The Every day Breakdown takes a better take a look at Amazon, because the inventory’s valuation has come down and amid sturdy earnings progress.

Earlier than we dive in, let’s be sure to’re set to obtain The Every day Breakdown every morning. To maintain getting our day by day insights, all it’s good to do is log in to your eToro account.

Friday’s TDLR

Analysts anticipate sturdy progress

AMZN’s valuation has fallen

However can the inventory acquire sufficient momentum?

Deep Dive

Many buyers consider Amazon as a web based retailer, nevertheless it’s turn into a behemoth within the cloud computing area — with its Amazon Net Companies unit — and has shaped right into a digital promoting juggernaut. After all, it’s ventured into different companies too, like on-line video streaming, audiobooks, music, pharmacy, and Entire Meals, amongst different issues.

For years, Amazon was often called a terrific enterprise, however too costly of a inventory. Has that modified? Let’s dig into the basics and see what’s occurring beneath the hood of this $2.3 trillion large.

Ahead Development

Trying forward, analysts anticipate roughly 9% to 10% annual income progress in 2025, 2026, and 2027. For buyers who’ve adopted Amazon over time, that will appear low. However take into account that if these estimates come to fruition, the corporate would generate greater than $830 billion in gross sales in fiscal 2027.

On the earnings entrance, it’s extra spectacular. Estimates name for 20.5% progress this 12 months, 17% progress in 2026, and 22.7% progress in 2027.

I have to stress that utilizing multi-year estimates is tough, and needs to be taken with a grain of salt. Nobody is aware of what is going to occur in October…not to mention in October 2027. Nonetheless, if earnings progress can outpace income progress, it bodes nicely for Amazon’s margins.

Valuation and Dangers

Supply: Bloomberg, eToro

Amazon’s historical past is a case examine in enterprise and inventory valuation. For years, this inventory was costly, however not many companies had the addressable market that Amazon did — and it allowed AMZN to develop into its wealthy valuation over time.

In that point, we’ve seen Amazon’s valuation decline as its earnings have accelerated. In reality, Amazon has a decrease ahead P/E ratio than Walmart!

Whereas the agency’s valuation has come down, many parts apart from earnings have elevated. As an illustration, working margins and return on belongings — the latter of which measures how successfully an organization makes use of its belongings to generate revenue — have greater than tripled during the last decade from roughly 3% in 2016 to greater than 11% at present.

Whereas Amazon’s cloud enterprise is a little more proof against macro-related volatility, Amazon’s principal threat is the financial system. If the US have been to enter a recession and client spending took a serious hit, Amazon’s income and enterprise mannequin can be disrupted. Additional — and like most Magnificent 7 shares — Amazon faces potential antitrust and headline dangers, in addition to ongoing trade-war dangers.

Wish to obtain these insights straight to your inbox?

Join right here

The Setup — Amazon

For what it’s price, the consensus value goal from analysts is at present close to $240.

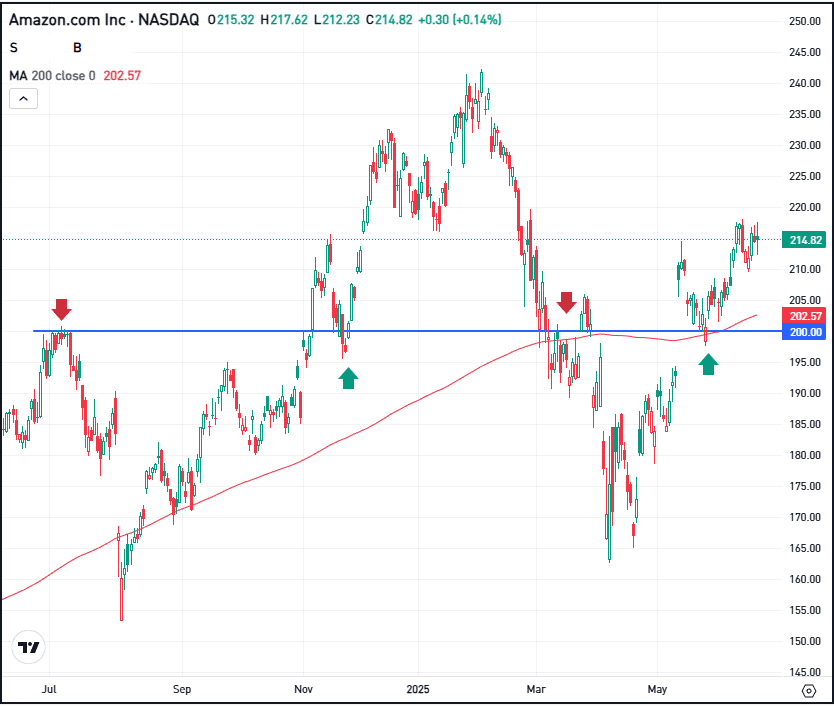

In July, Amazon struggled to interrupt by means of the $200 degree, then finally did so in November. It’s been a bumpy experience since then, however now shares are holding above this degree and the 200-day transferring common.

If it may possibly proceed to take action, bulls could possibly keep momentum.

On the one hand, shares are up simply 6% from the early July highs. Then again, the inventory continues to be down about 12.5% from its document highs within the $240s. Given its elevated progress charges and robust secular companies, mixed with a declining valuation, some buyers could view Amazon inventory as enticing underneath these circumstances.

For different buyers although, they could move on the inventory over sure macro- and company-specific considerations.

Choices

Buyers who consider shares will transfer larger over time could take into account collaborating with calls or name spreads. If speculating on a long-term rise, buyers would possibly think about using satisfactory time till expiration.

For buyers who would fairly speculate on the inventory decline or want to hedge an extended place, they may use places or put spreads.

To study extra about choices, take into account visiting the eToro Academy.

Disclaimer:

Please notice that on account of market volatility, a number of the costs could have already been reached and situations performed out.