In accordance with the newest on-chain information, Bitcoin has been witnessing an fascinating change in its holder habits, additional intensifying the bullish hypothesis available in the market.

Bitcoin UTXO Depend Declines As Worth Surges

In a Quicktake put up on CryptoQuant, market analyst CryptoOnchain revealed that long-term Bitcoin traders appear to be altering their funding technique by more and more holding on to their cash. This on-chain statement is predicated on the Bitcoin UTXO Depend metric, which tracks the full variety of particular person unspent transaction outputs on the blockchain.

Associated Studying

For context, an unspent transaction output is an quantity of a cryptocurrency (on this case, Bitcoin) that has been obtained by an handle, however has not but been used as enter for a brand new transaction.

CryptoOnchain shared that this on-chain metric has been on a gentle decline since January 2025. Within the put up, the crypto analyst identified that the UTXO depend lately reached about 166.6 million, the bottom level seen since April 2024.

Because the Bitcoin UTXO reached a peak of roughly 187.5 million in January, it has witnessed a contraction of as much as 11% — an occasion which CryptoOnchain interprets as a transparent signal of community consolidation.

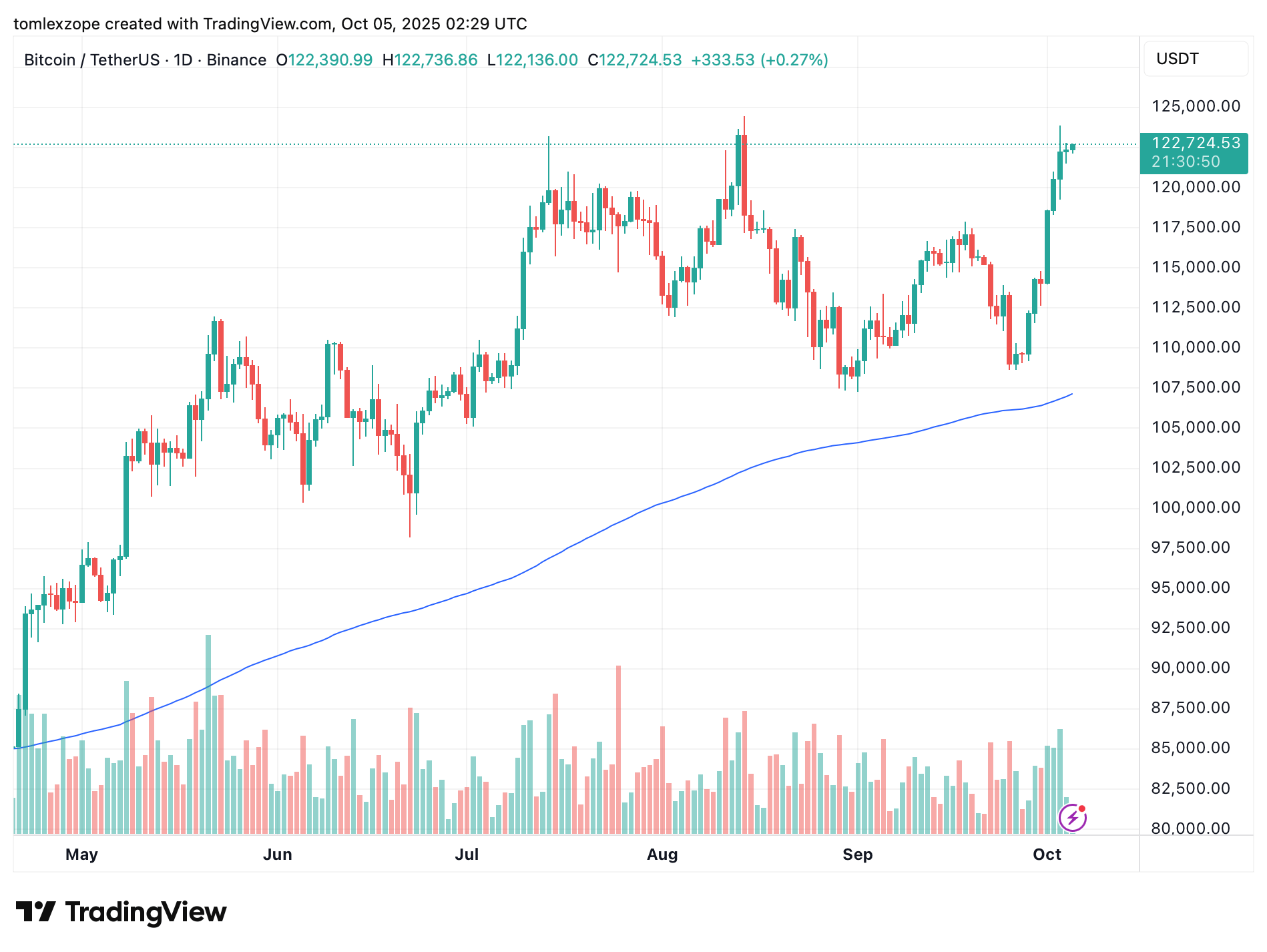

Curiously, this decline seen with unspent transaction output contrasts with Bitcoin’s worth motion. Whereas the UTXO has maintained a gentle bearish construction, Bitcoin’s worth has continued to ascend. The flagship cryptocurrency noticed a worth development from about $99,000 to its present market worth of round $122,000.

This “inverse relationship” is one which the net pundit defined to be a “traditional hallmark of a maturing market.”

Why The Decline And What To Count on

A decreased UTXO depend could possibly be a results of a number of underlying elements, together with that long-term holders are selecting to carry their cash fairly than promoting for revenue. Owing to this “hodling” habits, it may be mentioned that the market is beginning to achieve maturity.

Additionally, CryptoOnchain defined that low UTXOs may point out diminished transactions inside the Blockchain. By extension, this might imply that fewer gross sales are happening, which interprets to diminished promoting stress on worth.

Additionally, a decrease UTXO depend factors to growing community effectivity. As customers combination smaller UTXOs into bigger ones, they optimize the blockchain area, main probably to a much less congested community.

In the end, the simultaneous decline in Bitcoin’s UTXO and its worth improve paints an thrilling image for the cryptocurrency’s future. This mixture indicators that the premier cryptocurrency is at a reaccumulation section, that means that traders are strategically positioning themselves in expectation of the following important upward transfer.

As of this writing, the value of BTC stands at about $122,720, exhibiting an over 1% development previously day.

Associated Studying

Featured picture from iStock, chart from TradingView