Introduction

Crocs ($CROX) is a worldwide chief in informal footwear. The corporate owns the manufacturers Crocs and Heydude, which it not too long ago acquired. Its administration has made Crocs probably the most worthwhile firm within the business, even forward of firms like Nike or Adidas. Regardless of this, the market nonetheless doesn’t just like the acquisition of Heydude, which, in my view, will result in increased progress and a extra diversified providing of merchandise.

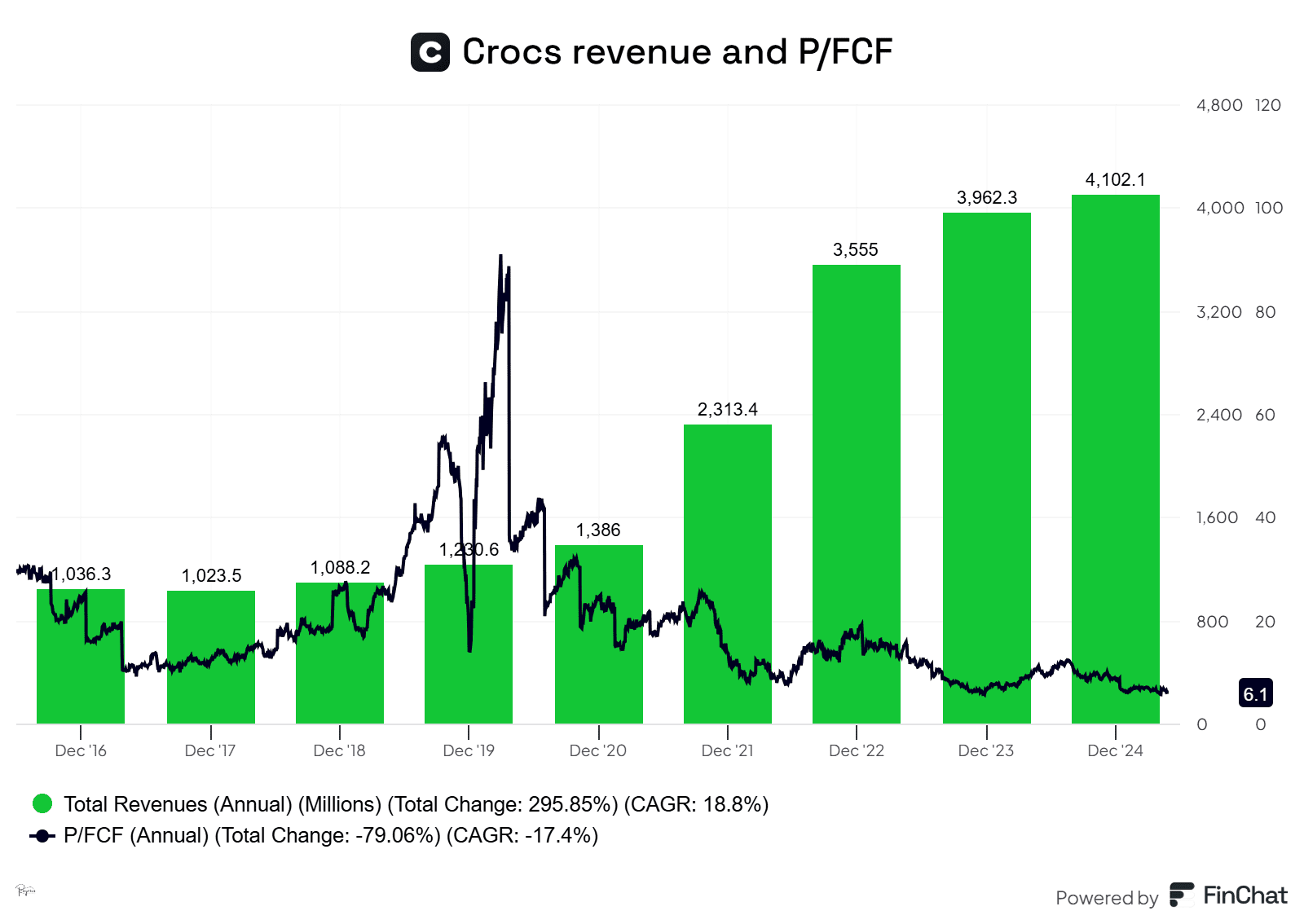

Supply: Finchat, Creator Evaluation

Key highlights

Greatest-in-class enterprise valued as a foul enterprise

Good capital allocation and good administration

Heydude, the massive situation of the corporate?

Enterprise Mannequin Overview

Crocs’ enterprise mannequin is straightforward: They promote sandals and footwear, taking good care of the design, improvement, distribution, and advertising and marketing of these footwear. As said earlier than, the corporate owns two completely different manufacturers: Crocs, which accounts for 80% of the corporate’s income, and Heydude, which accounts for the opposite 20%.

Concerning the Crocs model, its income comes primarily from the US (56%), though the worldwide phase of the corporate is rising bigger. Heydude has most of its income coming from the US.

Detailed Funding Thesis

Crocs is presently buying and selling at 6 instances earnings. With excessive Free Money Circulation conversion and a stable return on invested capital (ROIC), the market is discounting the corporate’s income to fall and its margins to lower. Nonetheless, even when that’s the case for its US enterprise, the corporate is pushing its worldwide growth, making room for extra progress. In reality, the corporate has steadily been rising its income by double digits in the course of the previous.

Supply: Finchat

The corporate has guided for 2025 that Crocs model goes to develop about 6%, whereas Heydude goes to maintain shrinking its income by 7% to 9%. As an mixture, that implies that the entire firm goes to develop its income by about 3%. Thus, the present valuation is ridiculous since it’s contemplating that the entire enterprise goes to shrink.

Within the meantime, the corporate has authorised $1.3B buybacks, which implies that the corporate should purchase 20% of its market cap at the moment underneath the present authorization whereas paying down debt.

Approaching the valuation conservatively, we are able to worth Crocs as a gradual grower, with income progress of about 3%-4% for the longer term. Concerning Heydude, the corporate has pushed an excessive amount of of its sale and is now specializing in a turnaround. The query is, can they do it?

The administration of the corporate has said that it’s following Crocs’ turnaround guide. They’re making use of the identical measures they took when Crocs’ income fell from 2015 to 2017. For my part, this turnaround can generate headwinds within the brief time period, however from 2026 on, it needs to be accomplished and will add some top-line progress to the corporate.

Thus, I assume that this 12 months’s EPS of 15$ per share is sustainable since Crocs’ progress ought to offset Heydude’s decline. Making use of a conservative PE a number of of 12 instances, a lot decrease than its opponents and beneath the typical of the US inventory market, the corporate’s inventory ought to double its value.

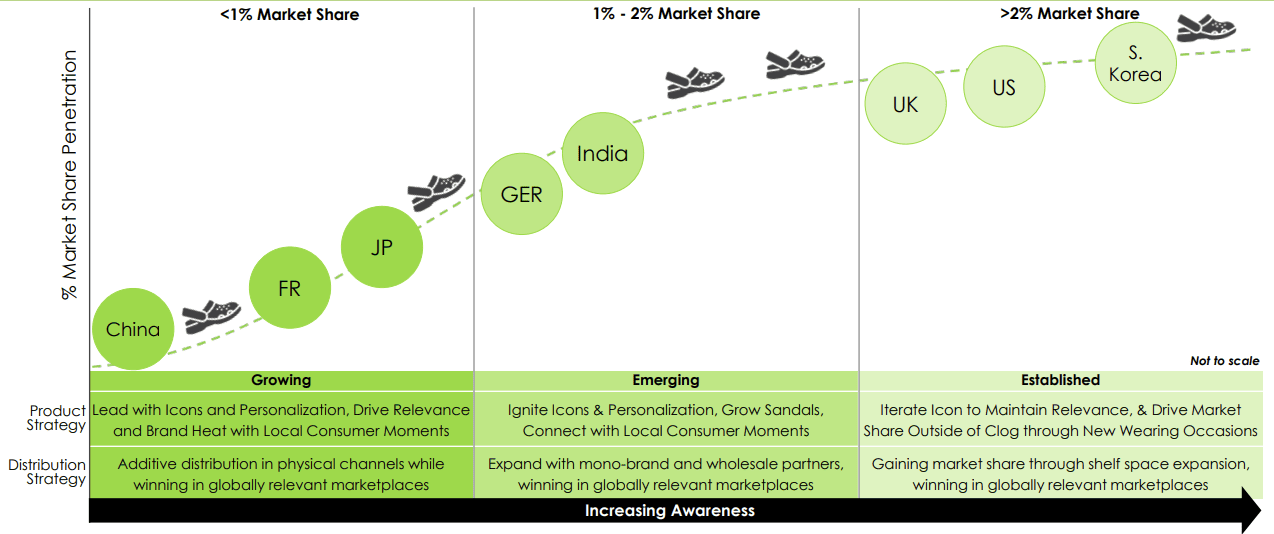

Nonetheless, with this valuation, we depart apart any progress that Heydude can probably generate sooner or later, in addition to any progress of Crocs model past 3%. Nonetheless, I take into account this state of affairs very pessimistic since Crocs’ worldwide growth is focusing on massive economies, like China and Japan, during which the corporate has low penetration of its merchandise.

Supply: Firm’s This autumn Earnings Presentation

Catalyst

The corporate has a present buyback program of $1.3B, able to deploy in 2025. It may probably purchase over 20% of the corporate with the free money circulation generated in 2025

The development of Heydude’s scenario, resuming progress, would fully change the attitude of the market. I anticipate this to occur in 2026.

Acceleration of worldwide progress, with a particular give attention to China, which is an underpenetrated market with an ideal addressable market.

Conclusion

Crocs is a top quality firm with rational management over prices and a excessive return on invested capital. At present, the market shouldn’t be appreciating the worth of the enterprise because of the worry of Heydude’s income lower. Nonetheless, as soon as its income stabilizes, the corporate as a complete shall be rising constantly.

Within the meantime, the depressed value of the corporate affords the administration a superb alternative to purchase again shares at about 6 instances value to free money circulation. I wouldn’t be stunned if all catalysts arrive on the similar time: buybacks and an enchancment of Heydude’s income. This could be a serious catalyst in a really brief time.

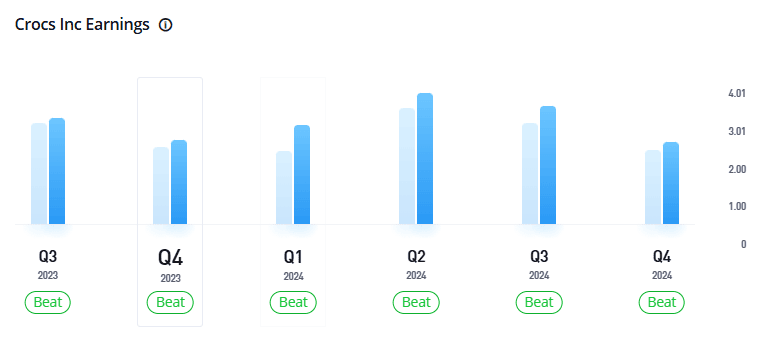

Additionally, the administration is inclined to attract a worst-case state of affairs to traders. As traders weight these projections to create their estimates, Crocs normally beats estimates constantly. Nonetheless, this isn’t taken into consideration in at the moment’s value.

Supply: Etoro

At about 6 instances earnings and free money circulation, with an enormous buyback program ongoing and whereas shortly deleveraging, Crocs is among the greatest choices obtainable to speculate our cash within the US. The worst state of affairs is priced in, leaving room to have a constructive return in virtually each state of affairs left for the longer term.

Danger Elements

Incapacity of the administration to show round Heydude.

Incapacity of the administration to develop internationally.

Slowdown in US gross sales attributable to macroeconomic challenges or better competitors.

Modifications within the style style of customers, which will be sudden and surprising.

I maintain a place in CROX on the time of writing.

This communication is for info and training functions solely and shouldn’t be taken as funding recommendation, a private suggestion, or a proposal of or solicitation to purchase or promote any monetary devices. This materials has been ready with out bearing in mind any specific recipient’s funding aims or monetary scenario and has not been ready in accordance with the authorized and regulatory necessities to advertise unbiased analysis. Any references to previous or future efficiency of a monetary instrument, index, or a packaged funding product will not be, and shouldn’t be taken as, a dependable indicator of future outcomes. eToro makes no illustration and assumes no legal responsibility as to the accuracy or completeness of the content material of this publication.