Ever want you could possibly set your investments on autopilot? eToro’s new Recurring Investments characteristic permits you to just do that. By automating your investing, you may construct steadily in direction of your targets, scale back volatility, and cease worrying about timing the market.

Right here’s all the pieces you should find out about this highly effective instrument — together with easy methods to set it up, and why automation might be your secret weapon for long-term development.

What’s recurring funding?

Recurring funding (RI), also referred to as recurring orders, permits you to set a hard and fast amount of cash to speculate month-to-month in your favorite property. A recurring funding plan is:

Straightforward to arrange: Select from 1000’s of shares, ETFs, and crypto to your recurring plans. You determine which quantity and date monthly works finest for you.

Value-effective: Begin investing from $25, plus take pleasure in decreased FX charges and decrease fee on recurring investments of shares and ETFs.

Constant: With an automatic plan, you may follow your technique and make investments with consistency, regardless of how busy you’re.

Much less nerve-racking: Free your self from timing the market and worrying about lacking alternatives.

Versatile: No lock-in interval means you may modify your plan or cease anytime — it’s fully as much as you.

Why contemplate recurring investments?

Construct a long-term technique with consistency. By repeatedly investing as a part of your common price range, your portfolio has potential to develop over time. Recurring investments additionally assist you leverage the compounding impact, turning constant small contributions into larger outcomes.

Keep disciplined, even when life will get busy. Automation ensures you’re all the time contributing to your portfolio, even throughout hectic intervals. This consistency is a key technique to reaching monetary targets.

Scale back danger with dollar-cost averaging. Investing smaller fastened quantities commonly, no matter market circumstances, permits traders to realize publicity at a mean of various buy costs — averaging out the price over time and serving to to handle volatility.

Timing the market vs. time available in the market

Let’s take a better have a look at what dollar-cost averaging can do.

Staying invested long run (referred to as “time available in the market”) can usually be extra essential than attempting to foretell the very best instances to purchase or promote (“timing the market”). You should utilize “persistently investing a set quantity every month” with a recurring funding plan as a dollar-cost averaging (DCA) buying and selling technique.

For instance, the chart beneath illustrates how DCA outperformed timing the market on the SPDR S&P 500 (SPY) ETF, an exchange-traded fund which tracks the S&P 500 Index.

Hypothetical $1000 funding in SPDR S&P 500 (SPY) ETF (2007-2024)

Information as of December 1, 2024. For illustrative functions solely. Previous efficiency just isn’t a sign of future outcomes.

Supply: Yahoo Finance, Galaxy Asset Administration.

If an funding was made every time the index dropped by greater than 5% (“shopping for the dip”), this could have resulted in 16 investments, in comparison with 210 months of constant DCA — with DCA performing 1.25x higher.

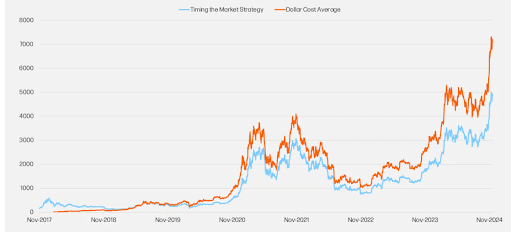

DCA’s benefit might be much more pronounced with risky property similar to cryptocurrencies.

The charts beneath illustrate how shopping for Bitcoin (BTC) utilizing a DCA technique carried out higher than an ideal market-timing technique over the identical time interval.

Throughout the timeframe from 2017 to 2024, DCA delivered 1.46x larger returns:

Hypothetical $1000 funding in Bitcoin (2017-2024)

Information as of December 1, 2024. For illustrative functions solely. Previous efficiency just isn’t a sign of future outcomes.

Supply: CCData, Galaxy Asset Administration.

You may learn extra about dollar-cost averaging right here.

Which property can I put money into with recurring investments?

eToro affords a variety of property for recurring investments, permitting you to diversify and scale back dangers:

Shares: Personal shares in your favorite firms with no fee charges.

ETFs: Put money into diversified funds designed to trace particular sectors or markets.

Crypto: Benefit from the rising potential of digital currencies.

By diversifying throughout these asset sorts, you may create a well-balanced portfolio that aligns together with your monetary targets.

Tips on how to arrange recurring investments on eToro

Log in to your eToro account. (Don’t have an account but? Get one right here.)

Select your asset. Head to the particular inventory, ETF, or crypto for which you wish to arrange an RI, or click on right here to find high property.

Click on “Make investments.”

Choose “Recurring Funding” and enter the quantity and date every month that works for you.

Verify your settings. That’s it — your portfolio is about for recurring funds.

What to think about earlier than beginning recurring investments

Earlier than organising your RI, it’s price interested by a couple of key elements:

Your price range: Begin with an quantity that matches your monetary consolation zone.

Frequency: Resolve how usually you wish to make investments (e.g., weekly or month-to-month).

Your targets: Are you saving for retirement, constructing wealth, or experimenting with crypto? Your technique will rely in your aims.

Market tendencies: Whereas RI can assist to mitigate market timing dangers, you’ll wish to keep knowledgeable about main market actions as a way to make the very best funding choices.

Begin constructing your future immediately

With Recurring Investments on eToro, you may create a disciplined, constant technique to assist develop your portfolio whereas having fun with:

Low fee charges on shares and ETFs

Low $25 minimal funding to get began

Full flexibility with no lock-in intervals

Whether or not you’re simply beginning out in your funding journey, or on the lookout for a easy method to assist develop your present portfolio, Recurring Investments might be the answer you’ve been ready for.

Set a Recurring Funding

eToro is a multi-asset funding platform. The worth of your investments might go up or down. Your capital is in danger.

For crypto: Don’t make investments except you’re ready to lose all the cash you make investments. This can be a high-risk funding and you shouldn’t anticipate to be protected if one thing goes mistaken. Take 2 minutes to be taught extra