Solana (SOL), the world’s sixth-largest cryptocurrency by market cap, is gaining large consideration from Binance merchants. Not too long ago, knowledge from the on-chain analytics agency Coinglass revealed that 79% of high merchants on Binance are going lengthy on SOL, regardless of the bearish market sentiment.

Solana (SOL) Value Motion and Upcoming Ranges

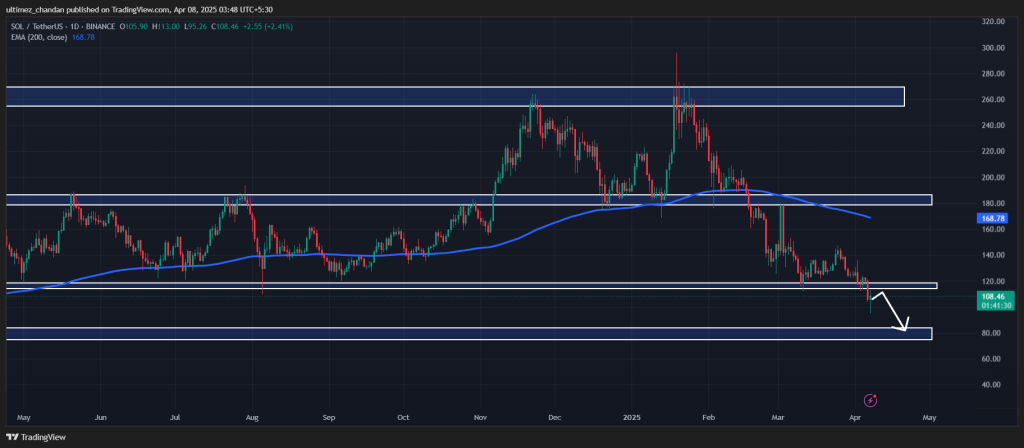

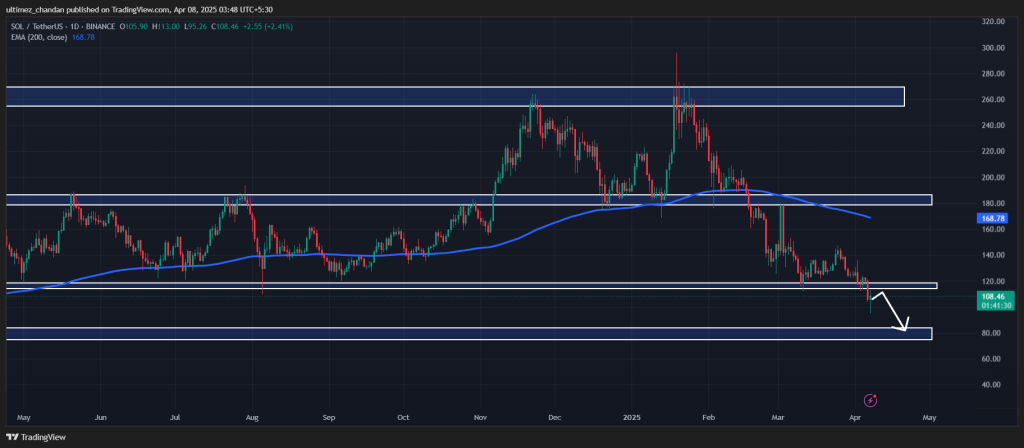

In line with knowledgeable technical evaluation, SOL seems bearish regardless of the continuing worth restoration. On April 6, 2025, SOL broke down from its extended key assist degree of $115 and likewise closed a day by day candle under that degree, a degree it had held since March 2024.

This breakdown has pushed SOL into a particularly bearish part. Nevertheless, the continuing worth restoration seems to be a retest of the breakdown degree.

Primarily based on the latest worth motion and historic momentum, if SOL stays under the $115 degree, there’s a robust risk it may decline by 30% and attain the $77 degree within the close to future.

This bearish outlook is strongly supported by momentum indicators such because the Relative Power Index (RSI) and the 200-day Exponential Shifting Common (EMA) on the day by day timeframe.

Present Value Momentum

As of writing, SOL was buying and selling close to $107 and had registered a worth drop of over 1% up to now 24 hours. In the meantime, the asset confirmed a powerful restoration, having hit a low of $95.6 throughout the Asian market session. Amid this important worth fluctuation and market volatility, SOL’s buying and selling quantity has skyrocketed by 185% throughout the identical interval.

$140 Million Value of SOL Outflow

Whereas inspecting the on-chain metrics, it seems that whales, traders, and long-term holders have seized the chance to build up SOL on the present worth degree, in response to the on-chain analytics agency Coinglass.

Information from spot influx/outflow reveals that exchanges have seen an outflow of roughly $140 million value of SOL over the previous 24 hours. This substantial outflow suggests potential accumulation and will result in shopping for stress.

Nevertheless, as a result of prevailing bearish sentiment, a powerful upside rally could also be troublesome to attain.