In a serious transfer for the digital asset neighborhood, Fort Crypto has introduced the acquisition of NFT-Stats.com, a number one portal for NFT market analytics. This integration combines probably the most in depth knowledge dashboards monitoring the worldwide NFT ecosystem with Fort Crypto’s information of blockchain media and cryptocurrency. Collectively, Fort Crypto will be capable to advance NFT stats protection and supply traders, collectors, and followers with a extra complete, clear, and helpful understanding of the market.

Why This Deal Issues

The NFT market is regularly characterised as erratic, quick-moving, and difficult to watch in actual time. Tasks have fluctuated almost immediately, from the height of 2021 to the cyclical declines and recoveries of 2023–2025. Making sense of the cacophony now requires having dependable, exact statistics; it’s not a alternative.

With this acquisition, Fort Crypto beneficial properties entry to detailed metrics on buying and selling volumes, gross sales, transactions, collections, and blockchain-level efficiency throughout Ethereum, Solana, Polygon, Arbitrum, Base, BNB Chain, and past. The synergy is not going to solely profit Fort Crypto’s readers but in addition broaden its affect as a go-to hub for professional-grade Web3 intelligence.

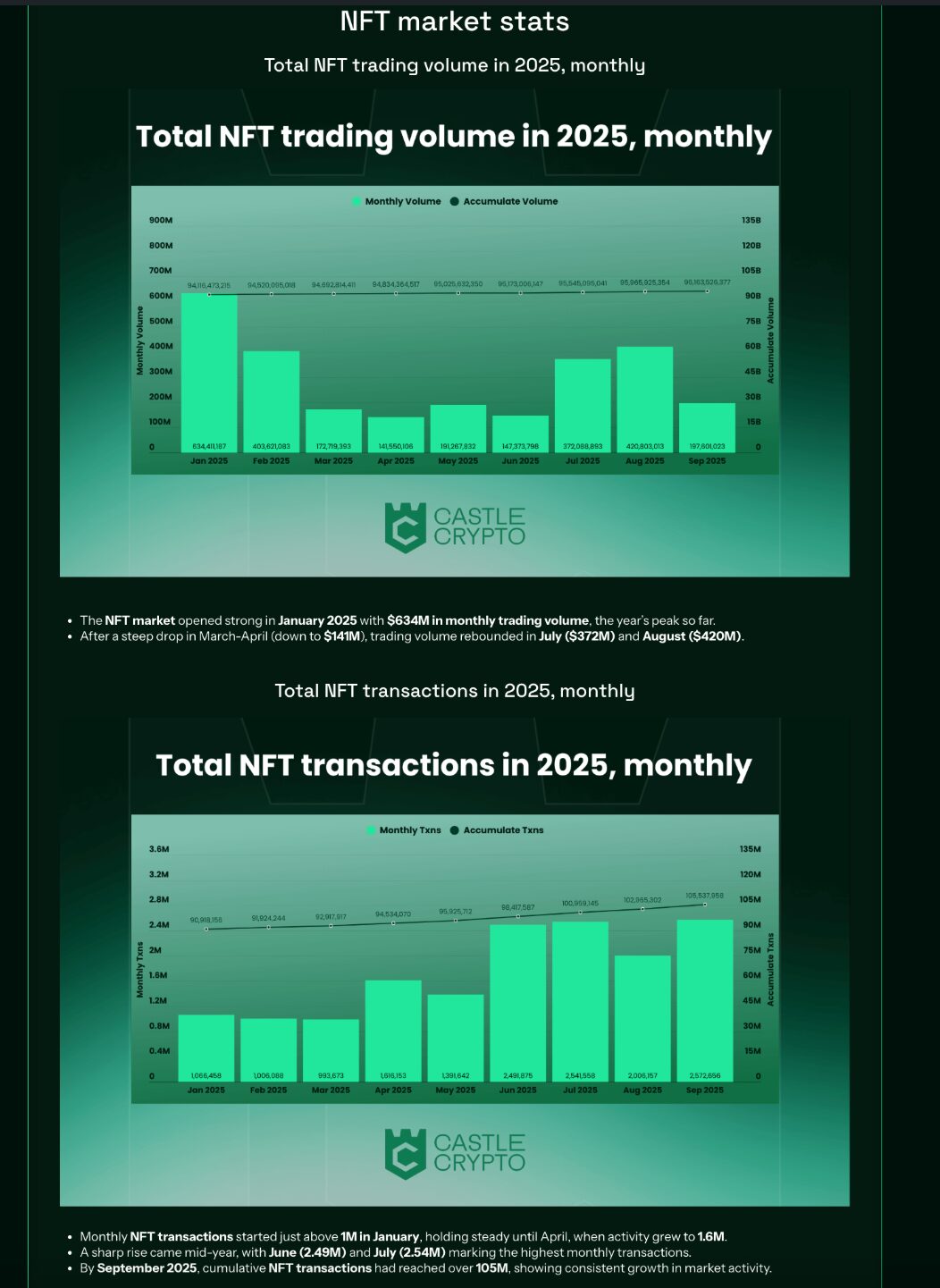

A Market Outlined by Highs and Lows

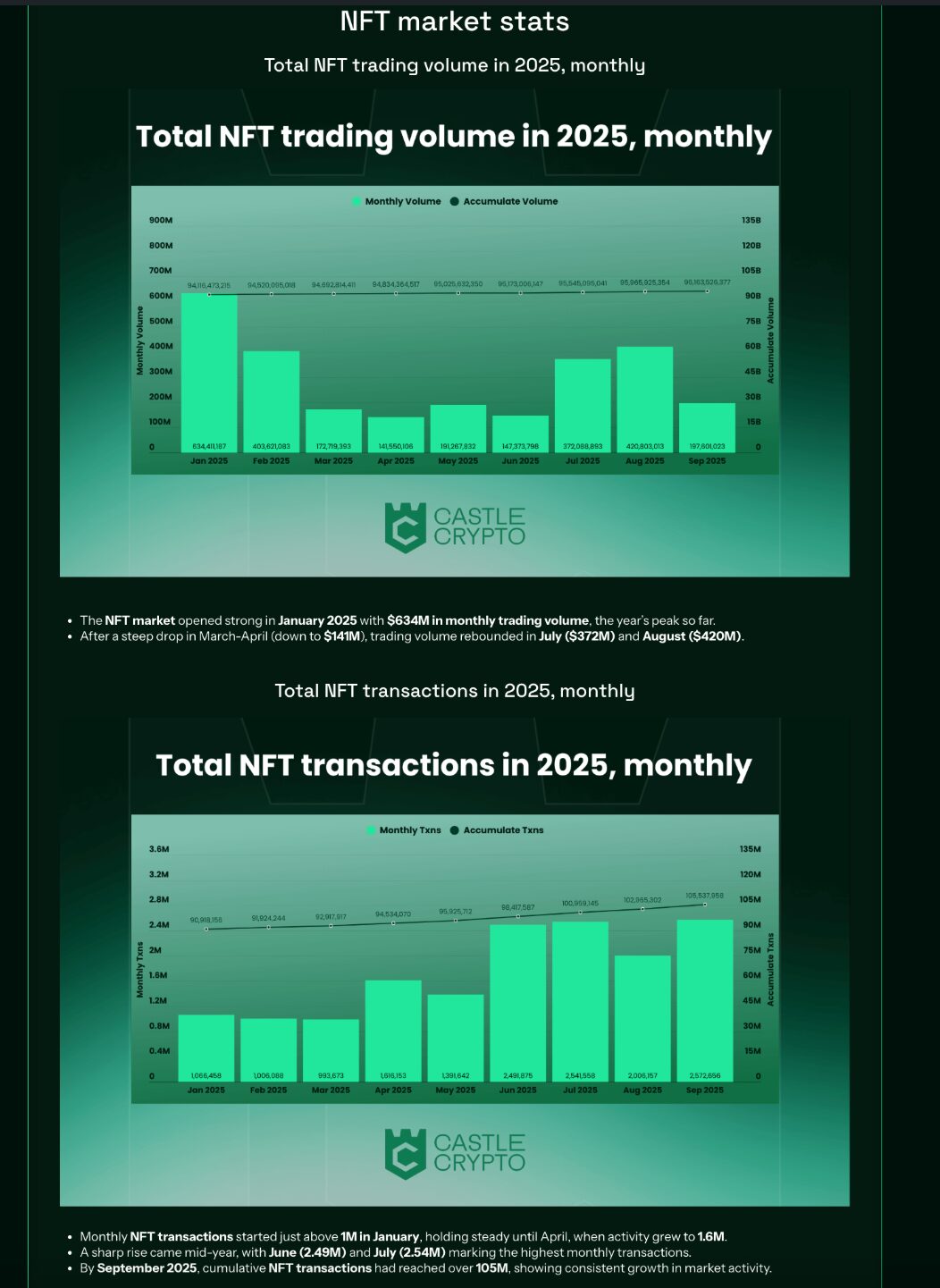

The NFT ecosystem in 2025 illustrates how shortly fortunes can shift. Buying and selling volumes, for instance, reached a yearly peak of $634 million in January, solely to plunge to simply $141 million by March–April. A pointy rebound in midsummer noticed volumes get better to $372 million in July and $420 million in August, underscoring the cyclical nature of the area.

Transaction counts inform the same story. Month-to-month exercise started at roughly 1 million transactions in January, accelerated to 1.6 million by April, and spiked above 2.5 million throughout June and July. By September, cumulative transactions exceeded 105 million, proof that regardless of volatility, engagement continues to broaden.

Gross sales, nevertheless, reveal the delicate facet of demand. The market peaked in April however dropped considerably afterward, with late-summer exercise barely reaching 1–4 million gross sales monthly. The imbalance between patrons and sellers was particularly pronounced in spring, though the second half of the yr noticed the 2 sides almost equalize at round 450,000 every by September.

Multi-Chain Competitors and Enlargement

Ethereum stays the undisputed heavyweight, commanding $90.93 billion in complete buying and selling quantity and greater than 38 million transactions. But the story of 2025 isn’t just Ethereum’s dominance however the speedy emergence of challengers.

Solana generated $2.48 billion in quantity with notable spikes on Magic Eden, although exercise cooled sharply in Q3.Polygon processed over 22.9 million transactions, cementing its function as a high-velocity, lower-cost hub.Base, a relative newcomer, surpassed 10 million transactions and delivered 124 billion gross sales in January earlier than settling into steadier ranges later within the yr.BNB Chain’s transactions collapsed from round 1,000 in April to solely 36 by September, whereas Arbitrum’s quantity dropped from $6.8 million in January to simply $1.8 million in September. Each corporations discovered it tough to maintain their momentum.

This cross-chain competitors reveals that whereas Ethereum units the benchmark, the NFT market is much from monolithic. Every community cultivates distinctive communities, marketplaces, and use instances.

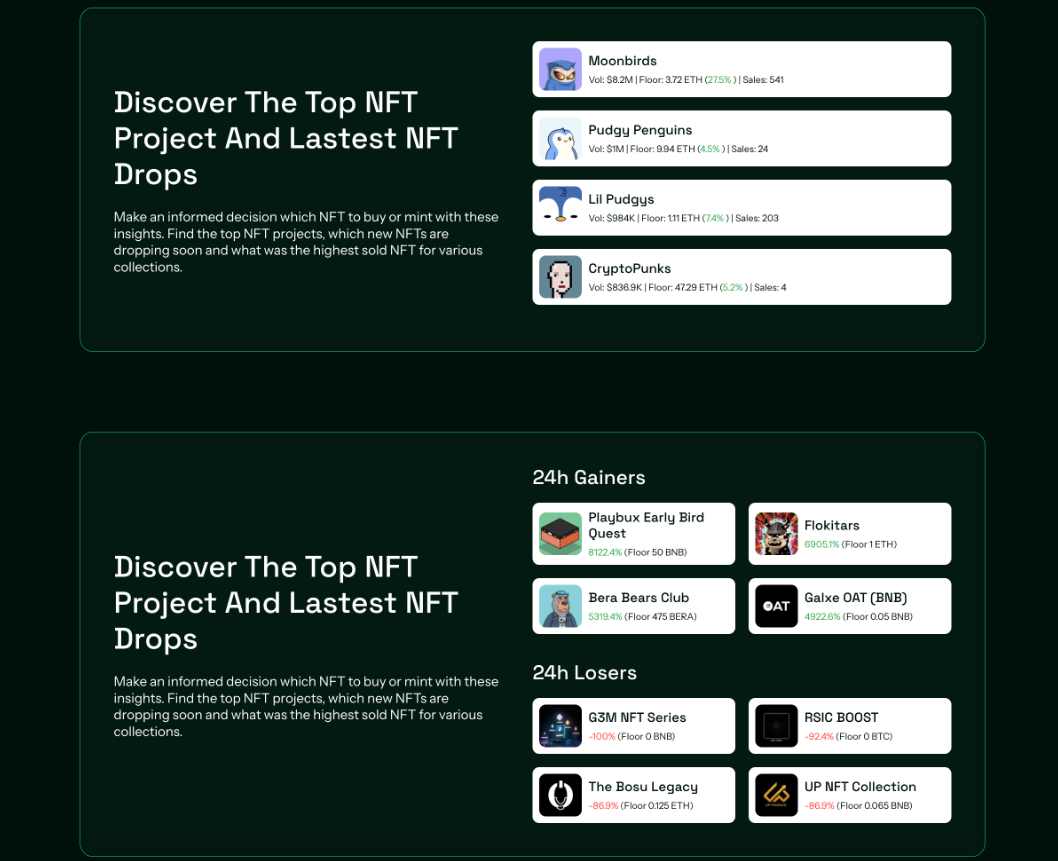

Blue Chips and Rising Stars

NFT collections present one other lens on market well being. Legacy initiatives like Crypto Punks and Bored Ape Yacht Membership (BAYC) stay iconic, however their efficiency displays ongoing hype cycles.

BAYC surged to $34.2 million in buying and selling quantity in August, greater than six occasions greater than June. Ground costs hover close to $39,000, up from a mint value of simply $26.Crypto Punks, initially free to mint, boast a flooring value exceeding $182,000 and cumulative buying and selling quantity surpassing $3.28 billion.

Different collections inform tales of explosive development and equally dramatic corrections:

Doodles hit a excessive of $41.9 million in buying and selling quantity in February with 3,800+ gross sales, however exercise pale towards the autumn.Pudgy Penguins delivered one of many strongest returns on funding, with a mint value of $1.18 rising to a flooring of over $42,000.Azuki, as soon as using excessive at $116.5 million in January quantity, misplaced greater than 98% of month-to-month exercise by September.Rising collections like Mad Lads and Milady showcased robust ROI for early adopters, although their buying and selling volumes trended downward via the yr.

Such statistics spotlight the twin nature of NFTs: on one hand, they create long-term blue chips with enduring cultural cachet, and on the opposite, they produce initiatives topic to speculative bursts and steep declines.

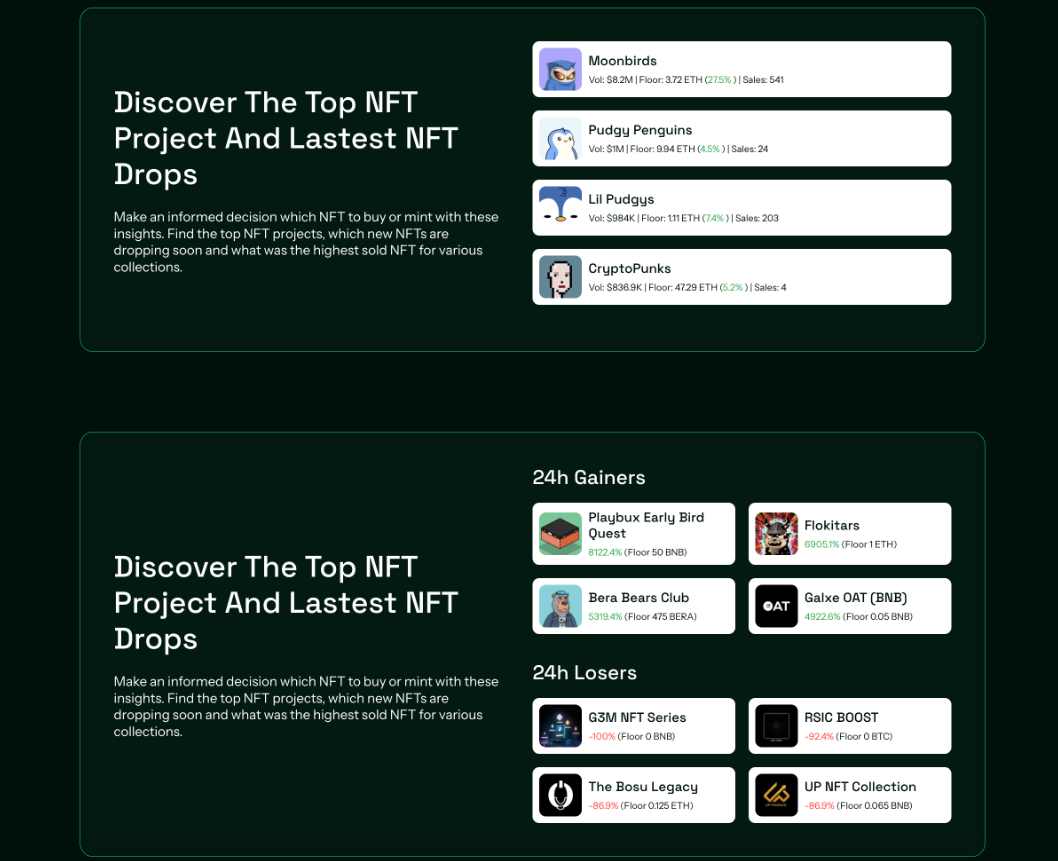

Market Wars

Equally telling is the battle amongst NFT marketplaces.

Magic Eden dominates Solana with month-to-month volumes exceeding $33 million, whereas rivals like TensorSwap almost vanished.OpenSea stays the first driver on Ethereum, Polygon, and Base, main in each gross sales and transaction counts. In June alone, OpenSea processed greater than 248,000 Ethereum transactions.Blur, a fast-rising competitor, peaked at $341 million in buying and selling quantity in January however struggled to take care of that momentum because the yr progressed.On BNB Chain, PancakeSwap and Tofu competed for scraps, dealing with volumes measured in hundreds fairly than hundreds of thousands.

These dynamics reveal not simply the place liquidity concentrates however how neighborhood belief and community results can shortly consolidate round a couple of dominant platforms.

The Worth of Clear NFT Stats

The mixing of NFT-Stats.com into Fort Crypto’s ecosystem will make these insights extra accessible and contextual. For skilled merchants, seeing real-time winners and losers throughout 24-hour home windows gives a tactical benefit. For long-term traders, understanding possession distribution, flooring value stability, and cross-chain growth gives a extra strategic perspective.

Fort Crypto’s editorial experience will be sure that uncooked knowledge will not be solely offered but in addition interpreted. Somewhat than a static dashboard of numbers, readers can anticipate deep dives into what these numbers imply, how they hook up with broader market shifts, and the place alternatives or dangers could lie.

Wanting Forward

The acquisition is a symptom of how significantly the crypto media scene is altering, and it goes past a easy monetary deal. Fort Crypto hopes to ascertain a brand new benchmark for dependability and transparency in a area that’s typically tainted by hype by integrating robust NFT analytics into its wider protection of blockchain and Web3 video games.

Correct knowledge will affect how builders, traders, and collectors traverse this quickly evolving area as NFTs proceed to search out their means into video games, metaverse platforms, and real-world functions. With Fort Crypto’s relocation, anyone with an curiosity in NFTs can have a single location with thorough knowledge, professional evaluation, and actionable insights.

Ultimate Ideas

Regardless of its volatility, the NFT market of 2025 displays resilience, innovation, and rising multi-chain acceptance over the long term. By buying NFT-Stats.com, Fort Crypto locations itself on the forefront of this improvement by offering not simply knowledge but in addition the tales that accompany it.

This new alliance marks a turning level for anyone who’s critical about understanding NFTs: the beginning of a extra sustainable, clear, and knowledgeable period for digital possession.