Bitcoin (BTC) is dealing with robust bearish stress, struggling to interrupt above the $85,000 stage as macro uncertainty weighs in the marketplace. Since late January, BTC has misplaced over 29% of its worth, with traders rising more and more scared of additional draw back. International commerce conflict fears and risky macroeconomic circumstances have put each the crypto and U.S. inventory markets beneath stress, leaving merchants unsure concerning the subsequent main transfer for Bitcoin.

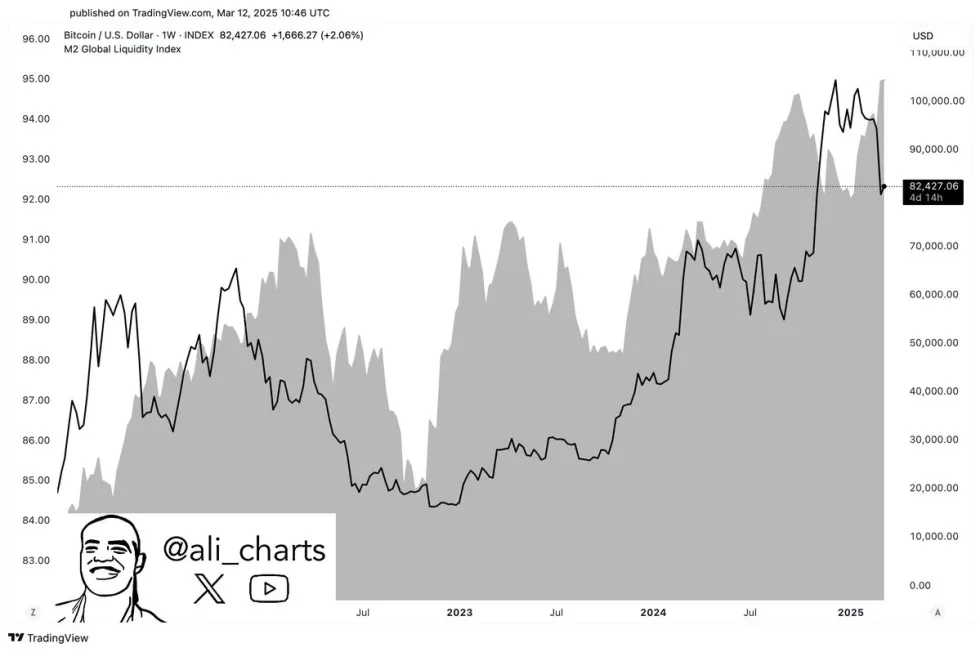

Regardless of the continuing downtrend, some analysts see potential for a market reversal. Prime analyst Ali Martinez shared insights on X, mentioning that international liquidity is increasing quickly. Traditionally, this development has been a bullish catalyst for Bitcoin, typically resulting in important value surges when liquidity enters the market. If this sample holds, BTC may see renewed shopping for stress within the coming weeks.

Nevertheless, within the quick time period, bears stay in management, and BTC should reclaim key technical ranges earlier than a restoration can start. If macro circumstances stay unsure, Bitcoin may keep beneath stress, probably testing decrease help ranges earlier than any significant bounce. The following few weeks shall be crucial in figuring out whether or not BTC can stabilize or if additional losses are forward.

Bitcoin Hits Lowest Ranges Since November 2024

Bitcoin (BTC) is at present buying and selling at its lowest ranges since November 10, 2024, with bulls struggling to regain management. The market has remained in a robust downtrend since late January, and worry continues to push lower cost targets, as many traders now query whether or not the Bitcoin bull cycle is over. With BTC failing to reclaim key resistance ranges, sentiment stays decisively bearish, rising the danger of additional draw back within the coming weeks.

Regardless of the continuing decline, Martinez’s insights on X comment that international liquidity is increasing quickly. Liquidity progress has been a driver for Bitcoin value will increase, and if previous traits maintain, BTC may catch up round mid-April. Nevertheless, for this state of affairs to unfold, bulls should defend key help ranges and regain momentum within the coming weeks.

The broader market downturn has been largely influenced by macroeconomic uncertainty and rising volatility for the reason that U.S. elections in November 2024. Issues over international commerce wars, unstable financial insurance policies, and erratic market reactions have made it troublesome for danger property like Bitcoin to maintain any important upward momentum. On condition that these macroeconomic considerations stay unresolved, Bitcoin is prone to keep beneath stress till market circumstances present indicators of enchancment.

For now, bulls have a whole lot of work to do to reverse the bearish development and convey BTC again above key technical ranges. If liquidity growth drives renewed shopping for stress, the market may see a restoration. Nevertheless, if macro circumstances stay unfavorable, Bitcoin could proceed to commerce in a downward trajectory within the quick time period.

Bitcoin Struggles to Reclaim $85K

Bitcoin is at present buying and selling at $83,300, with bulls struggling to regain momentum after weeks of promoting stress. The important thing stage for a possible restoration stays $85,000, as this mark aligns intently with the 200-day transferring common (MA). If BTC fails to interrupt above this stage quickly, bearish sentiment is prone to persist, rising the danger of additional draw back.

For Bitcoin to provoke a restoration rally, bulls should push above the 200-day MA rapidly. A break and shut above this stage would sign renewed shopping for curiosity, probably resulting in a stronger transfer towards greater resistance zones. Nevertheless, BTC’s struggles at this technical barrier point out that market confidence stays weak, with merchants hesitant to enter lengthy positions amid rising uncertainty.

If Bitcoin fails to reclaim the 200-day MA within the coming days, the danger of a pointy drop under $80,000 will increase considerably. A break under this psychological stage may set off additional sell-offs, sending BTC towards decrease demand zones. The following few buying and selling periods shall be crucial in figuring out whether or not BTC can reverse its latest losses or if the downtrend will proceed into deeper territory.

Featured picture from Dall-E, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluation by our workforce of high expertise specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.