Please see this week’s market overview from eToro’s world analyst workforce, which incorporates the newest market information and the home funding view.

In focus: Tariff Conflict; This autumn earnings season in full swing

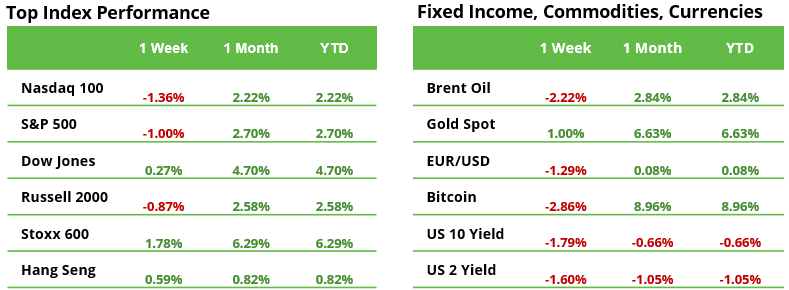

By no means a uninteresting second in markets. Final week, markets have managed to recuperate from DeepSeek-related sell-offs however got here below strain later within the week resulting from President Trump’s tariff proposals. The Nasdaq 100 completed the week at -1.4%, the S&P 500 -1.0%, whereas European markets surged by +1.8%. In the meantime, Bitcoin was down -2.9%, Brent oil -2.2%, and gold gained +1.0%.

This week, traders will intently monitor developments in Trump’s tariff technique and the anticipated retaliatory measures from key buying and selling companions as tariffs on Canada, Mexico, and China are anticipated to take impact on February 4th. Market individuals will assess the broader financial fallout and inflationary dangers tied to those measures. Additionally on the radar are vital occasions together with Eurozone inflation information launch, the Financial institution of England’s charge determination, the U.S. January jobs report, and a busy earnings week that includes main firms like Amazon, Google, and PayPal.

Enthusiasm in European Equities Reached Highest in Two Years

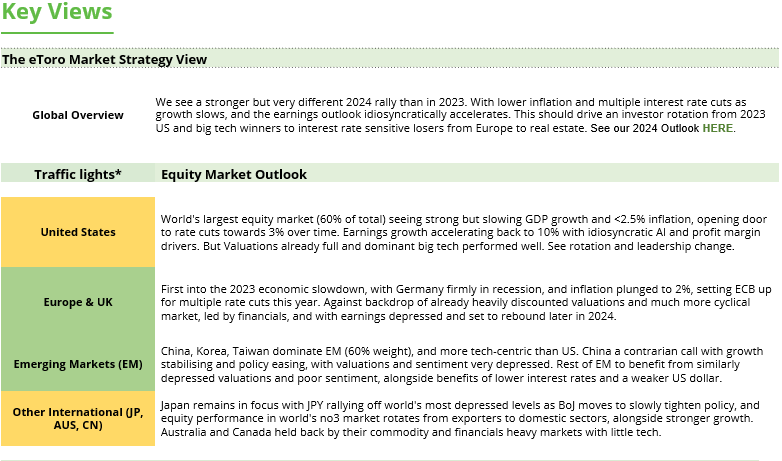

Investor sentiment for European equities has turned optimistic in January, displaying the strongest momentum relative to the US equities in two years. Enthusiasm is obvious in investor surveys: Financial institution of America’s newest world fund supervisor report reveals a pointy pivot towards Europe, with the most important month-to-month enhance in publicity since 2015 and the second-largest ever. Notably, the survey predates Trump’s inauguration.

So, why the renewed enthusiasm regardless of ongoing financial stagnation and political uncertainty throughout main European economies? One key issue is valuation: the 12-month ahead P/E of European shares stands at 13.5x, considerably decrease than World (18.0x), U.S. (22.0x), and Japan (13.6x). This valuation hole stays even after excluding the most costly “Magazine 7” shares from U.S. indices. If Europe experiences optimistic developments—comparable to peace in Ukraine or restored political stability, significantly in Germany and France, and manages to keep away from tariffs from the Trump administration—this undervaluation might translate right into a rewarding funding alternative.

Focus of Week: Strategic Investments in Commodities

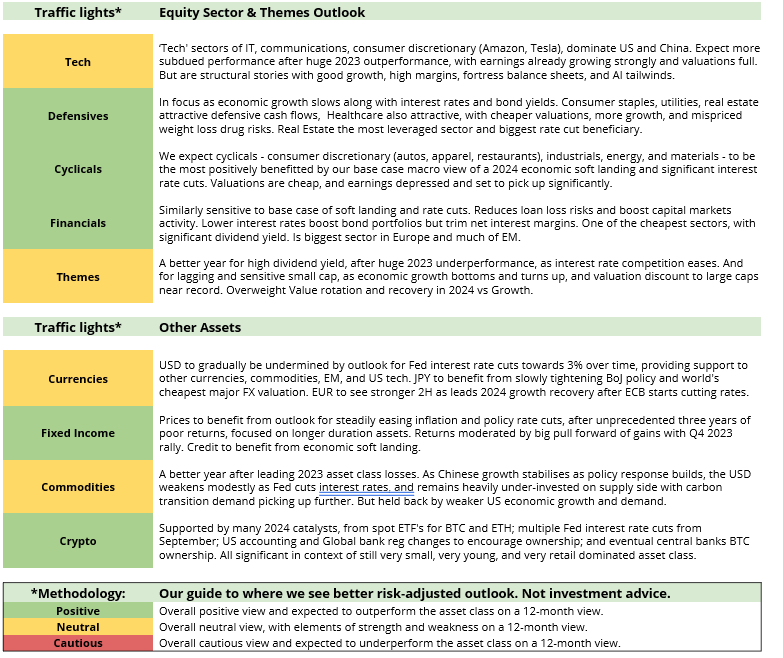

Current market dynamics have highlighted the distinct position commodities play in funding portfolios. Their behaviour differs from conventional property like equities or bonds resulting from their reliance on real-time macroeconomic forces—primarily provide and demand—slightly than projections of future money flows. This offers them a novel position in portfolios, significantly throughout heightened coverage uncertainty.

Inflation Safety: Commodities have traditionally maintained a powerful correlation with inflation, making them a robust hedge in opposition to sudden value surges. Over the previous 30 years, they’ve proven an inflation beta of 6 to 10, which means that even a small allocation to commodities can present outsized inflation safety for a broader funding portfolio.

Diversification and Threat Discount: Commodities might supply diversification resulting from their low correlation with conventional asset courses like equities and bonds. This will assist cut back general portfolio threat and enhances stability. In equity-heavy portfolios, commodities might play an important position by counterbalancing equities’ adverse skew—the place equities face sharp losses throughout downturns—by way of optimistic skew. Commodities usually expertise massive, event-driven value positive factors, significantly throughout provide disruptions, pure disasters, or geopolitical shocks. These positive factors can assist offset losses in different areas of the portfolio, offering safety throughout crises.

Occasion-Pushed Positive factors: Commodities, particularly inside the vitality and agricultural sectors, profit from optimistic occasion dangers. For instance, sudden provide shocks—comparable to oil provide disruptions or coverage modifications—could cause sharp value spikes, boosting returns in periods when different property could also be underperforming.

General, commodities act as a multi-faceted asset class, offering inflation safety, diversification, and resilience throughout market shocks, making them a significant element of a well-rounded funding technique.

Earnings and occasions

Macro

3 Feb. Eurozone Inflation, US ISM Manufacturing PMI

6 Feb. BoE Fee Resolution, US Jobless Claims

7 Feb. US Unemployment, Michigan Shopper Expectations

Earnings

3 Feb. Palantir

4 Feb. PayPal, Superior Micro Units, PepsiCo, Google, Pfizer

5 Feb. Walt Disney

6 Feb. Amazon

This communication is for data and training functions solely and shouldn’t be taken as funding recommendation, a private suggestion, or a proposal of, or solicitation to purchase or promote, any monetary devices. This materials has been ready with out considering any specific recipient’s funding goals or monetary scenario and has not been ready in accordance with the authorized and regulatory necessities to advertise unbiased analysis. Any references to previous or future efficiency of a monetary instrument, index or a packaged funding product should not, and shouldn’t be taken as, a dependable indicator of future outcomes. eToro makes no illustration and assumes no legal responsibility as to the accuracy or completeness of the content material of this publication.