Think about you’ve two completely different video video games, and each makes use of its personal particular form of coin. You’ve earned numerous cash in a single recreation, however you need to spend them within the different. There’s no built-in option to switch the cash, so a third-party instrument allows you to change your recreation cash from one to the opposite. That’s form of what a cross-chain bridge does on the earth of crypto, and in easy phrases, cross-chain bridges are instruments that enable individuals to maneuver their cryptocurrency or digital belongings from one blockchain to a different. For instance, you probably have Ethereum however need to apply it to the Solana community, a bridge helps you make that transfer.

It would sound like a magic trick, and in some methods, it’s, however like most magic tips, it’s not foolproof. Cross-chain bridges have turn out to be a key a part of DeFi, which is a system of economic apps and instruments constructed on blockchains, the place customers don’t want banks to borrow, lend, or commerce cash. Whereas DeFi has opened up tons of thrilling potentialities, bridges have launched certainly one of its greatest weaknesses.

Let’s break this down and discover why these bridges are so vital, and why they’re additionally seen because the Achilles heel of DeFi.

Why Do We Want Cross-Chain Bridges?

Blockchains are like islands, and each has its personal guidelines, foreign money, and apps. Ethereum, Bitcoin, Solana, and Avalanche are all completely different blockchains. They don’t naturally discuss to one another, however DeFi is rising quick, and customers don’t need to be caught on only one chain. They need to transfer their belongings round freely. That’s the place cross-chain bridges are available. They act like ferries, carrying your digital belongings throughout completely different blockchains.

Let’s say you need to use Bitcoin to purchase one thing on Ethereum. A bridge may also help, and often, it locks your Bitcoin on one facet after which creates a brand new token on Ethereum that represents your Bitcoin. Whenever you need your authentic Bitcoin again, the bridge burns the Ethereum model and unlocks the unique Bitcoin. It’s like checking your coat at a coat examine; your coat is stored secure, and also you get a ticket that proves you personal it.

This sort of blockchain interoperability, or the system of letting completely different blockchains work collectively, is important for the way forward for Web3, which is the following model of the web primarily based on decentralization and consumer possession.

RELATED: An Overview of Cross-Chain Bridges

The Hidden Hazard: DeFi Safety and Bridge Hacks

Whereas bridges make blockchains extra related, in addition they make them extra weak. In Greek mythology, Achilles was an incredible warrior who might solely be damage in a single spot: his heel. Bridges are like that weak spot for DeFi.

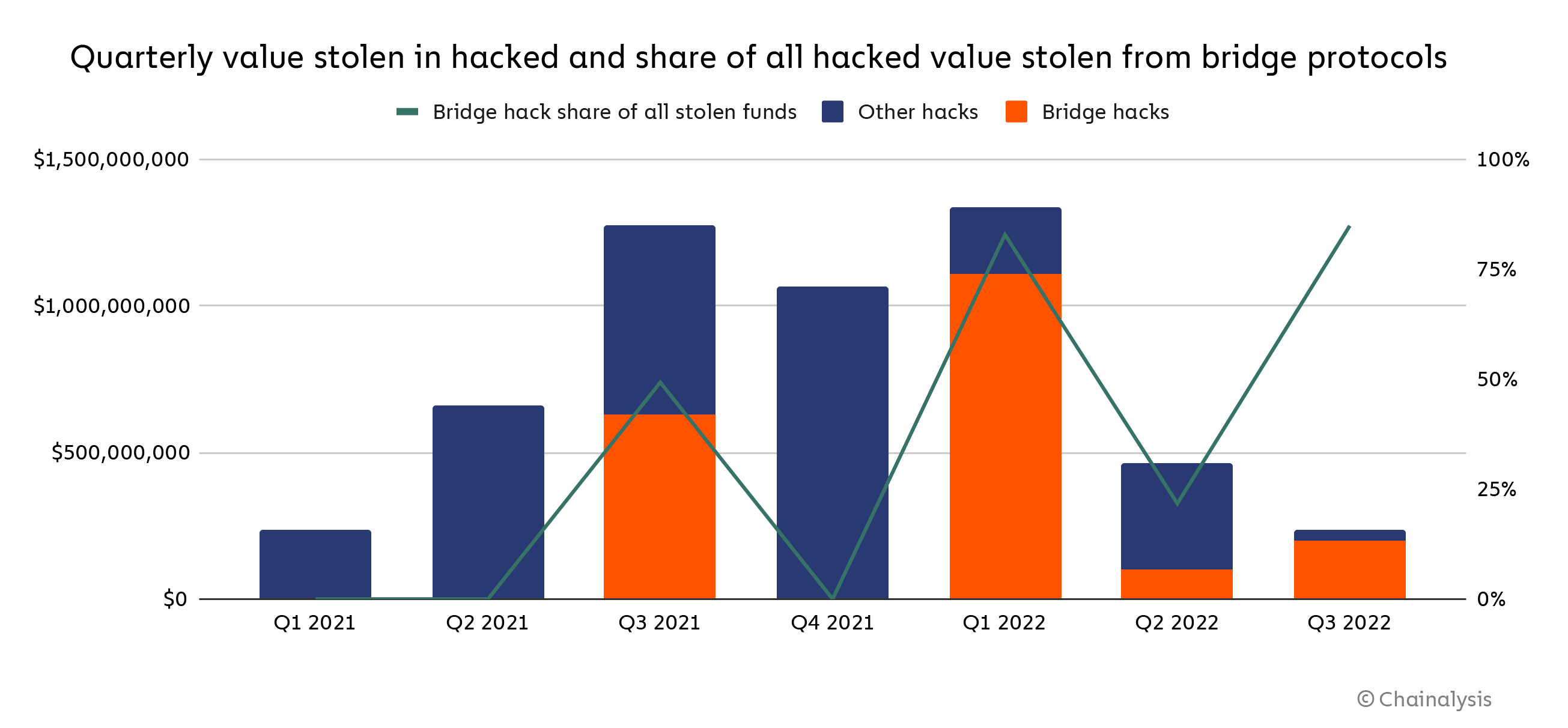

Why? As a result of bridges usually maintain big quantities of cash, and once you lock up your Bitcoin to get Ethereum tokens, that Bitcoin stays within the bridge. Now think about 1000’s of customers doing the identical factor; that provides as much as thousands and thousands and even billions of {dollars} sitting in a single place. Hackers see that as an enormous piggy financial institution ready to be cracked open, and so they’ve already finished it.

One of many greatest bridge hacks occurred in 2022, when a platform known as Wormhole was attacked. The hacker stole over $320 million value of crypto by tricking the bridge into creating pretend tokens. One other well-known instance is the Ronin bridge hack, the place hackers drained over $600 million from a bridge utilized by the favored crypto recreation Axie Infinity. These assaults didn’t simply damage the platforms; in addition they shook individuals’s belief in DeFi itself. If bridges might be hacked so simply, how secure is the remainder of the system?

RELATED: The Greatest Hacks and Exploits in DeFi Historical past & What We Can Be taught From Them

The Problem of Belief: Belief-Minimized Bridges

To unravel this drawback, builders try to create trust-minimized bridges, and which means bridges that don’t depend on one firm or group of individuals to be safe. As a substitute, they use sensible contracts and cryptography to make the method computerized and safer.

In idea, these sorts of bridges are safer as a result of there’s no single individual or staff who can mess issues up, or be bribed or hacked, however constructing trust-minimized methods is absolutely arduous. The expertise continues to be new, and even small bugs within the code can result in massive issues.

Many current bridges nonetheless depend on centralized methods, like a bunch of validators who determine whether or not a transaction is actual. This centralization goes towards the entire concept of DeFi, which is meant to be trustless and open to everybody.

Why Are Bridges So Susceptible?

Most cross-chain vulnerabilities come from the truth that these methods have to observe two blockchains on the similar time, and that’s not simple. Every blockchain works in a different way, and protecting monitor of what’s occurring on either side is hard.

Additionally, bridges usually take care of wrapped tokens, that are copies of authentic tokens that can be utilized on different chains. If the bridge is hacked or the wrapped token is poorly designed, these copies can be utilized to steal actual cash.

Lastly, as a result of a lot cash is concerned, bridges are a main goal for attackers. It’s like a financial institution with no safety guards. Even when most individuals use it the best approach, it solely takes one sensible thief to empty the vault.

The Way forward for Interoperability

So, the place will we go from right here? Ought to we cease utilizing bridges altogether? Not essentially. Blockchain interoperability continues to be extremely vital. For DeFi to develop and really substitute conventional finance, completely different blockchains want to have the ability to work collectively. However we’d like higher bridges; ones which are safe, environment friendly, and decentralized.

Some tasks are engaged on new methods to do that. They’re utilizing superior math, cryptography, and even zero-knowledge proofs (a approach of proving one thing is true with out revealing the main points) to make cross-chain transactions safer. Different builders are shared safety fashions, the place a number of chains work collectively to safe one another. These are complicated options, however they present promise in fixing the issues we’ve seen thus far.

So, the excellent news is that builders aren’t giving up. They’re engaged on new sorts of trust-minimized bridges, bridges that don’t depend on any single individual or group to work appropriately. Some are utilizing zero-knowledge proofs, a form of cryptographic magic trick that lets one blockchain show one thing to a different with out revealing any personal knowledge. Think about proving you’re sufficiently old to drive with out displaying your actual birthday; that’s how these proofs work. This makes cross-chain communication a lot safer.

Others are constructing bridges that use shared safety fashions. Which means a number of blockchains staff as much as watch over and shield one another’s bridges, form of like neighbourhood look ahead to crypto. There’s additionally work being finished on gentle purchasers—small applications that may independently confirm one other blockchain’s knowledge with out trusting any third social gathering.

These concepts are sophisticated beneath the hood, however the objective is straightforward: make DeFi safety robust sufficient to deal with billions of {dollars} flowing between blockchains with out fixed worry of hacks. We’re nonetheless within the early phases, however these developments present that it’s potential to repair what’s damaged. With the best innovation, cross-chain vulnerability doesn’t should be the Achilles heel of DeFi; it might turn out to be certainly one of its strongest options.

An Achilles Heel We Can Heal?

Cross-chain bridges are probably the most vital and most harmful components of in the present day’s crypto world. They make DeFi safety extra sophisticated and introduce massive dangers, however in addition they unlock large potential by making blockchain interoperability potential.

If we wish a future the place cash and knowledge can stream freely throughout chains, we have to construct bridges which are as robust and reliable as the remainder of the system. Which means fixing the bugs, bettering transparency, and shifting towards trust-minimized bridges that don’t depend on any single individual or group.

We’ve already seen what occurs when bridges break; the Wormhole hack and the Ronin bridge catastrophe have been wake-up calls, however they’ve additionally impressed a brand new wave of innovation. Builders and researchers are actually working more durable than ever to resolve these challenges and shield the way forward for DeFi.

Ultimately, identical to real-world bridges, cross-chain bridges want common upkeep, robust foundations, and sensible design. If we get that proper, the Achilles heel of DeFi would possibly simply turn out to be certainly one of its strongest belongings.

Disclaimer: This text is meant solely for informational functions and shouldn’t be thought of buying and selling or funding recommendation. Nothing herein must be construed as monetary, authorized, or tax recommendation. Buying and selling or investing in cryptocurrencies carries a substantial danger of economic loss. At all times conduct due diligence.

If you wish to learn extra market analyses like this one, go to DeFi Planet and observe us on Twitter, LinkedIn, Fb, Instagram, and CoinMarketCap Group.

Take management of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics instruments.”

The publish Cross-Chain Bridges: The Achilles Heel of DeFi? appeared first on DeFi Planet.