$ADBE has set the usual for inventive software program, driving skilled design and video enhancing with instruments like Photoshop, Illustrator, and Premiere Professional. Its improvements, like Firefly and AI-powered options in Acrobat, goal to rework content material creation. But, regardless of robust market management and a dependable subscription income mannequin, Adobe has lagged behind final yr’s tech rally, making it one of many weakest-performing mega cap tech shares.

Why is Adobe struggling in comparison with its friends, and is that this AI-related inventory price including to the portfolio in 2025?

Key Financials: How Adobe’s Subscription Mannequin Powers Development

Key Income Drivers

Adobe operates on a subscription-based mannequin, with subscriptions contributing 95% of its income—a metamorphosis initiated with the launch of Artistic Cloud in 2012. Beforehand, Adobe bought round 3 million items yearly through perpetual licensing. The shift to subscriptions revolutionized Adobe’s enterprise, delivering predictable income streams and quicker development. Its income is pushed by three core segments:

Artistic Cloud: The most important section, contributing 60% of income, stays pivotal. Instruments like Photoshop and Premiere Professional dominate their industries, whereas AI options like Adobe Firefly justify premium pricing.

Doc Cloud: Making up 25% of income, it advantages from Acrobat’s PDF market management and rising demand for Adobe Signal, fueled by the shift to digital workflows and distant work.

Expertise Cloud: Comprising 15% of income, it targets enterprise wants in advertising and marketing, analytics, and e-commerce, with scalability enhanced by partnerships with Microsoft Azure and AWS.

Adobe’s annual income grew from $13 billion in 2020 to $19.4 billion in 2023 (CAGR 14.7%), slower than its exceptional development from $4.8 billion to $12.87 billion (CAGR 22.1%) between 2015 and 2020, pushed by speedy SaaS adoption. Regardless of this moderation, Adobe’s innovation and strategic partnerships place it for sustained development.

Of their This autumn 2024 earnings name, CEO Shantanu Narayen said, “Adobe delivered document FY24 income, demonstrating robust demand and the mission-critical position Artistic Cloud, Doc Cloud and Expertise Cloud play in fueling the AI financial system. Our extremely differentiated expertise platforms, speedy tempo of innovation, diversified go-to-market and the combination of our clouds place us for an amazing yr forward.”

Subsequent earnings report is predicted to be launched on Wednesday, twelfth of March.

Robust Margins, Stronger Future

Adobe’s profitability underscores its enduring power. The corporate has proven constant enchancment on this space since they shifted to the subscription enterprise mannequin. The corporate’s gross margin constantly exceeds 85%, pushed by the low prices of delivering digital merchandise whereas sustaining excessive subscription revenues. Working margins are equally robust, constantly exceeding 35%. Adobe achieves this by maintaining bills below management whereas nonetheless investing closely in innovation, comparable to AI-powered instruments and cloud-based providers. Web revenue margins additional spotlight Adobe’s monetary power, with the latest quarter delivering a margin of 25.59%, that means it retained greater than 1 / 4 of its whole income as revenue in any case bills.

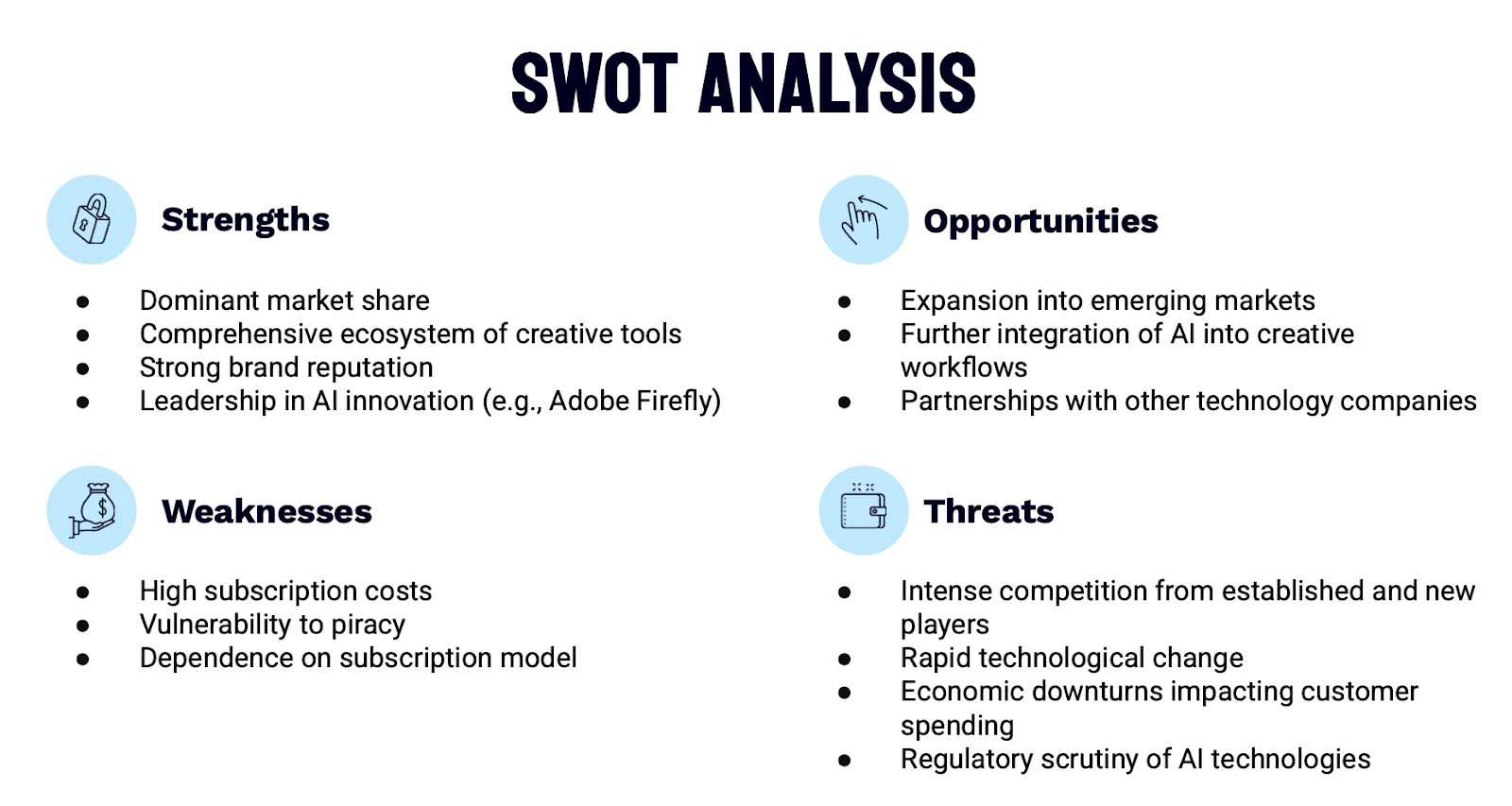

Adobe’s Edge in a Aggressive Artistic Software program Panorama

Adobe leads the inventive software program market with a dominant 42% share, powered by flagship merchandise like Photoshop and Artistic Cloud. The aggressive atmosphere, nevertheless, is intense. Microsoft, Corel, Autodesk, and Canva problem Adobe with extra inexpensive or specialised instruments, however Adobe stands out with its complete ecosystem, robust model, and superior AI integration. The general inventive software program {industry} is projected to develop at a compound annual development charge (CAGR) of 8.2% from 2024 to 2034 (supply), pushed by technological developments and rising demand for digital content material creation instruments, and Adobe is positioned to seize an enormous portion of this development.

Aggressive Snapshot:

Canva: Gives a user-friendly interface and a freemium mannequin, making it widespread amongst non-professional customers and small companies. Its simplicity and affordability have allowed it to realize important market share, significantly within the social media graphics and presentation design house.

Corel: Gives a variety of inventive software program, together with CorelDRAW, which competes with Adobe Illustrator. Corel’s merchandise are sometimes provided at a lower cost level than Adobe’s, making them a sexy choice for budget-conscious customers.

Autodesk: Identified for its professional-grade 3D modeling and CAD software program, Autodesk competes with Adobe in particular areas comparable to video enhancing (with merchandise like Smoke) and design (with merchandise like Sketchbook).

How Adobe is Profitable the AI Race in Artistic Software program

Adobe isn’t simply leaping on the AI bandwagon. They’re altering how folks create utilizing their instruments like Photoshop and Illustrator. Their AI instrument, Firefly, is constructed proper into their software program, making it simple for artists to make use of. What actually units Firefly other than different generative AI instruments is its moral method—utilizing licensed content material to make sure copyright security, a crucial differentiator in a crowded and generally murky AI panorama. With over 12 billion photos already generated, Firefly is making waves, even when its monetary impression is modest for now because of excessive R&D prices, competitors from extra inexpensive AI instruments, and Adobe’s give attention to embedding AI into its ecosystem somewhat than direct monetization. By way of this technique, they’re focusing extra on long-term development and person retention, reinforcing Adobe’s place because the best choice for professionals whereas adapting to the rising generative AI market.

Adobe’s AI Monetization Technique:

Adobe’s method to monetizing AI is multi-faceted:

Premium Options: Integrating AI-powered options into current Artistic Cloud purposes and charging a premium for entry.

New Product Choices: Launching new AI-driven instruments and providers, comparable to Firefly, as standalone merchandise or add-ons to current subscriptions.

Elevated Subscription Costs: Justifying larger subscription costs by providing enhanced performance and worth via AI-powered capabilities.

Threats to Adobe’s Dominance:

Intense Competitors: Adobe faces a multi-pronged assault. Established rivals like Autodesk and Corel proceed to problem them, whereas newcomers like Canva provide compelling options at extra accessible worth factors. This aggressive strain limits Adobe’s pricing energy and threatens to erode market share.

Piracy and Safety Issues: Widespread piracy of Adobe software program not solely impacts income but additionally poses important safety dangers to customers.

Pricing Stress: Excessive subscription prices can minimize off small companies and informal customers, pushing them towards cheaper options.

Fast Technological Change: The speedy evolution of generative AI and cloud-based options calls for fixed innovation from Adobe. Failing to adapt shortly might depart them susceptible to disruption and jeopardize their market management.

Why Adobe Might Be a Gem at Its Present Valuation

Adobe’s present valuation metrics could not seem as a cut price initially however reveal important potential when positioned in context. At an EV/EBITDA a number of of 17x, Adobe trades under its 10-year common of 23x, reflecting a reduction on its historic valuation. Its P/FCF ratio of 20x, in comparison with the 10-year imply of 30x, additional highlights its potential to generate sturdy money flows—an attribute of its subscription-based enterprise mannequin.

The corporate’s aggressive moat reinforces its worth. Adobe dominates with industry-standard instruments like Photoshop, Illustrator, and Premiere Professional, making certain excessive switching prices and constant recurring revenues. These merchandise anchor its ecosystem, making Adobe indispensable for professionals and enterprises alike. Improvements like Firefly and its dedication to moral AI practices strengthen its place, permitting it to remain forward in a quickly evolving market.

After the final earnings report, the inventory skilled a pull again because of 2025 Q1 steerage of $5.63–$5.68 billion, barely under Wall Road’s $5.73 billion forecast. This response overlooks Adobe’s monitor document of assembly or exceeding annual projections and its positioning to capitalize on transformative developments like AI and digital transformation.

Potential Situations

Optimistic Situation: Leveraging its management in AI and profitable improvements like Firefly, Adobe’s valuation might return to its 10-year EV/EBITDA common of 23x. This might lead to 30-35% upside, pushed by stronger development and investor confidence. Profitable integration of AI throughout its product line and additional enlargement into enterprise options would gas this situation.

Impartial Situation: If Adobe maintains regular development and meets its steerage, valuation restoration to barely above present ranges might ship 10-15% beneficial properties, reflecting resilience with out exceeding expectations. This assumes no main aggressive disruptions and continued, albeit reasonable, development in key segments.

Unfavourable Situation: Challenges like slowing development or intensified competitors might compress multiples additional, leading to a 10-20% decline. Failure to successfully monetize AI investments or important market share loss to rivals like Canva might set off this.

Conclusion

Adobe’s mixture of a reduced valuation, sturdy fundamentals, and a aggressive moat positions it as a compelling alternative regardless of short-term headwinds. With robust execution and management in transformative developments, Adobe is well-equipped to maintain its premium standing whereas shaping the way forward for inventive softwares. For these eager about a deeper dive into Adobe enterprise, don’t miss our Inventory Break episode devoted to the corporate.

This communication is for data and training functions solely and shouldn’t be taken as funding recommendation, a private suggestion, or a suggestion of, or solicitation to purchase or promote, any monetary devices. This materials has been ready with out making an allowance for any specific recipient’s funding targets or monetary state of affairs, and has not been ready in accordance with the authorized and regulatory necessities to advertise unbiased analysis. Any references to previous or future efficiency of a monetary instrument, index or a packaged funding product usually are not, and shouldn’t be taken as, a dependable indicator of future outcomes. eToro makes no illustration and assumes no legal responsibility as to the accuracy or completeness of the content material of this publication.