On-chain information reveals over half of the Ethereum provide is held by simply 10 addresses. Right here’s how different ETH-based tokens like Shiba Inu stack up.

Shiba Inu, Uniswap, & Ethereum Are Amongst The Most Centralized ETH Tokens

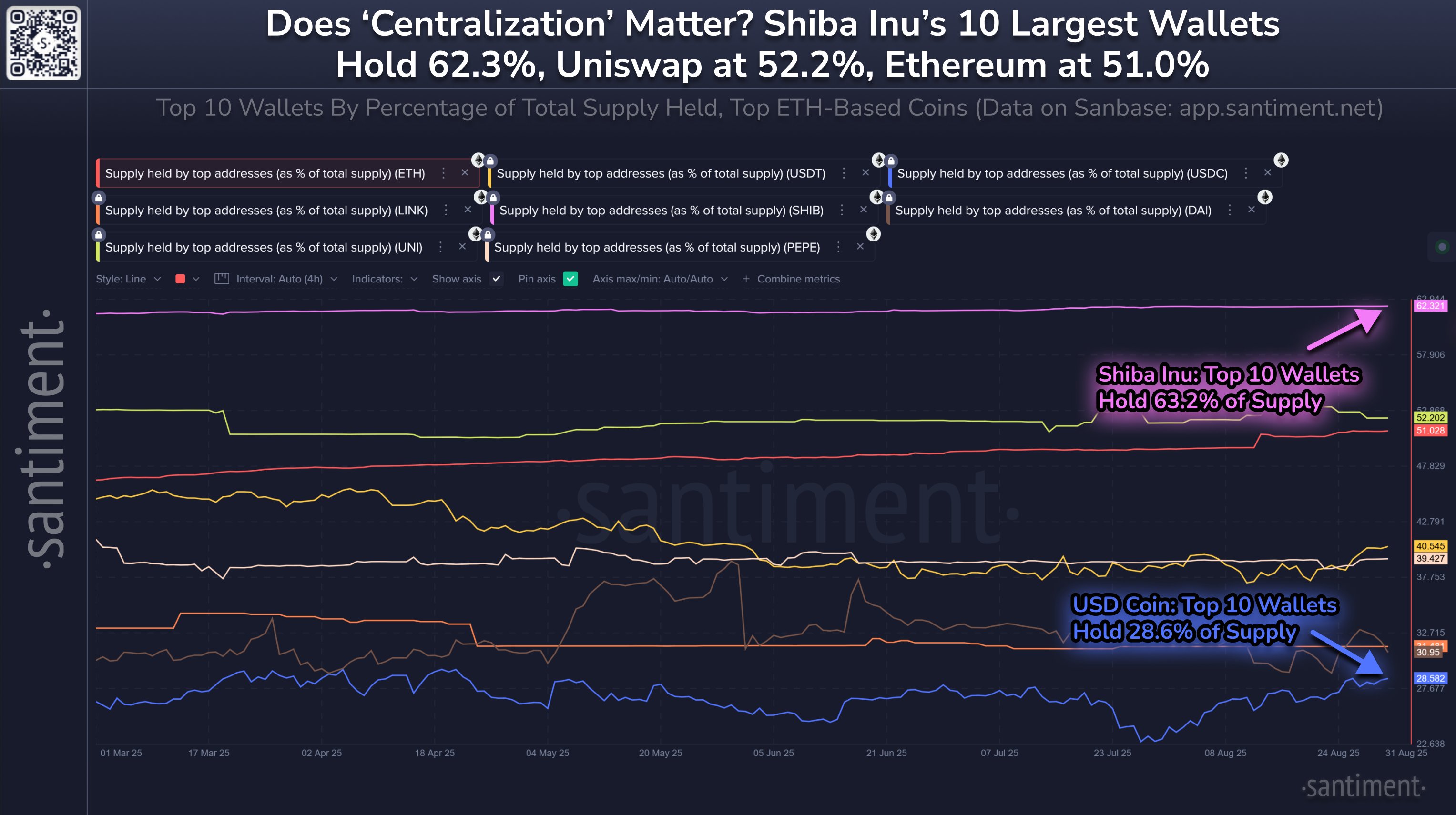

In a brand new submit on X, on-chain analytics agency Santiment has talked about how the completely different belongings within the Ethereum ecosystem line up in opposition to one another when it comes to the quantity of provide that’s targeting the highest 10 wallets.

Beneath is the chart shared by Santiment that reveals the development on this metric for eight cryptocurrencies over the previous few months.

Appears to be like like SHIB is on the prime of the record in the meanwhile | Supply: Santiment on X

From the graph, it’s seen that 51% of the Ethereum provide is owned by the ten largest wallets on the community. That is greater than many of the different ETH-based tokens on the record.

The 2 cash which are forward on this metric are Shiba Inu (SHIB) and Uniswap (UNI). The latter is barely marginally forward of ETH with a worth of 52.2%, however the former is considerably forward at 62.3%.

Usually, a cryptocurrency’s provide being closely targeting just some fingers doesn’t are usually a constructive sign, because it means just a few gamers are wanted to maneuver the market.

Past market dynamics, provide centralization has one other disadvantage: it probably weakens the community safety. Chains like Ethereum’s run on a consensus mechanism known as the Proof-of-Stake (PoS). Below this method, validators known as stakers need to lock up a stake in an effort to obtain an opportunity at including the subsequent block to the chain.

The upper is a validator’s stake, the upper is the possibility that they get picked. If a single staker crosses the 51% provide threshold, they will, in idea, achieve whole management over the blockchain.

The sort of assault doesn’t exist on Bitcoin, the place the Proof-of-Work (PoW) consensus mechanism is employed as an alternative. In PoW networks, miners compete in opposition to one another utilizing computing energy. Right here, too, nonetheless, if a validator positive aspects management over 51% of the community computing sources, they will mildew BTC to their will.

Contemplating that Ethereum has simply 10 holders controlling 51% of the provision, an assault on the community is feasible if these entities come collectively. The probabilities of it occurring, although, are fairly slim.

Nonetheless, the very fact the likes of ETH, SHIB, and UNI are notably centralized on just some holders might be one thing to observe for. In distinction, another tokens within the ecosystem like USDC (28.6%), DAI (31%), and Chainlink (31.5%) are in a more healthy zone when it comes to this metric.

ETH Worth

Ethereum has seen a surge of virtually 4% over the past 24 hours that has taken its worth to the $4,380 mark.

The value of the coin appears to have shot up over the previous day | Supply: ETHUSDT on TradingView

Featured picture from Dall-E, Santiment.internet, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent overview by our staff of prime expertise consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.