Bitcoin Change Traded Funds (ETFs) have achieved a historic milestone, amassing over $41 billion in cumulative inflows as of Might 14, 2025. This record-breaking achievement marks a major turnaround for the funds, which confronted outflows earlier amid international financial uncertainties, signaling sturdy investor confidence and rising mainstream adoption of Bitcoin.

After yesterdays inflows, the spot Bitcoin ETFs are actually at a brand new excessive water marketplace for lifetime flows. At the moment at $40.33 billion based on Bloomberg information h/t @EricBalchunas pic.twitter.com/0GKPNlmprs

— James Seyffart (@JSeyff) Might 9, 2025

A Historic Milestone for Bitcoin ETFs

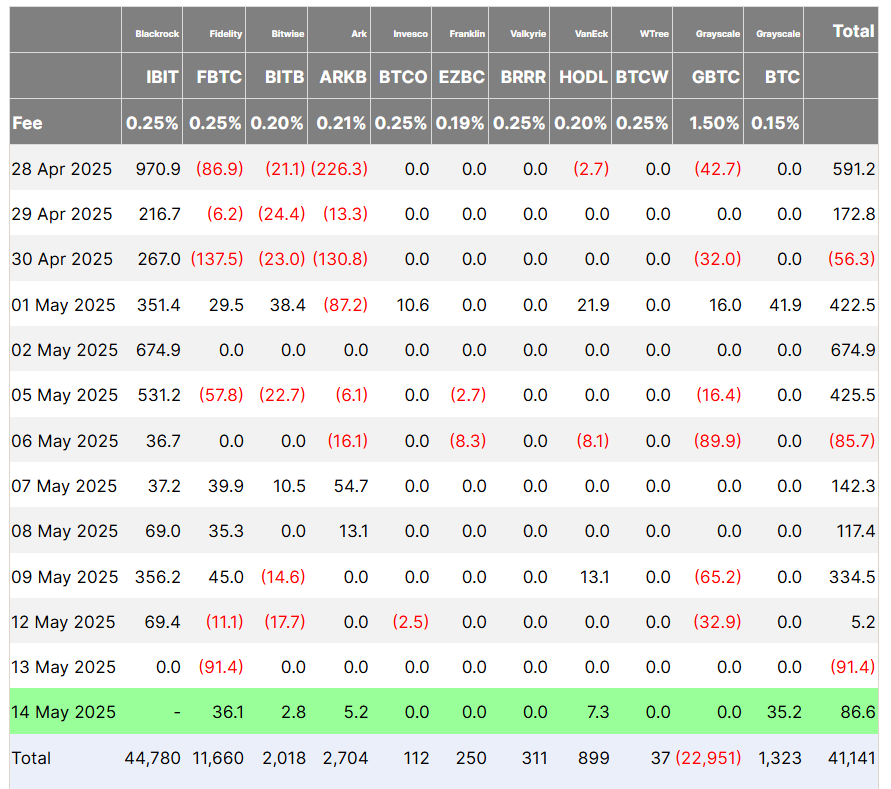

Bitcoin ETFs in the US have reached an unprecedented peak, with cumulative inflows surpassing $41.1 billion as of Might 14, 2025, based on information from Farside Buyers.

Supply: Farside Buyers

This all-time excessive comes simply over a yr after the Securities and Change Fee (SEC) authorised spot Bitcoin ETFs in January 2024, following a decade of rejections and a profitable lawsuit by ETF issuer Grayscale. The launch of those funds marked a pivotal second for cryptocurrency, providing buyers a regulated and accessible solution to acquire publicity to Bitcoin BTC with out immediately proudly owning the asset.

The journey to this milestone has been exceptional. Initially met with skepticism by conventional finance, Bitcoin ETFs have defied expectations, with main asset administration companies like BlackRock main the cost. BlackRock’s Bitcoin ETF, as an illustration, turned the fastest-growing ETF in U.S. historical past, a testomony to the rising urge for food for crypto-based monetary merchandise.

Learn extra: BlackRock Proposes Ethereum ETF Staking, Boosting ETH Worth

The $41.1 billion in internet inflows displays a major reversal of fortunes, as these funds had beforehand skilled fast outflows amid an erratic international commerce struggle and financial uncertainty. The flexibility to hit a brand new high-water mark so quickly after such challenges underscores the resilience of Bitcoin as an asset class and the growing belief buyers place in regulated crypto merchandise.

Bitcoin ETFs are the gateway to getting into the crypto sphere

This surge in inflows additionally aligns with broader market traits. As of This fall 2024, institutional buyers with over $100m underneath administration maintain $27.4 billion price of Bitcoin ETFs, based on CoinShares.

Asset administration giants like Millennium Administration and Jane Avenue account for 20% of whole Bitcoin ETF belongings, additional highlighting the institutional embrace of cryptocurrency. The report inflows sign that Bitcoin ETFs have develop into a cornerstone of crypto funding, bridging the hole between conventional finance and the digital asset house.

The success of ETF Bitcoin spot additionally underscores the growing mainstream adoption of cryptocurrency. Since their launch, these funds have smashed expectations, providing publicity to Bitcoin’s value actions via each spot and futures-based merchandise.

As Bitcoin ETFs proceed to draw capital, they’re prone to play a pivotal position in shaping the way forward for cryptocurrency funding, driving additional integration into conventional monetary programs.