CoinW is likely one of the fastest-growing crypto exchanges, letting you commerce 1,000+ cash with deep liquidity, low charges, and stable safety. It’s constructed for each newcomers and professional merchants worldwide. One of the best options of CoinW change are spot buying and selling, futures, leveraged ETFs, copy buying and selling, automated bots, staking, launchpad, P2P, cell apps, APIs, and passive earn applications.

On this CoinW evaluation, we are going to discover its charges, safety, supported property, buying and selling instruments, KYC tiers, nation restrictions, and enable you to resolve if it’s secure, legit, and price utilizing in 2025.

CoinW Evaluate: What Is It?

CoinW is a worldwide cryptocurrency change based in 2017 that allows you to purchase, promote, and commerce digital property like Bitcoin, Ethereum, and tons of of altcoins. It was began in Asia and is now headquartered in Dubai, United Arab Emirates. Immediately, the corporate claims to serve greater than 15 million registered customers and stories a every day buying and selling quantity of over $5 billion, making it one of many greatest exchanges by quantity.

Right here, moreover spot markets, you additionally get entry to perpetual futures contracts, leveraged ETFs, copy buying and selling, and automatic buying and selling bots. CoinW says it’s out there in over 200 international locations, however doesn’t serve sure restricted areas (extra on that later). Additionally, there are cell apps for Android and iOS, plus an online interface, so you possibly can simply commerce anyplace.

Based2017HeadquartersDubai, United Arab EmiratesRegistered Customers15M+Each day Buying and selling Quantity$5B+Supported Belongings1,000+ cryptocurrencies, 500+ buying and selling pairsCore MerchandiseSpot, Futures, Leveraged ETFs, Copy Buying and selling, Buying and selling Bots, Staking, LaunchpadCellular AppsAndroid, iOSSafety2FA, chilly storage (MPC + multi-sig), withdrawal tackle whitelist, danger monitoringBuying and selling ChargesSpot: 0.1% maker/takerFutures: 0.01% maker, 0.06% takerDeposit & WithdrawalsFree crypto deposits, withdrawal charges rely upon the communityKYC & LimitsC0-C2 tiers, as much as 100 BTC/day withdrawals after full KYCAvailability200+ international locations, not out there within the US, Canada, Singapore, Japan, and many others.

Is CoinW Legit & Secure in 2025?

Sure, most merchants think about CoinW to be legit and fairly secure as a result of it makes use of trendy safety practices and complies with worldwide tips, however sure you need to nonetheless take care and handle your personal danger. CoinW has not had any main public scandals, although there was a small sizzling‑pockets hack on a subsidiary in 2023, the place round US$13 million of funds had been stolen. However the good factor, the change lined the loss and tightened security controls.

Safety stack

CoinW implements a number of layers of safety to guard your account and funds:

2FA: You possibly can activate a number of types of two‑issue authentication (2FA), together with SMS, e mail codes, Google Authenticator, and {hardware} authentication like U2F passkeys.Buying and selling Password: Effectively, this six‑digit PIN is separate out of your login password. So, even when somebody someway guesses your essential password, truly they can not commerce your property with out the buying and selling PIN.IP Monitoring: CoinW retains a watch on IP addresses and login areas, and if it notices odd logins from numerous units or nations, it would provoke further verification.Chilly Storage: CoinW makes use of multi-party computation (MPC) and multi-signature expertise to retailer the vast majority of its clients’ property in chilly wallets. Therefore, this suggests that non-public keys are distributed amongst a number of units and people, stopping anyone particular person from shifting cash on their very own. Additionally, to allow fast withdrawals, a small quantity is saved in sizzling wallets; however once more, these wallets are safeguarded by real-time monitoring and inner danger management programs.WAF/DDoS: To be able to filter malicious visitors and cease denial-of-service assaults, CoinW makes use of Net Utility Firewalls (WAF) and DDoS safety towards exterior threats.

Transparency and previous incidents

CoinW retains its communication channels pretty open. It runs a assist heart by way of Zendesk the place you possibly can see safety insurance policies, system upgrades, and step‑by‑step tutorials.

So, as talked about earlier, there was a US$13 million sizzling‑pockets exploit in 2023 affecting a 3rd‑celebration service; CoinW reimbursed customers and strengthened its danger controls. There haven’t been extensively reported hacks or insolvency issues since then.

Compliance and KYC

CoinW truly follows know‑your‑buyer (KYC) and anti‑cash‑laundering laws, however it’s not necessary; it lets unverified accounts commerce as much as a sure every day withdrawal restrict.

No KYC: Permits every day deposits, buying and selling, and withdrawals as much as 2 BTCPrimary KYC: You possibly can simply unlock greater withdrawal limits, permitting for as much as 10 BTC per daySuperior KYC: Supplies the very best withdrawal limits, with as much as 100 BTC per day

CoinW operates legally in lots of areas, but it surely explicitly doesn’t serve customers from some international locations, and that compliance coverage is a part of its dedication to comply with native legal guidelines and sanctions. Primarily, the restricted record contains america, Canada, China (Mainland and Hong Kong), Japan, Iran, Iraq, and extra.

Is CoinW Accessible within the US?

No, you can’t legally use CoinW in america, as the corporate’s compliance coverage particularly lists the US as a restricted nation resulting from regulatory necessities. So, meaning US residents are blocked from signing up or buying and selling on the platform.

However keep in mind, CoinW is a no-KYC change, so there isn’t a exhausting rule right here. Many U.S. customers are utilizing it. However we should warn you, in case you try to bypass the block through the use of a VPN, your account could also be frozen, and your funds are in danger. Nonetheless, throughout our CoinW evaluation, we didn’t discover any widespread account frozen points.

What Are CoinW’s Key Options?

CoinW gives a big suite of buying and selling merchandise aimed toward each newcomers and skilled merchants. Right here, you get spot markets, derivatives, numerous order sorts, copy buying and selling, automated bots, and a strong cell app.

Spot Buying and selling

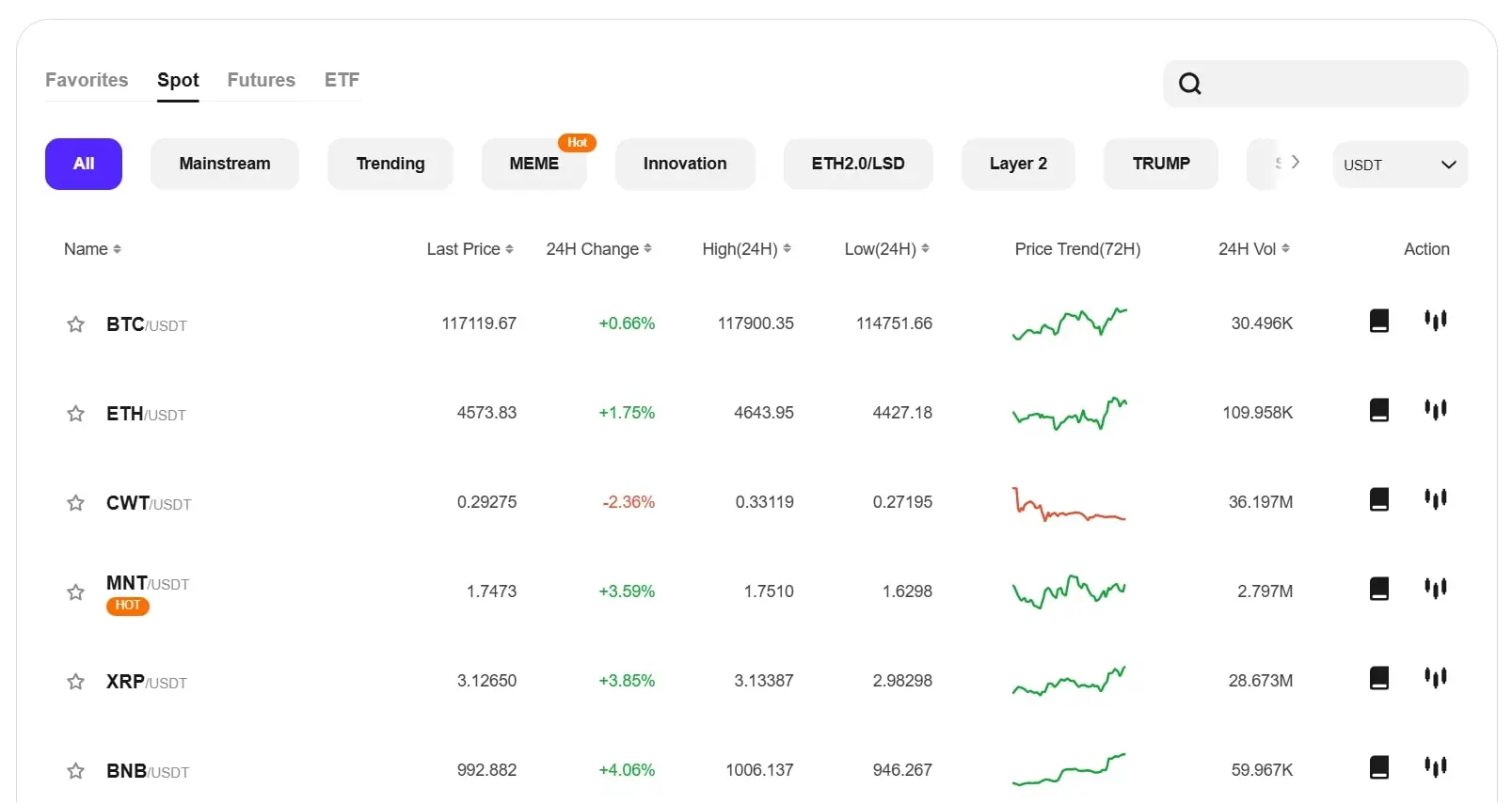

You should buy and promote cryptocurrencies on the present market costs utilizing CoinW’s spot buying and selling characteristic. The platform covers lots of the fashionable cash like Bitcoin (BTC), Ethereum (ETH), Solana (SOL), and Cardano (ADA), in addition to more moderen memecoins and area of interest tokens.

Proper now, it has over 1,500 buying and selling pairs and about 1,000 listed tokens. Right here, you possibly can simply swap between numerous time frames and indicators. The charts are additionally powered by TradingView, and the buying and selling interface is obvious and simple to make use of. A “Purchase/Promote” tab permits market orders with just a few clicks for quick trades.

Effectively, one downside we discover is that the positioning can really feel cluttered for brand new customers as a result of there are various product tabs, however when you get used to the format, putting trades turns into actually simple.

Stablecoins corresponding to USDT and USDC function the first base currencies on CoinW. So, it signifies that most buying and selling pairs are towards a steady worth token as a substitute of a fiat foreign money. , it’s a widespread observe on crypto exchanges, and it retains you out of the volatility of getting BTC as a quote foreign money.

Along with stablecoin pairs, there are additionally Bitcoin-denominated markets for well-known altcoins, together with some check pairs corresponding to Dogecoin towards Shiba Inu. You possibly can filter by quantity, high gainers, or new listings, and there’s a favorites record the place you possibly can pin your favourite pairs.

Derivatives (Perpetuals/Leverage/Funding)

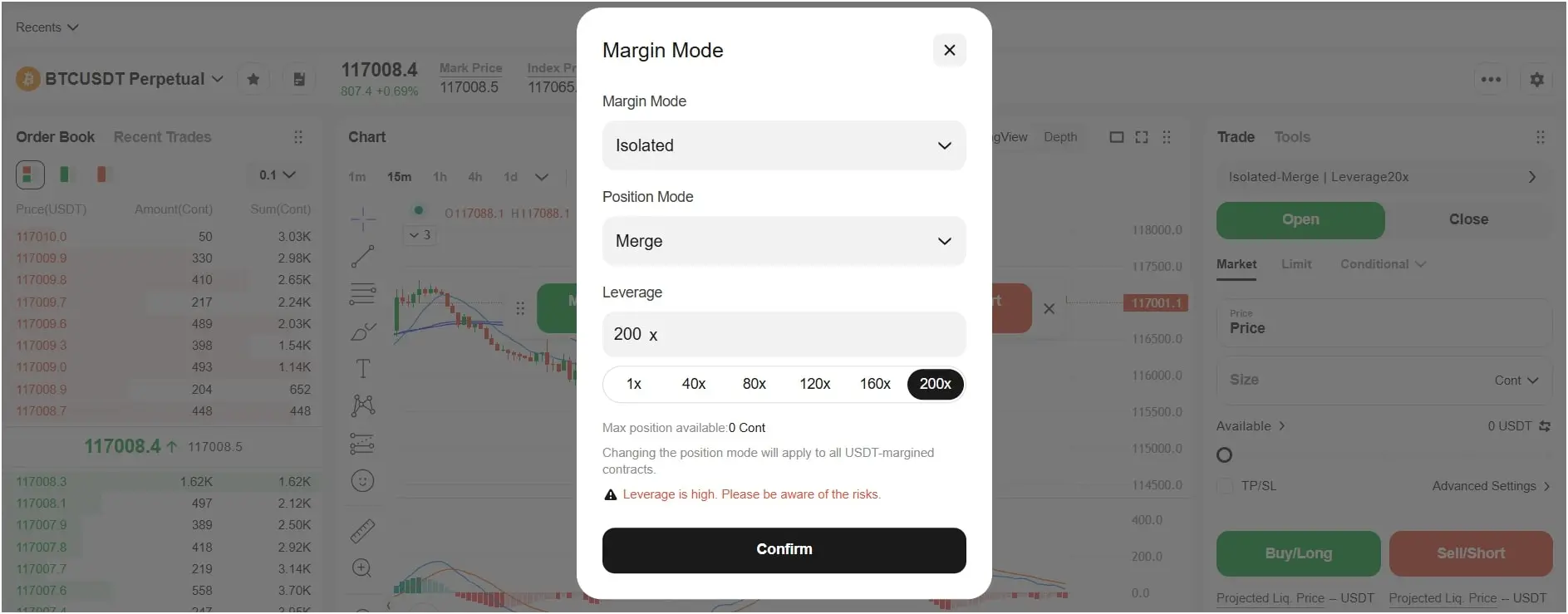

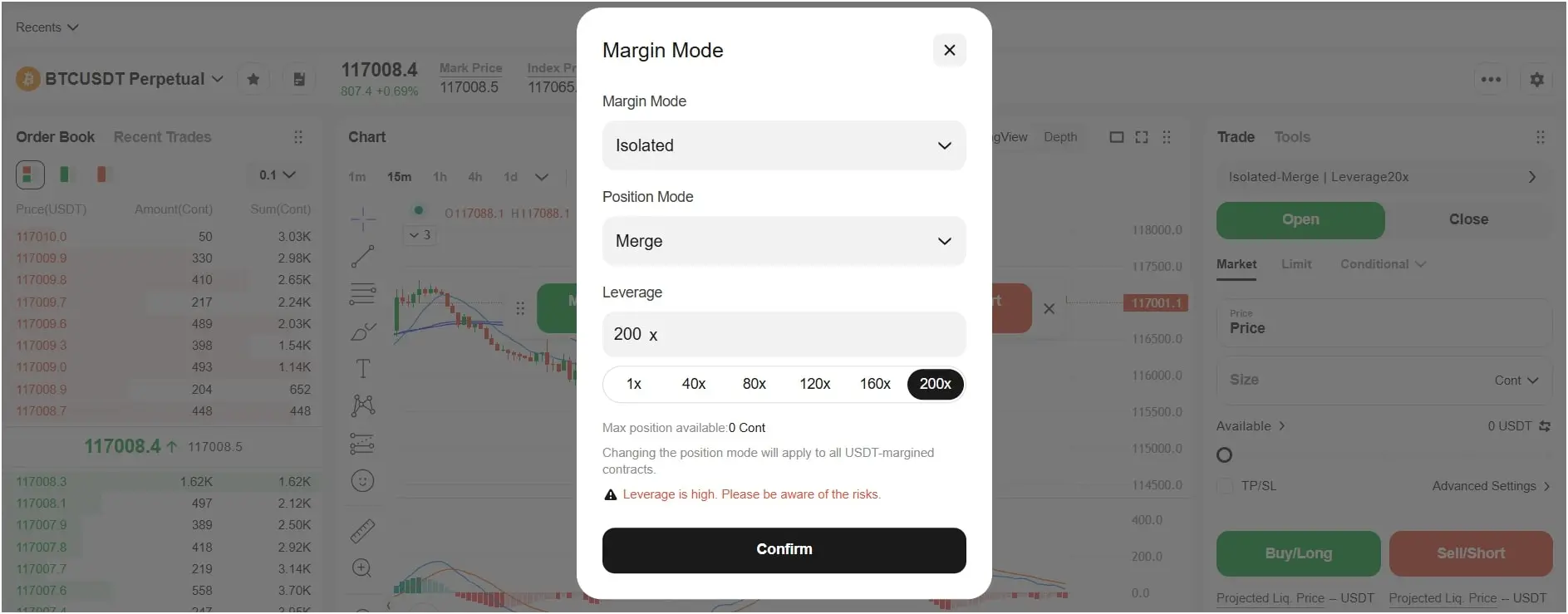

Derivatives buying and selling on CoinW contains USDT‑margined perpetual contracts with leverage as much as 200x or extra, relying on the instrument. Right here, futures contracts by no means expire, so you possibly can maintain positions indefinitely so long as you preserve margin necessities.

Additionally, there are separate markets for a few of the main property like BTC and ETH, in addition to altcoin futures. CoinW additionally gives inverse contracts the place the margin is denominated within the base cryptocurrency, though these are much less fashionable.

The funding fee mechanism retains the perpetual value near the underlying spot value. So, when the funding fee is optimistic, longs pay shorts; when it’s unfavourable, shorts pay longs. These funds primarily happen each 4 to eight hours, and CoinW doesn’t cost a service charge for funding transfers; the charge solely strikes between counterparties.

Now, moreover common futures, CoinW options leveraged ETFs that amplify value actions with out margin calls. So, for instance, a 3x lengthy BTC ETF will transfer thrice the every day share change of Bitcoin.

One other factor is the margin. CoinW gives each remoted and cross-margin modes. An remoted margin primarily ties your collateral to at least one place, limiting losses; however, cross margin shares collateral throughout your a number of futures positions and fits extra of the superior merchants. You can too learn our record of the greatest crypto futures buying and selling platforms.

Order Sorts

The completely different CoinW order sorts are market order, restrict, stop-limit, trailing cease, OCO, IOC, FOK, post-only, and iceberg order.

Restrict Order: You could specify a value to purchase or promote. The order sits within the order e book till it may be matched on the chosen value or higher. That is good for controlling entry and exit ranges.Market Order: You should buy or promote instantly at one of the best out there value. It takes liquidity and should result in some slippage, however it’s helpful for quick execution.Cease Restrict Order: You possibly can set a set off value and a restrict value. So, when the set off hits, a restrict order is positioned. It’s typically used to cease losses or enter breakout trades.Trailing Cease Order: The cease value strikes with the market value. This lets you lock in income because the market strikes in your favor. The cease follows the value by a set share or quantity.OCO (One‑Cancels‑the‑Different): You place two linked orders (normally a take‑revenue and a cease‑loss). Now, when one executes, the opposite is mechanically canceled.IOC (Instant‑or‑Cancel): The order executes totally or partially instantly and cancels any unfilled portion. Effectively, this one is helpful once you need fast fills at a sure value.FOK (Fill‑or‑Kill): Your complete order have to be stuffed instantly or else canceled. Really, no partial fills are allowed right here.Submit Solely: The order solely provides liquidity and by no means takes liquidity. If it had been to right away match, it could be canceled. Therefore, this ensures you all the time pay maker charges as a substitute of taker charges.Iceberg Order: On this one, you possibly can set a big order, however solely a small portion is seen within the e book. Because the seen half fills, extra of the hidden portion seems. A lot of the whales or merchants use this to keep away from revealing massive positions.

Copy Buying and selling

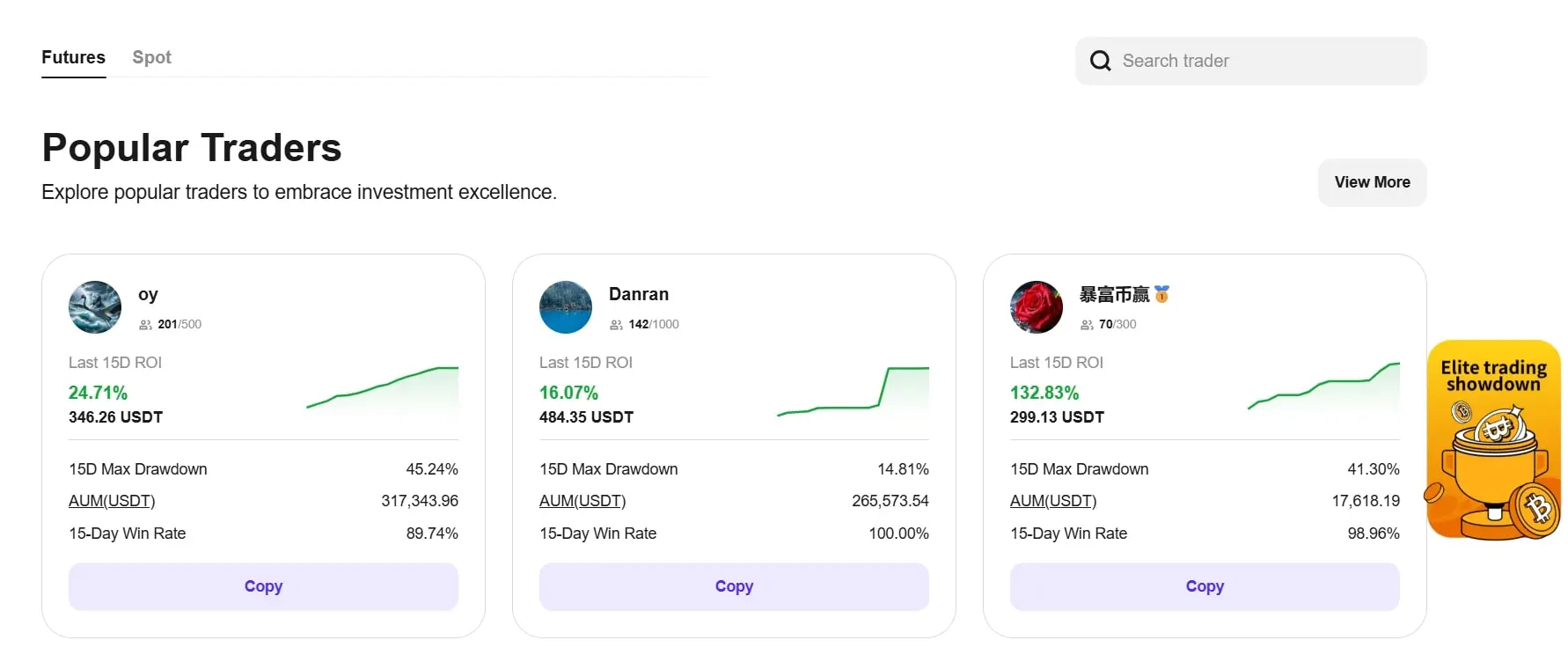

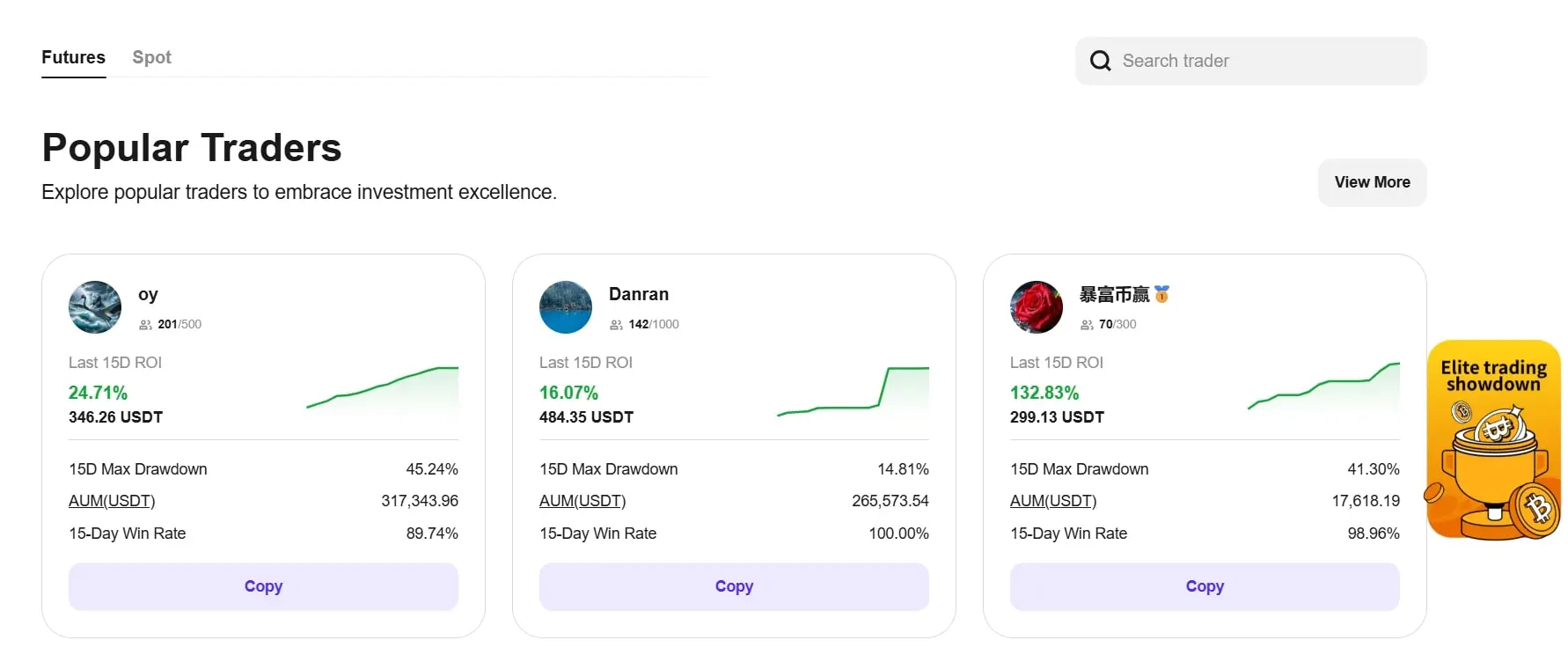

Copy buying and selling on CoinW enables you to mirror the trades of skilled merchants. Now, after looking a leaderboard of fashionable “masters,” you possibly can simply allocate a portion of your funds to mechanically replicate their positions. Right here, every grasp shows their historic returns, variety of followers, and danger score. And when you subscribe, the system will open and shut trades in your account on the identical time and value because the grasp. You possibly can set most place sizes and cease copying at any time.

Primarily, copy buying and selling is fairly engaging for brand new customers who don’t have time to watch charts, however clearly, it comes with dangers. , previous efficiency doesn’t assure future outcomes, so a grasp would possibly make aggressive trades that result in massive drawdowns.

CoinW additionally fees a efficiency charge (typically round 10%) on the income generated by copy buying and selling, which is paid to the grasp. Generally, there might also be delays between the grasp’s execution and your replication. Additionally, earlier than following anybody, you should take time to investigate their statistics. The leaderboard reveals whole ROI, win fee, most drawdown, and energetic time. Keep in mind, merchants with extraordinarily excessive returns over quick durations could also be utilizing excessive leverage, which might blow up shortly. So, it’s normally safer to comply with merchants with regular, average returns and clear methods. For more information, you can even learn our in-depth information on what crypto copy buying and selling is.

Buying and selling Bots

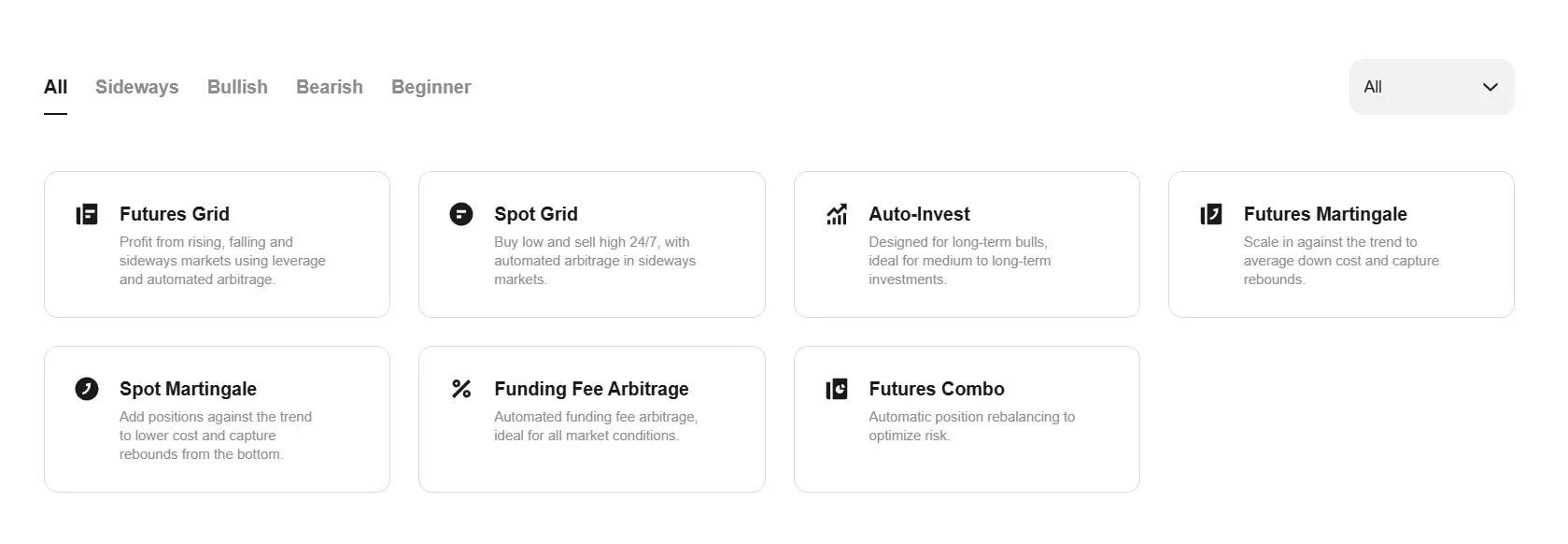

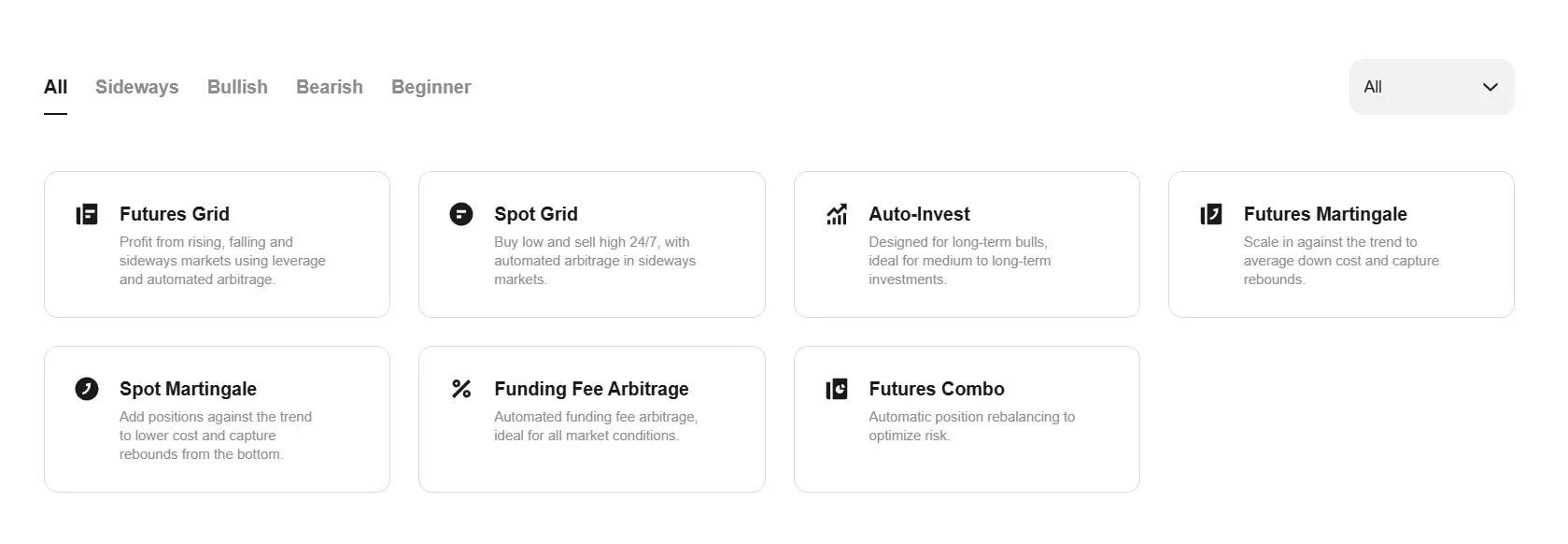

CoinW’s automated buying and selling bots assist you to run methods 24/7 with out handbook work. Right here, {the marketplace} contains a number of greatest crypto buying and selling bot sorts:

Spot Grid Bot: This traditional grid technique locations purchase and promote orders at predefined intervals inside a value vary. So, when costs oscillate, the bot buys low and sells excessive. It’s appropriate for sideways markets and might generate small, constant income.Futures Grid Bot: Much like the spot grid however utilized to perpetual contracts. You possibly can set leverage ranges after which finally select whether or not the bot is lengthy or quick biased.CTA (Commodity Buying and selling Advisor) Bot: This bot mechanically follows development alerts, and it might even use shifting averages or different indicators to open lengthy or quick positions. It’s designed for trending markets, however can truly underperform in uneven situations.Auto‑Make investments (Greenback‑Price Averaging) Bot: You could decide a coin and an interval (e.g., weekly or month-to-month), and the bot buys a set quantity at every interval. Largely, this one is an extended‑time period accumulation technique that evens out market volatility.Martingale Bots: Right here, on some superior markets, you possibly can run Martingale‑type bots that double place sizes after losses. Effectively, these are fairly dangerous and primarily for skilled merchants who perceive the compounding danger.

Additionally be aware, when organising a bot, you possibly can even select between pre‑constructed templates and customized parameters. Templates present beneficial ranges primarily based on historic volatility, which is useful in case you are uncertain the place to start out, and with customized settings, you possibly can outline the higher and cheaper price boundaries, the variety of grid ranges, and whether or not the bot reinvests income.

App & Instruments

The CoinW cell app is obtainable for Android and iOS and helps all main capabilities: account creation, KYC, deposits, buying and selling, and withdrawals. The app options biometric login choices corresponding to fingerprint or face unlock, and you’ll allow push notifications for order updates. Right here, charts and order books are effectively‑optimized for smaller screens, although heavy derivatives merchants might choose the desktop model for full technical evaluation instruments.

Now, for builders and algorithmic merchants, CoinW gives REST and WebSocket APIs that present market information, order placement, and account administration.

Additionally, past buying and selling, CoinW gives earn merchandise that can assist you generate passive earnings out of your holdings. It has the Easy Earn program, which lets you deposit fashionable cash into versatile or fastened financial savings accounts and earn some curiosity. You possibly can simply stake cash like ETH or DOT straight by way of the app and earn rewards with out operating your personal validator. Plus, CoinW additionally operates a Launchpad program for early entry to new tokens.

What Are CoinW’s Buying and selling Charges 2025

The CoinW buying and selling charges are low, with spot trades beginning at 0.1% and even decrease once you use VIP tiers or pay with CWT tokens. It additionally doesn’t cost deposit charges, whereas you solely have to pay community charges when withdrawing crypto.

Maker/Taker (Spot & Futures)

For spot buying and selling, the default CoinW maker charge is 0.10% and the default taker charge is 0.10%. So, it means you pay the identical fee whether or not you add or take liquidity. Now, as your 30‑day buying and selling quantity will increase or in case you maintain a specific amount of the platform token, you qualify for VIP ranges that scale back your buying and selling charges. The desk beneath lists the present VIP tiers and corresponding charges:

VIP Degree30-Day Avg. Asset Worth30-Day Buying and selling QuantityMaker PriceTaker PriceCommon Consumer$0$00.100%0.100%VIP 1$10,000$100,0000.090%0.095%VIP 2$25,000$250,0000.080%0.085%VIP 3$50,000$850,0000.070%0.075%VIP 4$150,000$1,500,0000.060%0.065%VIP 5$300,000$3,500,0000.050%0.060%VIP 6$500,000$8,000,0000.040%0.055%

For futures buying and selling, charges are less complicated: maker 0.01% and taker 0.06% for all types of contracts. And, there aren’t any VIP reductions for futures on the time of writing. As a result of the charges are fastened and low, CoinW is fashionable amongst excessive‑quantity futures merchants.

Deposit & Withdrawal Charges

Deposits of cryptocurrencies into your CoinW account are free, and also you solely have to pay community charges when sending cash out of your private pockets to the change, and people charges go to miners, not CoinW.

Now, for withdrawals, the charges rely upon the cryptocurrency and the community chosen. So, as an illustration, withdrawing Bitcoin on the primary BTC chain might price 0.00005 BTC to cowl miner charges, whereas withdrawing USDT on ERC‑20 may cost a little 5 USDT or extra resulting from fuel charges. CoinW updates withdrawal charges repeatedly to mirror community situations and doesn’t add any markup; it merely passes alongside the blockchain price.

Now, about fiat currencies: fiat deposits and withdrawals are primarily dealt with by third‑celebration companions, so charges range by area and cost methodology. Right here on CoinW, some customers can purchase crypto by way of bank card or financial institution switch, however the companion might cost round 3-5% as a processing charge. CoinW itself doesn’t deal with fiat; it simply integrates with suppliers like Banxa or Transak.

Which Belongings and Limits Are Accessible on CoinW?

CoinW gives a really large number of digital property. The change lists greater than 1,000 cash and tokens, together with massive caps, DeFi tokens, NFTs, stablecoins, and memecoins. Plus, there are over 1,500 buying and selling pairs, with many quote currencies like USDT, USDC, BTC, and ETH.

Right here, new listings seem often, so that you would possibly discover newly launched tokens earlier than they hit different crypto exchanges. However keep in mind, liquidity is highest on main pairs (BTC/USDT, ETH/USDT, SOL/USDT) and may be thinner on smaller tokens, so all the time verify order e book depth earlier than putting massive orders.

KYC tiers and withdrawal limits

As famous earlier, CoinW makes use of KYC ranges to set withdrawal limits. The next desk summarizes the every day limits for every degree. Additionally, keep in mind that these limits reset each 24 hours and apply to the full of all cash measured in Bitcoin worth.

KYC LevelVerification Needed24‑Hour Withdrawal RestrictUnverified (C0)Register with e mail or telephone2 BTC per dayC1 MainPresent ID images and primary private data10 BTC per dayC2 SuperiorVideo verification and proof of tackle100 BTC per day

So, if you should withdraw greater than 2 BTC in a day or use fiat cost options, finishing greater KYC ranges is definitely crucial. However no worries, it normally takes lower than one working day for CoinW to evaluation your paperwork. Till then, you possibly can nonetheless commerce and deposit with out limits.

Restricted international locations and accessibility

CoinW is obtainable in additional than 200 international locations and areas, however some jurisdictions are blocked. The change doesn’t serve customers from Afghanistan, Algeria, Bahamas, Bangladesh, Bolivia, Botswana, Burundi, China (Mainland and Hong Kong), Cambodia, Canada, Congo, Crimea, Cuba, Egypt, Nicaragua, North Korea, Pakistan, Panama, Qatar, Singapore, Somalia, Sri Lanka, Sudan, Syria, Tunisia, United States, Venezuela, Yemen, and Zimbabwe.

Use CoinW (Net & App)?

To make use of CoinW crypto change, you should create an account utilizing your e mail, full KYC verification (non-obligatory), deposit funds, and begin crypto buying and selling.

Create an Account

Enroll: Go to the CoinW web site or open the cell app and click on Signal Up. Now, enter your e mail or telephone quantity and select a powerful password. You additionally have to learn and settle for the consumer settlement.Confirm contact: You’ll obtain a verification code by way of e mail or SMS, so enter the code to verify your contact data.Set buying and selling password: The system will immediate you to create a six‑digit buying and selling password. Effectively, it’s necessary, however we advocate it, and it is best to memorize it, since you want it to position orders and withdraw funds.Allow 2FA: Subsequent, navigate to the safety settings of the change and bind your Google Authenticator or one other 2FA methodology you may have. The additional step vastly improves your account security.Full KYC (non-obligatory): , KYC will not be necessary, however nonetheless, in case you plan to withdraw greater than 2 BTC per day or use fiat providers, go to the KYC part, add your ID doc, selfie, and proof of tackle. Now, watch for the evaluation, which normally finishes inside 24 hours, and largely inside 5-10 minutes.

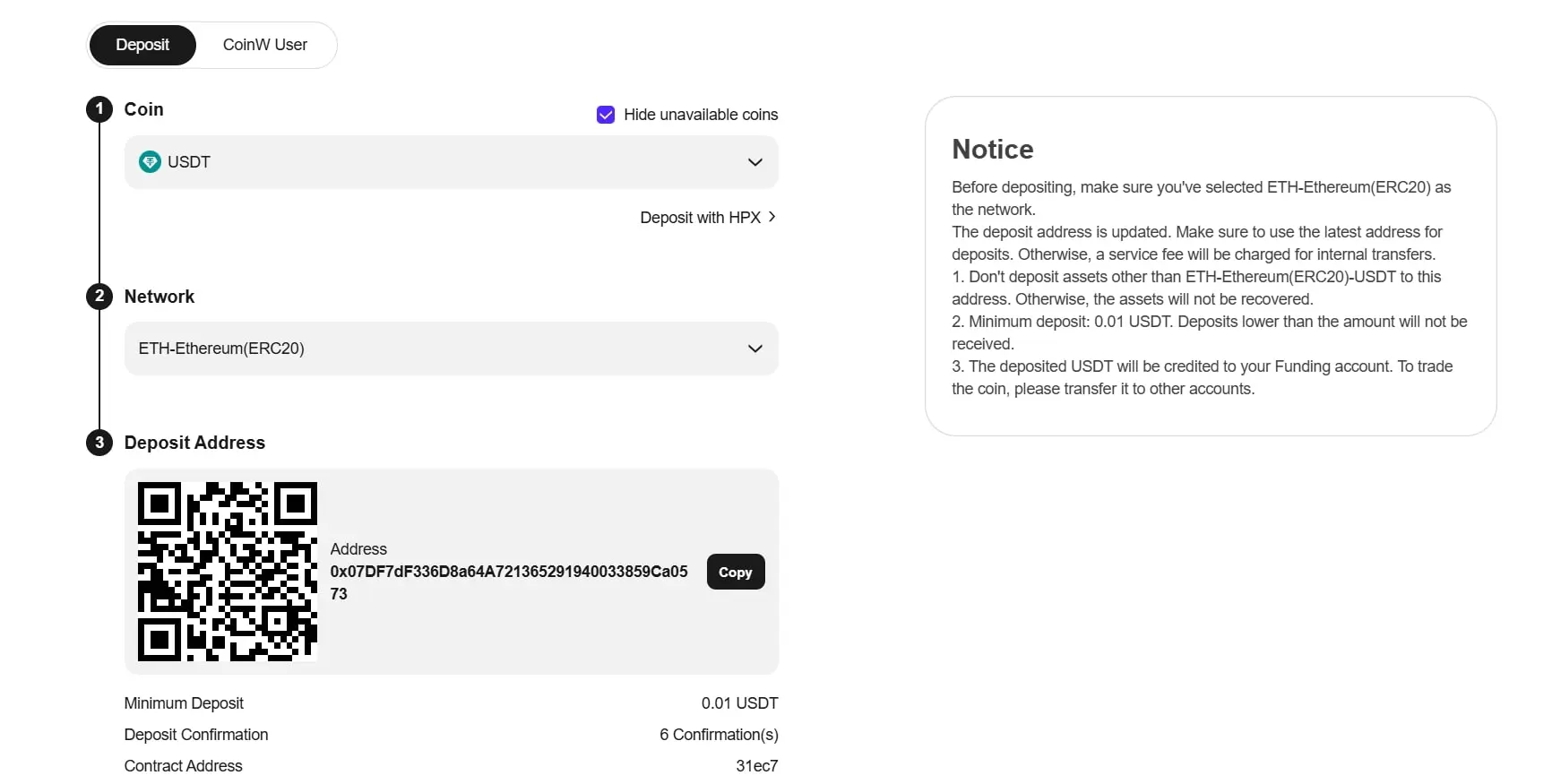

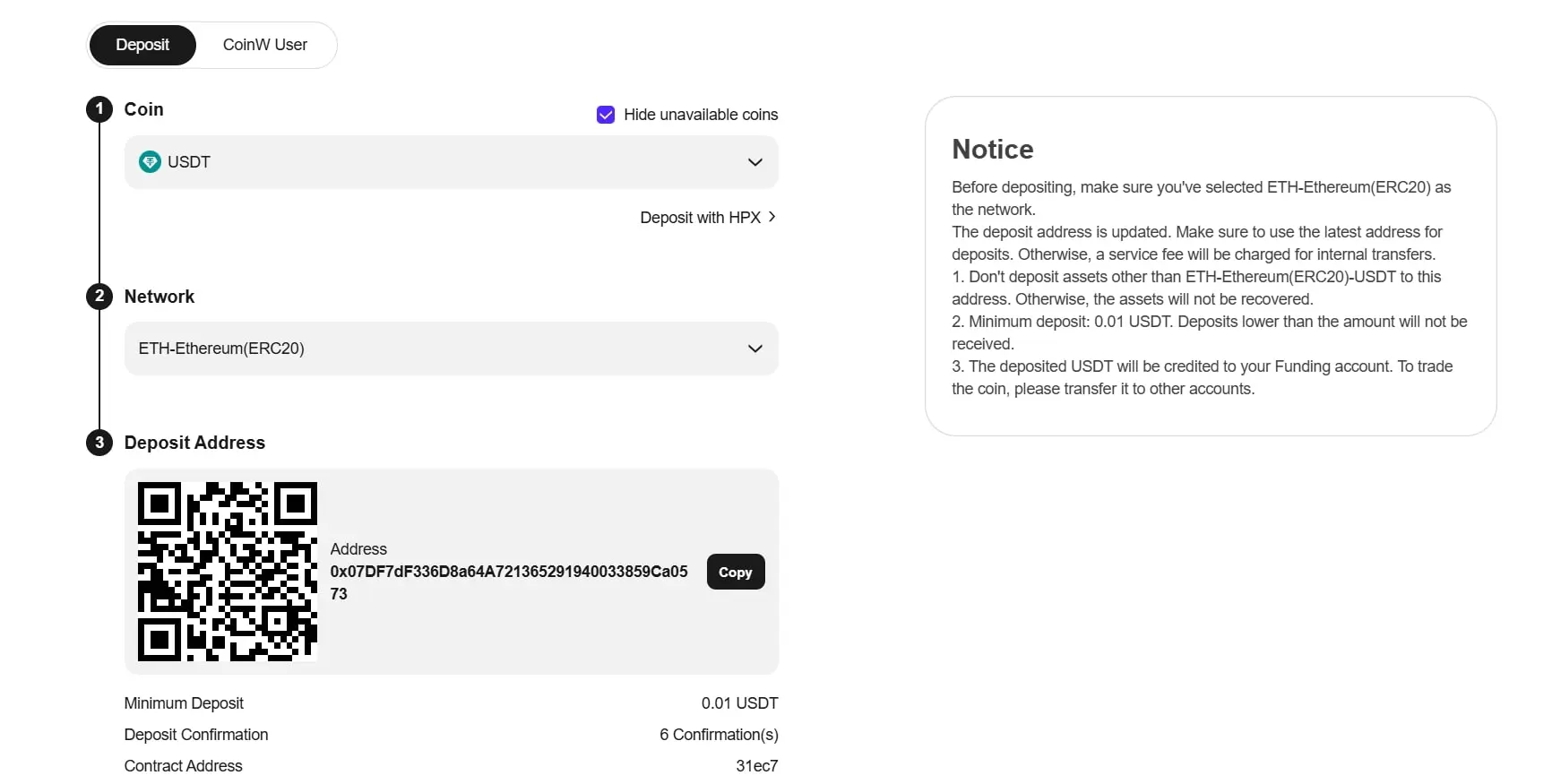

Deposit Funds

You possibly can simply deposit funds, and that may be achieved by way of cryptocurrency transfers, third‑celebration fiat funds, or peer‑to‑peer (P2P) trades.

Select deposit methodology: You could go to the “Wallets”, click on “Belongings Overview”, after which choose “Deposit” subsequent to the coin you need to fund. Now, in case you are transferring crypto, select the proper blockchain community (e.g., ERC‑20, BEP‑20, Arbitrum) and duplicate the deposit tackle. In case you are into the fiat half, choose a cost supplier like Banxa or Mercuryo.Ship crypto: Paste the CoinW deposit tackle into your pockets and ship the quantity, and likewise be sure you choose the identical community on each ends; sending on the improper community might result in misplaced funds. Now, watch for blockchain confirmations, as deposits are normally credited after one or two confirmations for fashionable chains.Use P2P: Additionally, in international locations the place direct financial institution transfers usually are not supported, you should use CoinW’s P2P market. Right here, all you should do is choose the foreign money, select a suggestion from a vendor with a superb status, and comply with the on‑display screen directions to switch cash to their checking account. And, when the vendor confirms receipt, the crypto is launched to you.Examine steadiness: After the transaction, you should return to “Wallets” to make sure the funds have arrived, and if the deposit doesn’t present up throughout the anticipated time, it’s important to contact assist along with your transaction hash.

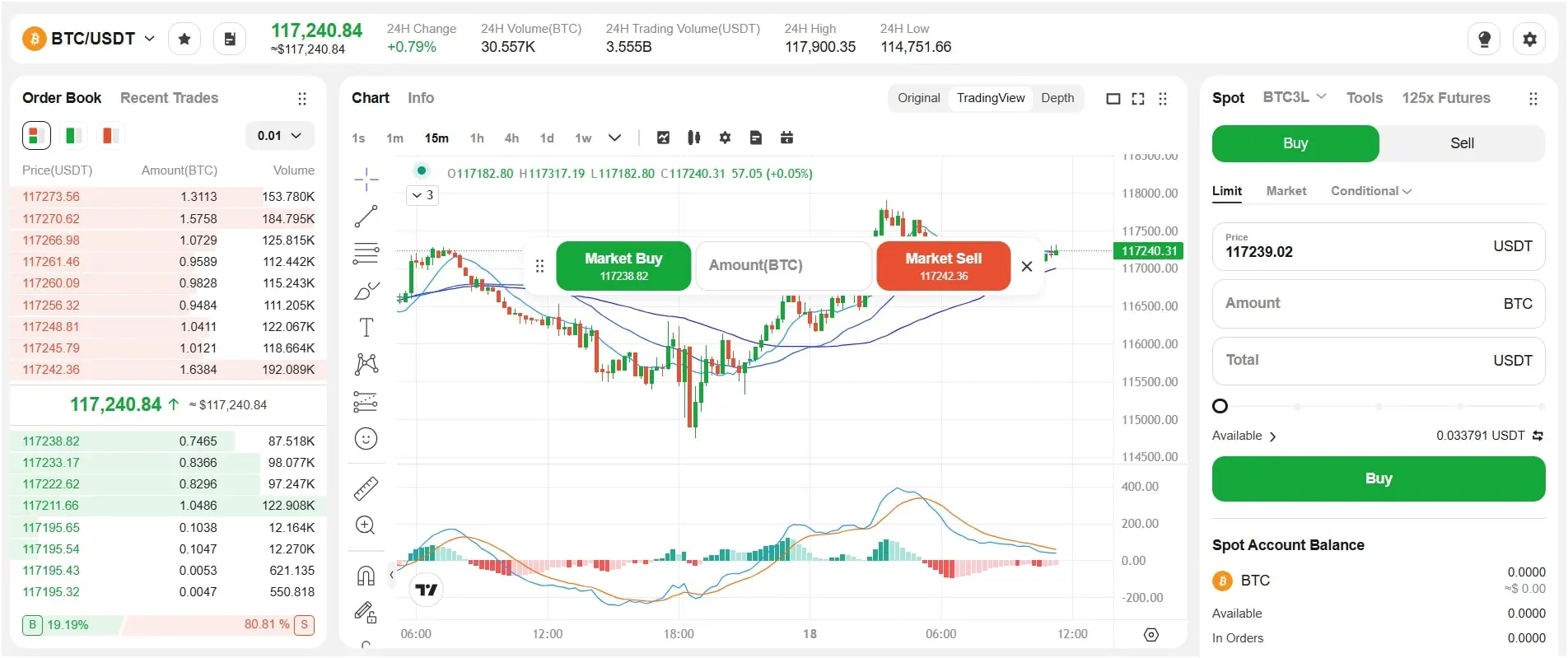

Place a Spot Commerce

Navigate to Markets: You could click on the “Commerce” tab on the internet or app, after which choose Spot to view spot markets. Now, browse the record or seek for the pair you need (e.g., BTC/USDT).Select order sort: On the buying and selling web page, you possibly can select between Restrict, Market, or one other order sort. So, for a restrict order, enter the value and quantity you need to purchase or promote. For a market order, you simply need to enter the quantity.Enter buying and selling password: You need to enter your six‑digit buying and selling password earlier than confirming, as this acts as a ultimate verify to stop unintended or unauthorized orders.Place the order: Click on Purchase or Promote. Your order will seem within the open orders part, and you’ll even cancel it at any time earlier than it’s stuffed. Now, as soon as stuffed, the funds will transfer out of your base foreign money to the asset you acquire.Monitor positions: View your stuffed orders and balances. Additionally, if you wish to commerce derivatives, swap to the Futures tab, switch funds out of your spot account to the futures pockets, and comply with comparable steps.

FAQs

Is CoinW Legit & Secure?

Sure, CoinW is usually thought-about authentic and secure resulting from robust security measures like 2FA, multi‑signature chilly storage, and anti‑phishing codes. The change has operated since 2017 with out main safety incidents, and immediately, it serves thousands and thousands of customers.

Is CoinW Accessible within the US?

No, residents of america and a number of other different areas (corresponding to Canada and Japan) can not legally open accounts. CoinW enforces these restrictions with IP checks. However, you understand, it’s a no-KYC change, so many individuals are utilizing it with out ID verification.

What Are CoinW’s Charges?

The CoinW spot buying and selling charges begin at 0.1% for each makers and takers, and futures buying and selling charges begin at 0.01% for makers and 0.06% for takers. Additionally, holding CoinW’s CWT token can scale back spot charges to as little as 0.01%.

How Many Cash Does CoinW Help?

The platform lists greater than 1,000 cryptocurrencies with over 1,500 spot pairs and roughly 300 perpetual futures contracts. It usually lists new tokens as quickly as they hit the market. So, new tokens are added repeatedly.

Does CoinW Require KYC?

No, CoinW doesn’t require KYC for primary buying and selling, as it may be achieved with out KYC, however withdrawals are capped at 2 BTC per day. Then, you should full KYC, it will increase your limits and grants entry to fiat gateways and the CoinW card.

Are Buying and selling Bots Free on CoinW?

Sure, creating and operating a primary bot is free, however some methods might contain efficiency charges or require a subscription if they’re constructed by third‑celebration builders. So, you should all the time learn the phrases earlier than enabling a bot.