Knowledge reveals the Bitcoin dealer sentiment has been teetering on the sting of utmost greed for the previous couple of days, an indication {that a} break could also be coming.

Bitcoin Concern & Greed Index Is Sitting On The Boundary Of Excessive Greed

The “Concern & Greed Index” refers to an indicator created by Various that tells us concerning the common sentiment current amongst buyers within the Bitcoin and wider cryptocurrency markets.

The index makes use of a numerical scale operating from zero to hundred for representing the market sentiment. All values above 53 correspond to greed among the many buyers, whereas these beneath 47 recommend the presence of worry. The in-between ranges naturally correspond to a web impartial mentality.

Now, right here is how the present market sentiment seems to be, in keeping with the Concern & Greed Index:

The worth of the metric seems to be 74 for the time being | Supply: Various

As is seen above, the indicator presently has a worth of 74, which suggests the buyers as a complete share a sentiment of greed and a robust one at that, contemplating the excessive worth.

In actual fact, this worth is so excessive that it’s proper on the gateway to a particular zone referred to as the intense greed. This area, which is located past the 75 degree, corresponds to euphoria among the many Bitcoin merchants. There’s a comparable territory on the opposite finish of the size as effectively, often known as excessive worry (underneath 25). When the index is on this zone, it naturally suggests the buyers are within the deepest state of despair.

Traditionally, each of those zones have held a lot significance for Bitcoin and different digital belongings, as main reversals have occurred when the buyers have held these mentalities. Thus, excessive greed can result in a high and excessive worry to a backside.

Lately, Bitcoin has climbed to cost ranges close to the all-time excessive, so it’s not stunning that the sentiment is heating up. Nonetheless, for now, the index hasn’t damaged into the intense greed zone but, so it’s potential that the run may have extra room to run earlier than overhype turns into a problem.

It solely stays to be seen how lengthy this might maintain, nonetheless, contemplating that the Concern & Greed Index has been sitting on this boundary degree for 3 straight days now.

The development within the Concern & Greed Index over the previous twelve months | Supply: Various

Any continuations to the rally may take the market sentiment past the intense greed threshold, at which level a reversal may turn into extra possible, the upper the index ventures into the zone.

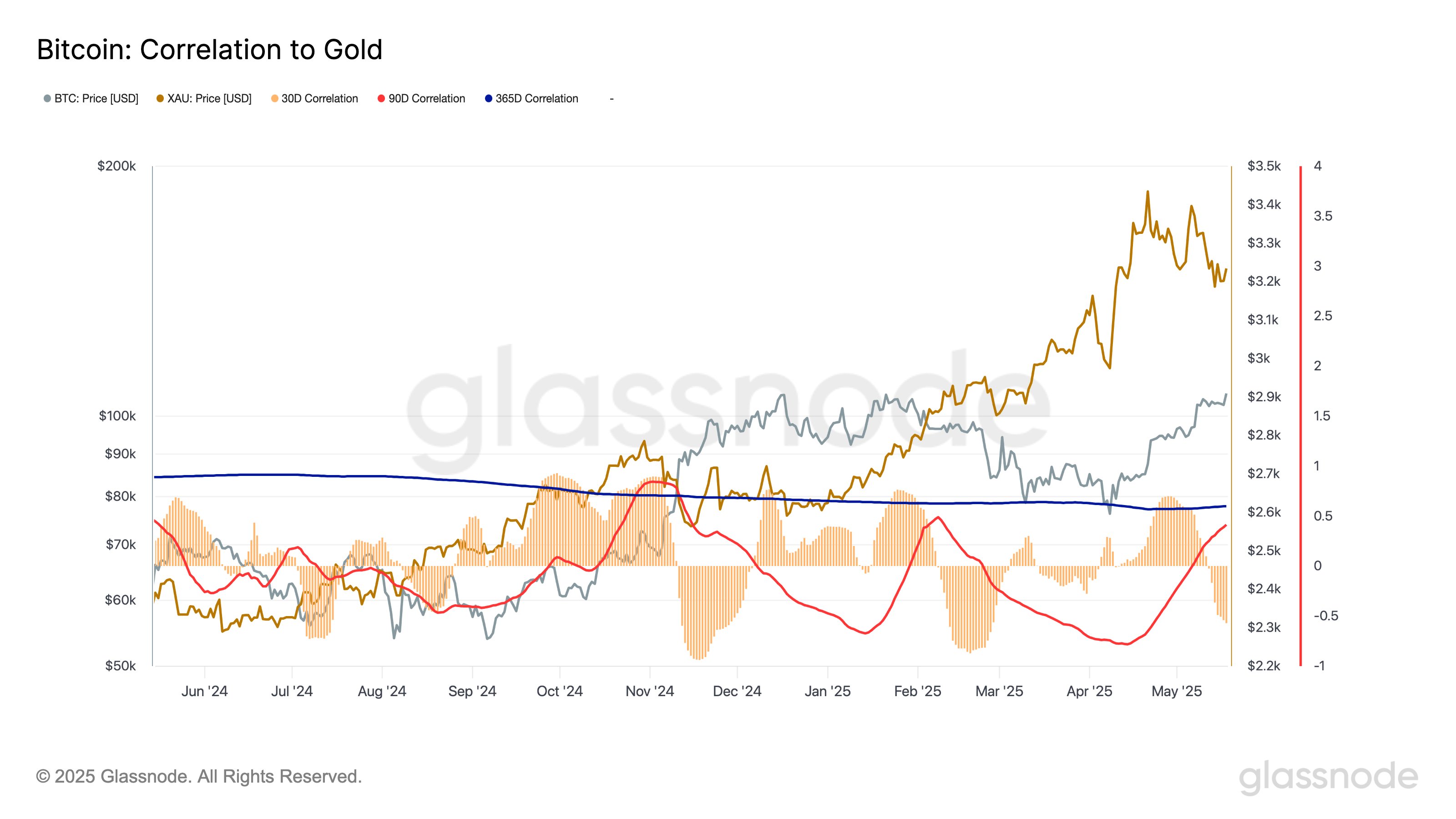

In another information, Bitcoin’s 30-day correlation with Gold has just lately declined to its lowest degree since February, because the analytics agency Glassnode has identified in an X submit.

Seems to be like BTC’s correlation to Gold is damaging on the month-to-month timeframe | Supply: Glassnode on X

At current, the 30-day correlation between Bitcoin and Gold is sitting at a worth of -0.54, which signifies that over the previous month, the 2 have traveled oppositely to one another to some extent.

BTC Worth

Bitcoin noticed a pointy burst to the $107,000 degree yesterday, however the coin has since fallen off simply as quickly, as its worth is now floating round $102,300.

The worth of the coin has been shifting sideways in the previous couple of days | Supply: BTCUSDT on TradingView

Featured picture from Dall-E, Glassnode.com, Various.me, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluate by our group of high expertise consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.