Binance – the world’s largest cryptocurrency alternate, is commonly thought of the “golden stamp” for a token as soon as it will get listed on the spot market. Nonetheless, in current months, the rising pattern of token delistings has raised severe questions concerning the sustainability of its itemizing ecosystem.

This text analyzes the ratio between tokens listed on the spot market and people delisted from Binance over the previous three years, providing key insights for traders.

Spot Itemizing vs. Delisting Ratio

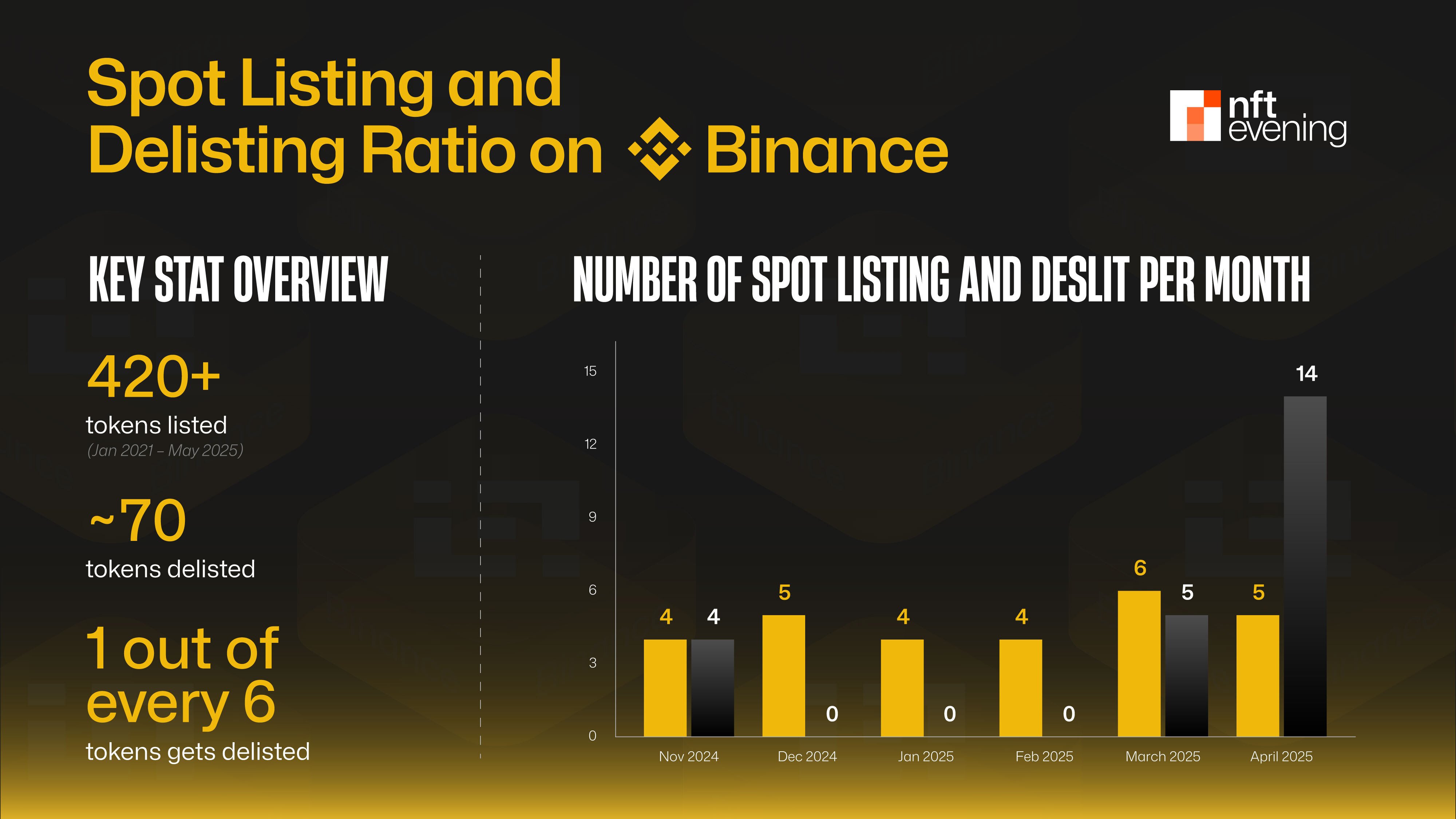

In response to knowledge compiled from CoinGecko and Dune Analytics, from early 2021 to Might 2025, Binance listed over 420 tokens on its spot market. Throughout the identical interval, almost 70 tokens have been delisted, equal to a delisting price of roughly 16.6%.

On common, for each 6 tokens listed, 1 token is delisted throughout the following 1 to 2 years. It is a notable statistic, particularly on condition that many traders nonetheless view a Binance itemizing as a mark of security and credibility.

Nonetheless, one noteworthy pattern is the shift in how Binance handles delistings. As an alternative of delisting tokens sporadically, Binance has moved towards a extra cyclical and clear analysis course of. That is evident in large-scale delisting batches in November 2024 and April 2025.

Learn extra: Binance Delist 14 Tokens in First “Vote to Delist” Batch

In these rounds, for each 10–15 tokens listed, a batch of 5–10 tokens was eliminated without delay, signaling that Binance is adopting a cluster-based cleanup technique, particularly throughout market downturns or when itemizing requirements are tightened.

This mannequin displays a stricter high quality management coverage, shifting away from relying solely on particular person token efficiency. It aligns with a broader push for improved regulatory compliance and better undertaking requirements in a extra mature market setting.

Learn extra: Buying and selling with Free Crypto Alerts in Night Dealer Channel

Causes for Delisting and the Periodic Evaluation Course of

Binance enforces a strict analysis course of earlier than itemizing any new token. Key standards embody the event group, liquidity, authorized compliance, and technological worth.

These identical standards are additionally utilized periodically to reassess listed tokens. If a token not meets the required requirements, Binance could resolve to delist it.

In response to Binance Academy and Binance Assist, frequent causes for delisting embody low buying and selling quantity, lack of technological progress, regulatory or safety points, and in some instances, delisting is requested by the undertaking group itself.

As well as, Binance has just lately launched a “Group Delisting Vote” mechanism – permitting customers to suggest the elimination of underperforming tokens from the platform.

Past technical and regulatory components, delisting can also be a strategic transfer to stop liquidity fragmentation throughout too many tokens. When a lot of property are listed, buying and selling quantity and capital can develop into diluted, decreasing market depth and person expertise.

By eradicating underperforming or inactive tokens, Binance can focus liquidity on higher-potential property – together with exchange-backed cash, newly listed tokens, and main ecosystem tasks. This method enhances buying and selling effectivity and helps the expansion of prioritized buying and selling pairs on the platform.

Some Notable Case Research

ALPACA (ALPACA) is a notable instance. Though the token was introduced for delisting in late This fall 2025, it unexpectedly surged by over 600% shortly afterward resulting from a sudden shopping for spree when liquidity reopened on decentralized exchanges (DEXs).

This highlights how “brief squeezes” or speculative buying and selling habits can happen even after destructive information, particularly when the market senses low liquidity and potential provide shortage throughout different platforms. Nonetheless, this worth rally didn’t mirror any elementary restoration or long-term worth of the token.

Learn extra: ALPACA Token’s Stunning Trip: Quick Squeeze, Issuance Freeze, and Looming Delisting

The case of MITH (Mithril) additionally drew consideration when the token was delisted in late 2022. The undertaking later sued Binance, alleging a scarcity of transparency within the delisting course of.

This set a authorized precedent, underscoring the regulatory dangers exchanges could face if delisting procedures are opaque. Being listed means little long-term except a undertaking stays clear and retains its group engaged.

TUSD, as soon as backed by Binance, was delisted in March 2024 with its liquidity eliminated unexpectedly.

Even tokens linked to the alternate danger delisting in the event that they lack transparency or face regulatory points.

What are the principle takeaways?

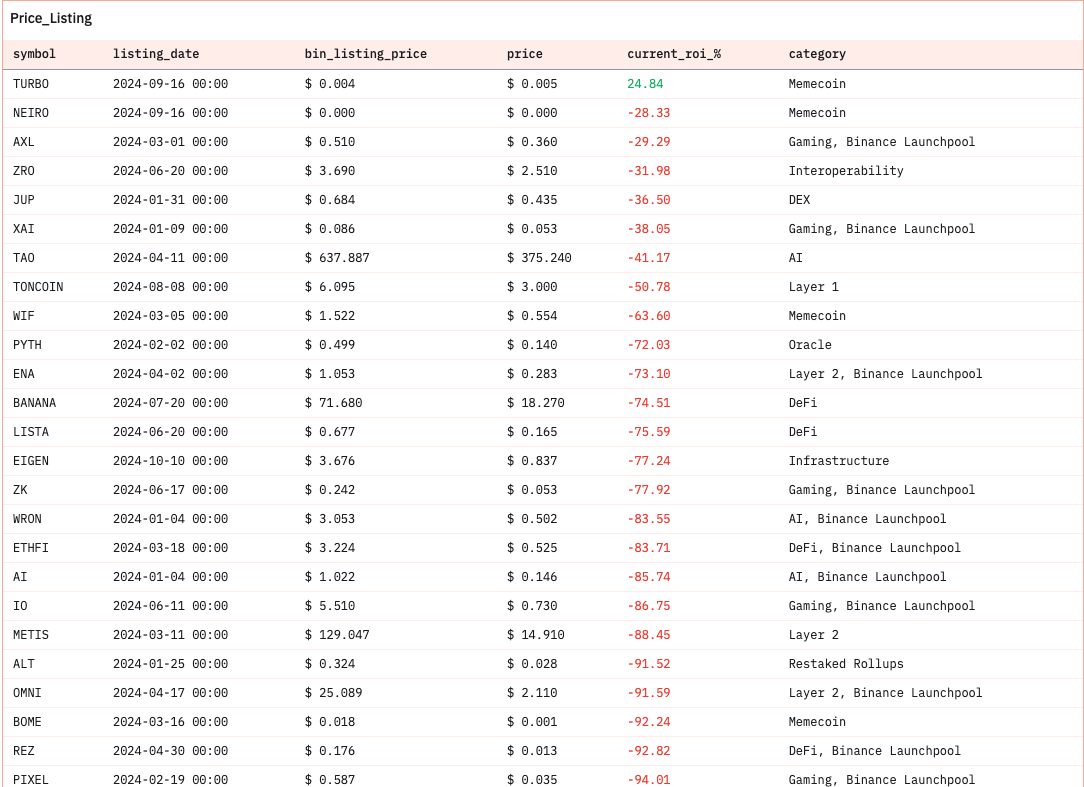

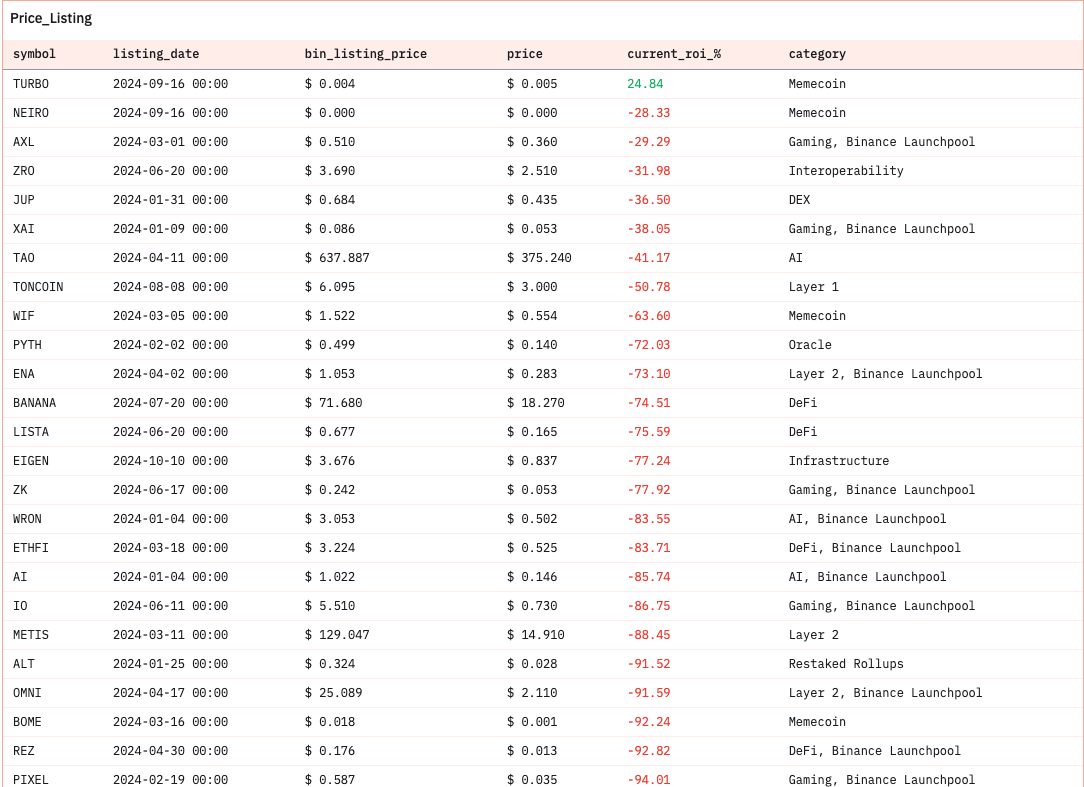

Binance has listed many tokens tied to traits like GameFi, AI, meme cash, and RWA previously 12 months. Many tokens commerce beneath $1M every day, with poor liquidity and broad bid-ask spreads.

Supply: Dune

Many tasks go inactive 3–6 months post-listing, risking delist if they’ll’t maintain progress or assist.

For instance, meme cash like XAI and BOME have been listed throughout waves of social media-driven FOMO. Nonetheless, they quickly skilled sharp declines in buying and selling quantity. Low updates and fading communities increase delisting dangers if tasks fail to ship lasting worth.

GameFi tokens like DAR and TLM now face low exercise and weak assist, risking delisting with out strategic modifications.

Supply: TradingView

Conclusion

Roughly 1 in 6 listed tokens will get delisted — itemizing doesn’t assure long-term security.

A token’s itemizing on Binance doesn’t guarantee long-term worth appreciation. Many tokens jumped 10–20x at itemizing, then dropped 99% inside a 12 months.

Excessive-FDV tokens with lengthy vesting typically face group abandonment or liquidity manipulation.