Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade specialists and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

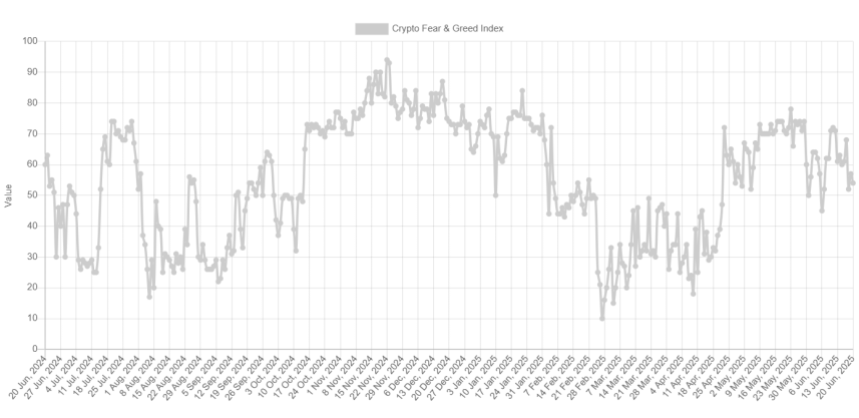

Information reveals the Bitcoin Worry & Greed Index has returned again to the impartial territory, an indication that traders are dropping optimism.

Bitcoin Worry & Greed Index Has Reset Again To Impartial

The “Worry & Greed Index” refers to an indicator created by Various that tells us in regards to the common sentiment current among the many merchants within the Bitcoin and wider cryptocurrency markets.

Associated Studying

The index makes use of the information of those 5 components as a way to decide the dealer mentality: buying and selling quantity, market cap dominance, volatility, social media sentiment, and Google Tendencies.

The indicator represents the calculated sentiment as a rating mendacity between zero and hundred. Values above the 54 mark correspond to the dominance of greed out there, whereas these beneath 46 to presence of concern among the many traders. All values mendacity between these cutoffs correlate to a internet impartial sentiment.

Now, right here is how the temper within the Bitcoin market is like proper now in keeping with the Worry & Greed Index:

As is seen above, the Bitcoin Worry & Greed Index has a price of 54 for the time being, which suggests the traders maintain a impartial sentiment, though one which’s proper on the sting of turning into greed.

The latest impartial mentality within the sector has come following a section of greed among the many merchants, because the beneath chart reveals.

As displayed within the graph, the Bitcoin Worry & Greed Index spiked to a excessive of 72 earlier within the month because the asset’s worth gave traders hope that its consolidation section may be coming to an finish.

Because the restoration rally has fizzled out and the coin has returned to its vary, nonetheless, optimism among the many traders has predictably light. If historical past is to go by, although, this growth might not really be so dangerous for the cryptocurrency.

Typically, digital asset markets have a tendency to maneuver in a manner that goes opposite to the expectations of the bulk. The likelihood of such an reverse transfer happening goes up the extra excessive the gang opinion turns into.

In addition to the three core sentiments, there are two particular areas referred to as the intense concern (underneath 25) and excessive greed (above 75). These zones are the place the probability of a opposite transfer has been the strongest prior to now, with tops and bottoms usually taking type.

Though the market sentiment has lately solely seen a reset to the impartial territory, the truth that the traders are not grasping may nonetheless be a constructive for Bitcoin and different cryptocurrencies. There have been many cases prior to now the place a dip into the impartial zone was sufficient for the bull run to regain momentum.

Associated Studying

It solely stays to be seen, although, how the costs of BTC and others would develop within the coming days.

BTC Value

On the time of writing, Bitcoin is floating across the $102,800 mark, down greater than 2% within the final seven days.

Featured picture from Dall-E, Various.me, chart from TradingView.com