On-chain information exhibits Bitcoin sharks and whales have noticed their inhabitants develop in the course of the latest market downturn, whereas retail has capitulated.

Bitcoin Sharks & Whales Have Been Rising In Quantity Lately

In a brand new submit on X, on-chain analytics agency Santiment has talked in regards to the newest development within the Provide Distribution of the important thing Bitcoin traders. The “Provide Distribution” is an indicator that tells us, amongst different issues, the variety of addresses that belong to a specific cohort.

Buyers are divided into these teams primarily based on the quantity of the asset that they’re carrying of their stability. For instance, the 1 to 10 cash cohort contains all wallets with no less than 1 and at most 10 BTC. The Provide Distribution for this group would decide the entire variety of addresses on the community that fall contained in the vary.

Within the context of the present matter, the vary of curiosity is the 100+ BTC one, equal to about $8.6 million on the present trade fee. It contains two key investor cohorts referred to as the sharks and whales. The sharks and whales are entities that may carry some extent of affect on the blockchain attributable to their massive holdings (with whales naturally being the extra essential of the 2), so their conduct can typically be price keeping track of.

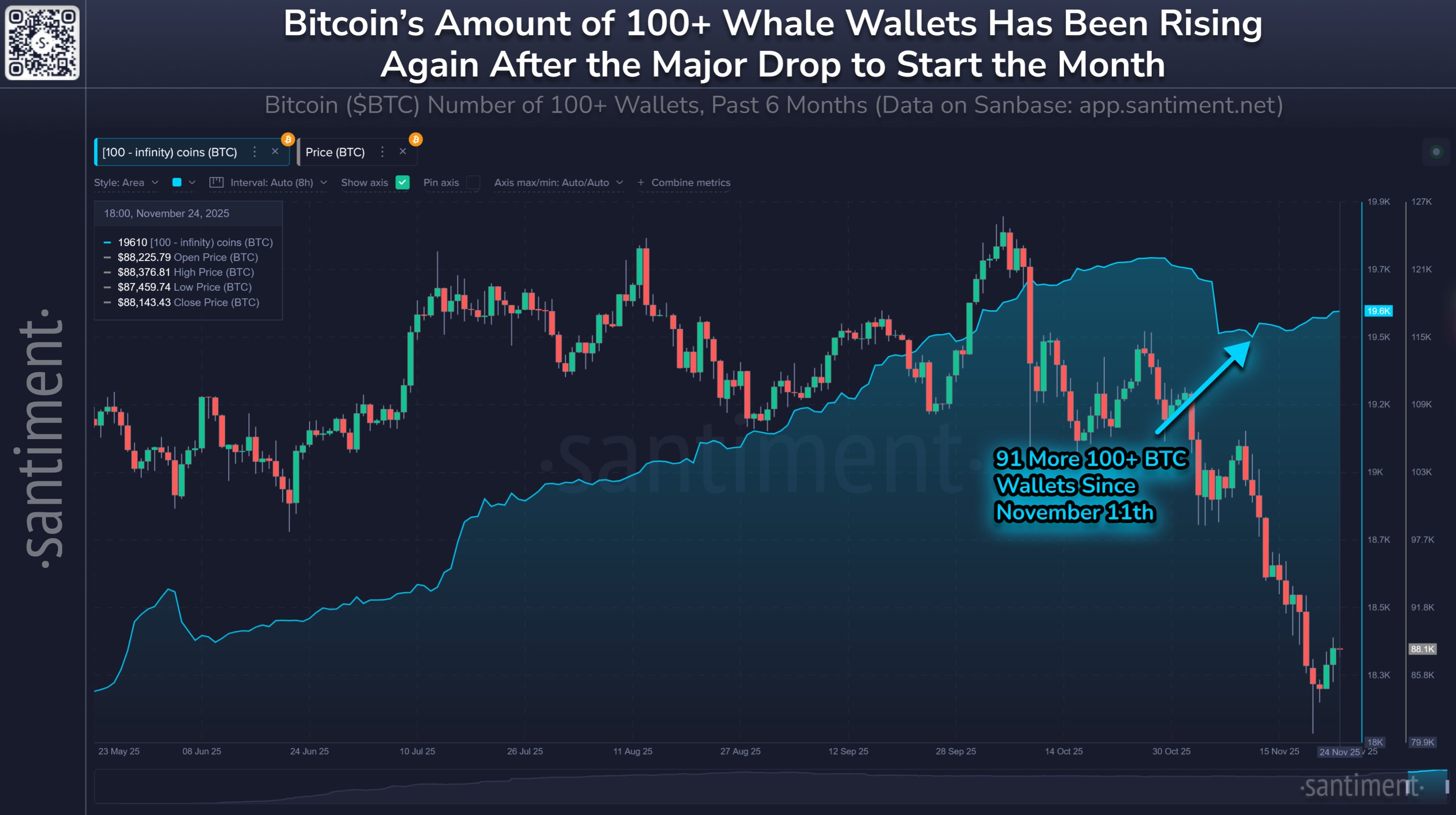

For the reason that all-time excessive (ATH) in October, Bitcoin has been following a downtrend, and because the chart beneath exhibits, the sharks and whales initially reacted by exiting as their Provide Distribution registered a pointy drop.

How the inhabitants of sharks and whales has modified on the BTC community over the previous few months | Supply: Santiment on X

Apparently, nevertheless, as Bitcoin’s decline has accelerated since November eleventh, the Provide Distribution of the sharks and whales has witnessed a reversal. Right now, there are 91 extra traders of this dimension on the community in comparison with the low earlier within the month. This represents a rise of 0.47% for the metric, which, whereas not that top, is an indication that huge cash holders have been slowly coming again in to purchase the crash.

Santiment has additionally revealed that the smallest of traders on the community (holding lower than 0.1 BTC or $8,700) have seen their inhabitants shrink concurrently this development within the sharks and whales.

This development may very well be a possible indication that the small fingers have been capitulating after the bearish momentum, and enormous entities have been shopping for cash off them. “Retail capitulation will typically play out effectively for crypto costs in the long term,” defined the analytics agency.

BTC Value

Bitcoin displayed a short restoration above $89,000 on Monday, however the coin has since retraced again to $87,000.

The value of the coin appears to have general moved sideways within the final 5 days | Supply: BTCUSDT on TradingView

Featured picture from Dall-E, Santiment.web, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent overview by our group of high know-how specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.