Be part of Our Telegram channel to remain updated on breaking information protection

The XRP worth has plunged 15% prior to now week and 1.1% within the final 24 hours to commerce at $2.12 as of three.45 a.m. EST on a 29% leap in buying and selling quantity to $6.05 billion.

This comes because the long-awaited launch of the Bitwise XRP ETF begins buying and selling at the moment on the New York Inventory Alternate beneath the ticker “XRP”.

Massive information: The Bitwise XRP ETF is ready to start buying and selling on NYSE tomorrow with the ticker $XRP.

It has a administration payment of 0.34%, which is waived for the primary month on the primary $500M in belongings. This product brings buyers spot publicity to XRP, the crypto asset that goals to… pic.twitter.com/0GLR37NnuI

— Bitwise (@BitwiseInvest) November 19, 2025

The ETF is anticipated to carry new liquidity from institutional consumers, however uncertainty nonetheless shadows the Ripple token after a tough November.

Bitwise’s transfer is huge information for the XRP neighborhood. The fund has a 0.34% administration payment (waived for the primary month), and it’s custodied by Coinbase.

Bitwise’s XRP ETF is designed as a spot product, promising direct publicity to XRP’s worth, in contrast to earlier crypto ETFs targeted on futures.

With Grayscale and Franklin Templeton additionally set to launch XRP funds within the coming week, might these funds assist stabilise the XRP worth?

XRP Value Beneath Strain As Sellers Dominate

Value motion for XRP has been beneath sustained downward stress. Information from Glassnode exhibits that over 41% of the XRP provide is now sitting at a loss, and solely 58.5% of XRP holders are nonetheless in revenue—the bottom degree since late 2024, when XRP was buying and selling close to $0.53.

On-chain analytics reveal whales have been promoting for the reason that summer season, sparking a shift in sentiment to “anxiousness.” Retail buyers are additionally dashing for the exits, particularly these with lower than 100 XRP tokens.

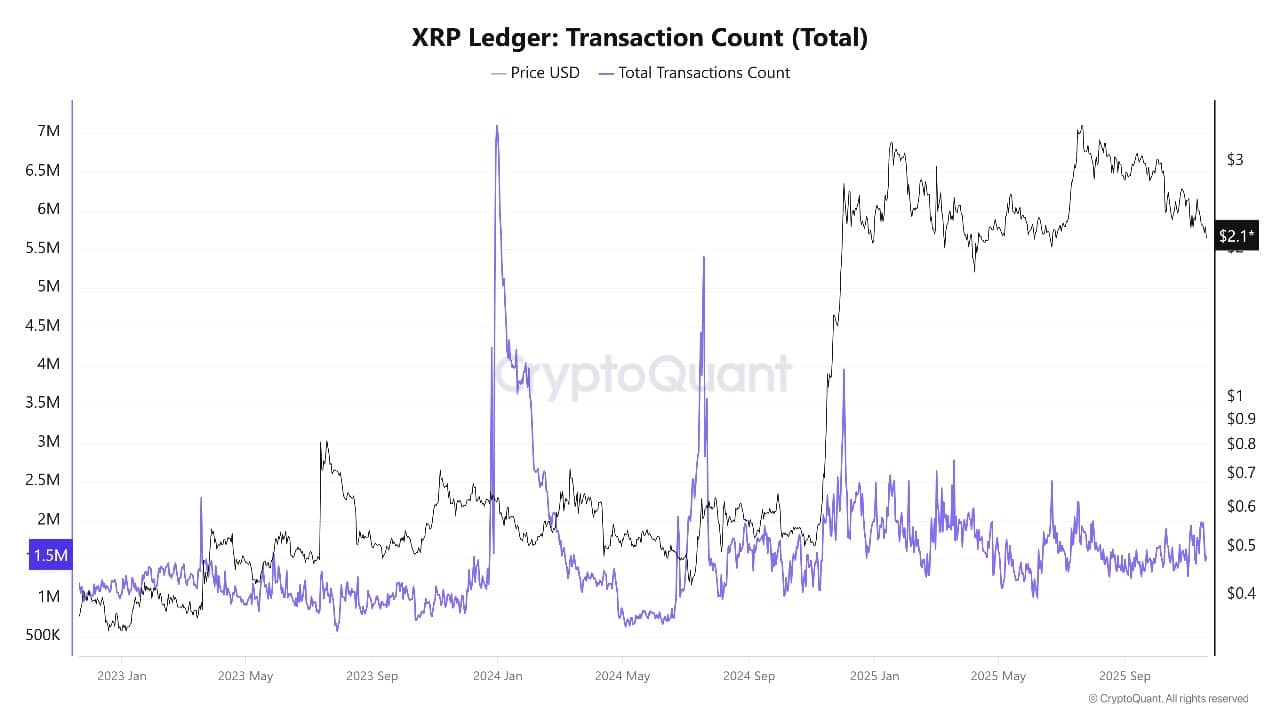

Nonetheless, the usage of the XRP Ledger stays sturdy regardless of the worth stoop. XRPScan stories that transaction volumes are excessive, with a number of each day spikes not associated to speculative buying and selling, however to will increase in utility.

Lately, over two billion XRP have been moved on the community in in the future, exhibiting that fee and settlement use circumstances are nonetheless energetic. The ledger continues to document between 1.5 and a pair of million profitable transactions per day, outperforming many various blockchains, even because the coin’s worth drops.

XRP Ledger Transaction Depend supply: CryptoQuant

XRP Value Bulls Might Regain Management

The XRP worth is now buying and selling at $2.12, beneath the 50-week easy transferring common (SMA) at $2.53 and approaching key assist ranges proven by the current multi-month buying and selling vary.

Bears are in management, because the coin struggles to carry above the crucial $2.10-$2.00 assist zone. The 50-week SMA at $2.53 has turn into sturdy resistance after the current breakdown. The 200-week SMA sits far beneath at $1.05, suggesting main long-term assist stays distant.

XRPUSDT Chart Evaluation Supply: Tradingview

The Relative Energy Index (RSI) is at 41, exhibiting that XRP shouldn’t be but “oversold,” however the pattern is bearish and momentum is missing. The MACD indicator is unfavourable, with the principle line beneath the sign and histogram bars in pink. This indicators that sellers are nonetheless in cost.

XRP’s worth is at the moment caught between $2.00 and $2.50, with the $2.00 space now performing as key assist. If bears break this degree, worth might drop rapidly to $1.80 and even $1.60, near the 61.8% Fibonacci retracement (at $1.60) from the earlier huge rally.

Beneath that, the 200-week SMA at $1.05 is the final “line within the sand” for long-term bulls. Nevertheless, for any rebound, XRP worth should reclaim $2.20–$2.25 first, then attempt to flip the 50-week SMA at $2.53 again into assist. Solely above $2.53 does the outlook begin to enhance, with upside targets close to $2.72 (23.6% Fib) and $3.10 (earlier native highs).

Will ETF Launches Stabilise XRP?

The brand new Bitwise XRP ETF launch at the moment is drawing enormous consideration from each institutional and retail buyers. Whereas it’s anticipated so as to add new liquidity and should entice recent waves of shopping for, the broader unfavourable sentiment and on-chain proof of heavy promoting make a fast turnaround unsure.

If at the moment’s ETF launch sparks demand, XRP might discover assist and get well to increased ranges. But when consumers don’t step in strongly, worth dangers will drift towards decrease helps within the coming weeks.

The following few days of buying and selling shall be essential for deciding whether or not XRP worth can lastly stabilise, or whether or not the downtrend continues regardless of Wall Avenue’s newest crypto product launches.

Associated Articles:

Finest Pockets – Diversify Your Crypto Portfolio

Simple to Use, Characteristic-Pushed Crypto Pockets

Get Early Entry to Upcoming Token ICOs

Multi-Chain, Multi-Pockets, Non-Custodial

Now On App Retailer, Google Play

Stake To Earn Native Token $BEST

250,000+ Month-to-month Energetic Customers

Be part of Our Telegram channel to remain updated on breaking information protection