At its March assembly, the Fed stored charges regular at 4.25-4.50%. Don’t pop the champagne but, although. The Fed additionally signalled it’s not declaring victory on inflation: officers nudged their inflation forecasts greater and trimmed progress expectations, citing a “extremely unsure” outlook. Translation? The outlook’s nonetheless foggy, and people inflation-fuelling tariffs aren’t serving to.

What It Means For Your Cash:

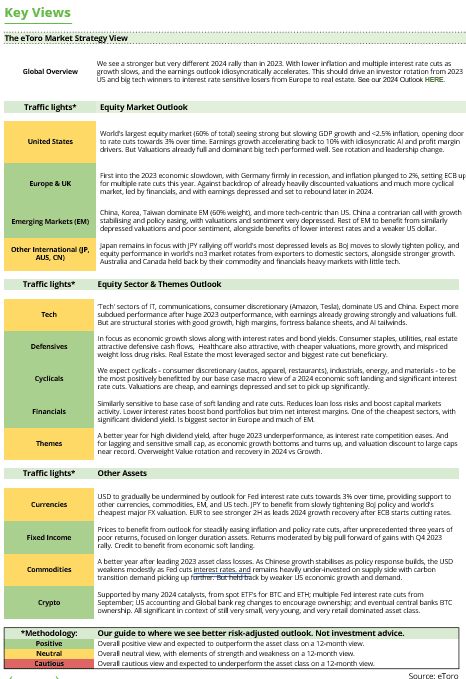

Increased-for-longer charges remind us to be selective in shares – give attention to corporations that may thrive in a moderate-growth, moderate-inflation world.

Banks profit from greater web curiosity margins (they earn extra on loans vs. what they pay on deposits), and insurers can earn extra from investing premiums.

Client staples are inclined to have dependable money move and may move some inflation on to customers.

Healthcare demand is non-cyclical — folks want meds and procedures no matter charges. Many healthcare corporations have steady money flows and pricing energy.

Not all tech will get punished in a high-rate world. Money-generating companies with sturdy moats and price management can nonetheless outperform. Cloud, cybersecurity, and AI-infrastructure gamers stay long-term winners.

To keep away from: 1. Excessive-growth, no-profit tech that get hit hardest by greater low cost charges. 2. Actual property (particularly business REITs) + greater charges = dearer debt, decrease property values. 3. Extremely leveraged sectors – companies loaded with debt see earnings eaten up by greater curiosity prices.

Earnings Season: Massive Names, Small Surprises

Nike, FedEx, and Accenture all upset—and Wall Road observed.

Nike expects additional income declines, nonetheless untangling final yr’s stock overload and seeing weaker demand. Trump’s tariffs on China and Mexico may contribute to a pointy decline in profitability. Nike imports 18% of its Nike-branded footwear from China, which Trump has levied a further 20% tariffs on.

FedEx is navigating greater prices and a dip in world delivery volumes as companies cool their spending.

Accenture? Down 13% year-to-date after company shoppers hit the cancel button on huge contracts (coupled with DOGE-related cancellations)– a doable signal that the company spending frenzy of the previous few years is easing up.

What’s occurring? If folks aren’t snapping up sneakers like they used to, or shippers like FedEx are seeing fewer packages, it factors to a broader financial cooldown on the horizon. However right here’s the silver lining: a light slowdown is perhaps precisely what the Fed (and long-term buyers nervous about overheating) want to chill inflation with no exhausting touchdown. And context is essential: all three corporations have weathered slowdowns earlier than. Every continues to be a dominant participant in its subject, with stable long-run prospects. The cautious alerts from Nike, FedEx, and Accenture remind us to control the broader financial system’s pulse.

Bottomline: For long-term buyers, dips in confirmed names brought on by momentary headwinds may even be alternatives. Should you’ve completed your homework and consider in an organization’s long-term story, a 5% drop on an earnings miss is perhaps an opportunity to purchase at a reduction. Simply be sure that these short-term points (weak client demand, greater prices, and so forth.) don’t threaten the corporate’s long-term aggressive edge.

PMI Knowledge in Focus: Can Main Indicators Rebuild Investor Confidence?

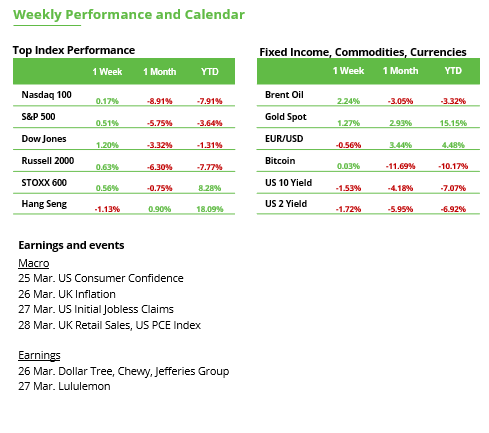

Buyers Searching for Route: Market members are dealing with many questions within the present surroundings – and rightly so. Trump stays the largest uncertainty issue, casting a thick fog over the markets. Many buyers really feel at the hours of darkness, looking for readability and orientation. Volatility has elevated considerably in current weeks, notably within the U.S.. Based on the RSI, the S&P 500 futures had been as oversold on the every day chart as they had been final seen in September 2022, following the current sell-off. Even the just lately sturdy European inventory market hasn’t been immune. Whereas the swings have been much less pronounced, the STOXX Europe 600 just lately skilled a 5% dip – a transparent signal that world uncertainty is spreading.

Shifting Market Situations: Whereas some buyers see current value weaknesses as shopping for alternatives, others consider the correction is much from over. The Fed’s message final week captured the dilemma buyers at the moment face: uncertainty makes forecasting extraordinarily troublesome. That doesn’t imply the market is collapsing—however the surroundings has clearly modified. Volatility is again, and it’s doubtless right here to remain. Somewhat than panicking, buyers ought to adapt and get used to the brand new circumstances. In any case, Trump will stay a serious market issue for almost 4 extra years.

PMI Knowledge as a Actuality Test: Main indicators aren’t the holy grail, however they provide a helpful glimpse into what’s forward. On Monday, the March PMI knowledge for Europe and the U.S. will likely be launched and will function a well timed actuality test for buyers. Within the U.S., the image has shifted in current months (see chart beneath). The manufacturing sector (52.7) has managed to recuperate from its downturn, whereas the providers sector (51.0) continues to point out indicators of weak point. The same development could be seen in Europe, although with a key distinction: manufacturing stays in recession territory (47.6), whereas the providers PMI is hovering nearer to the impartial 50 mark (50.6). Buyers ought to watch intently for brand spanking new momentum or important deviations from expectations. The principle focus stays on inflation dangers, notably these linked to rising tariffs.

Federal Council Approves Germany’s Monetary Bundle: The deliberate €1 trillion in new debt will likely be financed by numerous channels. Infrastructure and local weather investments will likely be funded by way of a particular fund, whereas protection, safety, and assist for Ukraine will likely be lined by a relaxed debt brake. The muted market response within the DAX, euro, and German authorities bonds means that the elevated public spending was largely priced in. One factor is obvious: curiosity prices will rise and put long-term stress on the federal funds. A powerful financial restoration will likely be important to maintain the debt manageable—for now, markets stay hopeful that Germany’s financial system will rebound considerably within the coming years.

Bottomline: Buyers ought to take the Trump issue severely, however not panic. The secret is to remain calm and suppose long-term. Rising volatility additionally presents new alternatives—those that stay versatile can profit. Consideration also needs to be paid to the differing dynamics between the U.S. and Europe. The upcoming PMI knowledge will likely be an vital indicator. Germany’s monetary package deal might present a short-term increase, however what actually issues is whether or not the investments are focused and successfully applied to assist sustainable progress.

This communication is for data and training functions solely and shouldn’t be taken as funding recommendation, a private suggestion, or a suggestion of, or solicitation to purchase or promote, any monetary devices. This materials has been ready with out considering any explicit recipient’s funding goals or monetary scenario and has not been ready in accordance with the authorized and regulatory necessities to advertise impartial analysis. Any references to previous or future efficiency of a monetary instrument, index or a packaged funding product will not be, and shouldn’t be taken as, a dependable indicator of future outcomes. eToro makes no illustration and assumes no legal responsibility as to the accuracy or completeness of the content material of this publication.