Ethereum is as soon as once more buying and selling at a decisive degree after reclaiming the $4,000 mark, a zone intently watched by merchants and analysts. Bulls have managed to defend the $4,100 space, exhibiting resilience after weeks of risky value swings. Nonetheless, momentum stays fragile, and ETH wants a decisive push above increased resistance ranges to verify {that a} pattern shift is underway. With out such a breakout, the danger of renewed consolidation stays on the desk.

Regardless of the uncertainty in value motion, on-chain information supplies a extra constructive view of the market. Recent figures reveal that whales proceed to build up ETH whilst broader sentiment has wavered. This regular influx of capital from giant holders suggests rising confidence in Ethereum’s long-term outlook, reinforcing the concept latest corrections could characterize alternatives reasonably than weak point.

Such accumulation has traditionally preceded durations of renewed power, as deep-pocketed buyers have a tendency to construct positions throughout phases of market doubt. If ETH can keep its maintain above $4,100 and construct momentum, whale exercise might present the assist wanted to spark a stronger restoration. For now, all eyes stay on Ethereum’s means to maintain this important degree and problem increased resistance zones.

Whale Exercise Alerts Confidence in Ethereum

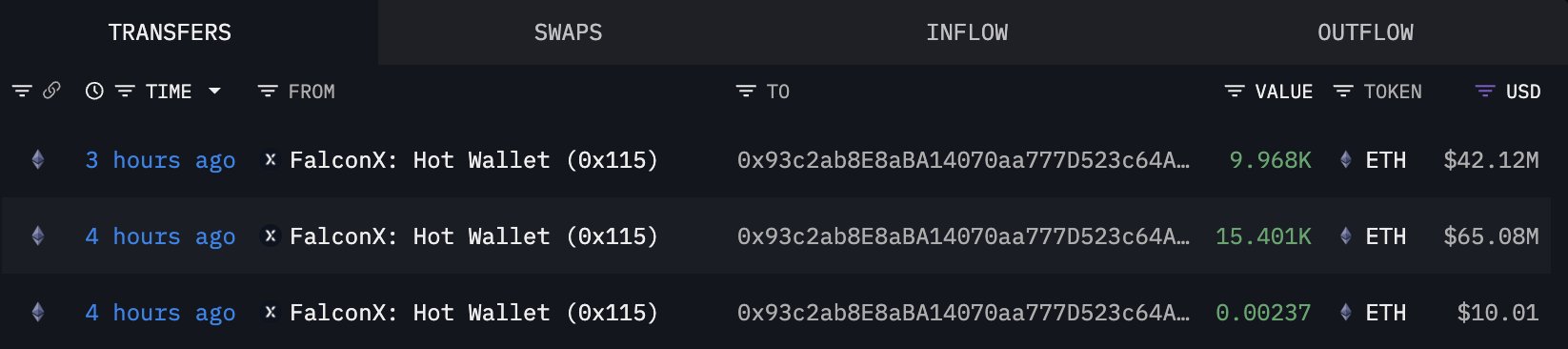

Ethereum’s latest value motion has left merchants unsure, however whale conduct tells a unique story. In keeping with on-chain information from Lookonchain, giant holders proceed to build up ETH regardless of the latest market drop. In simply the previous few hours, two main transactions highlighted this ongoing pattern.

A newly created pockets, 0x93c2 — which analysts recommend could belong to Bitmine — acquired 25,369 ETH, price roughly $106.74 million, from FalconX solely three hours in the past. Such a big influx right into a contemporary pockets suggests strategic accumulation, seemingly meant for long-term holding or staking reasonably than short-term buying and selling. In parallel, one other new pockets, 0x6F9b, withdrew 4,985 ETH (about $21 million) from OKX simply an hour later. These strikes cut back provide on exchanges, usually thought-about a bullish signal because it limits the fast promoting strain.

This sample highlights a broader market dynamic: whereas retail merchants and smaller contributors react to short-term volatility, whales seem to view the correction as a possibility. Their accumulation not solely demonstrates confidence in Ethereum’s resilience but additionally alerts preparation for future value appreciation. Traditionally, constant whale inflows into contemporary wallets have coincided with durations of structural assist and eventual restoration.

ETH Struggles To Reclaim $4,200

Ethereum is buying and selling close to $4,138 after a risky week that noticed the worth tumble under $4,000 earlier than bouncing again. The 8-hour chart highlights a restoration try, however ETH now faces important resistance across the $4,200 degree, the place each the 100-period (inexperienced) and 200-period (purple) transferring averages converge. This confluence creates a heavy provide zone that bulls should overcome to verify additional upside momentum.

The latest decline from the $4,600–$4,800 vary left Ethereum in a fragile state, with promoting strain intensifying through the drop. The rebound exhibits resilience, however value motion stays capped by overhead resistance, maintaining sentiment cautious. The failure to reclaim the 50-period transferring common (blue) earlier underscores the problem of reversing short-term bearish momentum.

On the draw back, the $4,000 mark acts as the primary important assist. A breakdown under that degree might re-expose ETH to $3,800 and even $3,600, the place stronger demand could seem. For now, Ethereum trades in a consolidation section, and the subsequent decisive transfer will seemingly rely on whether or not bulls can drive a breakout above $4,200. A clear transfer increased would open the door towards $4,400, whereas rejection dangers renewed draw back strain.

Featured picture from Dall-E, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluate by our crew of high expertise consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.