distributed proportionally amongst pool members based mostly on the quantity of ETH they contributed.

Staking vs. Mining: What’s extra worthwhile?

When evaluating ETH mining and staking, there are important components, corresponding to beginning capital, technical experience, and power consumption, that you have to think about.

Crypto mining may be extra worthwhile within the quick time period, particularly for miners with high-octane mining {hardware} and working in areas with an affordable supply of electrical energy. The one downside is the necessity for a considerable up-front funding and ongoing operational prices, which function a major entry barrier for many individuals.

In relation to staking, all that you simply want as an funding is separating a specified quantity of tokens, corresponding to 32 ETH, for Ethereum staking to start, which makes it much less capital-intensive for events in comparison with crypto mining. Furthermore, staking is taken into account extra eco-friendly as a result of it consumes a smaller quantity of power. Crypto staking may additionally grow to be a long-term funding technique, given the probabilities for the worth of the staked tokens to understand over time-based on the emotions of the broader cryptocurrency market.

In the end, the choice between mining and staking will come right down to particular person funding objectives and prevailing circumstances. Potential customers should analysis each staking and mining, contemplating key components corresponding to technical necessities, startup and operational prices, and potential rewards earlier than deciding which choice is finest for them.

Dangers of Ethereum Staking

Whereas staking could have taken the place of Ethereum mini and brings varied advantages, we now have already acknowledged that there are a number of trade-offs you need to think about earlier than becoming a member of the bandwagon:

1. Technical Experience: To run and keep a validator node, a sure stage of technical experience is required. Additionally, there can be points it’s important to cope with, like software program vulnerabilities and downtimes that would simply result in missed rewards:

2. Penalties: Critical validator errors can set off slashing penalties, probably inflicting partial or complete lack of staked ETH. These penalties assist keep validator honesty and shield the Ethereum community. They fall into two predominant varieties:

Inactivity Slash: This occurs while you’re offline for too lengthy, lacking block proposals or transaction verifications. You could lose a part of your staked ETH based mostly on downtime.Vote Slash: Extra extreme, this penalty applies when a validator votes on two conflicting blocks. It can lead to bigger losses and disrupt community consensus. The community imposes a harsher penalty for this offense, which may end in shedding a bigger portion or your entire staked quantity.

3. Volatility: The cryptocurrency market is risky, primarily because of the important fluctuations in ETH costs in some circumstances. Because of this the worth of your staked ETH and the potential rewards you may earn will fluctuate based mostly on market sentiment.

4. Centralization Danger: When a big portion of ETH is staked in a number of swimming pools, it raises centralization considerations. If not correctly monitored, this might have an effect on the blockchain’s governance and safety—particularly if a malicious group features management over a major share.

5. Regulatory Danger: The authorized and regulatory setting surrounding the crypto house continues to be evolving. Nobody can inform when new rules may negatively influence the viability of Ethereum staking.

Different Strategies to Earn ETH

Beginning in July 2015 as an formidable undertaking geared toward addressing Bitcoin’s shortcomings, Ethereum has come a good distance and is now the second-largest cryptocurrency by market capitalization. For some people, it has grow to be a supply of revenue. For anybody holding some quantity of ETH and questioning how else you possibly can make use of your tokens to earn some curiosity, we suggest no less than three other ways customers can earn passive revenue from their ETH holdings:

Offering Liquidity to ETH Buying and selling Pairs

Supporting DeFi mining swimming pools may be an fascinating approach free of charge Ethereum mining as you contribute particularly to DeFi platforms to facilitate their buying and selling actions. Contributors present ETH tokens in buying and selling pairs by depositing ETH and every other cryptocurrency corresponding to USDT, USDC, or BTC) right into a decentralized alternate’s liquidity pool. This permits merchants on the DEX to alternate ETH for various property and vice versa, thereby making the market extra liquid. In alternate, liquidity suppliers earn a proportion of the transaction charges the platform earns from merchants who use it.

Yield Farming

Consider a yield farmer as a digital farmer who crops crypto tokens as a substitute of rising the standard crops grown on farms. The seed you present is your ETH tokens to decentralized finance (DeFi) platforms to spice up their liquidity. After getting deposited your ETH tokens, the platform will use your seed capital to facilitate crypto loans that debtors pay again with curiosity. The yield farmer is paid a portion of the curiosity earned from lending, transaction charges, and, at occasions, varied bonuses right here and there. The very best factor about yield farming is the potential for attaining important returns, particularly at a time when DeFi tasks are disrupting the standard methodology of borrowing from banks.

Ethereum Mining Alternate options

The Ethereum mining panorama has undergone important modifications. In 2025, the idea of mining Ethereum utilizing conventional GPUs or ASIC miners is now not relevant, because the community transitioned to the Proof-of-Stake consensus mannequin in 2022. Within the present period, Ether mining has been changed by staking, a extra eco-friendly course of that provides individuals the chance to earn crypto rewards and passive revenue. Nonetheless, for those who’re nonetheless serious about mining, the next can be found alternate options to make use of your mining gear.

1. Bitcoin (BTC)

Bitcoin (BTC), the flagship cryptocurrency, stays probably the most extensively mined cryptocurrency that makes use of the Proof-of-Work (PoW) mechanism to facilitate trustless transactions with out an middleman, corresponding to conventional banks. With its fastened provide of 21 million cash, it’s believed that near 19 million cash have been mined thus far. To at the present time, Bitcoin mining stays tougher than it was up to now, which means you possibly can now not use an everyday GPU to mine BTC. As a substitute, the Bitcoin mining area is dominated by highly effective ASIC miners, making BTC mining a singular enterprise, with large companies operating a few of the largest mining corporations conceivable.

2. Ethereum Basic (ETC)

Ethereum Basic (ETC) is a rival blockchain that forked from the Ethereum Mainnet in 2016 following a cut up over disagreements on dealing with a severe DAO hack. It follows the unique Ethereum precept of immutability, guaranteeing that transaction historical past stays unaltered underneath any circumstances. Ethereum Basic nonetheless operates on the proof-of-work consensus mechanism, much like Bitcoin, and miners are chargeable for validating transactions and securing the community. Miners obtain rewards within the type of newly created ETC tokens for his or her contribution to the welfare of the community.

3. Litecoin (LTC)

Litecoin was created in 2011 as a lighter model of Bitcoin. Because of this, it shares many similarities with the unique cryptocurrency however differs by way of sooner transaction speeds and decrease transaction charges. As a substitute of utilizing Bitcoin’s SHA-256 algorithm, Litecoin makes use of Scrypt, which made mining sooner than BTC and extra accessible to individuals utilizing CPUs and GPUs, particularly within the earlier days. Nonetheless, as competitors and community problem elevated, it’s now commonplace for Litecoin miners to make use of ASIC computer systems. The cryptocurrency has a complete provide of 84 million tokens, which is 4 occasions bigger than Bitcoin’s. LTC’s present block reward is 6.25 LTC per block, and the subsequent Litecoin halving occasion is anticipated in 2027.

4. Dogecoin (DOGE)

Dogecoin (DOGE) was initially designed as a lighthearted different to Bitcoin, however the token shortly gained recognition resulting from its low transaction charges and pleasant neighborhood. The token is in style for tipping creators, micro-transactions, and totally different types of charitable donations. Like Bitcoin, Dogecoin operates on a proof-of-work mechanism however with a considerably sooner block time of 1 minute. Dogecoin operates on an inflationary provide mannequin, which means it doesn’t have a most cap. This ensures that miners will proceed to obtain mining rewards so long as the token exists.

5. Ravencoin (RVN)

The creators of Ravencoin designed it to be ASIC-resistant. This implies it may well solely be mined utilizing commonplace GPU laptop {hardware}. The very design of the Ravencoin blockchain makes it handy for all ranges of buyers to create tokens and conduct transactions, making it a really perfect selection for folks serious about residence mining since you can even use an ordinary CPU to mine the token. If you happen to’re serious about becoming a member of crypto mining on a finances and making a revenue, then look no additional than Ravencoin.

6. Monero (XMR)

Monero (XMR) is a cryptocurrency designed to facilitate safe and nameless transactions by hiding sender and receiver particulars, in addition to transaction quantities, utilizing RingCT, a sophisticated cryptographic approach, and stealth addresses. The blockchain doesn’t make the transactions public, in contrast to Bitcoin, which means all transactions stay confidential. Monero additionally makes use of the proof-of-work mannequin and doesn’t have a cap on the numbers that may be mined. An increasing number of miners are becoming a member of the Monero mining bandwagon for its long-term attraction.

Conclusion

Ethereum mining in 2025 is probably not potential in the identical approach we all know it. Nonetheless, anybody serious about collaborating within the community’s actions can go for staking, which is what has been used following the 2022 Merge improve. If you happen to nonetheless need to get entangled in mining, there are different alternate options you possibly can think about in order that your mining rigs don’t stay idle.

If you happen to’re asking, “Is mining Ethereum worthwhile?” In 2025, you need to know that staking, which is the choice to mining, has much less {hardware} and electrical energy prices and may change into equally worthwhile. When contemplating different cryptocurrency mining, you should definitely work out what it could price you and select one that’s worthwhile to mine.

FAQs

Is crypto mining nonetheless lifeless?

Crypto mining isn’t lifeless. Whereas Ethereum may have transitioned from the PoW mannequin to the PoS consensus mechanism that entails staking, crypto mining continues to be a viable exercise, as many different blockchains, corresponding to Bitcoin, Monero, Litecoin, Ethereum Basic, and others, use proof-of-work.

Is ETH mining nonetheless worthwhile in 2025?

Following the 2022 Merger improve, you possibly can now not mine Ethereum because the community transitioned to the proof-of-stake mannequin, which means the blockchain now helps staking as a substitute of mining.

Can I mine Ethereum free of charge?

No, you possibly can’t mine Ethereum free of charge in 2025 or at any level following the 2022 Merger improve. As a substitute of mining, individuals now stake Ethereum to earn passive revenue.

How lengthy will it take to mine 1 ETH?

ETH mining is now not potential after the transition to the proof-of-stake consensus methodology in 2022. As a substitute, individuals now use staking to earn rewards. For staking, the period of time it could take you to earn 1 ETH token can be decided by components like how a lot ETH is staked the staking pool’s cost construction, and the general community exercise.