Cryptocurrencies are well beyond being simply digital cash. At the moment, you’ll be able to simply discover tokens constructed for funds, governance, gaming, and even digital possession. There’s a coin for the whole lot these days, and figuring out the varieties of cryptocurrency is important to fluently navigate the market. We’ve collected all of the varieties of cash in a single easy checklist that will help you perceive their variations.

What Are Cryptocurrencies?

Cryptocurrencies are digital belongings—they exist nearly, however can signify bodily objects or conventional cash. Crypto transactions and data are supported by a decentralized system, utilizing cryptography, therefore the title. Cryptocurrencies don’t want a financial institution to operate, however they do exist inside an ecosystem that features exchanges, completely different blockchain networks, particular platforms, and apps.

Primary Forms of Cryptocurrency

Totally different cryptocurrencies serve completely different functions. For instance, native currencies energy their very own blockchains, whereas different tokens depend on present networks and sometimes signify both a challenge or an asset. After all, there are additionally stablecoins that purpose to keep up a secure value and maintain the market roughly in sync with conventional finance.

You’ve most likely heard of NFTs (non-fungible tokens), that are distinctive digital collectibles that show possession of artwork, music, or in-game gadgets. And eventually, Central Financial institution Digital Currencies (CBDCs) are doing their humble half in sustaining authorities presence inside the market. On this information, we’ll concentrate on every kind intimately.

Cash: Native Cryptocurrencies

The concept behind cash—native cryptocurrencies—is to have the ability to pay transaction charges or reward community members. These currencies assist the chain they exist on.

Learn extra: Cash vs. Tokens: What’s the Distinction?

Cost Cash: Bitcoin, Litecoin, Sprint

Cost cash are the unique type of cryptocurrency—constructed to maneuver worth rapidly, securely, and with out middlemen. They concentrate on being environment friendly digital money as a substitute of serving advanced capabilities like sensible contracts. Bitcoin (BTC) is the pioneer of fee cash. Bitcoin was created to let individuals ship cash peer to see with out counting on banks. Litecoin (LTC) adopted as a sooner, lighter model of Bitcoin. It’s not as fashionable, however usually used for smaller or extra frequent funds. Sprint (DASH) took it a step additional by introducing elective privateness options and immediate transactions, making on a regular basis crypto funds much more sensible.

Privateness Cash: Monero, Zcash, Sprint PrivateSend

The primary function of privateness cash is maintaining your monetary exercise non-public. Privateness cash use superior cryptographic strategies to cover particulars like sender, receiver, and quantity. For instance, Monero (XMR) makes use of applied sciences like Ring Signatures and Stealth Addresses, making transactions fully untraceable.

In the event you’re on the lookout for extra flexibility, Zcash (ZEC) takes a selective method, permitting customers to decide on between clear and shielded transactions utilizing zero-knowledge proofs. Then there are cash like Sprint PrivateSend, which provide elective privateness by mixing funds from a number of customers and making it tough to hint the place any single coin got here from.

Governance Cash: Tezos, Cardano (ADA)

Governance cash flip holders into energetic members. They let customers suggest, vote on, and affect key selections for a blockchain or protocol they’re utilizing. Tezos (XTZ) was one of many first to introduce on-chain governance and permit upgrades and rule adjustments to be authorized by the neighborhood with out exhausting forks. Cardano (ADA) follows an identical precept, giving holders the facility to vote on improvement proposals and funding allocations.

Tokens: Cryptocurrencies Constructed on Different Blockchains

Tokens are cryptocurrencies that run on present blockchains, utilizing their infrastructure to serve a challenge or signify an asset. Here’s a checklist of various kinds of tokens. We’ll discover every of those in additional element under.

How one can Get Free Crypto

Easy methods to construct a worthwhile portfolio at zero value

Utility Token

A utility token provides you entry to a services or products inside a blockchain ecosystem, like paying charges, utilizing options, or unlocking premium instruments.

Governance Token

A governance token lets holders vote on challenge updates, proposals, and selections, giving its neighborhood a say in how the platform adjustments.

Safety Token

A safety token represents possession in real-world belongings like shares or actual property. Due to that, safety tokens are regulated equally to conventional monetary securities.

Non-Fungible Token

Non-fungible tokens, or NFTs are one-of-a-kind digital collectibles. They show possession of things like artwork items, music, or any distinctive digital asset.

Learn extra: Fungible vs. Non-Fungible Tokens

Wrapped Token

A wrapped token is a tokenized model of one other coin (like Wrapped Bitcoin on Ethereum). Merely put, they permit the unique token for use on completely different blockchains.

Artificial Asset

A digital token that mirrors the value of actual belongings is an artificial asset. Artificial belongings aren’t backed by something, however because of cleverly crafted sensible contracts, they replicate the market habits of no matter they signify—shares, currencies, or commodities. Their primary objective is giving their proprietor publicity to the belongings with out really proudly owning them.

Staking By-product

A staking by-product is a token you obtain when staking crypto. It represents your locked belongings and means that you can commerce or use them elsewhere.

Rebase Token

A rebase token mechanically adjusts its provide to keep up a goal value. In different phrases, the variety of tokens in your pockets will increase or reduces as market circumstances change.

Memecoin

Memecoins are designed to be enjoyable and fashionable. Their energy is in the neighborhood and the sheer religion that they’ll succeed. Memecoins are sometimes impressed by memes or popular culture, like Dogecoin or Shiba Inu, and typically they even acquire actual worth.

Learn extra: 10 Finest Memecoins to Purchase

Asset-Backed Token

In the event you’re critical about your funding, an asset-backed token is your finest guess. These digital tokens are absolutely supported by actual belongings like gold, oil, or property. They hyperlink crypto worth to tangible assets.

Change Token

An alternate token is a local token of a crypto alternate platform. These tokens are used for price reductions, rewards, or, like their governance counterparts, for voting on exchange-related proposals.

Charity Token

Each on occasion, a charity token will get launched. Charity tokens are designed to help social causes and a portion of transactions or earnings goes on to charitable organizations.

Fan Token

Celebrities and organizations typically launch fan tokens—belongings that permit followers work together with and help their favourite sports activities groups, artists, or manufacturers. These tokens can permit individuals to vote, or get rewards and unique perks.

Soulbound Token

A soulbound token is a kind of non-transferable NFT. Soulbound tokens signify achievements, credentials, or id. They’re completely tied to the holder’s pockets.

Reward Token

Earned via staking, gaming, or loyalty packages, a reward token encourages participation and rewards person exercise inside the challenge it represents.

DAO Token

A DAO token is a kind of governance token. It’s used for voting and participation in decentralized autonomous organizations, the place members collectively govern and fund shared initiatives.

Be taught extra: What Are DAOs and How Do They Work?

Inflation-Resistant Token

The aim of an inflation-resistant token is to keep up long-term worth. That is accomplished by limiting provide development or pegging the worth to secure or deflationary belongings like Bitcoin.

Governance NFT

A governance NFT is an NFT with the traits of a governance token. It’s a novel collectible that grants its proprietor decision-making energy or voting rights in a challenge’s system.

Reserve-Backed Token

The title “reserve-backed token” is self-explanatory—it’s a token backed by reserves of secure belongings (like fiat or crypto) with the purpose of making certain its liquidity and belief in its worth.

Fractional NFT

A fractional NFT is used to separate possession of a single NFT into smaller components. This manner, a number of customers can co-own and commerce shares of a priceless asset.

Wrapped NFT

Equally to a wrapped coin, a wrapped NFT tokenizes the unique NFT and permits it to be traded or used throughout completely different blockchains or platforms.

Metaverse Cash

Digital currencies used inside digital worlds are known as metaverse cash. With these cash, customers can purchase land, gadgets, or experiences in metaverse platforms like Decentraland or The Sandbox.

Play-to-Earn Cash

Play-to-earn cash are tokens earned by taking part in blockchain video games. The video games purpose to reward customers for time, talent, and participation with actual, tradeable worth.

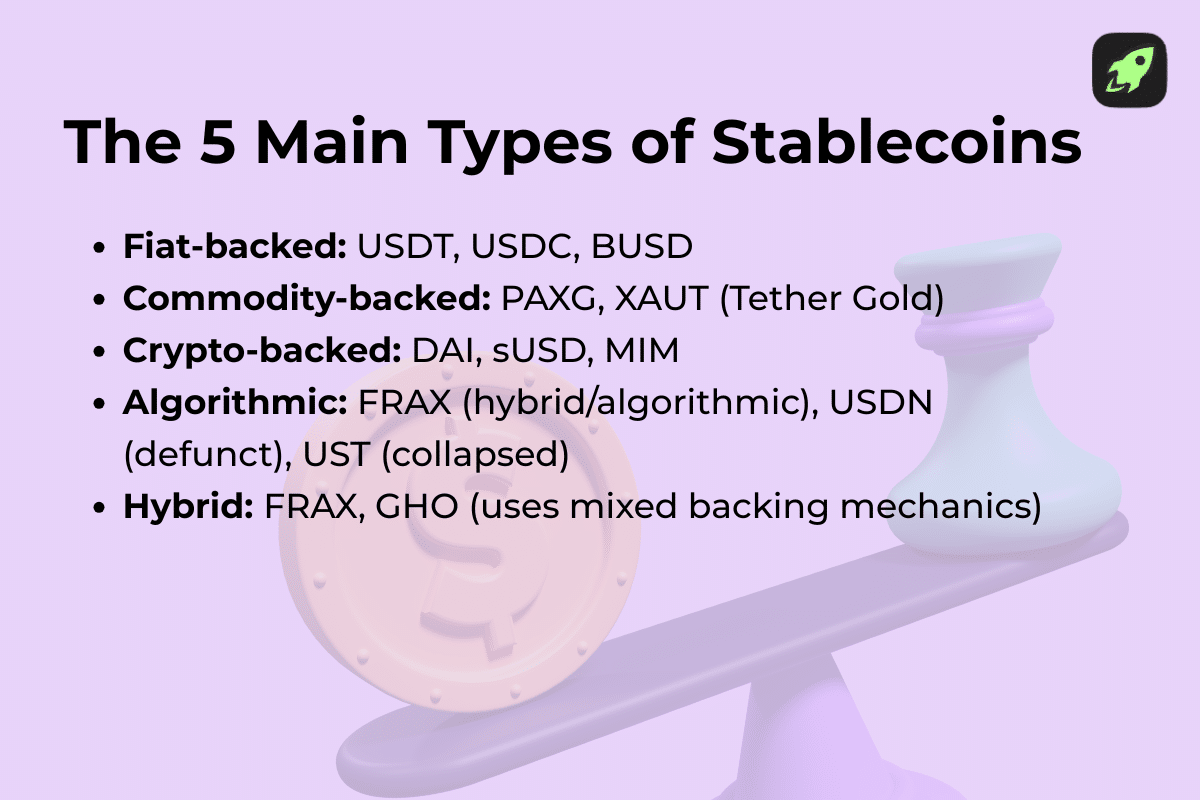

Stablecoins: Cryptocurrencies Pegged to Actual Worth

Stablecoins are cryptocurrencies designed to maintain a gradual worth. They’re both backed by real-world belongings—just like the US greenback, gold, or different crypto—or keep their worth with the assistance of an algorithm. A stablecoin’s value is pegged to a selected asset, often one greenback, which makes these cash excellent for storing cash and making transactions. Let’s take a fast have a look at the varieties of stablecoins.

Fiat-Collateralized Stablecoin

A fiat-collateralized stablecoin is backed by conventional cash like US {dollars}. The cash is stored in a financial institution, whereas these cash (like USDT or USDC) stay secure particularly as a result of every token represents actual money held in reserve.

Discover out which of those two fashionable stablecoins is the higher selection: USDC or USDT?

Crypto-Collateralized Stablecoin

A crypto-collateralized stablecoin is backed by different cryptocurrencies as a substitute of fiat. Extra crypto (like ETH or BTC) is locked on a wise contract to maintain the token’s worth secure, even when costs swing.

Commodity-Collateralized Stablecoin

A stablecoin pegged to bodily items similar to gold, oil, or silver, is named a commodity-collateralized stablecoin. The regular worth of real-world belongings helps these tokens keep value stability and worth.

Algorithmic Stablecoin

An algorithmic stablecoin makes use of sensible algorithms to steadiness provide and demand. It helps maintain costs secure via automated minting or burning of tokens.

Learn a deeper dive into the subject right here: Algorithmic Stablecoins Defined for Novices

Privateness Stablecoin

Similar to a privateness coin, a privateness stablecoin retains transaction particulars hidden. The distinction is, this coin additionally has a secure worth. It’s very best for customers who need a assured value with further discretion for his or her transfers.

Artificial Greenback

An artificial greenback is a blockchain-based token that mimics the US greenback’s worth utilizing decentralized collateral or sensible contracts—with out really holding actual {dollars} in reserve.

Wrapped Stablecoin

A wrapped stablecoin is a model of an present stablecoin (like Wrapped USDC) that may transfer throughout completely different blockchains for higher flexibility and compatibility.

Artificial Euro

An artificial euro is designed to observe the worth of the euro, usually constructed via decentralized techniques utilizing crypto collateral or algorithms.

Central Financial institution Digital Currencies (CBDCs)

Central Financial institution Digital Currencies or CBDCs are digital variations of nationwide cash issued by central banks. In each sense they’re similar to common money, however they solely exist on-line. Folks can use CBDCs for on a regular basis funds, transfers, or financial savings—simply sooner, safer, and extra clear than conventional banking techniques.

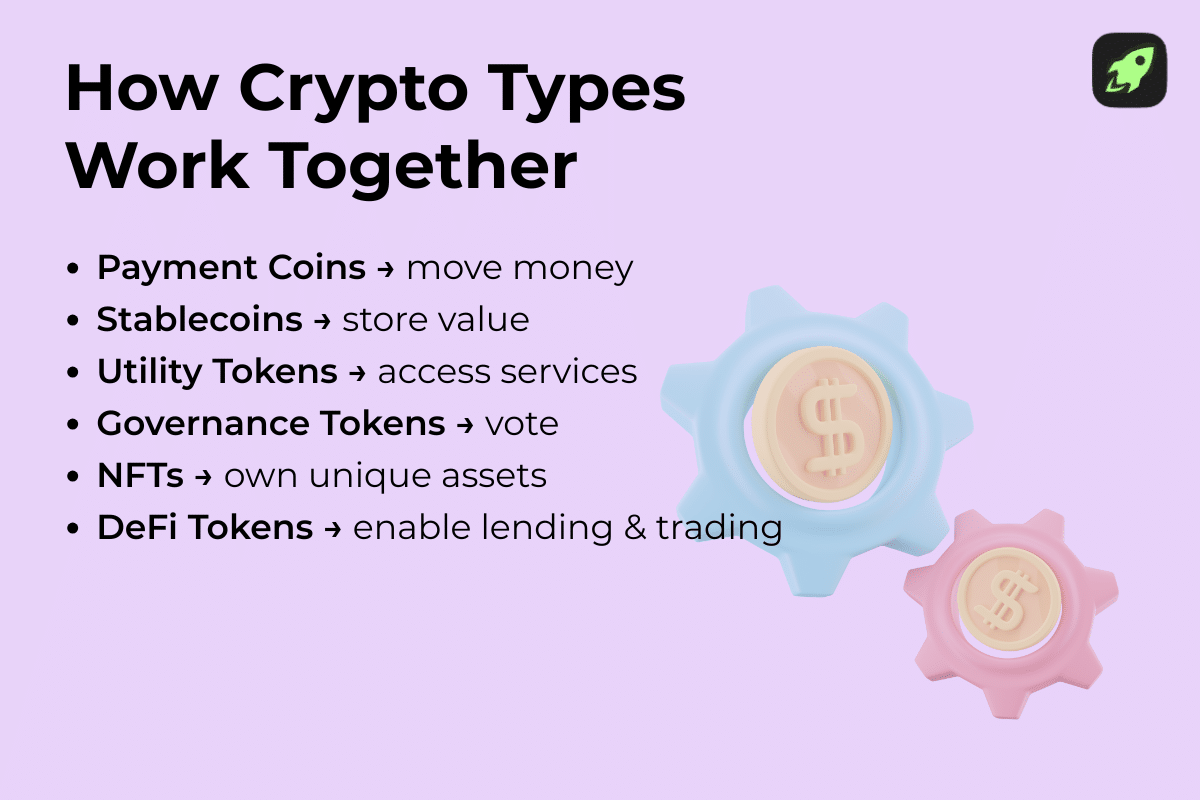

How Crypto Varieties Work Collectively

Various kinds of cryptocurrency work collectively to construct a whole digital ecosystem. Cost cash deal with on a regular basis transactions, transferring worth between customers. Stablecoins maintain costs regular for buying and selling and financial savings, utility tokens grant entry to providers, and governance tokens let customers vote on adjustments. In that very same ecosystem, NFTs signify distinctive belongings, and different tokens allow lending, borrowing, and yield farming. All varieties of digital belongings are important relating to constructing a related, versatile monetary system that may rival conventional finance.

How one can Select the Proper Kind of Cryptocurrency for You

Earlier than you begin shopping for essentially the most talked-about cash, ask your self: what do you want them for? Now that you know the way every kind of coin is used, you’ll be able to decide the one which serves your targets.

Funds and Transfers. You need to use fee cash like Bitcoin, Litecoin, or Sprint to ship cash immediately throughout borders, pay for items and providers, or switch funds with out banks.

Saving and Stability. Stablecoins similar to USDT or USDC are nice for storing worth or defending towards crypto volatility.

Investing and Incomes. You need to use staking tokens (like ETH or ADA) to earn rewards, or maintain safety tokens that signify real-world belongings and generate passive revenue.

Accessing Providers. Utility tokens unlock options inside crypto platforms, like paying fuel charges, accessing premium instruments, or becoming a member of ecosystems.

Voting and Governance. Governance tokens (like UNI or AAVE) allow you to take part in neighborhood votes.

Gathering and Gaming. NFTs give possession of digital collectibles, artwork, or in-game belongings. Play-to-earn tokens reward gamers for time and talent in blockchain video games.

Buying and selling and Hypothesis. Purchase and commerce memecoins or established belongings with long-term development potential.

Exploring New Worlds. Metaverse cash allow you to purchase land, gadgets, or experiences in digital worlds like Decentraland or The Sandbox.

How Do I Purchase My First Cryptocurrency?

To purchase your first cryptocurrency, you’ll want a crypto buying and selling platform (CTP)—an internet service that connects consumers and sellers. Some platforms ship crypto straight to your pockets, whereas others maintain it of their custody. Earlier than signing up, at all times test if the platform is registered and controlled.

You’ll be able to select any of over 1000 cash accessible on Changelly to begin your portfolio.

You may additionally come throughout Preliminary Coin Choices (ICOs) or Token Choices (ITOs). New initiatives run them to lift funds. These tokens usually don’t have any assured worth and might be dangerous. Do your analysis and make investments solely what you’ll be able to afford to lose.

Ultimate Ideas

Navigating the varieties of crypto can appear overwhelming, however simply keep in mind—the whole lot it’s essential to know needs to be offered within the challenge’s whitepaper. It’s a doc that helps you be taught all in regards to the token’s use, views, and tokenomics. As soon as you understand the fundamentals, you’ll be higher geared up to judge initiatives and make knowledgeable selections within the crypto area.

FAQ

Why are there so many various cash and tokens?

Every crypto challenge serves a special function—some concentrate on funds, others on gaming, DeFi, or governance. Builders create new tokens to unravel particular issues or energy their very own ecosystems.

Do all cryptocurrencies have actual use?

Not all crypto has actual use. Some have robust use circumstances like funds or lending, whereas others exist primarily for hypothesis or hype. It’s finest to analysis how a token is definitely used earlier than shopping for.

Which kind of crypto ought to learners begin with?

Begin with well-known cash like Bitcoin or Ethereum. They’re simpler to know, extensively supported, and extra secure in comparison with new or experimental initiatives. different for learners is stablecoins, as they’re designed to keep up their value.

How can I spot faux or rip-off initiatives?

Test if the crew is clear, the web site appears skilled, and the challenge has clear targets. Keep away from provides that promise assured earnings or sound too good to be true.

Can one crypto be multiple kind?

Sure. Some cryptocurrencies match a number of classes—for instance, a governance token may additionally act as a utility token inside its platform. It relies on how the challenge is designed.

Disclaimer: Please observe that the contents of this text aren’t monetary or investing recommendation. The knowledge offered on this article is the writer’s opinion solely and shouldn’t be thought-about as providing buying and selling or investing suggestions. We don’t make any warranties in regards to the completeness, reliability and accuracy of this data. The cryptocurrency market suffers from excessive volatility and occasional arbitrary actions. Any investor, dealer, or common crypto customers ought to analysis a number of viewpoints and be acquainted with all native laws earlier than committing to an funding.