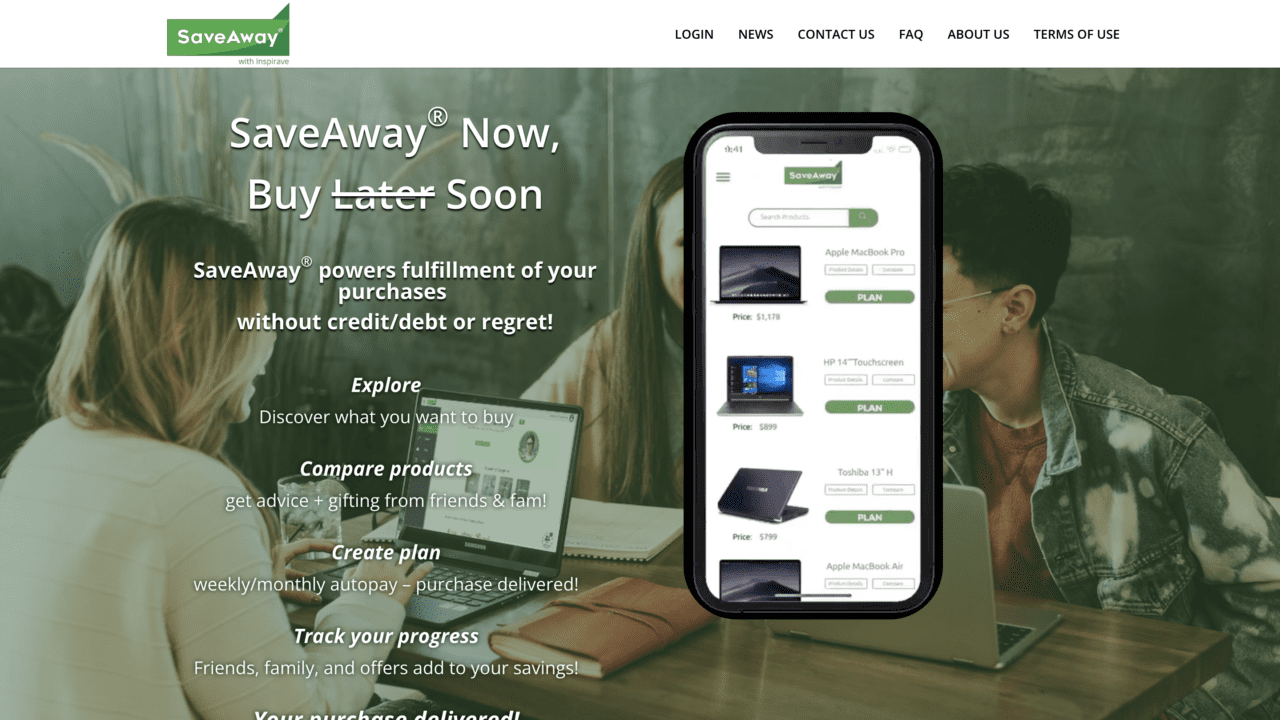

Financial savings and buy achievement platform SaveAway has launched a collection of latest options.

The brand new performance contains Customized Plans and Associates & Household Feedback and Voting, which transfer past conventional nameless evaluations and blind gift-giving.

SaveAway made its Finovate debut at FinovateFall 2016 in New York. Om Kundu is Founder and CEO.

Aim-based financial savings and buy achievement platform SaveAway launched a variety of latest options. The brand new capabilities increase the platform’s core performance to satisfy purchases with out counting on credit score or debt.

For years, SaveAway clients have been in a position to make use of the platform to determine a financial savings and buy aim, arrange autopay through their FDIC-insured SaveAway pockets, after which obtain their merchandise after the financial savings aim is met. With this announcement, SaveAway now permits customers to buy any product—not simply these accessible through the SaveAway internet app—just by offering product particulars. This Customized Plans performance expands entry to a broader vary of merchandise and a wider community of retail companions and types. It additionally makes it simpler for customers to set buy targets which might be higher aligned with their private preferences.

The corporate additionally introduced Associates & Household Feedback and Voting capabilities. This performance lets customers invite buddies, household, and different members of their very own “trusted circle” to remark, advise, and vote on a person’s potential purchases. Not solely can they supply suggestions on potential purchases, however family and friends can also contribute financially towards the acquisition. This performance takes e-commerce past conventional nameless evaluations and blind gift-giving by integrating each the opinions and assist of those that know and care in regards to the shopper and their private funds.

“SaveAway triages these first-of-its-kind capabilities to make the trail to buy extra memorable and accountable, slightly than one which relinquishes company to the slippery slope of credit score/debt/remorse,” firm Founder and CEO Om Kundu mentioned in a press release. “Consumers and sellers can thus be part of the group of those that SaveAway to appreciate their buy targets, whereas retailers recapture misplaced gross sales beforehand perceived as deserted carts, affordably and sustainably.”

SaveAway’s announcement comes as the corporate ramps up its outreach efforts by way of campaigns similar to “$25 for ’25,” a referral program that rewards new customers and people they refer once they join SaveAway and full a financial savings and buy plan. The corporate additionally introduced its program to encourage content material creators, influencers, and early adopters to attempt to check the platform. Lastly, SaveAway has enhanced its “Monitor Your Plan” web page, boosting ease of use and transparency by making the content material extra intuitive and informative.

Based in 2014 and headquartered in New York, SaveAway made its Finovate debut at FinovateFall 2016. At a time when Purchase Now Pay Later platforms are gaining prominence, SaveAway provides another for these trying to restrict or cut back their reliance on credit score and debt. Greater than merely a greater method for shoppers to “save for what issues,” SaveAway permits shoppers to leverage the knowledge (and, probably, the discretionary money) of buddies and households to advertise monetary wellness and to construct a technology of smarter savers and smarter spenders.

Picture by Miguel Á. Padriñán

Views: 53