Chainlink’s LINK token has slipped again right into a consolidation part after a unstable summer time.

The quick climb from $11 to $28 didn’t maintain, and the worth later dropped to round $14 in early November.

Analysts say the pullback displays broader uncertainty out there, as merchants await clearer indicators on rates of interest and financial coverage.

Regardless of the correction, Chainlink stays central to the blockchain ecosystem. It’s nonetheless the principle community that connects good contracts to real-world knowledge, a task that almost all DeFi platforms depend on.

DISCOVER: The 12+ Hottest Crypto Presales to Purchase Proper Now

How Might CCIP Change Cross-Chain Communication for DeFi?

The oracle system now helps tons of of DeFi protocols and delivers value feeds that assist safe billions of {dollars} locked throughout the sector.

The subsequent huge step for the venture is the Cross-Chain Interoperability Protocol, or CCIP. It’s designed to let apps on totally different blockchains share knowledge and messages in a safe method.

Unstable Coin has upgraded to the Chainlink interoperability normal & made USDUC a Cross-Chain Token (CCT) to allow seamless token transfers throughout HyperEVM & Solana through CCIP.@usduc_official additionally built-in Chainlink Knowledge Streams to ship extremely safe, sub-second knowledge to… pic.twitter.com/LEWLmsWzQl

— Chainlink (@chainlink) November 19, 2025

That’s a serious challenge in a market the place most networks nonetheless work on their very own.

Some massive monetary establishments are finding out CCIP for their very own techniques. If that curiosity continues to construct, it could push demand for LINK increased, since nodes use the token as collateral contained in the community.

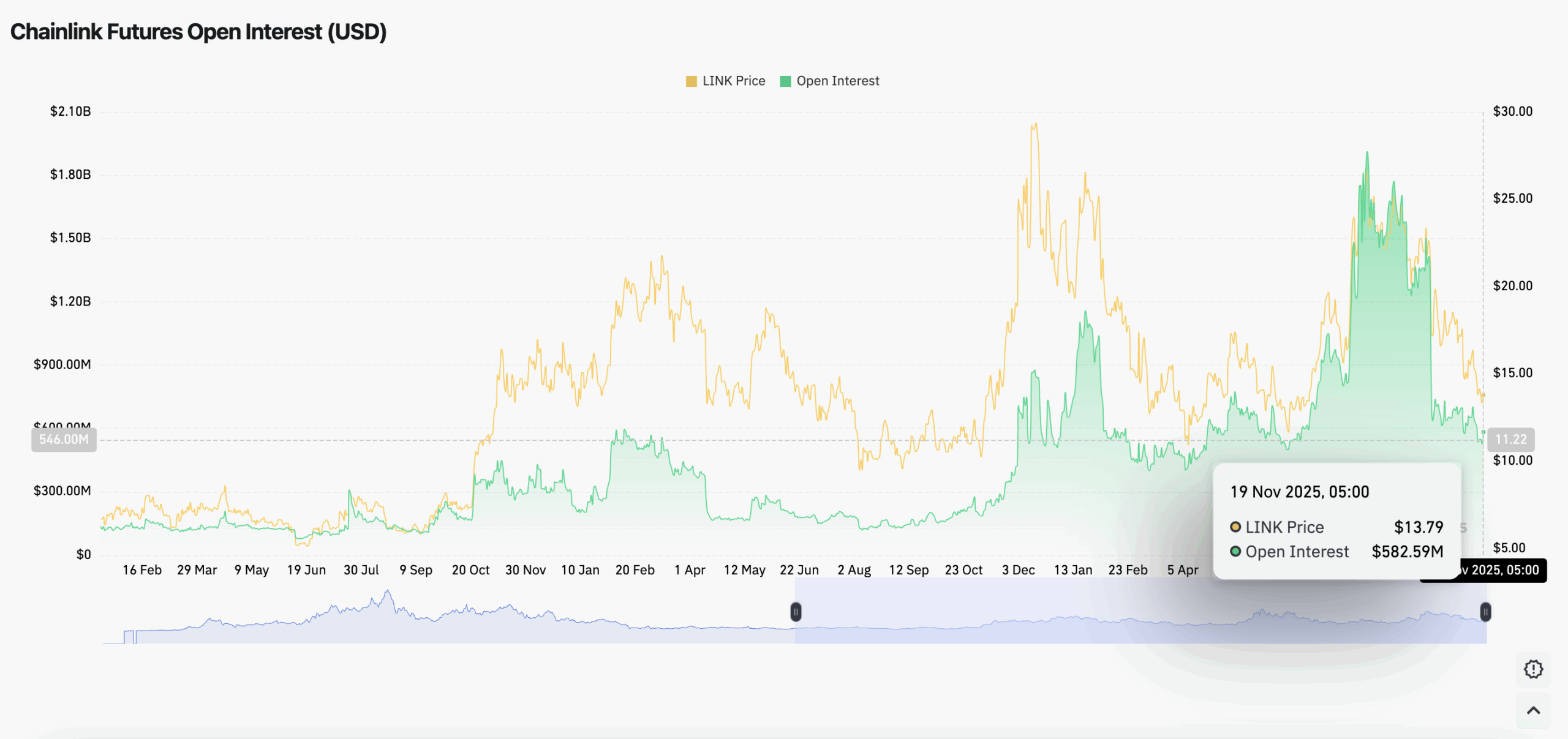

Knowledge from Coinglass exhibits futures open curiosity sitting close to $582.59M, with about $1.1Bn in futures buying and selling quantity over the previous 24 hours on main exchanges.

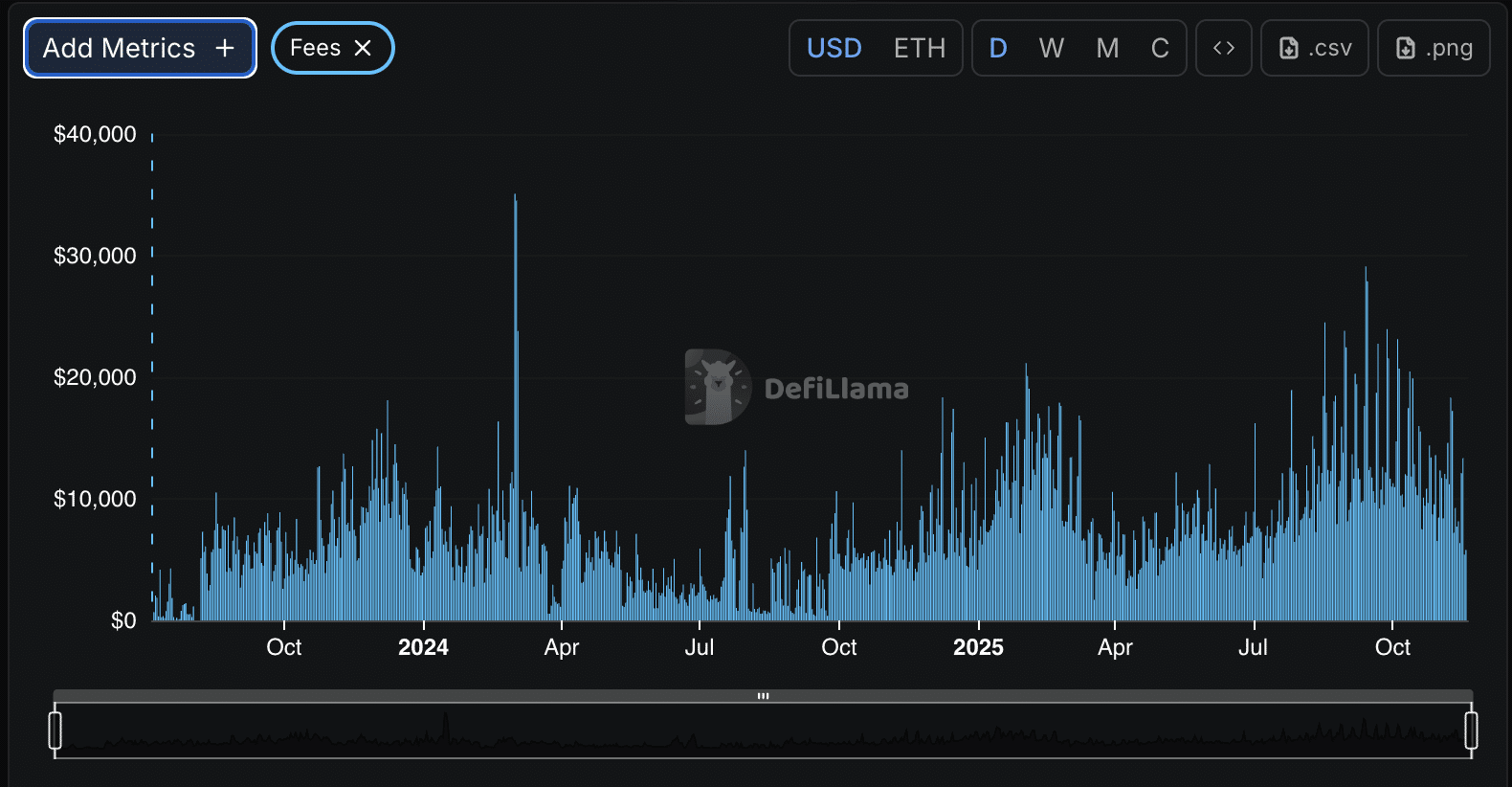

DefiLlama’s newest figures listing Chainlink oracles securing roughly $48.5 billion in Complete Worth Secured, an indication that the community nonetheless performs a central position throughout DeFi.

Chainlink stays central to DeFi lending, derivatives, and most main on-chain markets. Its perpetuals dashboard exhibits about $45Bn in 24-hour decentralized perpetual quantity.

DISCOVER: 9+ Greatest Memecoin to Purchase in 2025

LINK Value Prediction: Is Chainlink Dropping Bearish Momentum as It Approaches Oversold Ranges?

A few of that circulate will depend on Chainlink’s value feeds, although the studies don’t break down how a lot comes from particular belongings like LINK.

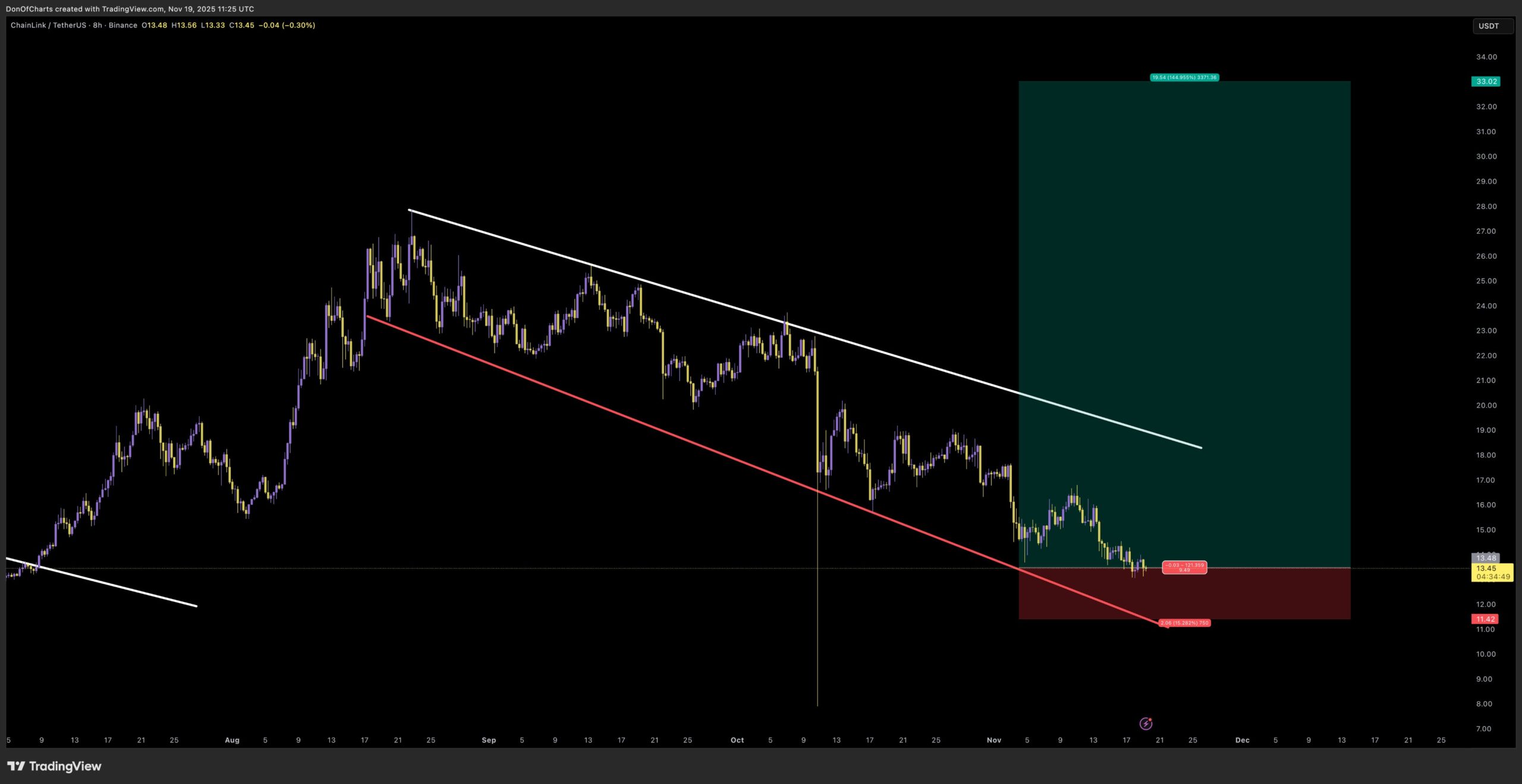

Don, a crypto analyst, posted the chart on X, which exhibits LINK remains to be transferring inside a long-running descending channel. The value has reacted to each side of this sample for months.

The higher trendline has stopped each try and push increased, whereas the decrease pink line continues to behave as assist.

Current buying and selling locations LINK close to the underside of the channel, which indicators that sellers stay in management for now.

LINK has slipped again towards the $12–$13 space, a zone that has acted as assist since September.

The value tapped this area once more however didn’t fall by it, suggesting sellers are shedding momentum because the token strikes deeper into oversold circumstances.

Even so, the broader development stays bearish. The chart nonetheless exhibits a sample of decrease highs and decrease lows, maintaining LINK inside a downward channel.

The analyst notes {that a} lengthy setup solely turns into legitimate if LINK climbs again above the mid-range and breaks out of the channel.

The stop-loss sits slightly below the trendline close to $11.40. The primary goal is within the $30–$33 band. Reaching that zone would mark a clear breakout and sign a shift in sentiment.

The token remains to be buying and selling beneath the white resistance line that has rejected each bounce since mid-August. With no breakout, the market has little proof of renewed power.

For now, LINK stays in a gentle downward sample, and merchants are watching the $12 space intently. If this stage fails, the chart leaves room for additional losses.

EXPLORE: DEXTools vs. DEX Screener: Which One is Higher in 2025

The submit LINK Value Prediction: Is Chainlink Near a Pattern Reversal After Months of Decrease Highs? appeared first on 99Bitcoins.