Bitcoin has formally entered a capitulation section as relentless promoting stress and macro uncertainty push the market into certainly one of its most anxious moments of the cycle. After reaching its $126,000 all-time excessive in early October, BTC has collapsed to a contemporary native low close to $80,000 in beneath two months — a shocking 35% drawdown that has shaken investor confidence. Many market members who anticipated a continuation of the bullish development are actually dealing with steep unrealized losses, amplifying worry and forcing short-term holders to exit at a loss.

Based on high analyst Axel Adler, the power of the US greenback has turn out to be one of many dominant forces behind this wave of capitulation. Because the DXY index holds firmly above 100, international liquidity tightens, historic patterns present that Bitcoin short-term holders have a tendency to appreciate losses extra aggressively. Adler notes that this dynamic is at the moment taking part in out with depth, mirroring earlier phases of market stress.

Nonetheless, not all indicators level downward. The likelihood of a December Federal Reserve price reduce has climbed to 69%, and Adler means that if markets start pricing this extra aggressively, it may flip macro momentum and set off a reversal. For now, Bitcoin stays in a fragile state — however a macro catalyst could also be forming.

Quick-Time period Holder Capitulation Deepens as Macro Stress Overrides Behavioral Indicators

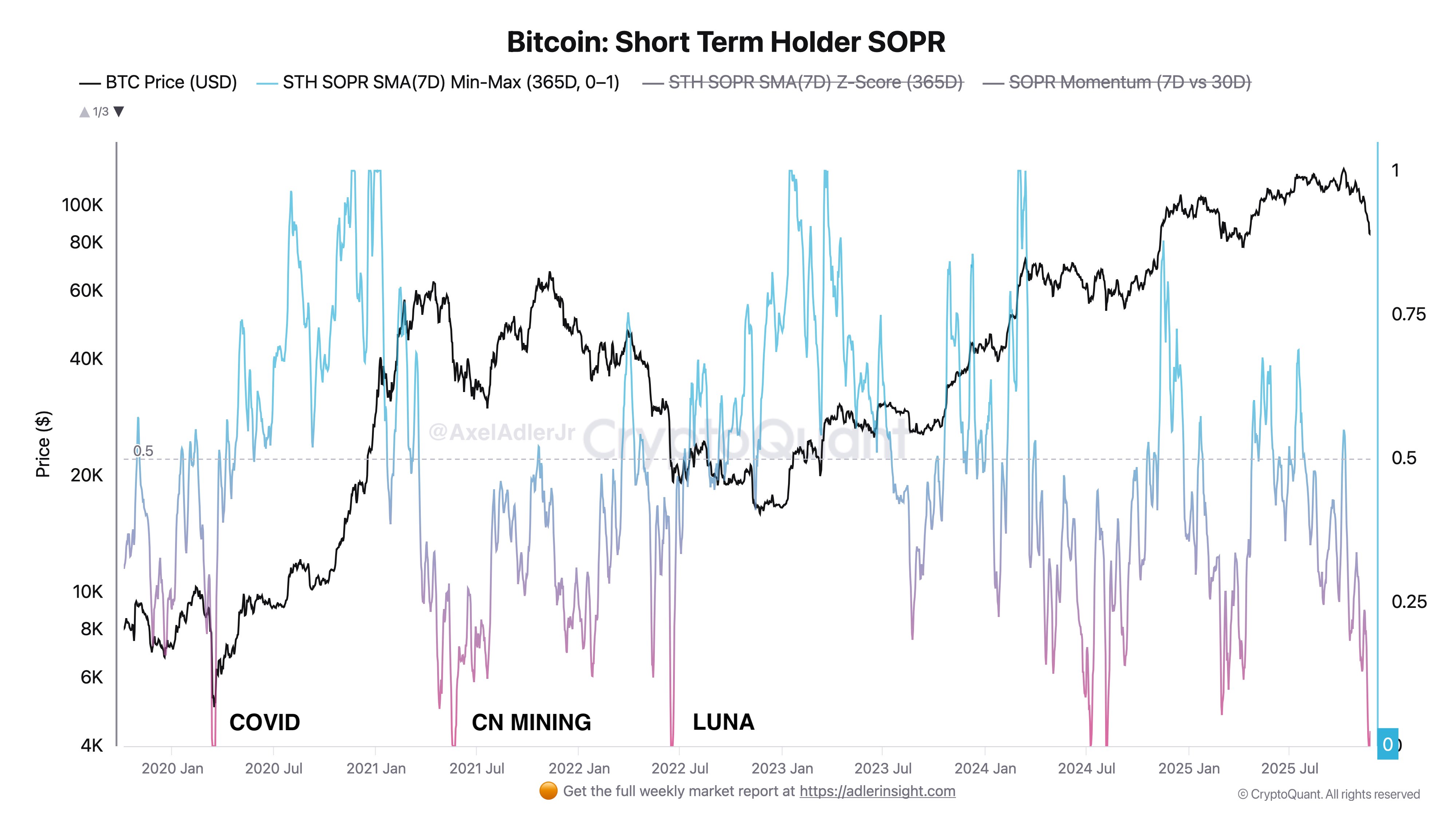

Axel Adler explains that short-term holders are actually realizing losses with an depth corresponding to a few of Bitcoin’s most violent historic shocks — together with the COVID crash of 2020, the China mining ban in 2021, and the Luna collapse in 2022.

The most recent knowledge reveals that SOPR Momentum, a key indicator of realized profitability, has dropped almost to 0, a stage that usually marks full capitulation amongst reactive market members. Traditionally, readings this depressed have aligned with explosive V-shaped reversals or sharp aid rallies, as promoting stress turns into exhausted and stronger palms start absorbing provide.

Nonetheless, Adler emphasizes an necessary nuance: whereas behavioral capitulation is clearly underway, macro forces at the moment dominate market construction. Excessive SOPR readings can produce bottoms, however they will additionally generate short-lived bounces inside broader downtrends when macro situations stay unfavorable. With the greenback index (DXY) nonetheless elevated above 100, liquidity stays tight — and Bitcoin continues to commerce beneath stress.

Adler notes that the whole lot now hinges on the Federal Reserve. If markets start actively pricing within the December price reduce, it may weaken the greenback and relieve among the stress weighing on BTC. Till then, macro stays the stronger power, overshadowing even extreme capitulation indicators.

Testing Assist After a Steep Breakdown

Bitcoin’s value motion on the 1D chart reveals the market making an attempt to stabilize after one of many sharpest multi-week declines of this cycle. BTC dropped from the $126,000 peak to the $80,000–$86,000 vary in lower than two months, and the chart clearly displays this capitulation construction. The collection of lengthy crimson candles highlights aggressive promoting stress, with bears firmly in management all through November.

The chart reveals BTC buying and selling under all main transferring averages—the 50-day, 100-day, and 200-day—confirming a transparent breakdown in development construction. The 200-day MA across the mid-$88K area is now performing as resistance somewhat than assist. This flip is often a bearish sign and aligns with the continued macro-driven weak point highlighted by analysts throughout the market.

Quantity stays elevated in the course of the downturn, reinforcing that the sell-off has been pushed by robust palms exiting. Nonetheless, the latest candles present wicks forming close to $83K–$86K, suggesting early makes an attempt at demand absorption. If BTC can maintain above the latest low round $80K and shut again above the 200-day MA, the market may see a short-term aid rally.

Featured picture from ChatGPT, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluate by our workforce of high know-how specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.