Lululemon’s robust progress has made it the second most useful sportswear model globally, pushed by worldwide demand, and a loyal buyer base.

Regardless of current good points, Lululemon’s valuation stays comparatively low in comparison with friends, suggesting potential upside if progress continues.

Nevertheless, dangers from competitors, shifting client tendencies, and financial uncertainties may impression its progress trajectory.

After rising by over 10% since its final earnings report, Lululemon overtook Adidas to turn out to be the world’s second most useful sportswear producer. What many wrote off as a inventory previous its prime is trying extra like a diamond within the tough. Whereas most retailers wrestle with weak client tendencies and international financial uncertainty, Lululemon continues to face out.

This athleisure designer is maintaining its top-line progress going, propelled by new designs, retailer expansions, and surprisingly robust demand in China. Couple that with a loyal, higher-income client base, and you’ve got the recipe to defy trade tendencies.

However after its newest rally, traders should ask: Is that this yoga-based model priced for perfection, or is there nonetheless room to develop?

What does Lululemon do?

Lululemon Athletica reworked from a distinct segment yoga-wear model into a world athleisure participant, providing a variety of merchandise—from technical athletic clothes and footwear to health equipment—for each women and men.

Lululemon embraced e-commerce and made on-line gross sales a key a part of its technique and enabled the model to develop its footprint. Its distinctive method to advertising – creating a way of group and belonging made Luluemon not only a model, however a way of life. This has been a profitable playbook for a lot of manufacturers.

How is administration dealing with progress?

Lululemon is executing its Energy of three×2 plan, which laid out targets in 2021 to double three KPI’s by 2026.

(lululemon.com)

Firstly, Lululemon plans to double males’s income by 2026. It’s utilizing its confirmed mannequin of technologically superior premium materials to ascertain itself in males’s working, coaching, and yoga, whereas increasing into new classes reminiscent of tennis, golf and mountaineering and tapping into footwear and equipment.

Secondly, the model doubled down on e-commerce and intends to double on-line revenues by 2026. They’ve a stable basis already. Over 39% of gross sales are finished on-line and Lululemon has over 24 million membership customers, reinforcing its group method.

Thirdly, the corporate plans to quadruple international income from 2021. It has important alternatives to develop globally, having just lately entered China and began enlargement into EMEA and APAC. Out of its 749 shops, 138 are in China, 47 in Emea and 105 in APAC, establishing a foothold in these markets and creating additional alternatives for Lululemon.

The place Lululemon is missing

Expert administration is the important thing to success on this planet of style. Beneath the present CEO, the corporate has been increasing, however it got here at a price. Luluemon has misplaced a few of its luster with an absence of innovation, or what the corporate calls “newness”. It recognized and began engaged on the difficulty, managing to barely revive progress within the final quarter, significantly within the troublesome ladies’s phase.

We’ve got to say the U.S., the place comparable gross sales had been down -3% for the primary time final quarter. Weakening customers have dragged on many companies, and it was time for Lululemon to really feel the sting.

This scary development has considerably reversed course as income progress elevated to 2% YoY and comparable gross sales declined -2% as in comparison with -3% final quarter. It stays to be seen if this can be a long-term restoration trajectory or a seasonal blip, however administration was constructive about US progress on the earnings name. Bettering macroeconomic situations might present a lift to gross sales in 2025.

Quarterly beat spurred investor optimism

The December 2024 quarterly report confirmed an organization nonetheless in progress mode. Internet income for Q3 FY2024 reached $2.4 billion, representing a 9% year-over-year improve. This top-line enlargement was fueled by a mixture of retailer openings, enhancing e-commerce penetration, and profitable product launches within the males’s and footwear classes. Comparable gross sales rose 3%, with gross margins of 58.5%.

Earnings per share (EPS) got here in at $2.87, a notable enchancment from $2.53 in the identical interval final 12 months. The corporate additionally raised its full-year income steering from a variety of $9.5 billion to $9.7 billion, reflecting administration’s confidence in sustaining this momentum.

China: Why Lululemon is excelling the place others wrestle

Gross sales in China surged by 40% within the first two quarters – with costs 20% larger than within the U.S. This can be a hanging demonstration of Lululemon’s pricing energy.

Whereas many Western retailers are dealing with points in China amid altering client preferences and fierce native competitors, Lululemon is bucking the development. China gross sales surged by roughly 25% this quarter, outpacing progress in nearly each different geography. So what’s the key?

Lululemon’s model message of wellness, high quality, and premium craftsmanship resonates with Chinese language customers who worth authenticity and way of life over cut price pricing.

Moreover, the corporate has localized its method, partnering with native health influencers, internet hosting group yoga occasions, and providing merchandise tailor-made to the preferences and local weather of Chinese language cities. Mixed with Lululemon’s digital technique—leveraging Chinese language social media platforms and integrating with native e-commerce giants—allows it to satisfy customers the place they store. This method has allowed the corporate to maintain its Chinese language operations rising.

Is Lululemon undervalued?

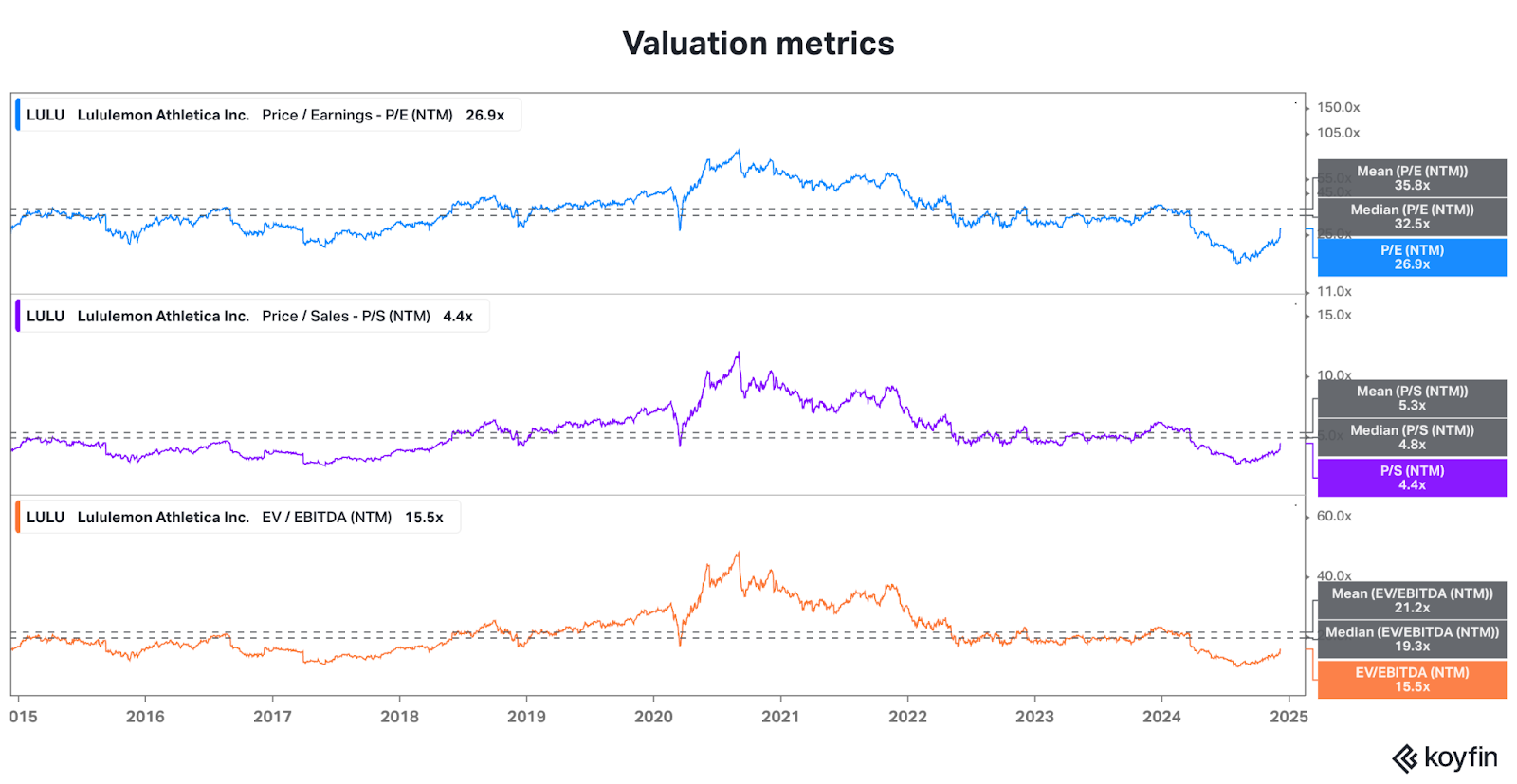

(koyfin.com)

Due to revenues rising 21% p.a. over the previous 10 years, Lululemon’s inventory was given a premium valuation. After progress collapsed in 2023, the valuation grew to become its enemy, and the inventory collapsed over 50% from its highs as traders feared that Lululemon’s progress was finished for good. However with each income and earnings progress outpacing estimates and rising in Q3, investor sentiment has improved. Proper now, the corporate’s P/E ratio stands at 27.43, which signifies about 20% upside from right here to the historic median.

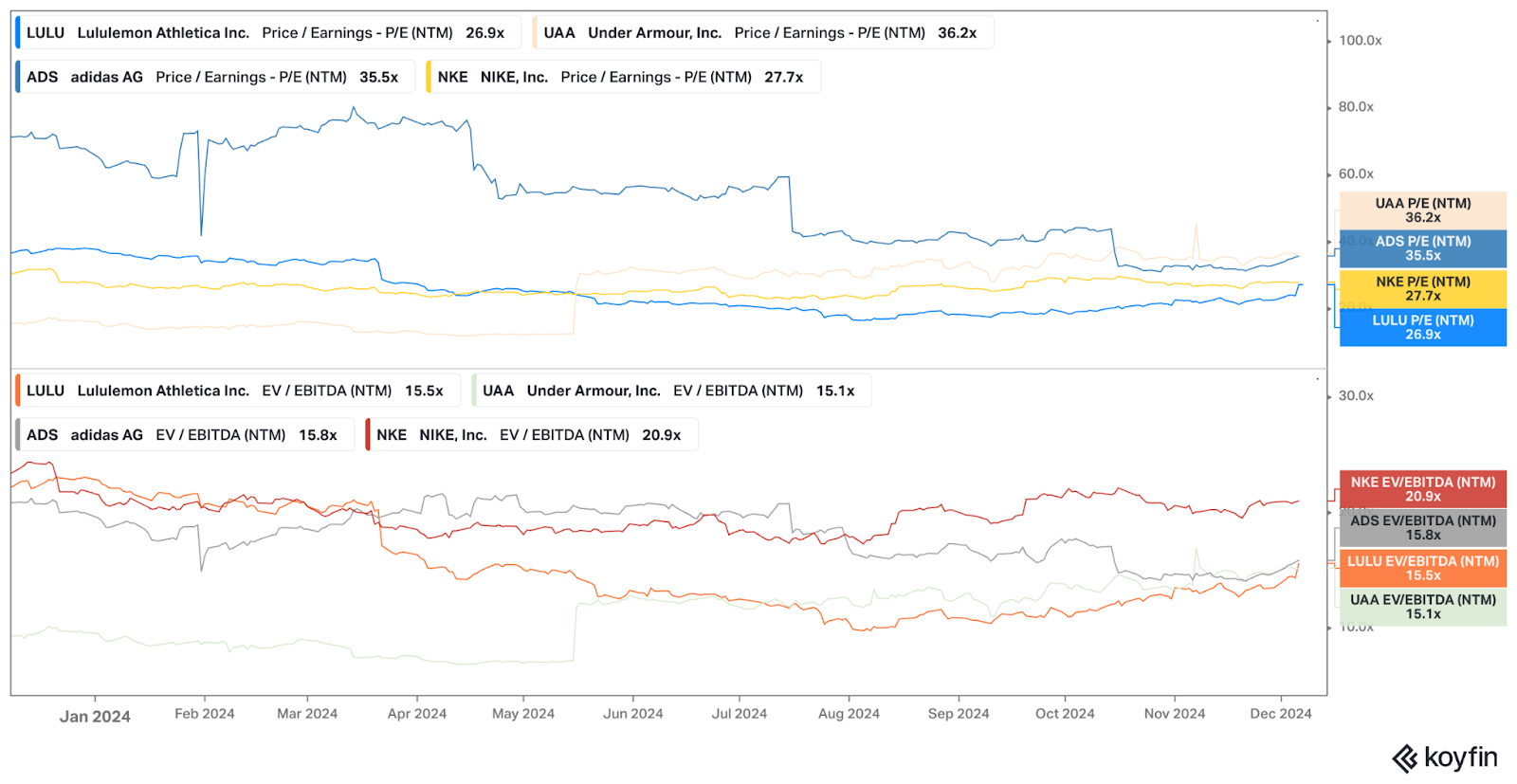

Trying on the valuation of its friends, we are able to see that regardless of robust efficiency, Luluemon’s inventory continues to be buying and selling on the low finish of the group. This may mirror much less urge for food from traders, but additionally create a chance for the corporate to to develop if it proves itself to the market.

(koyfin.com)

Let’s have a look at three potential eventualities to see how Luluemon’s valuation stacks up:

Bull Case: Lululemon continues to develop earnings by 15%+ yearly over the following 5 years, pushed by geographical enlargement and sequential progress and margin enchancment due to a stronger client. On this state of affairs, long-term shareholders may reap important rewards.

Impartial Case: Progress moderates to round 10% per 12 months as markets like North America method saturation and China’s progress normalizes. If margins keep robust, the valuation may compress to mirror slowing progress. Whereas the aggressive evaluation means that Lululemon’s inventory might continue to grow, I’d not count on explosive good points.

Bear Case: Weak spot in China catches as much as Lululemon, whereas slower international financial restoration may inhibit enlargement. American customers keep weaker as a result of larger charges for longer. Margins may face strain from competitors and better enter prices. The valuation may compress and go away traders with a stagnating or slowly declining inventory.

For traders, it’s necessary to gauge how international macroeconomic situations evolve and the way they may have an effect on the expansion trajectory in opposition to excessive multiples. Lululemon might proceed to outperform, but when progress stumbles, the inventory may face a harsh valuation reset.

What dangers is Lululemon dealing with?

Even the strongest manufacturers face challenges. For Lululemon, dangers embody elevated competitors from established names like Nike, Adidas, and rising direct-to-consumer manufacturers that would chip away at market share reminiscent of Alo Yoga or Vuori.

Shopper preferences in style and health can shift quickly, and Lululemon’s premium pricing may go away it weak if financial situations tighten and customers start to commerce down. There’s already a rising development of saggy outsized clothes as in comparison with the modern, determine enhancing model of Lululemon’s merchandise.

Provide chain disruptions, rising materials prices, or surprising geopolitical tensions may additionally dampen progress, particularly due to the chance of commerce wars with China.

Outlook for the enterprise

Lululemon stands at a juncture. The corporate’s newest quarterly outcomes present no signal of slowing down, with progress firing on a number of cylinders. However we can’t ignore the truth that Lululemon is a standout within the trade. It’s questionable whether or not the corporate is known as a diamond within the tough, or if client weak spot simply hasn’t caught as much as this model but. Traders must resolve whether or not they’re snug paying prime greenback for progress that will depend on persevering with stabilization of financial situations.

For long-term traders who imagine within the premium model, the inventory could also be a purchase. However if you happen to want conservative bets, ready for a greater entry level could be your greatest yoga pose. Ultimately, Lululemon stays a pretty enterprise, however within the attire trade, success may be fleeting.