DeFi lending in 2025 is extra highly effective than ever, but additionally extra complicated. Between fluctuating rates of interest, scattered liquidity swimming pools, and intimidating interfaces, many customers nonetheless discover the method overwhelming and dangerous. What the house wants is a platform that simplifies entry with out sacrificing efficiency or management.

That’s why Chester Bella and Danny Boahen launched ETHA Lend. It guarantees a wiser, extra approachable DeFi expertise by providing fixed-term, collateralized credit score merchandise and automatic yield methods, all designed with on a regular basis customers in thoughts.

Let’s focus on how ETHA Lend works and whether or not it lives as much as the promise of creating DeFi lending actually accessible.

What Is ETHA Lend?

ETHA Lend is a DeFi protocol designed to simplify and optimize the lending and borrowing expertise. The aim is to make yield technology and credit score entry extra user-friendly, steady, and environment friendly, particularly for customers who’re new to DeFi or overwhelmed by complicated interfaces and risky rates of interest.

The platform is deployed on each Ethereum and Polygon, giving customers the pliability to decide on between Ethereum’s safety and Polygon’s low-cost, high-speed transactions. This multi-chain method ensures that customers can entry ETHA Lend with minimal charges and delays, no matter their most well-liked community.

Listed here are the important thing options:

ETHA Token

The ETHA token is the platform’s utility token, used for governance (voting on protocol adjustments), staking for rewards, and liquidity mining.

Buying and selling market

ETHA Lend’s Buying and selling Market acts as its core liquidity hub, permitting customers to purchase, promote, and swap supported property with minimal friction. Built-in instantly into the platform, it advantages from automated algorithms that route trades by optimum liquidity swimming pools, making certain aggressive charges and lowering slippage.

eVaults

eVaults are automated yield-generating vaults that allocate deposited property throughout a number of DeFi protocols. Customers merely deposit their tokens, and ETHA Lend’s algorithm distributes them strategically to maximise returns, without having for guide changes. These vaults can rebalance in real-time to seize the very best alternatives.

Single-asset stake swimming pools

For customers searching for leveraged yield, Single-Asset Stake Swimming pools will let you stake one asset and earn enhanced rewards through leverage methods constructed into the pool’s logic. This permits deeper farming potential on a single token, although it comes with elevated complexity and threat mitigation measures in place.

ETHA pockets

The ETHA Pockets is a non-custodial, interface-native pockets designed for seamless interplay with the platform. It helps atomic trades, enabling customers to swap and stake tokens in a single transaction to optimize returns. The pockets integrates intently with ETHA Lend’s yield methods, providing customers one-click entry to optimized positions.

How Does Ether Lend Work?

ETHA Lend operates on a decentralized, smart-contract-driven mannequin that lets customers lend and borrow property with out centralized intermediaries, dealing with all the things routinely.

Lending

Customers deposit crypto into ETHA Lend’s lending swimming pools, which mixture liquidity from a number of members. These pooled funds are made out there for debtors.

Lenders earn curiosity based mostly on utilization and mortgage period, funds that come instantly from the borrower’s curiosity. Due to an clever yield optimization engine, deposited property are allotted throughout totally different protocols to maximise general returns.

Borrowing

To borrow, customers lock up collateral, usually valued larger than the requested mortgage quantity, to safe the debt. This overcollateralization mannequin protects the protocol towards value volatility. Debtors can select from fixed-term loans (with predictable compensation schedules) or versatile loans (which permit early compensation however might carry variable curiosity). Good contracts implement these phrases clearly and routinely.

Rates of interest

ETHA Lend makes use of a dynamic, algorithmic curiosity mannequin that adjusts based mostly on real-time provide and demand circumstances inside every liquidity pool. This ensures aggressive and honest charges for each lenders and debtors, and helps preserve wholesome liquidity within the system.

Good contract automation

All lending and borrowing processes, together with collateral administration, curiosity accrual, repayments, and liquidations, are executed by audited good contracts. These contracts automate each step securely and transparently, eliminating the necessity for third-party intervention or guide oversight.

Yield Optimization Engine: Smarter Lending Returns

ETHA Lend’s Yield Optimization Engine dynamically allocates your deposits throughout DeFi protocols like Aave, Compound, and Curve to maximise returns.

Multi-protocol routing

Once you deposit crypto property, the engine analyzes yield alternatives throughout a number of protocols and routes funds accordingly. It helps Polygon-based lending and liquidity swimming pools, choosing platforms providing larger returns, balancing security and profitability.

Dynamic rebalancing

ETHA Lend’s portfolio rebalancing helps customers maximize returns by routinely adjusting asset allocations throughout high DeFi protocols like Aave, Compound, and Curve.

As an alternative of counting on static methods, ETHA Lend makes use of historic information and predictive analytics to forecast which platforms will provide higher yields. As market circumstances shift, as a consequence of adjustments in rates of interest or token volatility, the system rebalances your portfolio accordingly.

Passive vs. Lively technique

With ETHA Lend, you’ll be able to select a completely passive “set-and-forget” mannequin, trusting the engine to observe and rebalance, or go for a extra energetic method, rebalancing manually whenever you see match. Both means, the system handles allocations and changes for you.

Safety, Audits, and Threat Controls

ETHA Lend implements a safety framework combining impartial audits, good contract safeguards, and threat administration instruments to guard customers and preserve platform stability.

Good contract audits & identified vulnerabilities

ETHA Lend was independently audited by CertiK in April 2021, which discovered solely informational and minor points and confirmed that the protocol meets trade requirements.

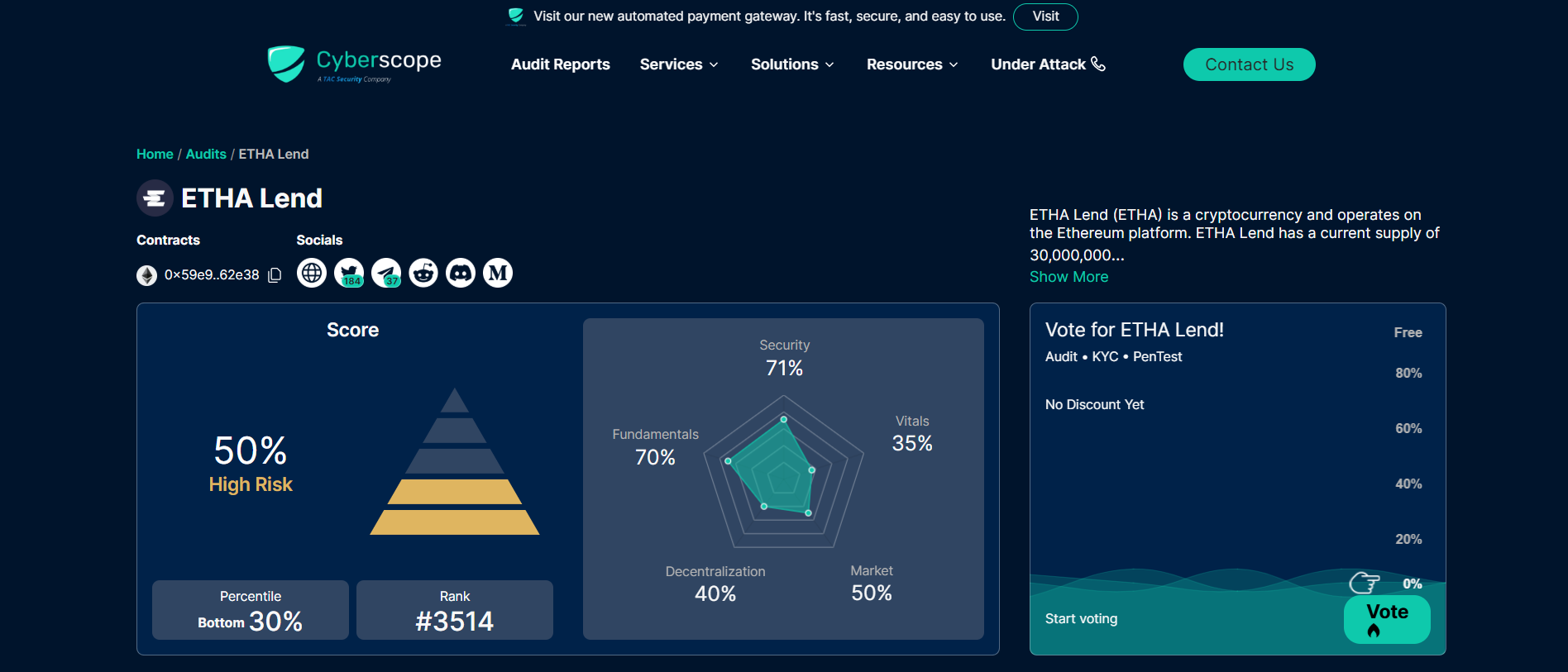

Actual-time evaluation by CertiK Skynet exhibits no present unresolved safety vulnerabilities. A 3rd-party safety evaluation by Cyberscope flagged some medium‑threat issues associated to decentralization and infrastructure, however no essential good contract flaws.

Threat administration: liquidation mechanisms & collateral monitoring

ETHA Lend enforces over-collateralized borrowing thresholds and repeatedly displays a well being issue to evaluate mortgage security. If collateral worth drops close to the protocol-defined liquidation threshold, bots or automated techniques provoke liquidation to guard lenders’ funds. These mechanisms cut back systemic threat and uphold platform solvency.

Controls, bounties & reserves

Whereas there’s no public document of a proper bug-bounty program or insurance coverage reserve presently, ETHA Lend’s structure, constructed on audited good contracts and over-collateralization, presents robust baseline safety. The protocol additionally incorporates a liquidity buffer in every lending pool, enabling smoother dealing with of liquidations and overlaying short-term funding wants to attenuate dangers throughout market stress.

Limitations and Challenges

Whereas ETHA Lend brings innovation to DeFi lending, it nonetheless faces a number of hurdles that might influence its long-term adoption, person development, and aggressive edge.

1. Decrease asset selection in comparison with Aave or Compound

ETHA Lend helps a curated set of property, specializing in in style stablecoins and choose risky tokens. Nonetheless, customers seeking to lend or borrow a broader vary of digital property, together with long-tail or newer tokens, may discover ETHA’s choices restricted.

Platforms like Aave and Compound present considerably extra asset choices, giving customers extra flexibility and diversification alternatives.

2. Mounted-term lending might restrict flexibility

Mounted-term lending can provide extra predictable yields, nevertheless it’s not all the time preferrred for customers who want liquidity on brief discover. Not like versatile lending fashions, the place customers can withdraw funds anytime, ETHA’s time-bound construction means property are locked for a set interval, doubtlessly creating frustration throughout sudden market shifts or emergencies.

3. Lengthy-term sustainability of token rewards

ETHA Lend depends closely on its native token ($ETHA) to incentivize participation, notably for liquidity provision and staking. Whereas this could entice customers within the brief time period, long-term sustainability relies on actual utility and demand.

With out ongoing innovation, robust tokenomics, or ecosystem enlargement, reward dilution and person drop-off may turn into challenges.

4. Competitors from different yield optimizers

ETHA Lend competes in a extremely aggressive phase of DeFi, going up towards established gamers like Yearn Finance, Idle Finance, and Beefy. These platforms provide bigger treasuries, wider integrations, and energetic communities. Until ETHA Lend continues to distinguish with distinctive options, intuitive UX, or superior returns, it dangers getting overshadowed.

5. Restricted model visibility and ecosystem partnerships

Regardless of its technical choices, ETHA Lend has comparatively low visibility within the DeFi house. It lacks high-profile partnerships or main integrations with Layer-2s, DAOs, or institutional gamers. This restricted publicity may decelerate person adoption and developer engagement except supported by stronger advertising and ecosystem collaboration.

6. Good contract dependency and centralization dangers

Like many DeFi tasks, ETHA Lend’s operations are powered by good contracts. Nonetheless, any bugs, exploits, or over-reliance on admin controls pose dangers to person funds and belief. If a small group or multisig pockets governs upgradeability or essential protocol capabilities, this centralization might be a degree of failure except addressed by decentralized governance or audits.

Conclusion: Can ETHA Lend Compete within the Subsequent DeFi Section?

ETHA Lend has carved out a novel place within the DeFi house by simplifying lending and borrowing by automation, good asset routing, and a user-friendly interface. Its give attention to fixed-term credit score merchandise and yield optimization instruments makes it particularly interesting to customers who worth predictable returns with out having to actively handle positions.

That mentioned, ETHA Lend isn’t designed for everybody. Customers searching for extremely customizable lending phrases, unique property, or most flexibility may choose platforms like Aave or Compound. Nonetheless, for these prioritizing effectivity, steady yields, and a much less technical expertise, ETHA Lend is a powerful contender.

ETHA Lend combines good automation with a clear person expertise, making it a stable selection for on a regular basis DeFi customers. If the group continues to innovate, increase asset assist, and entice extra integrations, ETHA Lend may develop into a serious participant within the subsequent technology of DeFi credit score protocols.

Disclaimer: This text is meant solely for informational functions and shouldn’t be thought-about buying and selling or funding recommendation. Nothing herein ought to be construed as monetary, authorized, or tax recommendation. Buying and selling or investing in cryptocurrencies carries a substantial threat of monetary loss. All the time conduct due diligence.

If you want to learn extra articles like this, go to DeFi Planet and comply with us on Twitter, LinkedIn, Fb, Instagram, and CoinMarketCap Neighborhood.

Take management of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics instruments.”

The publish Is ETHA Lend Remodeling Lending in DeFi? A Evaluation of Its Collateralized Credit score Merchandise appeared first on DeFi Planet.