Be a part of Our Telegram channel to remain updated on breaking information protection

The Chainlink worth has dropped 7% within the final 24 hours to commerce at $12.17 as of three.40 a.m. EST on a 122% enhance in every day buying and selling quantity to $609 million.

This comes whilst Grayscale secures approval to listing the primary US Chainlink ETF (exchange-traded fund) on NYSE Arca this week.

🔥 UPDATE: Grayscale Chainlink ETF set to launch this week as first spot $LINK ETF, per ETF analyst Nate Geraci.

Grayscale will convert its Chainlink non-public belief to ETF format following SEC submitting approval. pic.twitter.com/GSt86B4SWO

— Cointelegraph (@Cointelegraph) December 1, 2025

US regulators have given the inexperienced gentle for Grayscale to transform its $30 million Chainlink Belief into an ETF that may listing on NYSE Arca underneath the ticker GLNK. The construction is designed to provide conventional buyers publicity to LINK with out holding the token straight.

🔥 In accordance with @NateGeraci , this week the market might even see Grayscale launch its personal Chainlink ETF, the primary Spot ETF for $LINK .The agency goals to transform its non-public belief into an ETF. pic.twitter.com/retps09xWr

— ALLINCRYPTO (@RealAllinCrypto) December 1, 2025

The ETF can also embody staking for a part of its holdings, permitting the fund to earn rewards whereas utilizing a money‑primarily based creation and redemption mannequin just like different crypto ETFs.

This approval comes after months of filings and indicators a rising willingness from regulators to accommodate altcoin ETFs past Bitcoin and Ethereum.

Even so, merchants seem like “promoting the information” as LINK slides right now, suggesting that expectations for the ETF had been already priced in and brief‑time period speculators are locking in earnings.

If the Chainlink ETF attracts significant inflows after launch, it may enhance liquidity and deepen market depth for the Chainlink worth over the approaching months.

Chainlink On‑Chain Alerts

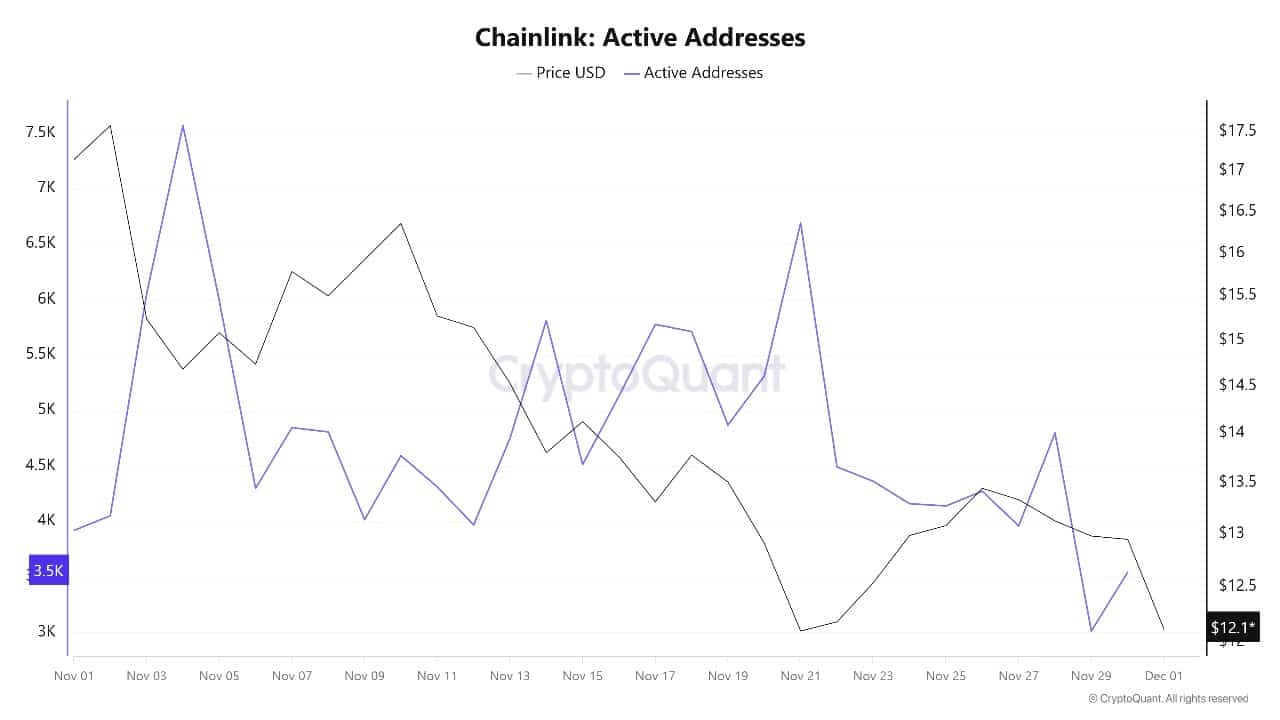

On‑chain information in This fall 2025 reveals that Chainlink community utilization has been trending increased, whilst worth has turned decrease in current weeks. Analytics suppliers report round 2,298 new addresses and roughly 10,000 energetic addresses at current highs. Ranges not seen since early 2025 point out that consumer adoption remains to be increasing.

Chainlink Lively Addresses Supply: CryptoQuant

Trade reserves of LINK have dropped to about 158 million tokens, their lowest level since mid‑2022. This normally means fewer cash are instantly accessible to promote on the open market. This decline in liquid provide aligns with the Chainlink Reserve Program, which converts protocol income into LINK and removes roughly 0.35% of the overall provide every year, performing a bit like a inventory buyback program that slowly will increase shortage.

Massive monetary gamers akin to UBS and regional banks in Turkey are testing or integrating Chainlink requirements for tokenised securities, reinforcing the view that Chainlink’s oracle and messaging instruments may sit on the centre of the subsequent wave of tokenisation.

Chainlink Worth Continues Downturn Development In Falling Channel

The Chainlink worth has damaged down from a rounded‑high sample after failing to carry above the mid‑$20 area earlier this 12 months. The coin has been falling inside inside a descending channel, with decrease highs and decrease lows for the reason that final peak.

It now sits simply above a horizontal help zone round $11–$12 that beforehand acted as a powerful ground in 2024.

The 50‑week easy transferring common is now falling close to $17.5, whereas the 200‑week easy transferring common hovers near $12.6. LINK is buying and selling barely beneath or round this lengthy‑time period pattern line. Exhibiting that bulls are preventing to defend a significant help cluster.

LINKUSD Evaluation Supply: Tradingview

There have been a number of bounces indicating that many lengthy‑time period holders view the present space as a price zone, however a clear weekly shut beneath it might sign a deeper bearish section.

Momentum indicators lean cautious quite than outright oversold. The weekly RSI is sitting within the excessive‑30s, which signifies weak bullish power but in addition leaves room for a reduction rebound if contemporary consumers step in.

The MACD has crossed beneath the sign line and stays in destructive territory, confirming that sellers nonetheless management the pattern, whereas the ADX round 30 factors to a reasonably sturdy downtrend that has not but exhausted itself.

Chainlink Eyes Essential $11–$12 Assist

Within the brief time period, if the Chainlink worth loses help at $11–$12, the subsequent draw back goal may very well be the decrease horizontal space close to $8–$9, the place the final main accumulation zone shaped earlier than the earlier rally.

Nonetheless, if the $11–$12 band holds LINK may try a restoration again towards preliminary resistance across the $17–$18 area.

Near the falling 50‑week SMA and the higher boundary of the current channel. A weekly shut above that stage could be the primary signal that the downtrend is ending. Probably opening a path towards $22.

Associated Articles:

Finest Pockets – Diversify Your Crypto Portfolio

Simple to Use, Function-Pushed Crypto Pockets

Get Early Entry to Upcoming Token ICOs

Multi-Chain, Multi-Pockets, Non-Custodial

Now On App Retailer, Google Play

Stake To Earn Native Token $BEST

250,000+ Month-to-month Lively Customers

Be a part of Our Telegram channel to remain updated on breaking information protection