Layer-1 blockchain, Mantra, has launched a $108,888,888 ecosystem fund geared toward accelerating the expansion of startups centered on real-world asset (RWA) tokenization and decentralized finance (DeFi).

The launch of this fund, named the Mantra Ecosystem Fund (MEF), comes amid the rising demand for secure, asset-backed digital merchandise.

As we speak, we’re asserting the launch of the MEF – a $108,888,888 million funding initiative designed to propel actual world asset innovation, adoption and progress.

However we’re not doing this alone. We’ve obtained main incubators, accelerators and capital companions by our facet;… pic.twitter.com/oyeCOJ9QrE

— MANTRA | Tokenizing RWAs (@MANTRA_Chain) April 7, 2025

Huge Gamers Have Invested Into The Mantra ‘MEF’ Fund

Mantra, a L1 blockchain constructed particularly for tokenized RWAs, has launched its ‘MEF’ fund to speed up the expansion and adoption of tasks and startups constructing on its community, per its official announcement from immediately (April 7) on X.

The press launch from Mantra states that it’ll deploy the capital over the subsequent 4 years amongst “high-potential blockchain tasks” worldwide, with funding alternatives sourced by way of Mantra’s community of companions.

Backing the fund are among the largest institutional companions round, together with; Laser Digital, Shorooq, Brevan Howard Digital, Valor Capital, Three Level Capital and Amber Group, amongst others.

The launch of the Mantra Ecosystem Fund comes a month after the L1 grew to become the primary DeFi/RWA platform to acquire a digital asset service supplier (VASP) license underneath Dubai’s Digital Belongings Regulatory Authority (VARA).

Per CoinGecko, Mantra’s native token, OM, is at present buying and selling at $6.1 with a market cap of $5.9 billion, making it the twenty second largest cryptocurrency by market cap.

(COINGECKO)

EXPLORE: Will CME Hole Save BTC USD? Over $1Bn Liquidated in 1 Hour Forward of Crypto Black Monday

Tokenized RWA Gem No.1 – Landshare (LAND)

Landshare (LAND) provides its holders the chance for actual property funding by way of its user-friendly platform constructed on the BNB Sensible Chain (BSC) chain.

This platform removes the stress and heavy monetary necessities (akin to massive down funds), that sometimes include actual property funding. With the Landshare ecosystem, customers have a plethora of alternatives to achieve actual property publicity with RWA belongings.

By Landshare, traders can stake stablecoins to earn a share of rental earnings and property worth appreciation and take part in crowd-funded property flips.

Notably, the Landshare platform is led by its well-developed NFT ecosystem. All NFTs minted on Landshare signify fractional possession of actual property belongings.

Holders can improve and restore their digital properties utilizing NFTs, this innovation provides a gamified layer to the expertise, a purpose why many at the moment are selecting to put money into LAND.

Landshare represents a real micro cap gem, as its market cap stands at a tiny $3.1 million. With its groups huge expertise, being practically 4 years outdated at this level, this stage of blue chip venture might doubtlessly be one which Mantra’s RWA ecosystem fund could have an in depth eye on.

LAND is at present buying and selling at $0.55 and is down 9% on the day, which is spectacular when contemplating that multi-billion greenback ETH is down practically 20% in the identical timeframe.

(COINGECKO)

Tokenized RWA Gem No.2 – Clearpool Finance (CPOOL)

Clearpool Finance (CPOOL) is a number one hybrid DeFi/RWA crypto platform with over $67 million in Whole-Worth Locked (TVL) to its identify. It additionally acts as a decentralized credit score market and to-date has issued greater than $770 million in loans, per its web site dashboard.

The Clearpool platform gives its person entry to a number of merchandise. These embody staking swimming pools, credit score vaults, institutional DeFi swimming pools, and treasury swimming pools.

Only recently, by way of its Clearpool Prime product which acts as a KYC & AML compliant community for wholesale borrowing and lending of digital belongings, Euronext-listed international buying and selling agency FlowTraders efficiently secured a $10 million USDC mortgage.

This marked an enormous milestone for the platform with such an enormous participant utilizing its platform for a 10-figure stablecoin mortgage.

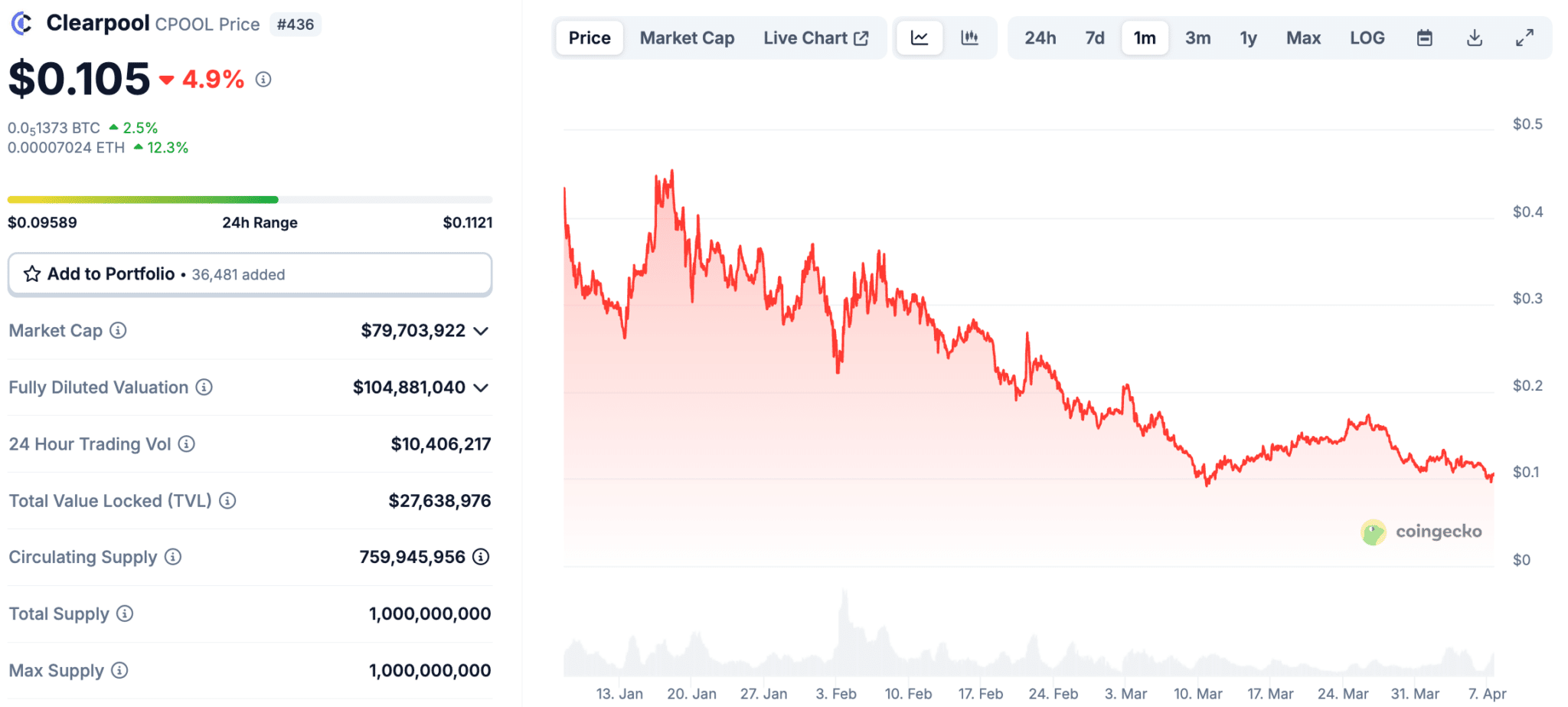

Nevertheless, Clearpool has been affected together with the remainder of the market and consequently, is at present buying and selling at simply over $0.1. Per CoinGecko, it’s down practically 20% prior to now month and 5% alone prior to now 24 hours.

With a tokenized RWA venture that continues to construct and thrive whatever the wider market situations, this dip for CPOOL seems like an awesome level for an inexpensive entry earlier than the market reversal comes.

(COINGECKO)

DISCOVER: Greatest Meme Coin ICOs to Spend money on April 2025

Be part of The 99Bitcoins Information Discord Right here For The Newest Market Updates

Mantra, a L1 blockchain constructed for tokenizied RWA, has launched a $108m ecosystem fund

Buyers within the fund embody Three Arrows Capital, Amber Group and Brevan Howard Digital

Mantra just lately obtained a digital asset service supplier (VASP) from Dubai’s Digital Belongings Regulatory Authority (VARA)

The native token for Mantra, OM, is at present buying and selling at simply over $6 with a $5.9 billion market cap

Landshare (LAND) and Clearpool Finance (CPOOL) are two RWA gems that the Mantra ecosystem fund might be eyeing for funding

The put up Mantra Blockchain Launches $108M RWA Fund: Greatest Tokenized Asset Gems To Purchase On The Dip appeared first on 99Bitcoins.