Alisa Davidson

Printed: November 03, 2025 at 10:40 am Up to date: November 03, 2025 at 5:34 am

Edited and fact-checked:

November 03, 2025 at 10:40 am

In Transient

October introduced a surge of exercise throughout main blockchains, from Ethereum’s Fusaka improve and Bitcoin’s debate over Ordinals, to Solana and Polkadot protocol enhancements, and extra.

It appears like October lastly shook off that mid-year quiet. All over the place you look — from Ethereum’s testnets to Bitcoin’s mempool wars — the most important chains abruptly had one thing to say. Some rolled out actual tech, others reopened previous ideological battles, and some simply reminded everybody they’re nonetheless alive and constructing. Right here’s what stood out to us — and, frankly, what we expect is price listening to as we head into the final stretch of the yr.

Ethereum’s Fusaka units the stage

Let’s begin with the plain one. Fusaka. The improve went reside throughout testnets this month, and whereas it didn’t make flashy headlines, we expect it’s a kind of “you’ll look again and notice this modified the whole lot” moments.

The important thing piece is PeerDAS — peer data-availability sampling — which primarily means Ethereum’s rollup ecosystem is about to get a bandwidth enhance. In plain English: rollups can publish knowledge extra effectively, so charges drop and throughput jumps.

We’ve really seen this film earlier than: Ethereum quietly provides a knowledge layer enchancment, everybody yawns, and 6 months later all the L2 house seems cheaper and sooner. Fusaka feels precisely like that sort of catalyst. It’s additionally the primary actual step towards a sharded-scale Ethereum — not simply scaling rollups, however scaling how Ethereum scales.

Bitcoin: ideology meets bytes once more

In the meantime, Bitcoin had some drama, of the great previous variety. Core v30 dropped, enjoyable knowledge limits and successfully making room for bigger OP_RETURN payloads. Which means extra room for Ordinals, inscriptions, and, relying on who you ask, both innovation or spam.

Then got here BIP-444 — the counterpunch. A proposal to ban large knowledge embeds altogether, briefly at the least. If adopted, it will nuke the Ordinals scene in a single day. The group’s been cut up proper down the center: purists saying Bitcoin ought to keep lean and censorship-resistant, others arguing for artistic freedom on-chain.

Solana’s Alpenglow and Firedancer deliver confidence again

Solana’s October was all about velocity and redemption. The validator group green-lit the Alpenglow improve, which goals to deliver finality right down to round 150 milliseconds. Mix that with Firedancer — the brand new validator consumer from Soar Crypto now working in restricted mainnet mode — and also you begin to see why Solana abruptly feels assured once more.

We keep in mind the times when Solana meant downtime jokes and restart memes. However now the tone has clearly shifted. Firedancer provides variety and uncooked efficiency to the node software program, whereas Alpenglow tightens the protocol itself. If each stick, Solana’s about to develop into the closest factor to “real-time blockchain” the house has seen. We’d name {that a} comeback story in progress.

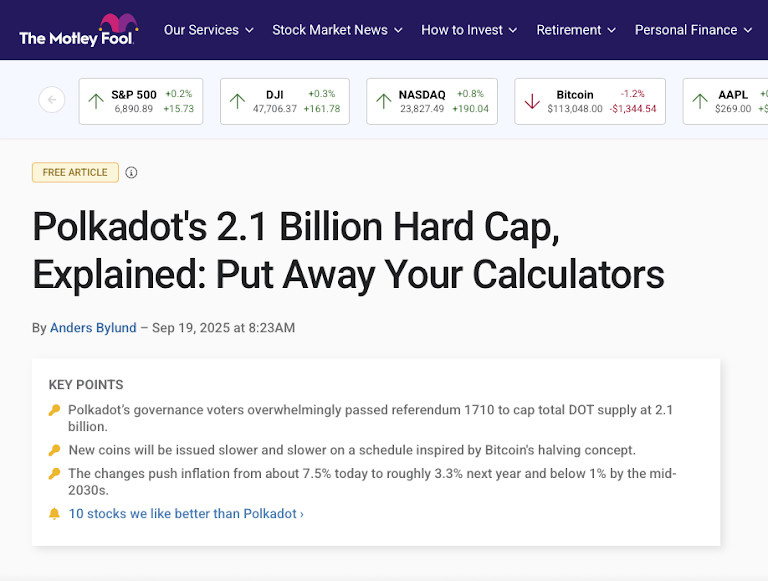

Polkadot: rebuilding itself from the within out

Polkadot had an enormous October, even when most individuals missed it. The core tech upgrades — Asynchronous Backing, Agile Coretime, Elastic Scaling — all went reside, with the aim to make parachains sooner and extra versatile. Mainly, Polkadot 2.0 arrived.

However the headline for us was the brand new laborious cap on DOT provide: 2.1 billion tokens, full cease. That’s a fairly philosophical pivot — DOT mainly went from “inflationary Web3 token” to “shortage narrative”. For buyers, it reframes DOT’s long-term story; for the ecosystem, it alerts maturity.

It appears as if Polkadot lastly feels prefer it is aware of what it desires to be. The timing’s good too — infrastructure’s prepared, tokenomics mounted, sentiment recovering. Undoubtedly one to observe into Q1.

Portal to Bitcoin, the long-promised DeFi bridge

Right here’s one which caught even seasoned watchers off guard. Portal to Bitcoin (PTB) launched its mainnet mid-October, positioning itself as the primary severe Bitcoin-native DeFi platform. Suppose atomic swaps, yield, lending — all instantly on Bitcoin, with out wrapping or sidechains.

We’ve heard that pitch earlier than, however PTB really shipped. If it really works, it may lastly make “Bitcoin DeFi” one thing greater than a meme. Our opinion: even a modest success right here can be large symbolically — proof that BTC’s liquidity can transfer with out leaving house.

Midnight: Cardano’s privateness sidechain grows up

Midnight, Cardano’s privacy-focused sidechain, made a fairly strategic transfer: it partnered with Google Cloud in October. Sure, that Google Cloud. The deal means the cloud large will assist run validator infrastructure and produce confidential computing instruments to the community.

Cardano is clearly making an attempt to do one thing completely different — not simply scale however to mix privateness and compliance. If finished proper, this might be a fairly large deal for enterprise and controlled DeFi use instances. And no, it doesn’t seem like hype-bait; Cardano’s clearly pushing its proud, slow-but-steady model of innovation.

Lighter brings in ZK perps and severe quantity

Now, over to DeFi correct. Lighter, a brand new Ethereum Layer-2 DEX for perpetuals, went reside in early October and instantly began pulling severe consideration. On the menu are ZK-powered matching, ultra-low latency, and quantity metrics that trace it may compete with GMX-class gamers.

The larger story right here is the pattern: DeFi derivatives are booming once more. With volatility creeping again, protocols like Lighter are positioning for institutional liquidity. It’s a kind of “listen now, thank your self later” launches.

ANyONe Protocol — the place DePIN meets privateness

DePIN initiatives had a reasonably quiet yr — till ANyONe confirmed up. It’s constructing a privacy-layered physical-infrastructure community: suppose IoT relays, encrypted knowledge routing, person rewards. October noticed its bug bounty and staking testnet go reside, with mainnet deliberate quickly.

We like this one as a result of it blends tangible infrastructure with crypto economics — one thing the market’s been craving after too many summary “meta” performs. It’s early, positive, but it surely already feels grounded.

MapleStory Universe — a contemporary new twist on Web3 gaming

And at last, a uncommon brilliant spot in blockchain gaming. MapleStory Universe — sure, the one tied to Nexon — reported regular progress this month, now at 1.7 million registered accounts and integrating Chainlink CCIP for cross-chain asset transfers.

The takeaway right here is that Web3 gaming isn’t useless, it’s simply gone quiet and sensible. When a legacy title like MapleStory begins utilizing cross-chain infrastructure in manufacturing, that’s undoubtedly price noting.

Disclaimer

In keeping with the Belief Challenge tips, please observe that the data supplied on this web page isn’t meant to be and shouldn’t be interpreted as authorized, tax, funding, monetary, or some other type of recommendation. You will need to solely make investments what you’ll be able to afford to lose and to hunt unbiased monetary recommendation when you’ve got any doubts. For additional data, we advise referring to the phrases and situations in addition to the assistance and assist pages supplied by the issuer or advertiser. MetaversePost is dedicated to correct, unbiased reporting, however market situations are topic to alter with out discover.

About The Creator

Alisa, a devoted journalist on the MPost, makes a speciality of cryptocurrency, zero-knowledge proofs, investments, and the expansive realm of Web3. With a eager eye for rising tendencies and applied sciences, she delivers complete protection to tell and interact readers within the ever-evolving panorama of digital finance.

Extra articles

Alisa, a devoted journalist on the MPost, makes a speciality of cryptocurrency, zero-knowledge proofs, investments, and the expansive realm of Web3. With a eager eye for rising tendencies and applied sciences, she delivers complete protection to tell and interact readers within the ever-evolving panorama of digital finance.