Discussing when and promote Bitcoin could be controversial, however in the event you’re planning to take income this cycle, it’s important to do it strategically. Whereas holding Bitcoin indefinitely is an possibility for some, many buyers purpose to seize good points, cowl residing bills, or reinvest at decrease costs. Historic tendencies present that Bitcoin typically experiences drawdowns of 70-80%, offering alternatives to reaccumulate at decreased valuations.

For a extra in-depth look into this matter, take a look at a current YouTube video right here: Confirmed Technique To Promote The Bitcoin Value Peak

Why Promoting Isn’t All the time Taboo

Whereas some, like Michael Saylor, advocate by no means promoting Bitcoin, this stance doesn’t all the time go well with particular person buyers. For these not managing billions, taking partial income can provide flexibility and peace of thoughts. If Bitcoin peaks at, say, $250,000 and faces a reasonably conservative 60% correction, it will revisit $100,000, creating an opportunity to reenter at decrease ranges than we’ve already seen.

The purpose isn’t to promote every part however to strategically scale out of positions, maximizing returns and managing dangers. Reaching this requires pragmatic, data-driven selections, not emotional reactions. However once more, in the event you by no means need to promote, then don’t! Do no matter works finest for you.

Key Timing Instruments

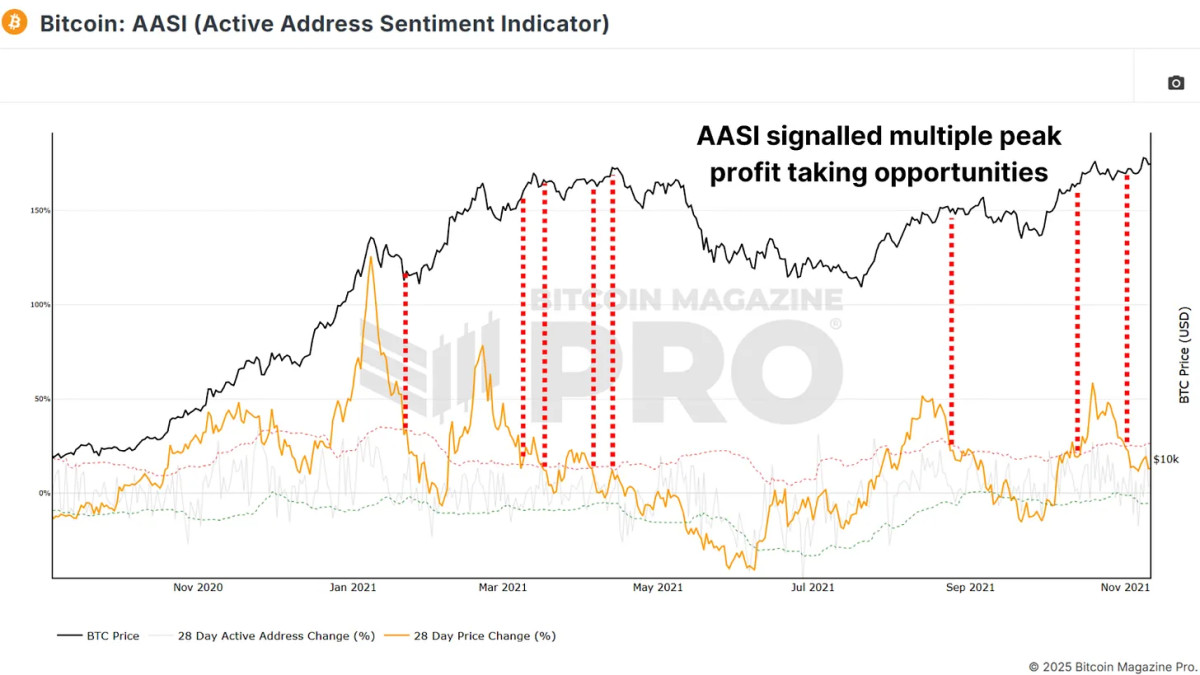

This Lively Handle Sentiment Indicator (AASI) compares modifications in community exercise to Bitcoin’s worth motion. It measures deviations between worth (orange line) and community exercise, proven by inexperienced and pink deviation bands.

View Stay Chart 🔍

For instance, in the course of the 2021 bull run, indicators emerged when the worth change exceeded the pink band. Promote indicators appeared at $40,000, $52,000, $58,000, and $63,000. Every supplied a chance to scale out because the market overheated.

The Worry and Greed Index is a straightforward but efficient sentiment instrument that quantifies market euphoria or panic. Values above 90 counsel excessive greed, typically previous corrections, equivalent to in 2021, when Bitcoin rallied from $3,000 to $14,000, the index hit 95, signaling an area peak.

View Stay Chart 🔍

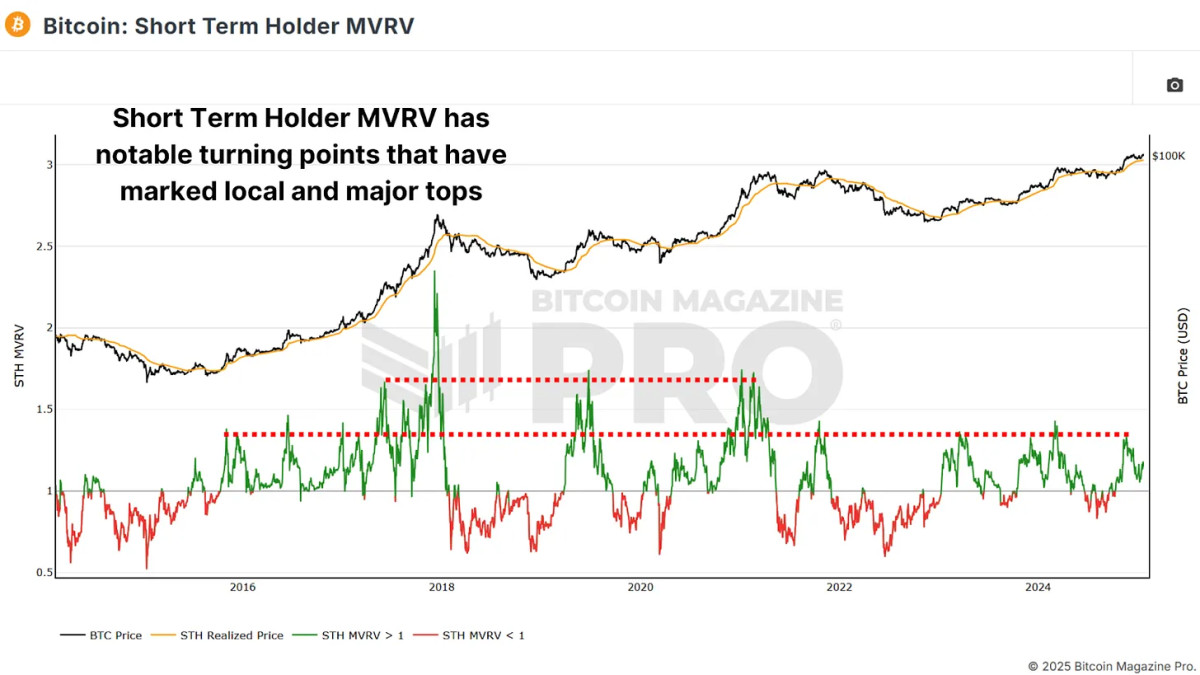

The Brief-Time period Holder MVRV measures the typical unrealized revenue or lack of new market members by evaluating their price foundation to present costs. Round 33% revenue ranges typically mark reversals and native intracycle peaks, and when unrealized income exceed round 66%, markets are sometimes overheated and could also be near main cycle peaks.

View Stay Chart 🔍

Associated: Bitcoin Deep Dive Knowledge Evaluation & On-Chain Roundup

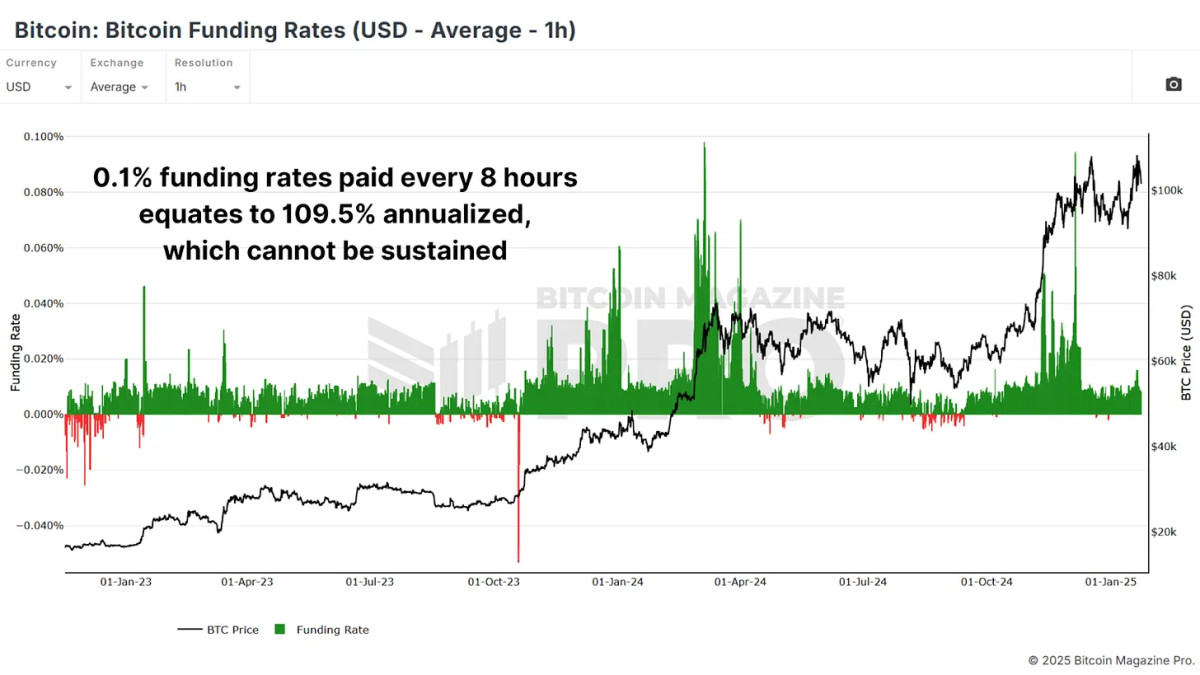

The Bitcoin Funding Charges mirror the premiums merchants pay to keep up leverage positions in futures markets. Extraordinarily excessive funding charges counsel extreme bullishness, typically previous corrections. Like most metrics, we are able to see that counter-trading a very euphoric majority often supplies an edge.

View Stay Chart 🔍

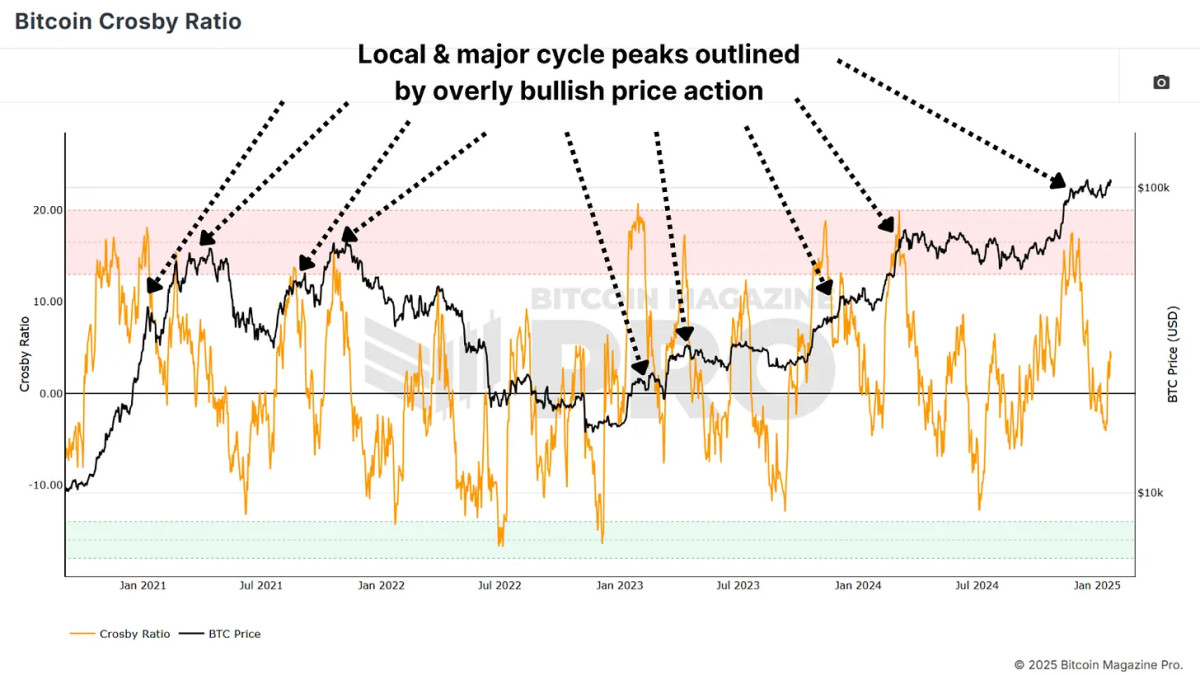

The Crosby Ratio is a momentum-based indicator that highlights overheated circumstances. When the ratio enters the pink zone on the every day chart, and even decrease timeframes in the event you use our TradingView model of the indicator, market turning factors have sometimes occurred. When these indicators happen in confluence with different top-marking metrics, it solidifies the chance of a larger-scale prediction.

View Stay Chart 🔍

Conclusion

Timing the precise high is nearly unimaginable, and no single metric or technique is foolproof. Mix a number of indicators for confluence and keep away from promoting your total place directly. As a substitute, scale out in increments as key indicators sign overheated circumstances, and contemplate setting trailing stops tied to key ranges or a proportion of worth motion to seize extra good points if worth rallies even larger.

For extra detailed Bitcoin evaluation and to entry superior options like stay charts, personalised indicator alerts, and in-depth trade stories, take a look at Bitcoin Journal Professional.

Disclaimer: This text is for informational functions solely and shouldn’t be thought of monetary recommendation. All the time do your personal analysis earlier than making any funding selections.