Be part of Our Telegram channel to remain updated on breaking information protection

China’s Ant Digital Applied sciences, a unit of the Jack Ma-owned Ant Group, is tokenizing over $8 billion value of vitality infrastructure by itself blockchain community.

That’s in keeping with a Bloomberg report that cited sources conversant in the matter as saying the unit is within the means of tokenizing 60 billion yuan ($8.4 billion) of energy infrastructure on the AntChain community.

The report stated Ant Digital Applied sciences has been monitoring the facility output and outages for 15 million new vitality units in China, together with photo voltaic panels and wind generators, and importing the information to its blockchain.

Ant Digital Applied sciences Plans To Subject Tokens For Vitality Infrastructure

It has already raised round 300 million yuan ($42 million) to finance three clear vitality initiatives. The unit now plans to difficulty tokens linked to these property.

One in all plans on the unit’s roadmap is to additionally provide tokens on offshore decentralized exchanges (DEXs) to create extra liquidity for the property.

That might be topic to regulatory approval, in keeping with the nameless sources cited within the report.

This isn’t the primary transfer by the unit to tokenize vitality property. In August final yr, Ant Digital Applied sciences raised $14 million for the vitality agency Longshine Expertise Group, and linked 9,000 of the corporate’s electrical charging models to AntChain.

In December, the unit additionally secured greater than $28 million for GCL Vitality Expertise by connecting photovoltaic property to its blockchain.

RWA Sector Soars To Report Excessive This Week

The transfer by Ant Digital Applied sciences to tokenize vitality property and doubtlessly difficulty tokens for them is a part of a rising pattern of tokenizing real-world property (RWAs).

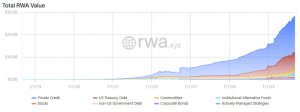

The sector continues to be in its early phases, however is beginning to achieve momentum. Simply this week, the worth of tokenized RWAs soared to a report excessive of $28.4 billion, information from RWA.xyz exhibits. That is nearly double the worth seen at the start of the yr.

RWA on-chain worth (Supply: RWA.xyz)

Greater than half of the digital RWA worth is non-public credit score that has been tokenized on the blockchain. Over 1 / 4 of the worth can also be tokenized US Treasurys.

Different tokenized property embrace commodities ($2 billion), institutional different funds ($1.8 billion), public fairness ($421.2 million) and non-US authorities debt ($340.2 million).

The Ethereum blockchain stays the blockchain of alternative for tokenized RWA issuers, and has a 57% share of the market.

Ant Group Wanting To Get Into The Booming Stablecoin Area

Ant Group isn’t simply concerned within the vitality infrastructure house, however can also be reportedly trying to be part of the booming stablecoin market.

In July, a report stated that the group plans to include Circle’s USD Coin (USDC), which is the second-largest stablecoin by market cap, into its blockchain community.

Ant Group had additionally collaborated with ecommerce large JD.com to foyer the Folks’s Financial institution of China (PBOC) to approve stablecoins backed by the Chinese language Yuan.

That occurred throughout the identical month that US President Donald Trump signed the GENIUS Act into regulation, which is the primary invoice on the federal stage that units regulatory necessities for issuers within the US to adjust to.

A few of these necessities embrace sustaining a 1:1 backing with the stablecoin’s underlying asset, in addition to abiding by Anti-Cash Laundering (AML) and Counter Terrorism legal guidelines.

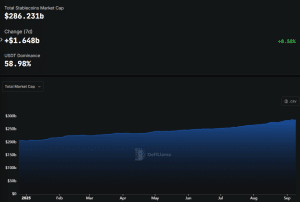

Because the GENIUS Act was signed into regulation in July, the stablecoin market cap has climbed from $260.715 billion to a report excessive $286.231 billion, in keeping with DeFiLlama information.

Stablecoin market cap (Supply: DeFiLlama)

Much like the RWA sector, Ethereum is the popular blockchain for stablecoin issuers.

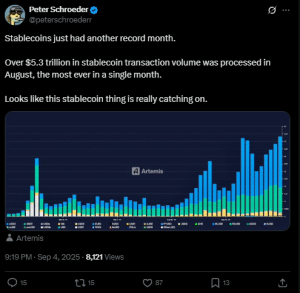

Stablecoin transaction volumes spike in August (Supply: X)

Along with vitality asset tokenization and stablecoins, Ant Digital Applied sciences has additionally invested in a public blockchain referred to as Pharos Community Expertise. The undertaking is led by a former Ant worker.

The unit has additionally entered into an settlement with a monetary companies agency primarily based in Hong Kong referred to as Yunfeng Monetary Group. As a part of the strategic cooperation settlement, the 2 will leverage Pharos’s platform to discover areas together with RWA tokenization.

Associated Articles:

Greatest Pockets – Diversify Your Crypto Portfolio

Simple to Use, Function-Pushed Crypto Pockets

Get Early Entry to Upcoming Token ICOs

Multi-Chain, Multi-Pockets, Non-Custodial

Now On App Retailer, Google Play

Stake To Earn Native Token $BEST

250,000+ Month-to-month Lively Customers

Be part of Our Telegram channel to remain updated on breaking information protection