Bitcoin is buying and selling above the $95,000 stage as bulls attempt to reclaim management and push towards six figures. After a robust rebound from its April lows, BTC has entered a good consolidation vary between $92K and $96K, with market members watching carefully for a decisive breakout. A transfer above the $96K mark may set off the following leg up, probably opening the door to a take a look at of the long-awaited $100K milestone.

Nevertheless, macroeconomic dangers stay elevated. Rising fears of a recession, coupled with ongoing commerce tensions between international powers, have added uncertainty to the broader market. This makes the upcoming periods particularly essential for BTC’s short-term course.

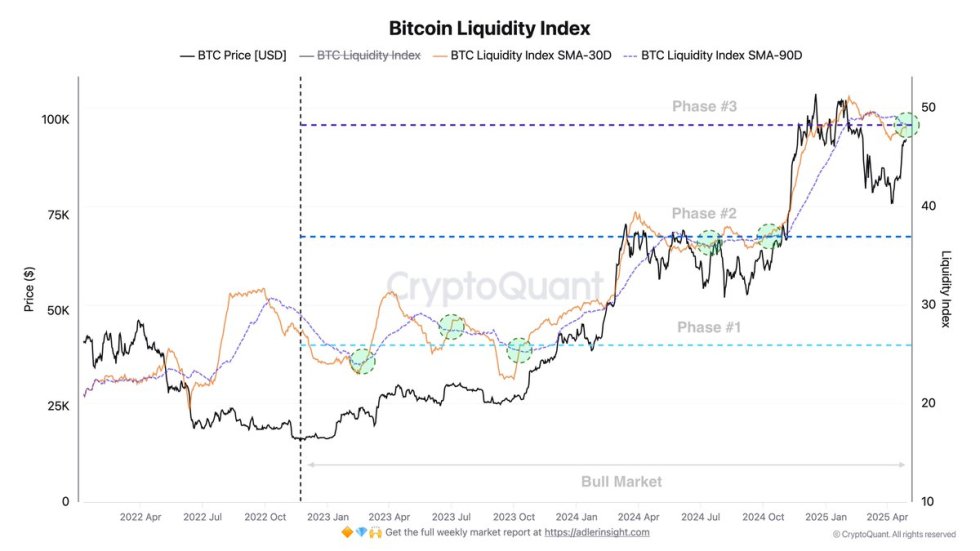

Prime analyst Axel Adler shared insights pointing to a deeper structural improvement beneath the value motion. In line with Adler, the market is at the moment within the third part of liquidity enlargement — a part characterised by rising on-chain exercise, rising trade flows, and renewed investor engagement. His Bitcoin Liquidity Index, which contains key on-chain community metrics alongside normalized trade knowledge, is trending upward. This part, if sustained, may help a breakout and propel BTC into uncharted territory. The approaching days will probably outline whether or not the breakout materializes — or if BTC continues to vary.

Bitcoin Pushes Larger as Liquidity Growth Indicators a Potential Breakout

Bitcoin continues to steer the crypto market, now buying and selling slightly below the $96,000 stage as bulls try to reclaim management. After final week’s rebound, momentum stays on BTC’s aspect—however time is ticking. Bulls should push past $100,000 quickly to verify that the present transfer is not only a reduction rally, however the starting of a broader euphoric part. And not using a decisive breakout, fading momentum may drag BTC again into consolidation or set off one other correction.

Regardless of the cautious optimism, Bitcoin is exhibiting resilience. Wholesome retests of key help zones between $90,000 and $92,000 have strengthened bullish conviction. The broader market has adopted BTC’s lead, with altcoins starting to get up in tandem.

Axel Adler helps the bullish thesis, noting that Bitcoin is now within the third part of liquidity enlargement—a vital turning level traditionally related to important worth motion. In line with Adler, this liquidity index combines all main on-chain metrics with trade knowledge. Importantly, every part is normalized to take away distortions from BTC/USD exchange-rate volatility, giving a clearer view of structural market well being.

Adler emphasizes that month-to-month liquidity readings are quickly approaching quarterly ranges. If no exterior “Black Swan” occasions derail momentum, he outlines three probably situations: a take a look at of the $100K stage, a retest of earlier all-time highs, and finally a breakout into new highs. For now, Bitcoin is holding regular, however the subsequent transfer may outline the remainder of the cycle.

BTC Worth Outlook: Bulls Push Towards Key Breakout Ranges

Bitcoin is at the moment buying and selling at $95,800 as bulls proceed their try to reclaim greater floor and make sure the following leg of the rally. The instant goal is the $96,000–$98,000 zone, which has acted as a significant resistance space over the previous a number of days. A clear breakout above this vary would probably open the door for a retest of the psychological $100,000 stage, thought of by many as the edge for a full-scale market breakout.

Market sentiment stays cautiously optimistic, supported by robust on-chain exercise and whale accumulation. Nevertheless, the battle isn’t over but. Bulls should defend the $90,000 help stage to take care of structural power and keep away from invalidating the latest uptrend. A drop under this stage may set off short-term weak point, pushing BTC again towards decrease demand zones within the $85,000–$88,000 area.

So long as Bitcoin holds above $90K and reclaims $96K–$100K, the technical setup favors continuation to new highs. Merchants are watching carefully for indicators of elevated quantity and momentum to verify the breakout. Till then, BTC stays in a vital consolidation part—one that would both launch the following main transfer or stall the present rally.

Featured picture from Dall-E, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluate by our workforce of high know-how specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.