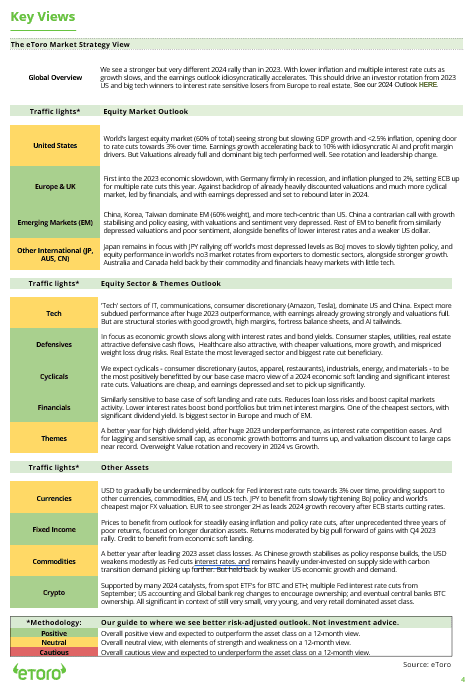

Markets confronted a whirlwind of tariffs, CEO warnings, and Huge Tech actuality checks final week. Coverage shifts and earnings set the stage for what’s subsequent – and all eyes are actually on the tech giants able to report. Right here’s what traders have to know heading right into a crucial stretch.

Tariff Pressures Eased After CEO Warnings:

After market turmoil, falling polling numbers, and warnings from the CEOs of Walmart, Goal, and Dwelling Depot about increased costs and empty cabinets as a result of tariffs, the US has made a collection of concessions that show there’s now an effort to show down the temperature on tariffs. Buyers are adjusting portfolios, with client, retail, and industrial sectors more likely to profit if commerce tensions keep contained. Whereas a full US- China deal just isn’t carried out, the shift lowered the temperature for now- a reminder that coverage threat stays a swing issue for markets worldwide.

Mega-Cap Tech’s Actuality Test: The once-invincible Magnificent 7 tech giants are coming again to earth. Their earnings progress remains to be outpacing the remainder of the S&P, however by a far slimmer margin heading into 2025-26. AI & Software program – Silver Lining: One clear brilliant spot amid the uncertainty is the continued increase in AI and enterprise software program. From cloud computing to generative AI, tech leaders are doubling down on innovation to drive effectivity and new income streams. This week’s Huge Tech earnings are anticipated to hammer this residence, which may showcase AI prowess and resilient software program demand. For traders, the message is that long-term tech themes (AI, cloud) stay intact – even when the macro winds blow chilly within the quick time period.

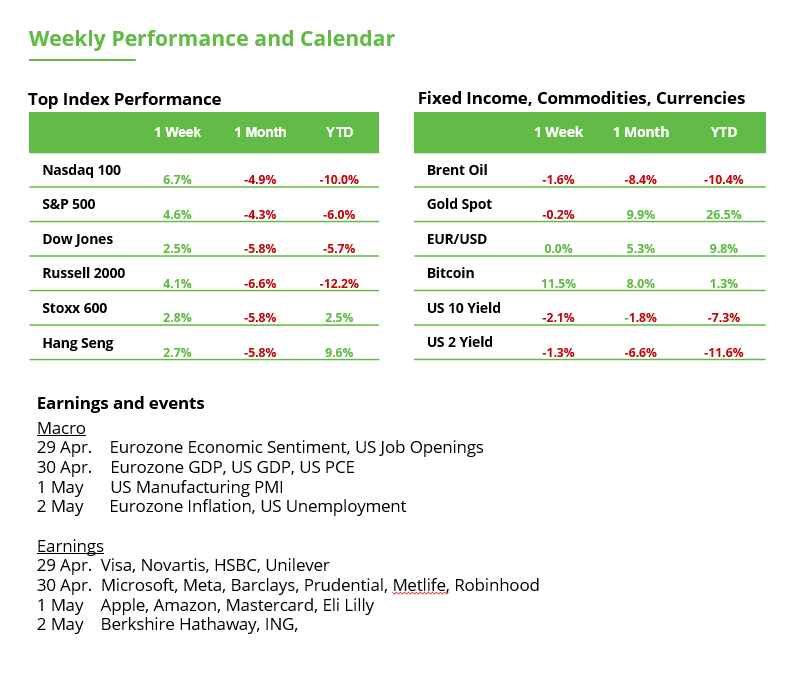

Huge Tech Earnings Bonanza Upcoming: This week brings a tech earnings bonanza that would set the market tone. 4 of the 5 largest US tech corporations report this week: Meta and Microsoft on April 30, and Apple and Amazon on Could 1. All eyes can be on their outcomes and steerage – particularly any commentary on cloud spending, digital adverts, and AI initiatives. Buyers can be in search of affirmation that innovation and price self-discipline can counterbalance any financial softness.

Key focus areas:

Cloud Spending: AWS, Azure, and Google Cloud outcomes will present how IT budgets are evolving in a extra cautious economic system.

AI Commercialization: Progress on AI product rollouts and monetization can be crucial for market sentiment.

Shopper Demand Indicators: Apple’s iPhone and companies progress can be a significant learn on discretionary spending resilience.

Promoting Developments: Meta and Google will present perception into small and mid-sized enterprise advertising budgets – a number one indicator for broader financial well being.

Prime 3 Themes to Look ahead to:

Tariff De-escalation = Retail and Shopper Reduction: Commerce concessions may ease stress on provide chains and margins.

Software program and AI = Relative Power:Software program and AI adoption developments are sturdy, even in opposition to macro headwinds.

Huge Tech Earnings = Market Catalyst: Ahead steerage will form threat urge for food throughout sectors, not simply in know-how.

Between tariff coverage and financial information – traders want sturdy nerves

The calendar is full of essential updates: Latest weeks have clearly proven how delicate markets are to new headlines, which may result in sharp short-term strikes. In unsure instances, macro information and earnings season present real-world insights past hypothesis.

The Fed’s most well-liked inflation gauge: The Core PCE Worth Index stays clearly above the central financial institution’s 2% goal, at the moment sitting at 2.8%. The important thing can be whether or not the March information, due Wednesday, present a significant decline. The ISM Manufacturing PMI, due Thursday, is predicted to fall from 49.0 to 47.9. That might sign weakening industrial exercise and will assist expectations for charge cuts – supplied inflation continues to ease and Friday’s labor market information additionally are available in weak.

Germany stays Europe’s weak spot: Inflation and GDP information from Europe on Wednesday will significantly spotlight Germany. The area’s largest economic system has been in recession for 2 years. The German authorities expects stagnation at greatest in 2025. And but, the DAX retains reaching new report highs. The rationale: DAX-listed corporations generate 82% of their income overseas. The inventory market due to this fact displays world progress, not the home German economic system.

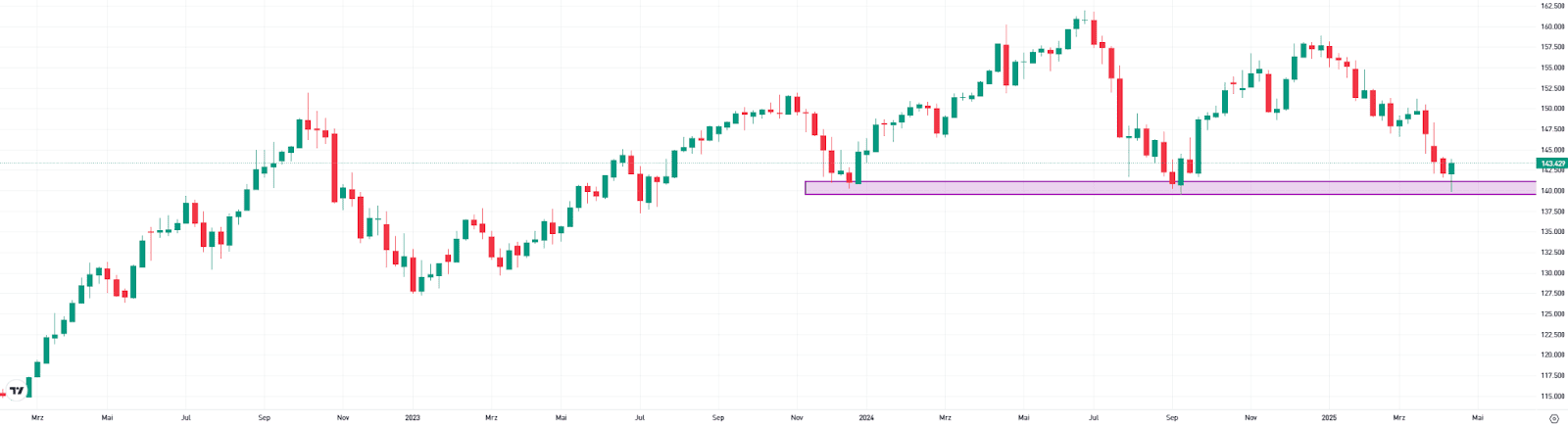

Japan: In contrast to most different central banks, the Financial institution of Japan is at the moment in a rate-hiking cycle. Nonetheless, it’s anticipated to carry charges regular on Thursday. Merchants can be watching intently to see whether or not additional charge hikes is likely to be delayed or whether or not there’s imminent want for motion. A hawkish tone would doubtless assist the yen additional. The USD/JPY pair has fallen by 8% over the previous three months and examined long-term assist round 140 final week (see chart).

Bottomline: Given the flood of knowledge from the US and Europe, there might be loads of short-term buying and selling alternatives in EUR/USD. The pair has been buying and selling in a slim vary between 1.13 and 1.14 in latest days. Rate of interest-sensitive sectors equivalent to know-how, financials, and actual property may react significantly strongly to adjustments in charge expectations. For USD/JPY, we could quickly see whether or not a long-term development shift is underway.

USD/JPY

This communication is for data and schooling functions solely and shouldn’t be taken as funding recommendation, a private suggestion, or a proposal of, or solicitation to purchase or promote, any monetary devices. This materials has been ready with out making an allowance for any explicit recipient’s funding targets or monetary state of affairs and has not been ready in accordance with the authorized and regulatory necessities to advertise unbiased analysis. Any references to previous or future efficiency of a monetary instrument, index or a packaged funding product will not be, and shouldn’t be taken as, a dependable indicator of future outcomes. eToro makes no illustration and assumes no legal responsibility as to the accuracy or completeness of the content material of this publication.