Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade consultants and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

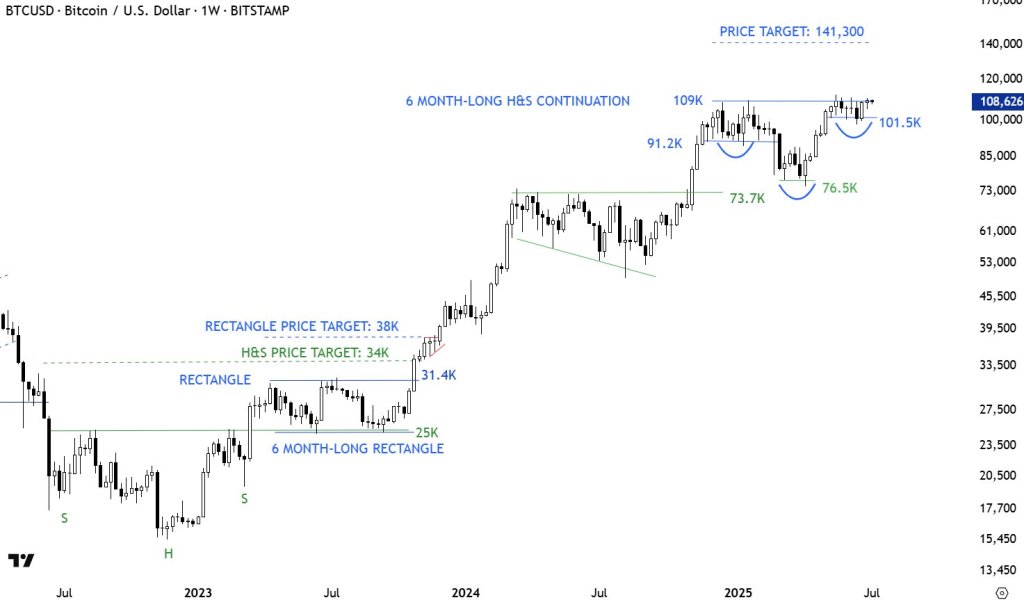

Prime analyst Aksel Kibar (CMT) believes Bitcoin is approaching a decisive second on the weekly chart. In a put up shared on 9 July 2025, the veteran technician famous that BTC/USD is “holding proper on the sample boundary.” The annotated chart he launched—masking Bitstamp weekly costs again to mid-2022—reveals the cryptocurrency compressing immediately beneath a horizontal resistance band at $109,000, the neckline of what he labels a six-month head-and-shoulders (H&S) continuation formation.

Bitcoin Poised For $141,300

Kibar’s chart first revisits the basing sequence that reversed the 2022 bear cycle. A textbook inverse head-and-shoulders backside accomplished in early-2023, with troughs at roughly $17,600 (left shoulder), $15,500 (head) and $19,500 (proper shoulder). The breakout above the neckline despatched Bitcoin to $31,400.

Associated Studying

Instantly thereafter, value stalled in a six-month rectangle bounded by $25,000 assist and $31,400 resistance. The eventual topside decision propelled the market to the rectangle’s implied goal of $38,000, validating two consecutive classical projections in lower than a 12 months. Afterwards, the BTC value grinded greater. Beneath $73,700, BTC consolidated in a falling wedge, ending with a breakout towards $109,000.

From that time, the preliminary pullback bottomed at $91,200, creating what Kibar designates because the left shoulder. A deeper descent to $76,500 carved out the top. Then, the Bitcoin value shaped the best shoulder at $101,500, echoed by the blue bowl-shaped arc on the chart.

All through this construction the neckline at $109,000 remained intact, performing as a transparent demarcation between consolidation and contemporary highs. The inverse head-and-shoulders sample spans roughly half a 12 months, matching the analyst’s “6-month-long” annotation.

Associated Studying

Utilizing the orthodox H&S continuation rule—including the vertical distance from the top ($73,700) to the neckline ($109,000) to the breakout stage—Kibar derives a value goal of $141,300. He notes in an X reply that this goal is separate from the sooner $137,000 goal, which got here from a bigger cup-with-handle on the month-to-month scale. In different phrases, the shorter-term weekly sample now initiatives modestly greater than the longer-term construction.

At press time Bitcoin, Bitcoin traded close to $111,000, surpassing the neckline. Nonetheless, from a technician’s standpoint, the breakout nonetheless wants to verify with the weekly shut. Affirmation requires a decisive weekly settlement north of the $109,000 neckline. As Kibar notes: “Breakout must happen with a protracted white candle, much like earlier sample completions. There needs to be no hesitation.”

Invalidation would emerge on a weekly shut again beneath the newest swing-low assist at $101,500; deeper failure beneath $91,2000 would unravel the sample completely.

For now, Bitcoin sits on the fulcrum of its six-month equilibrium. A weekly candle or two ought to reveal whether or not the biggest digital asset can convert yet one more classical chart formation right into a measured transfer—this time towards mid-six-figure territory.

Featured picture created with DALL.E, chart from TradingView.com