With its worth surging sharply to new all-time highs this yr, BNB (The Binance native coin) is now one of many best-performing cryptocurrency property within the ongoing bull market cycle. Whereas the altcoin is at present holding robust above the $1,300 worth mark, a number of key components have been recognized as possible answerable for the current upward pattern to new heights.

What Pushed The worth Of BNB To New Highs

BNB retains surpassing market expectations, breaking by way of boundaries, and reaching new all-time highs because the cryptocurrency market is swept by bullish momentum. In a current quick-take publish on the CryptoQuant platform, a market knowledgeable with the nickname XWIN Analysis Japan has outlined the doable triggers of the altcoin’s robust upside motion this cycle.

As of October 8, the Binance coin skilled a spike to $1,300, exhibiting the very best efficiency amongst main cryptocurrencies. With this exceptional progress, BNB has grown from being considered as simply the native token driving Binance’s ecosystem to turning into a significant participant in DeFi and Web3.

In line with XWIN Analysis Japan, the continued surge is past a short-term speculative transfer. The knowledgeable has solely attributed the upward transfer to Binance’s structural restoration and deeper integration with conventional finance.

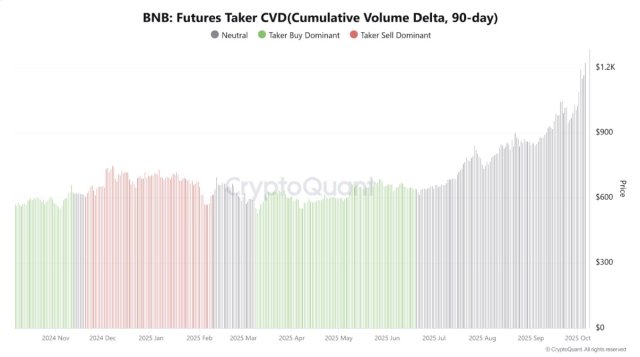

Presently, on-chain information are displaying sturdy shopping for momentum out there as noticed within the Spot and Futures Taker CVDs. As noticed within the chart, spot and futures Taker CVDs are trending upward, which is a sign of a resurgence in purchaser dominance.

As well as, the Binance Dominance Energy – Share of Stablecoin Reserves vs Market Complete, reveals that its share of ERC-20 stablecoin reserves has elevated to just about 70%. This marks its highest degree ever recorded in years. Curiously, this focus of liquidity supplies a stable basis for BNB’s energy by producing real demand for buying and selling, staking, and Launchpad participation.

Whereas sentiment has improved, XWIN Analysis highlighted that this occurred after Changpeng “CZ” Zhao, the founding father of Binance, reinstated the “Binance” title on his profile on X, a transfer signifying regulatory stability. On the identical time, Binance’s quarterly burn of about 2 million BNB, or $1 billion, retains provide tight, immediately connecting shortage to quantity enlargement and platform progress.

A number of Collaborations Finished This Cycle

With BNB rising, buyers’ conviction within the altcoin has risen. One other issue that has bolstered buyers’ confidence is Binance’s partnerships with international monetary establishments. These embrace Collaborations with Franklin Templeton to co-develop tokenized securities (RWA) and with Chainlink to carry US financial information on-chain, which mark essential advances towards institutional-grade DeFi.

There have additionally been key tasks launched on the BNB chain, comparable to the brand new Crypto-as-a-Service (CaaS) initiative. The principle use case of this initiative is to allow banks and brokerages to offer crypto providers below their very own manufacturers, reflecting Binance’s shift from alternate to monetary infrastructure supplier.

In the meantime, for BNB, the robust institutional hyperlinks, deflationary provide mechanisms, and liquidity focus have remodeled it from a simple alternate token into an important asset that connects Web3 and traditional banking. Such shifts characterize a blatant indication of Binance’s contemporary supremacy within the digital market.

Featured picture from Adobe Inventory, chart from Tradingview.com

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent assessment by our workforce of high know-how consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.