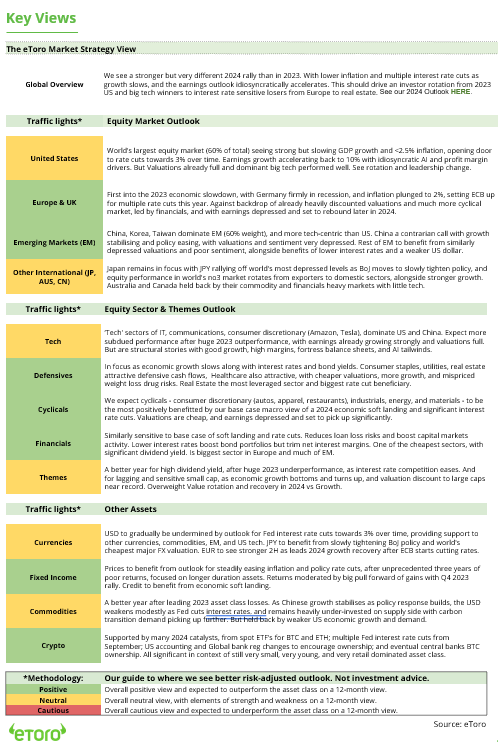

Decoding China’s Tech Surge

Traders are re-evaluating the tech hole between China and the USA, sparking a revaluation of Chinese language tech shares. The Dangle Seng Tech Index, monitoring giants like Alibaba, Tencent, and JD, has surged 31% year-to-date in native forex phrases. Right here we have a look at the explanations behind the surge.

AI Growth and Innovation: DeepSeek’s AI breakthrough is attracting world curiosity in China’s tech and AI sectors, particularly amongst firms as soon as thought of undervalued. With Alibaba teaming up with Apple to combine AI options into the Chinese language iPhone and Tencent’s WeChat incorporating DeepSeek, demand for AI cloud computing is predicted to develop quickly. This accelerated progress in AI can also be driving down prices.

Enticing Valuations and Progress Potential: Regardless of some market volatility, long-term development prospects stay robust, with present valuations at solely 65% of their US counterparts. Whereas one of the best time to purchase was a 12 months in the past—when valuations have been deeply discounted, providing a a lot bigger margin of security earlier than the practically 60% rally—Chinese language tech shares nonetheless current alternatives. Earnings surprises and a shift of institutional investments into the sector are fueling momentum. Furthermore, whereas Beijing’s September coverage pivot helped cut back draw back dangers, innovation-driven tech breakthroughs are more likely to maintain the restoration higher than rebounds pushed purely by coverage shifts and market re-pricing.

Authorities Help and Renewed Confidence: Indicators of elevated authorities assist for personal companies are additionally boosting sentiment. President Xi Jinping’s energetic engagement with prime executives from Alibaba, BYD, and Tencent underscores efforts to revive confidence within the tech sector after years of regulatory crackdowns.

Regardless of the bullish outlook, buyers should contemplate potential dangers: First, whereas China has signaled assist for personal enterprise, previous crackdowns stay contemporary in investor reminiscence. Second, export controls on superior chips and AI-related know-how might decelerate China’s progress. Third, ongoing tensions with the US and Europe might influence overseas funding flows.

Bottomline: China’s tech resurgence is now not only a policy-driven rebound however a shift fueled by innovation, rising AI competitiveness, and robust authorities assist. With valuations nonetheless under US ranges and institutional flows rising, Chinese language tech shares proceed to current compelling opportunities- although buyers should stay conscious of regulatory and geopolitical dangers.

Progress vs. valuation: Is Nvidia value its value?

Sector Rotation Pressures Tech Shares: Because the starting of the 12 months, tech shares have been among the many greatest losers within the S&P 500. With a modest 0.9% decline, the sector lags behind the broader market. Solely Shopper Discretionary shares have carried out worse at -3.4%. In the meantime, Vitality, Well being Care, and Communications Companies are the winners, gaining between 5% and 6%.

Nvidia Earnings on Wednesday After Market Shut: Analysts count on EPS development of 61.2% to $0.79 and $38.1 billion in income. Traders ought to look ahead to any indicators of weakening demand and the way easily the transition to Blackwell chips unfolds, as these might drive the following efficiency leap and development cycle.

Provide Chain and Tariffs as a Danger: Nvidia depends closely on TSMC, which might turn out to be a weak spot if Trump imposes new tariffs. China additionally stays a danger, as commerce conflicts and export restrictions might additional restrict market entry.

Excessive Valuation, however Distinctive Profitability: Nvidia trades at a ahead P/E of 34.2, above business friends, however its LTM EBIT margin of 62.7% underscores its superior profitability. Nvidia is not only a development inventory—it’s a extremely environment friendly revenue machine.

Third Breakout Try Attainable: Nvidia has narrowed the hole to its file excessive to 10%. Since November, the inventory has confronted two failed breakouts at $149 (see chart). The uptrend stays intact, making a 3rd try attainable. Help ranges at $100.84 and $90.58 might present a cushion in case of promoting stress.

Bottomline: Nvidia has shortly recovered from DeepSeek-related losses, however the important thing query stays: What’s subsequent? Wednesday’s earnings report will present not simply an replace on Nvidia, but additionally insights into the place we stand within the AI cycle. With its excessive valuation, potential dangers are in focus. To remain aggressive, Nvidia should diversify its provide chain and reassess its China technique. Traders are on the lookout for clear solutions.

Supply: eToro, TradingView

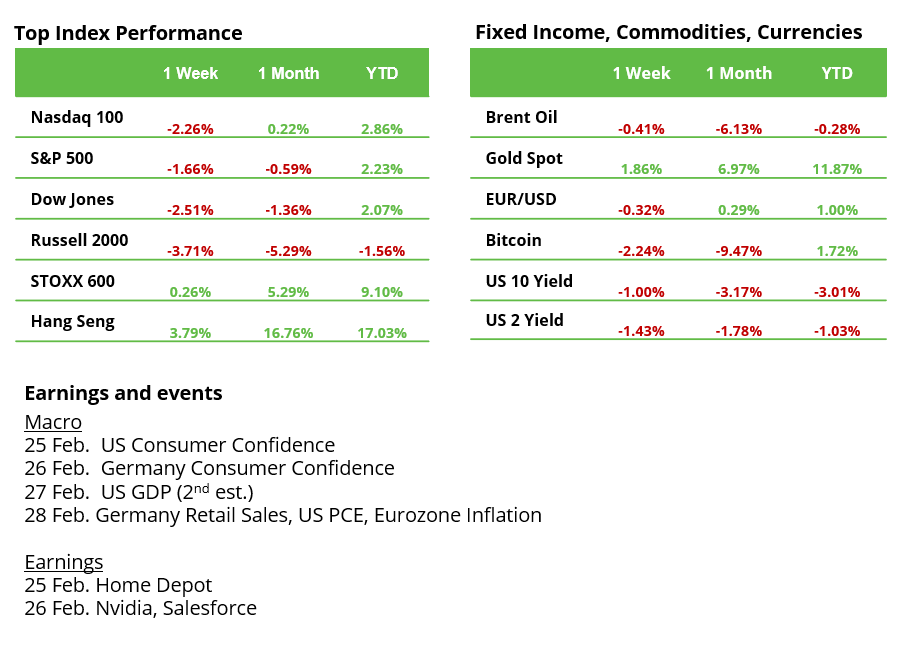

Weekly Efficiency and Calendar

This communication is for data and schooling functions solely and shouldn’t be taken as funding recommendation, a private advice, or a proposal of, or solicitation to purchase or promote, any monetary devices. This materials has been ready with out considering any specific recipient’s funding targets or monetary state of affairs and has not been ready in accordance with the authorized and regulatory necessities to advertise impartial analysis. Any references to previous or future efficiency of a monetary instrument, index or a packaged funding product will not be, and shouldn’t be taken as, a dependable indicator of future outcomes. eToro makes no illustration and assumes no legal responsibility as to the accuracy or completeness of the content material of this publication.