Bitcoin information and Ethereum value held regular over the previous day as merchants saved one eye on value and the opposite on new coverage alerts from Washington and London.

Bitcoin traded close to $95,648, up +0.04%, whereas Ethereum hovered round $3,168, a small achieve of 0.16%.

7d

30d

1y

All Time

Robert Kiyosaki, the creator of Wealthy Dad Poor Dad, informed his viewers on X that he has no plans to promote his Bitcoin or gold, regardless of the sharp decline in costs.

BITCOiN CRASHING:

The every thing bubbles are bursting….

Q: Am I promoting?

A: NO: I’m ready.

Q: Why aren’t you promoting?

A: The reason for all markets crashing is the world is in want of money.

A: I don’t want money.

A: The actual cause I’m not promoting is as a result of the…

— Robert Kiyosaki (@theRealKiyosaki) November 15, 2025

He mentioned what he calls the “every thing bubbles” at the moment are beginning to burst. He argued that the deeper drawback behind the market drop is a worldwide money scarcity.

“The reason for all markets crashing is the world is in want of money,” he wrote.

Kiyosaki additionally warned that what he calls “The Huge Print” is coming, echoing Lawrence Lepard’s view that governments might resort to heavy cash creation to handle rising debt.

He reiterated the purpose in a separate replace and said that his long-term stance stays the identical. “I’ll purchase extra Bitcoin when crash is over,” he wrote, once more pointing to Bitcoin’s fastened provide of 21M cash.

TWO MORE THINGS:

1: I willl purchase extra Bitcoin when crash is over.

There are solely 21 million Bitcoins.

2: When you’ve got a Cashflow Sport kind a Cashflow Membership and produce Birds of Feather collectively…. Educate and be taught collectively.

— Robert Kiyosaki (@theRealKiyosaki) November 15, 2025

Bitcoin Value Prediction: Is BTC USD Newest Bearish Crossover Signaling a Deeper Correction Forward?

Bitcoin, in the meantime, slipped under its short-term development line this week as a bearish crossover shaped on the each day chart.

The fast-moving common dropped beneath the 200-day line after a number of weeks of slowing momentum close to $110,000.

(Supply: X)

Merchants usually deal with this setup as a potential “demise cross.” In previous cycles, comparable crossovers lined up with native bottoms that later produced sturdy rebounds.

This time, the setup seems weaker. Bitcoin has slipped firmly under the 200-day shifting common for the primary time since late 2023, and the drop has pushed costs into the high-$90,000 vary.

The chart additionally reveals a decrease excessive forming under the spring peak, indicating that momentum has waned.

If Bitcoin remains to be monitoring its normal cycle, previous patterns counsel patrons have a tendency to look inside a number of days of a demise cross.

But when the market doesn’t bounce within the coming week, the following transfer could also be one other slide earlier than any try and climb again towards the 200-day line.

DISCOVER: 9+ Greatest Excessive-Danger, Excessive-Reward Crypto to Purchase in November2025

Ethereum Value Prediction: Are Derivatives Markets Signaling Extra Draw back for ETH?

7d

30d

1y

All Time

As per Coingecko knowledge, the Ethereum value is down -18.5% previously month and one other 5.2% this week.

It has been barely steadier than Bitcoin on the weekly chart, however there’s nonetheless no actual sign of a restoration.

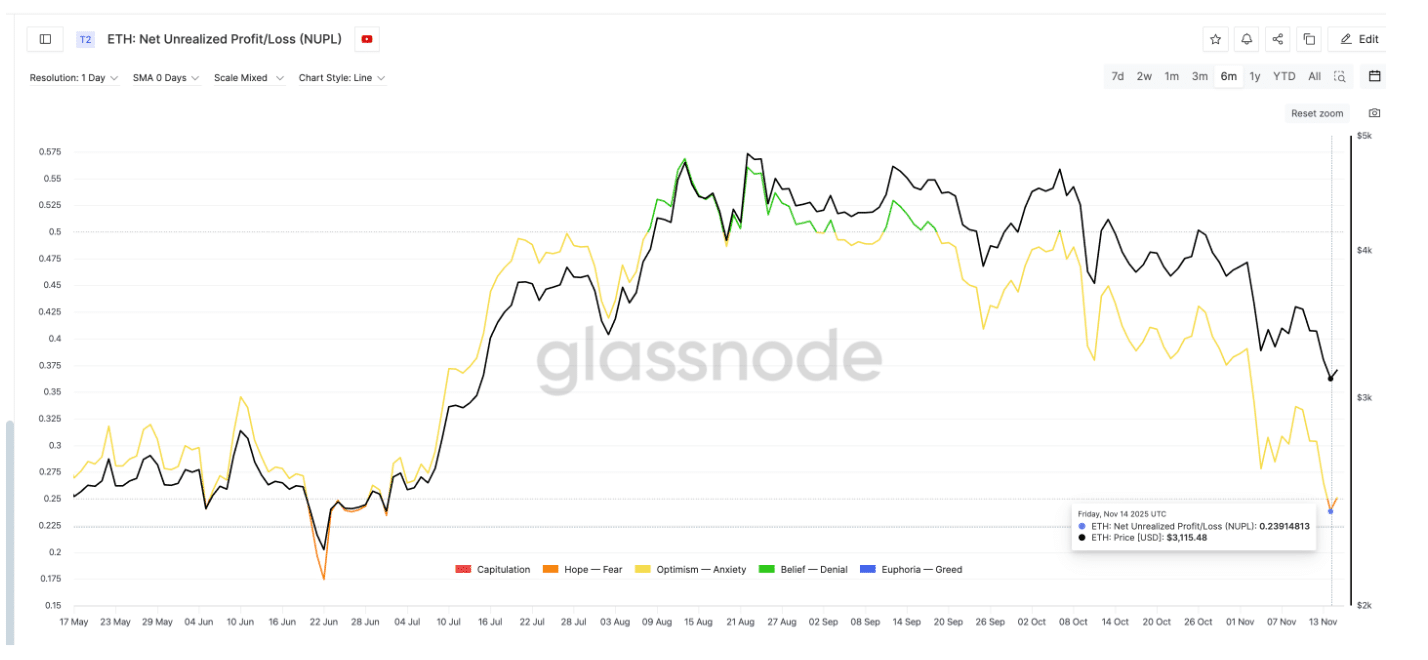

A key on-chain sign reveals that merchants have little cause left to lock in income. Internet Unrealized Revenue and Loss (NUPL) has slipped to 0.23, its lowest studying since July 1.

NUPL measures how a lot unrealized achieve or loss sits throughout the market and helps monitor shifts in sentiment.

(Supply: Glassnode)

It strikes by way of phases resembling capitulation, when most wallets maintain losses, and perception or denial, when confidence begins to construct.

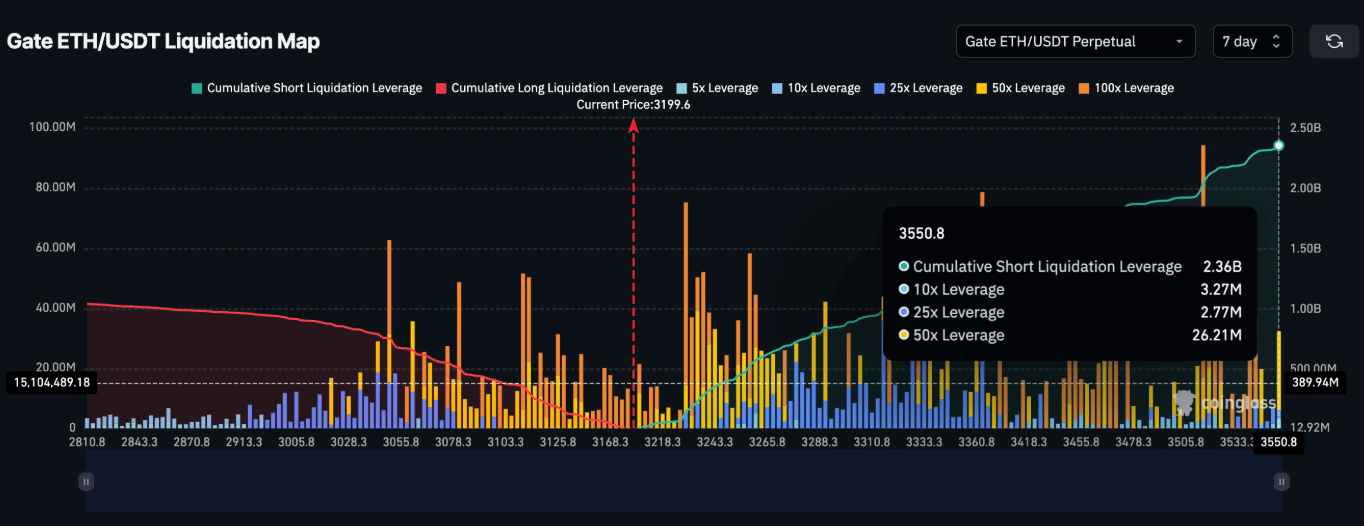

Gate’s ETH-USDT liquidation map reveals brief positions stacked at $2.36Bn, with lengthy positions nonetheless notable at $1.05Bn.

(Supply: Coinglass)

The break up highlights a market caught between warning and conviction, leaving Ethereum’s short-term course unclear.

Ethereum’s short-term development nonetheless factors decrease, and Crypto Tony says a liquidity sweep might come earlier than any strong restoration.

The chart locations ETH close to $3,170, shifting inside a transparent corrective construction.

Value motion is forming an ABC sample, with the newest pullback opening the door for one more transfer down towards the $3,105–$3,110 assist zone.

That space strains up with the earlier swing low marked as wave (a), the place many stops are probably resting.

(Supply: X)

The chart additionally reveals a rising wedge that broke down earlier within the transfer, an indication that momentum had already weakened.

ETH did not push previous the wave (b) excessive close to $3,250 and turned decrease quickly after, displaying sellers nonetheless have management.

The anticipated path on the chart suggests a deeper drop into the liquidity pocket, adopted by a potential rebound towards $3,260 if patrons step in.

For now, Ethereum stays in a corrective section, and merchants are looking forward to a sweep of the decrease vary earlier than searching for lengthy positions.

DISCOVER: Subsequent 1000X Crypto: 10+ Crypto Tokens That Can Hit 1000x in 2025

The put up Bitcoin Information and Ethereum Maintain Regular as Kiyosaki Warns of “Huge Print” and World Money Crunch appeared first on 99Bitcoins.