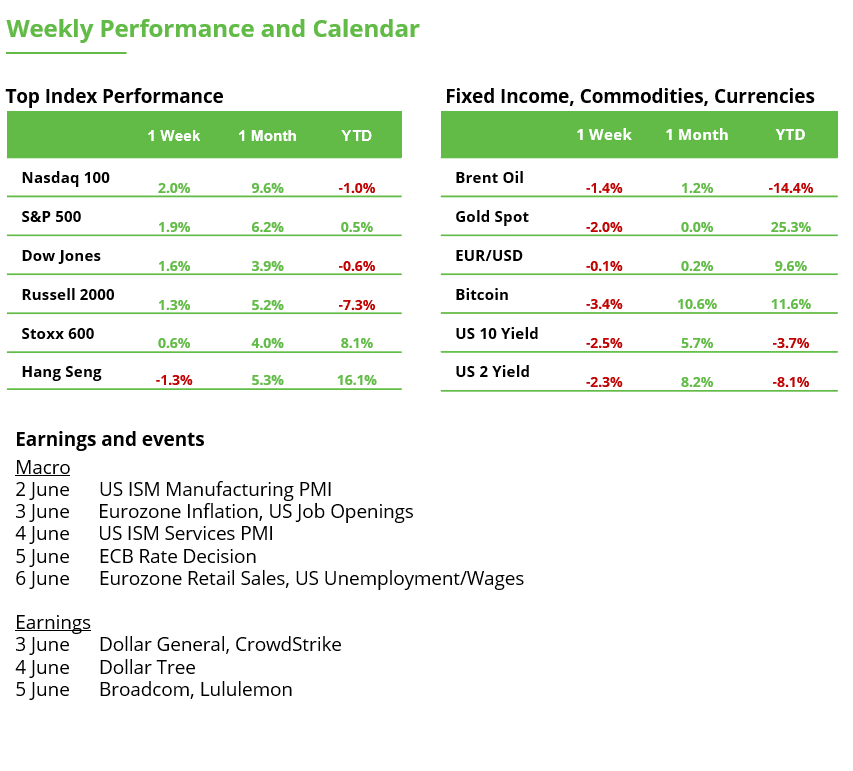

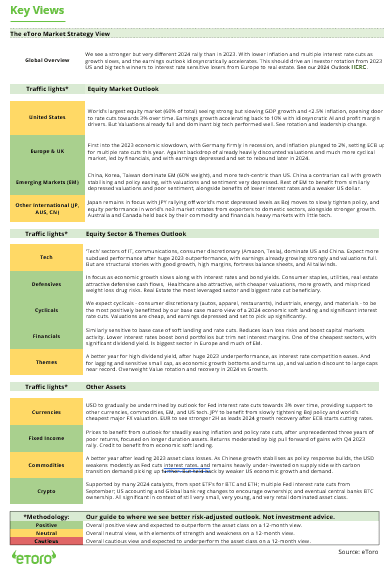

Analyst Weekly, June 2, 2025

From Web to Intelligence: Mary Meeker’s AI Playbook for the Subsequent Decade

Mary Meeker, lengthy dubbed the “Queen of the Web,” has returned to long-form with the AI Developments Report 2025, her first main deep-dive since pausing the Web Developments Report in 2019.

Over twenty years, she constantly recognized key inflections: the explosion of web customers (1996), on-line advertisements overtaking print (2000), and cell’s eventual dominance (2008). At Kleiner Perkins and later BOND Capital, she backed a lot of tech’s iconic names- Fb, Spotify, Twitter, Sq., Snap.

AI is shaping as much as be one of the vital capital-intensive and transformational tech shifts because the web. The report highlights that Massive Tech has already spent over $200B on AI infrastructure in 2024 alone, with NVIDIA rising because the standout winner, now accounting for 25% of world knowledge heart CapEx.

Crucially, whereas coaching AI fashions stays expensive (usually $100M+), the associated fee to make use of them (known as inference) has dropped ~99.7% in two years. That’s fueling a surge in developer and enterprise adoption. Microsoft’s AI income hit $13B; OpenAI crossed $3.7B; Anthropic and others are seeing comparable progress.

Funding Takeaway:

This setup has opened up funding alternatives throughout three fronts: (1) infrastructure suppliers (NVIDIA, Oracle, CoreWeave), (2) enterprise software program embedding AI into workflows (Microsoft, Salesforce, Adobe), and (3) specialised AI-first verticals in healthcare, regulation, and industrials (e.g., Abridge, Harvey, Anduril). In the meantime, China’s open-source LLMs are quickly narrowing the efficiency hole, elevating geopolitical and aggressive issues.

The report underscores a historic platform shift, likened to cell or cloud, with the “interface layer” transferring from apps to brokers. The subsequent decade of productiveness (and returns) might come from whoever owns that layer. Traders ought to place throughout each enablers (infrastructure, chips, fashions) and integrators (software program, automation).

Earnings Watch: Decrease Bar, Greater Shock Potential

Wall Road is dialing again full-year S&P 500 revenue forecasts- now anticipating 7% EPS progress in 2025. That’s down barely, however nonetheless robust vs. the two.3% common earlier than previous recessions. Q1 earnings already confirmed resilience: income jumped 13%, with gross sales up 5%. A lot of the cuts are targeted on Q2, the place tariff-driven value will increase and demand headwinds are anticipated to hit hardest.

However right here’s the twist: decrease expectations may set the stage for upside surprises. If corporations handle provide chain shifts, or maintain pricing energy, Q2 may beat the (now-lowered) bar- particularly for industrials and shopper discretionary.

Volatility Watch: Fragile Calm

Proper now, markets appear to be on stable footing. Inner momentum appears to be like wholesome, with greater than half of S&P 500 shares simply hit new 20-day highs, a sign that has traditionally pointed to robust 6-month returns. Industrials are main the way in which, and even the important thing Discretionary vs. Staples ratio, a gauge of danger urge for food, has turned increased after a quick dip.

That mentioned, there are a number of developments on the radar that might stir volatility within the coming weeks:

Liquidity squeeze: Treasury money balances (TGA) start draining on June 15.

Fiscal stress: Web curiosity prices now make up 18% of US tax income.

Tariff cliff: The present pause on reciprocal tariffs expires July 9 and we might not have courtroom readability by then (see under). The authorized appeals course of is transferring slowly, making it tougher for the US to finalize new commerce offers in time.

Tariff Drama: Courtroom Says No, Appeals Say Maintain Up

A US courtroom dominated US tariffs are unlawful and gave a 10-day rollback deadline – however plot twist: an appeals courtroom hit pause. So for now, tariffs keep. The authorized struggle may stretch into summer season, possibly even to the Supreme Courtroom.

Why it issues: The present truce on reciprocal tariffs ends July 9, and we would not have authorized readability by then. That’s making it tougher for the US to ink new commerce offers, giving different nations a cause to play hardball.

Massive image: Authorized uncertainty = market volatility. If international companions assume the US is dropping grip on enforcement, they may retaliate and markets don’t love uncertainty. Control volatility as this unfolds.

Now Everybody’s Enjoying Hardball: The EU’s stalling on concessions, probably utilizing US authorized uncertainty as leverage. Trump tossed out a 50% tariff menace final week, however Brussels didn’t flinch. Subsequent transfer? The G7 Summit (mid-June) will probably be key to observe for progress, particularly with Japan.

In the meantime, China’s dragging its toes on a Could 12 tariff deal to restart rare-earth exports (yep, we had flagged it). The US hit again with tighter export controls.

The vibe: If the US appears to be like unsure, others will take benefit. It’s shaping as much as be a tense summer season for commerce.

Gold’s Rise Displays Structural Shifts in Reserve Administration

The yellow metallic stays elevated close to report highs. Gold is hovering round $3,300/oz after a 26% surge this 12 months, underpinned by its safe-haven attraction. We expect that gold’s ascent previous $3,300 isn’t the product of speculative extra however the results of a sustained shift in how international establishments handle reserve belongings. Central banks have been the dominant patrons over the previous two years, signaling a structural slightly than cyclical revaluation.

This pattern accelerated after 2022, when geopolitical occasions highlighted the dangers of overconcentration in a single reserve asset class. In response, a rising variety of nations, significantly in Asia and the Center East, started diversifying away from sovereign debt holdings, notably US Treasuries. With no credible various reserve foreign money, many have elevated allocations to gold- a impartial, liquid, and traditionally acknowledged retailer of worth.

Investor positioning, in contrast, has remained conservative. Gold at present accounts for roughly 1% of world funding portfolios. That determine is much under historic ranges: in the course of the Bretton Woods period, gold and associated belongings made up 50–60% of institutional holdings. Whereas a return to these ranges is neither probably nor fascinating in a contemporary monetary system, even a modest reallocation to three–5% would indicate important incremental demand.

The current uptick in ETF inflows and fund publicity suggests that personal traders are starting to observe central banks into the commerce.

Silver, in the meantime, has lagged gold however might current uneven upside. Whereas central banks don’t maintain silver, its twin function as a financial metallic and a important industrial enter, significantly in photo voltaic, batteries, and semiconductors, makes it more and more related in a worldwide financial system transitioning towards electrification.

For traders, a balanced method stays prudent: 75–80% publicity to bodily gold or gold ETFs for stability, and 20–25% to high-quality miners for upside potential. The latter stay deeply discounted relative to bullion however carry materially increased volatility.

Investor Takeaway: We see a compelling case for growing long-term publicity to gold. Current value motion has created a extra enticing entry level and additional alternatives might emerge. Over the long-term, we imagine gold stays a strategic asset: a core holding amid accelerating de-globalization, and a transition asset throughout a interval marked by coverage uncertainty and central financial institution steadiness sheet shifts.

This communication is for info and schooling functions solely and shouldn’t be taken as funding recommendation, a private advice, or a suggestion of, or solicitation to purchase or promote, any monetary devices. This materials has been ready with out making an allowance for any explicit recipient’s funding aims or monetary scenario and has not been ready in accordance with the authorized and regulatory necessities to advertise unbiased analysis. Any references to previous or future efficiency of a monetary instrument, index or a packaged funding product are usually not, and shouldn’t be taken as, a dependable indicator of future outcomes. eToro makes no illustration and assumes no legal responsibility as to the accuracy or completeness of the content material of this publication.