Bitcoin has remained in a good consolidation vary under its all-time excessive of $112,000 since late Might, irritating each bulls and bears. Regardless of a number of failed breakout makes an attempt, BTC has held key demand zones above vital help ranges, suggesting robust underlying power. As value compresses, volatility is declining — a basic signal {that a} main transfer may very well be imminent.

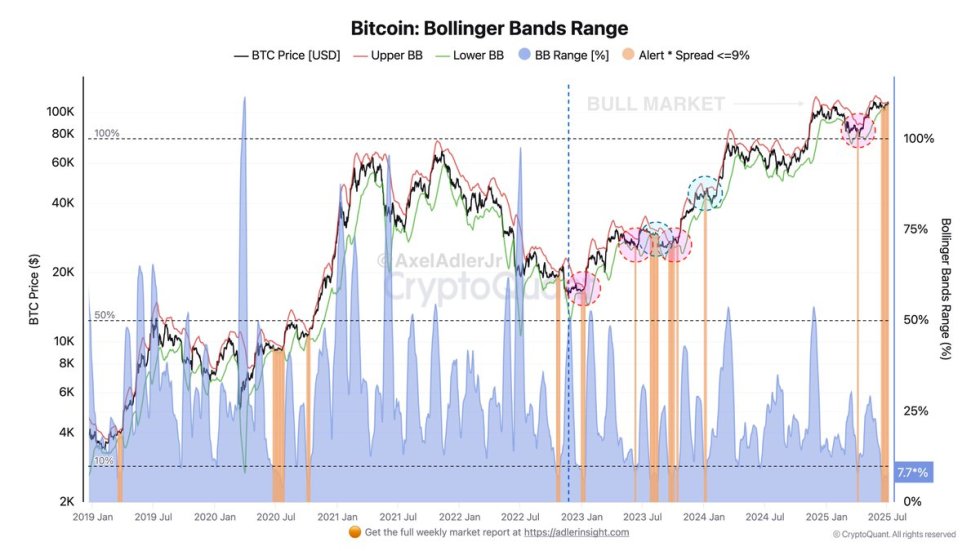

High analyst Axel Adler shared recent information indicating that Bitcoin is at the moment experiencing a textbook Bollinger Bands squeeze. The unfold between the higher and decrease bands has narrowed to only 7.7%, marking one of many tightest ranges seen all through the present bull cycle. Traditionally, such compressions have preceded explosive strikes in both path. Given Bitcoin’s place above help and inside a broader uptrend, the likelihood favors an upside breakout.

This technical setup, mixed with macroeconomic tailwinds and renewed investor curiosity, may function the catalyst for BTC to lastly push into value discovery. If confirmed, it will not solely open the door for a run past $112K but additionally reset expectations throughout the crypto market. Within the coming days, all eyes shall be on how Bitcoin responds to this mounting strain.

Bitcoin Consolidates As Bollinger Bands Squeeze Indicators Subsequent Transfer

Bitcoin continues to consolidate just under its all-time excessive of $112,000, irritating bulls and bears alike. Regardless of ongoing resistance on the prime, bears have did not drive the worth under $105,000, confirming robust demand at key help ranges. As the worth tightens, the broader macroeconomic image provides complexity to the outlook.

The US Congress just lately handed President Donald Trump’s “large, lovely” financial invoice simply earlier than the July 4 deadline. The bundle contains tax cuts and aggressive public spending, that are anticipated to gas inflation within the coming quarters. Coupled with optimistic job information, these developments are shaping investor sentiment throughout conventional and crypto markets.

On the technical aspect, Axel Adler highlighted a basic Bollinger Bands squeeze at the moment forming on Bitcoin’s chart. The vary between the higher and decrease bands has compressed to only 7.7%—one of many tightest readings seen all through the continuing bull cycle. This sort of volatility drop suggests vitality accumulation, with the worth getting ready for a major transfer.

Historic patterns provide perception: of six main Bollinger Band squeezes this cycle, 4 resulted in quick upside strikes, and two triggered temporary corrections earlier than rallies resumed. With this precedent, Adler believes the present setup most probably foreshadows a bullish breakout, though minor consolidation beforehand continues to be attainable.

BTC Value Holds Above Key Shifting Averages

The 12-hour Bitcoin chart reveals BTC buying and selling at $108,892, struggling to interrupt above the important thing resistance zone round $109,300. This degree has acted as a rejection level a number of occasions since early June, confirming its power. Regardless of the latest pullback, value stays above the 50 SMA ($106,442) and 100 SMA ($106,671), indicating bullish momentum continues to be in play.

Importantly, bulls have defended the $106,000–$107,000 help vary a number of occasions, stopping deeper corrections and conserving BTC inside a good consolidation vary. Quantity has declined in latest periods, suggesting the market is ready for a catalyst to interrupt out of this vary. If Bitcoin closes decisively above $109,300 on robust quantity, a run towards the $112,000 all-time excessive turns into more and more probably.

On the draw back, a break under the 100 SMA may expose BTC to the subsequent main help round $103,600, a key degree that has held since mid-Might. The 200 SMA (at the moment at $99,093) stays a long-term help zone that hasn’t been examined in months.

Featured picture from Dall-E, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent assessment by our group of prime expertise consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.