Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business consultants and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

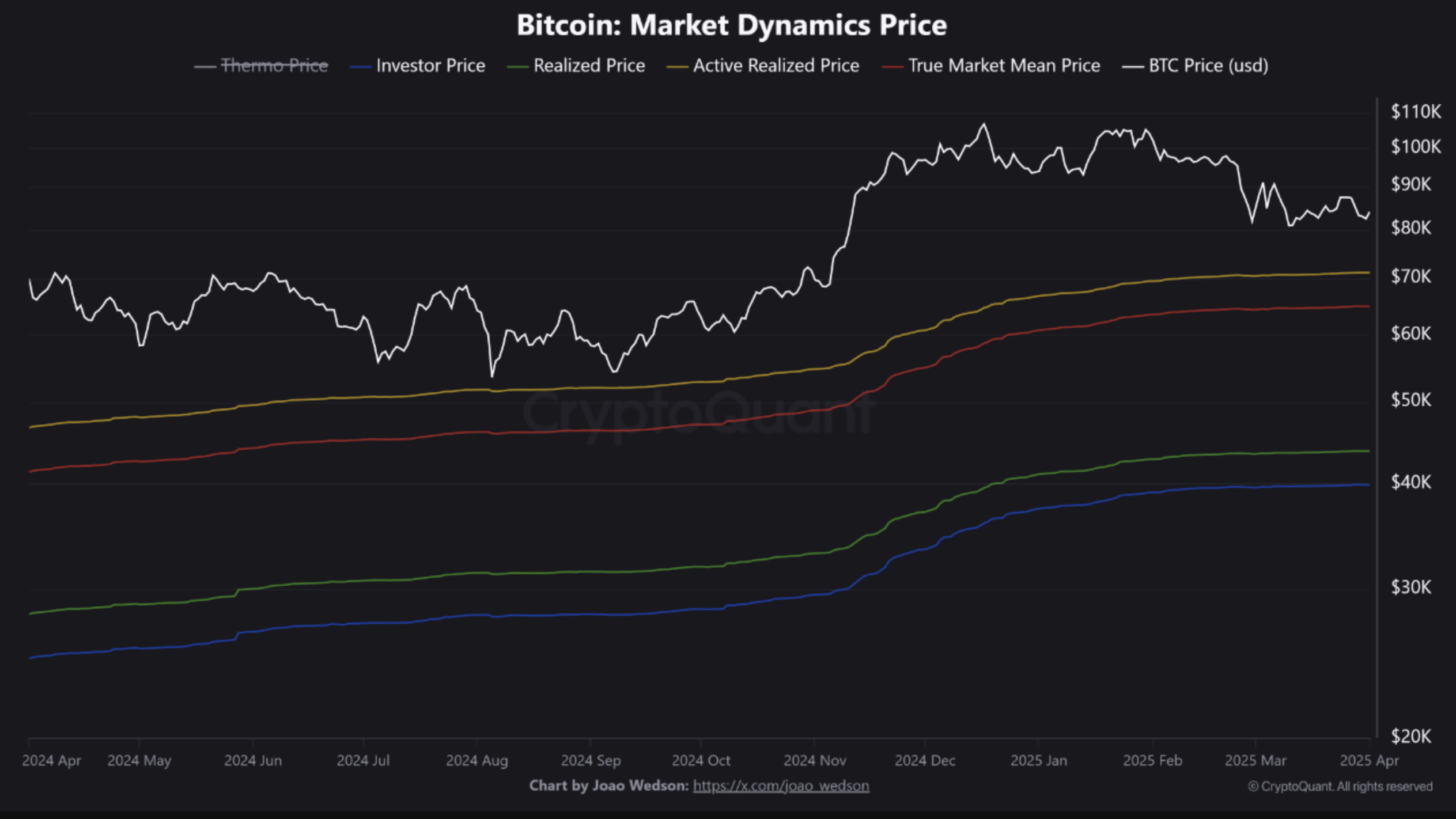

In a CryptoQuant Quicktake submit revealed as we speak, contributor BorisVest highlighted a key demand zone for Bitcoin (BTC) that might supply buyers a chance for ‘substantial good points.’ The analyst used the Lively Realized Worth (ARP) and the True Market Imply Worth (TMMP) to establish this essential zone.

Shopping for Bitcoin Right here May Be Worthwhile

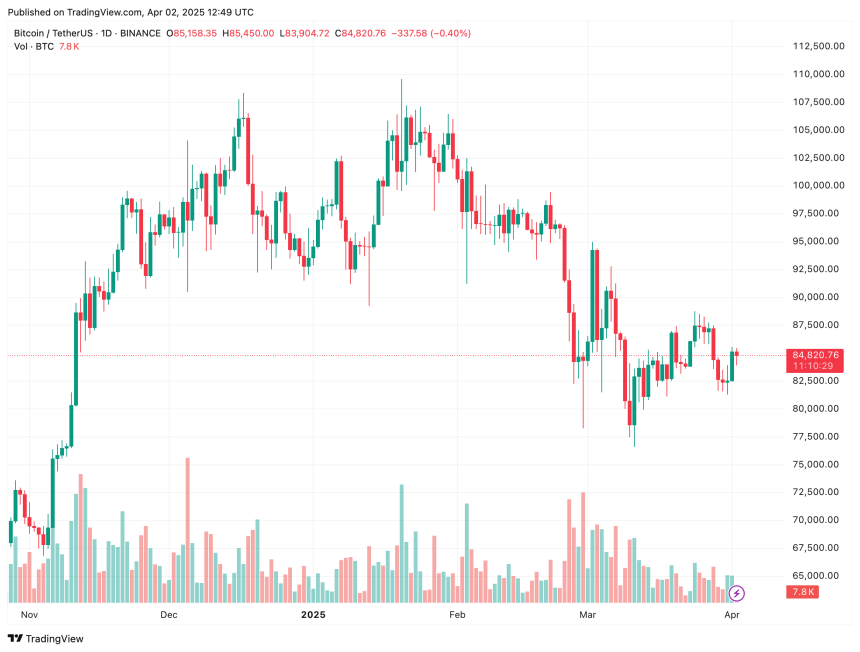

Bitcoin is at present buying and selling roughly 10% increased than its latest native backside of practically $77,000, recorded on March 10. Nonetheless, uncertainty out there has elevated because of US President Donald Trump’s looming commerce tariffs, with some analysts predicting that the highest cryptocurrency might expertise additional draw back earlier than a pattern reversal happens.

Associated Studying

Amid this backdrop, CryptoQuant contributor BorisVest famous that, primarily based on market dynamics, BTC’s ARP is at present hovering round $71,000 – representing virtually a 20% pullback from its present value within the mid-$80,000 vary.

For the uninitiated, Bitcoin’s ARP is a metric that calculates the typical acquisition value of all actively traded BTC, filtering out dormant cash. It helps establish market sentiment by exhibiting the associated fee foundation of energetic buyers, offering insights into potential assist or resistance ranges.

Moreover, BorisVest identified that BTC’s TMMP at present has a key assist stage at $65,000. The analyst said:

If we outline the realm between the Lively Realized Worth and the True Market Imply Worth as a zone, we are able to count on that within the close to future, if the value declines, it ought to meet vital demand on this vary.

In essence, BTC’s present main demand zone lies between $71,000 and $65,000. Buying BTC inside this vary might present buyers with a good risk-reward ratio, doubtlessly resulting in substantial good points.

Analyst Factors Out Key Resistance Ranges

In distinction to BorisVest’s evaluation, distinguished crypto analyst Ali Martinez recognized two key resistance ranges for Bitcoin. Martinez said:

Bitcoin BTC faces the 200-day MA at $86,200 and the 50-day MA at $88,300 as key resistance forward! A break above these ranges might shift momentum again to the bulls.

Shifting-average (MA) primarily based resistance ranges typically operate as key psychological and technical value limitations. Market merchants usually place their promote orders round these ranges, main to cost reversal or consolidation.

Associated Studying

Martinez’s evaluation aligns with that of fellow crypto analyst Rekt Capital, who famous that regardless of BTC breaking its day by day Relative Energy Index (RSI) downtrend, it could nonetheless face vital resistance forward.

That stated, a bullish pattern reversal could also be on the horizon for BTC. Current experiences counsel that Trump could soften his stance on reciprocal tariffs, doubtlessly enabling a reduction rally for risk-on belongings like BTC. At press time, BTC is buying and selling at $84,820, up 1.5% previously 24 hours.

Featured picture from Unsplash, Charts from CryptoQuant, X, and TradingView.com