Be a part of Our Telegram channel to remain updated on breaking information protection

Technique CEO Phong Le says Michael Saylor’s agency has “extra flexibility than ever” to proceed shopping for Bitcoin.

Talking on the “What Bitcoin Did” podcast, Le mentioned that Technique has a capital construction that’s constructed on long-dated debt and that there is no such thing as a short-term strain on its capacity to boost funds.

The $60 Billion Bitcoin Wager | @Technique CEO Phong Le https://t.co/H216CRFggP pic.twitter.com/w0WBg42PaD

— Michael Saylor (@saylor) November 28, 2025

Capital Markets The Cause Technique Can Purchase Bitcoin In Completely different Market Cycles

Technique is the most important company Bitcoin holder globally, and began buying BTC as a part of its treasury again in 2020.

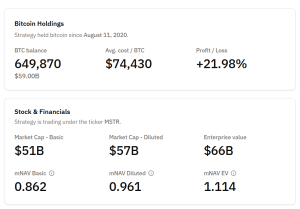

Knowledge from Bitcoin Treasuries reveals the agency holds 649,870 BTC valued at about $59 billion at present costs.

Technique’s BTC holdings (Supply: Bitcoin Treasuries)

These holdings have been acquired by way of a collection of purchases that have been funded by way of convertible word tranches which can be long-dated and carry little near-term dilution danger.

Le mentioned capital-markets are the “magic” that allows Technique to proceed its Bitcoin accumulation by way of a number of market cycles, including that its steadiness sheet is engineered to keep away from liquidity stress and to depart room open for opportunistic issuance.

The corporate’s first debt maturity is simply set for December this 12 months, giving Technique “plenty of flexibility to be opportunistic,” he mentioned.

He argued that Technique at the moment has extra flexibility than at any level in its historical past, citing the corporate’s capacity to boost fairness by way of at-the-market applications in addition to its monitor report of issuing zero-coupon or low-coupon convertible notes.

“We’ve proven we are able to do each,” he mentioned, including that the agency can both increase extra capital throughout robust fairness markets or lean on the convertible notes when charges and market situations favor long-duration issuance.

Technique Share Worth In A Quick-Time period Uptrend

The corporate rebranded from MicroStrategy to Technique earlier this 12 months, and has transitioned from a standard software program firm to a hybrid enterprise combining enterprise analytics with a Bitcoin-buying treasury plan.

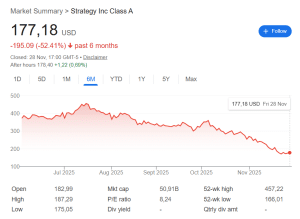

Le acknowledged that some buyers nonetheless query the way to worth Technique, particularly given the volatility round Bitcoin’s worth. Technique’s MSTR inventory has plummet over 52% previously six months.

Technique share worth efficiency over the previous 6 months (Supply: Google Finance)

That, and the drop within the Bitcoin worth, precipitated Technique’s Market Internet Asset Worth (MNAV), which is the ratio of the corporate’s market cap to the online asset worth of its crypto holdings, to plunge. The ratio has since recovered considerably to stand at 1.13.

MSTR has recovered previously week, climbing 2.4% after a acquire of 0.8% previously 24 hours. The restoration coincided with a 5% leap within the Bitcoin worth over the previous week.

Associated Articles:

Finest Pockets – Diversify Your Crypto Portfolio

Simple to Use, Function-Pushed Crypto Pockets

Get Early Entry to Upcoming Token ICOs

Multi-Chain, Multi-Pockets, Non-Custodial

Now On App Retailer, Google Play

Stake To Earn Native Token $BEST

250,000+ Month-to-month Energetic Customers

Be a part of Our Telegram channel to remain updated on breaking information protection